Functional Food Market Size (2024 – 2030)

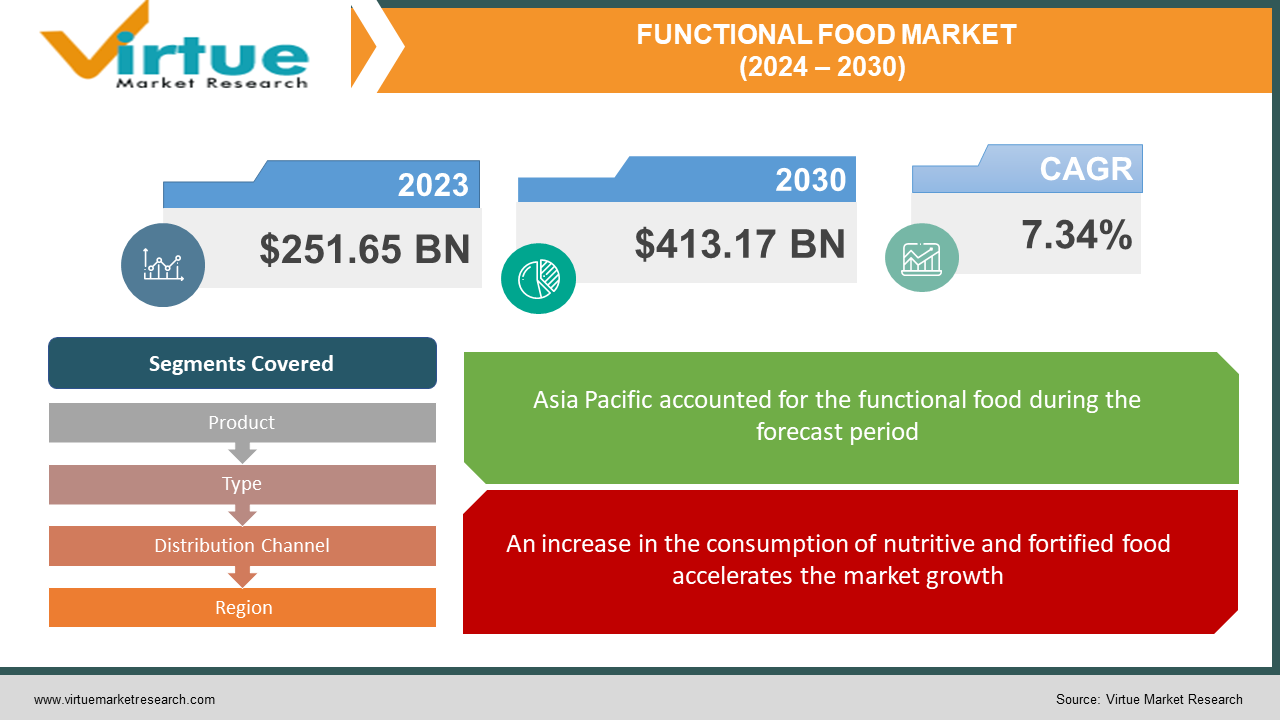

The Global Functional Food Market was valued at USD 251.65 billion in 2023 and is projected to reach a market size of USD 413.17 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.34%.

Increasing demand for nutritious and fortified foods is expected to support this growth. Food and beverage retailers promote their products with additional nutrients such as omega-3 fatty acids, fiber, vitamins, minerals, and more. The main purpose of adding the above chemicals to the food and beverage industry is to increase the nutritional value of food. It does not cure diseases but helps improve the health of the body by providing essential nutrients and proteins, thus reducing the risk of life-threatening diseases. Including nutritious foods in the diet can improve a person's physical health.

Key Market Insights:

Prebiotics and probiotics are an emerging field of food ingredients where scientists are working to develop different uses and benefits. Nutrigenomics, or personalized nutrition, is a specialized diet in which nutritionists attempt to use specific nutrients to treat chronic conditions such as heart disease, obesity, Alzheimer's disease, and diabetes.

Functional ingredients such as Omega-3 fatty acids and probiotics, commonly found in fish oil and yogurt, will reduce the risk of heart disease and improve your gut health. Additionally, during the COVID-19 pandemic, more and more people are turning to various medicines and foods that promise to boost immunity or fight diseases. This trend is expected to drive the industry in the coming years.

Most companies in the food market launch new products to attract and meet consumer needs. Launching new products helps these companies increase sales and capture a large portion of the food market.

Functional Food Market Drivers:

An increase in the consumption of nutritive and fortified food accelerates the market growth.

Global demand for fortified foods is increasing. Active substances such as vitamins, minerals, antioxidants, hydrocolloids, prebiotics, amino acids, plant extracts, and carotenoids are the main components of energy foods. The health-conscious population in emerging markets is growing rapidly, which will lead to strong demand for energy products. Differences in food consumption in different regions have contributed to the different health status of the population in different countries. Many factors such as the increase in chronic diseases and micronutrient deficiencies, the growth of the middle class in developing economies, new government support programs, the increase in the world's aging population in regions such as Europe, and the interest in health and well-being. For COVID-19, it is expected that sales of energy products will increase on the 19th of the month and the demand for food products will strengthen.

Growing Research and Development Activities helps in the market growth.

Research and development in the peanut industry focuses on identifying new trends in Functional Food, discovering their compounds, and understanding their potential uses. These conditions aim to unlock the potential of Functional Food and create new products for various industries.

Functional Food Market Restraints and Challenges:

Maintaining quality and Standardization provides a challenge to market growth.

Maintaining consistency in quality and standardization of Functional Food can be difficult due to differences between extraction and processing. Ensure batch-to-batch consistency and compatibility requirements, especially for companies sourcing Functional Food from multiple suppliers or regions.

Supply Chain Snags hinder the market growth.

The market for agricultural products is based on international products, often involving many intermediaries and international suppliers. Managing product risks, ensuring traceability, and maintaining the stability and reliability of Functional Food can be challenging. Issues such as crop failures, climate change, geopolitical events, and limited supplies of certain plants can disrupt the supply chain.

The volatility in Functional Food prices brings a challenge to market growth.

Global Functional Food prices fluctuate significantly due to factors like currency fluctuations, and speculation. This uncertainty can discourage investment and harm smaller players.

Sustainability and Environmental Impact restrains market growth.

The increasing demand for functional foods has led to concerns about their products' sustainability and environmental impact. Overharvesting, deforestation, and ecosystem destruction can threaten certain plants and ecosystems. Maintaining sustainable practices, promoting biodiversity conservation, and supporting local communities are key challenges facing the Functional Food industry.

Functional Food Market Opportunities:

The introduction of new technologies such as encapsulation, nano-encapsulation, and bio-encapsulation has increased technology in the food industry. Encapsulation technology helps improve the flavor of many foods. For example, omega-3 fatty acids are associated with unpleasant odors. Using encapsulation technology, the taste and aroma of these ingredients are improved. Recent advances in liposome technology have been used to produce various ingredients such as probiotics and other ingredients, providing various health benefits. Therefore, this leads to the development of technology in niche applications such as food and children.

FUNCTIONAL FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.34% |

|

Segments Covered |

By Product, Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Coca-Cola Company, GFR Pharma, Arla Foods amba, Amway Corp., Herbalife International of America, Inc., Cargill, Incorporated, General Mills Inc, BASF SE , Standard Functional Foods Group Inc. KFSU |

Functional Food Market Segmentation - by Product

-

Dairy Products

-

Bakery & Cereals

-

Meat, Fish, & Eggs

-

Soy Products

-

Others

Dairy products have the highest market share with over 40% revenue in 2023, followed by bread and cereals. Other important products include meat, eggs, soy products, fish, and oils and fats. Yogurt, milk drinks, and spreads are the best products to send to the grocery store. They are rich in beneficial compounds and can be used as a food ingredient in cooking. The dairy industry is expected to grow at a CAGR of approximately 7.9% during the forecast period.

Bread and cereal holds 28% of the market in terms of revenue in 2023. The creation of new products in the baking and food industry is expected to support the market in the coming years. Additionally, increasing demand for snack products such as cereal bars protein bars, nutrition bars, and energy bars is expected to drive the market growth during the forecast period. A rise in fortified foods is expected, with companies like Kellogg launching new products such as fiber-crunchy granola, Special K, muesli, and tortilla chips fortified with iron, zinc, and nine essential vitamins to capture business.

Increased demand for consumer products due to population growth is expected to help increase the supply of nutritious foods such as meat, poultry, and eggs. Consumer preferences and awareness of best features are expected to drive the global meat, fish, and egg food market during the forecast period, with the segment expanding at a CAGR of 9.3%.

The soy product segment is expected to grow at a CAGR of 9.7% from 2024 to 2030. The food industry is expected to further benefit from the increasing demand for gluten-free wheat flour with good results in terms of protein, iron, vitamins, and calcium. Additionally, the demand for clean-label, healthy foods is increasing the use of oil and gas in the food and beverage industry. Fats are organic substances that provide heat to the body and are thought to be essential for the proper functioning of the body. As consumers become more aware of the need to improve their immunity, spending on foods high in fats and oils is increasing.

Functional Food Market Segmentation - by Type

-

Prebiotics & Probiotic

-

Carotenoids

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Vitamins

-

Others

By Type, the market is segmented into carotenoids, dietary fiber, fatty acids, minerals, prebiotics and probiotics, vitamins, and others. The prebiotics and probiotics segment is expected to have the largest market share in 2023. Prebiotics and probiotics are important ingredients in the food industry and play an important role in altering the intestinal tract and affecting the healthy home of the host. Prebiotics are non-digestible carbohydrates that support the growth of beneficial bacteria in the gut, including Bifidobacteria and Lactobacilli. Probiotics, on the other hand, are live bacteria that benefit the host by improving the immune system, improving intestinal function, and producing bioactive metabolites. Prebiotics and probiotics have many health benefits in the food industry, such as the prevention and treatment of intestinal diseases, reducing the risk of metabolic diseases from the gut-brain axis, obesity, blood sugar, and heart diseases, and preventing infections and allergies.

Functional Food Market Segmentation- by Distribution Channel

-

Offline

-

Online

Based on the Distribution Channel, the market includes Offline and Online stores. Offline will have the largest market share in 2022. The offline segment offers a wide range of products and plays an important role in the food industry. These large businesses are often located in cities with ample floor space, parking, and self-service checkout technologies. Supermarkets are important distribution channels for food products, offering consumers convenience, variety, accessibility, and affordability. The online segment is expected to witness a higher CAGR during the forecasting period.

Functional Food Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific is emerging as one of the largest markets for nutritious foods, with a market share of 39% in terms of revenue in 2023, as the population grows rapidly along with disposable income. Rapid growth in the food processing industry and increased health and health awareness are important factors in the region's economic development. Especially during the COVID-19 pandemic, increased consumer awareness and concerns about food safety in the region affected consumer behavior and led to economic growth.

In terms of revenue, North America accounted for more than 24.7% of the global dietary supplement market in 2021. The main application areas in the North American market are infection prevention, weight control, health, and cardiac. This could increase consumer interest in health in the United States, Mexico, and Canada, where demand for food and beverages is expected to increase. Additionally, the proliferation of protein bars, shakes, and cookies as healthy snacks among millennials is also expected to increase the number of nutritious foods in North America.

COVID-19 Impact Analysis on the Global Functional Food Market:

The sudden outbreak of COVID-19 has impacted the health of raw materials, production, cultivation, processing, packaging, and transportation of food and beverage operations. The strict closure of the economy by many countries to prevent the spread of the disease has negatively affected the production and distribution of these products, according to the manufacturers/factories, there was a labor shortage in the first month and they were partially or completely closed. However, as the COVID-19 process eased, the speed of doing business also increased. Another problem faced by the business is the restriction of export of some valuable food products from large exporting countries such as China, India, and the USA. The growth of the food and beverage market was also affected by transportation and the economic impact of the pandemic.

Latest Trends/ Developments:

The use of technology in the extraction and processing process increases the quality, efficiency, and diversity of Functional Food. Advanced techniques such as supercritical fluid extraction, nanotechnology, and biotechnology can remove certain elements, preserve biological functions, and create new structures. This technology opens up new possibilities for using various compounds in various applications and expands their functions.

Probiotics and prebiotics are no longer niche marketers. From fermented yogurt to stomach-boosting drinks, consumers are getting ingredients that support digestion and overall immunity.

The one-size-fits-all approach is slowly disappearing. The industry uses genetic testing and artificial intelligence to create personalized nutrition plans and offer personalized meal recommendations.

Vegan and plant-based alternatives are exploding, with functional ingredients like pea protein, hemp seeds, and algae finding their way into everything from meat substitutes to dairy-free pints of milk.

Key Players:

-

The Coca-Cola Company

-

GFR Pharma

-

Arla Foods amba

-

Amway Corp.

-

Herbalife International of America, Inc.

-

Cargill, Incorporated

-

General Mills Inc

-

BASF SE

-

Standard Functional Foods Group Inc.

-

KFSU

-

In May 2022, Cargill launched a new probiotic product called EpiCor, a dry yeast fermented in a clinical trial in a food trial to positively alter the gut microbiome and provide immune system support.

-

In February 2022, Cargill and Manna Tree invested in Evolve BioSystems, Inc., which will help the company continue to commercialize next-generation probiotics targeting the microbiome for poor gut health in infants.

Chapter 1.Functional Food Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Functional Food Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Functional Food Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Functional Food Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Functional Food Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6.Functional Food Market – By Product Type

6.1 Introduction/Key Findings

6.2 Dairy Products

6.3 Bakery & Cereals

6.4 Meat, Fish, & Eggs

6.5 Soy Products

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Functional Food Market – By Type

7.1 Introduction/Key Findings

7.2 Prebiotics & Probiotic

7.3 Carotenoids

7.4 Dietary Fibers

7.5 Fatty Acids

7.6 Minerals

7.7 Vitamins

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Type:

7.10 Absolute $ Opportunity Analysis By Type:, 2024-2030

Chapter 8. Functional Food Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Offline

8.3 Online

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Functional Food Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Type

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Type

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Functional Food Market – Company Profiles – (Overview, By Product Type Portfolio, Financials, Strategies & Developments)

10.1 The Coca-Cola Company

10.2 GFR Pharma

10.3 Arla Foods amba

10.4 Amway Corp.

10.5 Herbalife International of America, Inc.

10.6 Cargill, Incorporated

10.7 General Mills Inc

10.8 BASF SE

10.9 Standard Functional Foods Group Inc.

10.10 KFSU

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Functional Food Market was valued at USD 251.65 billion in 2023 and is projected to reach a market size of USD 413.17 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.34%.

The segments under the Global Functional Food Market based on Type are Prebiotics & Probiotic, Carotenoids, Dietary Fibers, Fatty Acids, Minerals, Vitamins, and Others.

The Asia-Pacific region is the dominant Global Functional Food Market.

The Coca-Cola Company, GFR Pharma, Arla Foods amba, Amway Corp., Herbalife International of America, Inc., Cargill, Incorporated, etc.

The sudden outbreak of COVID-19 has impacted the health of raw materials, production, cultivation, processing, packaging, and transportation of food and beverage operations. The strict closure of the economy by many countries to prevent the spread of the disease has negatively affected the production and distribution of these products, according to the manufacturers/factories, there was a labor shortage in the first month and they were partially or completely closed.