Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Size (2024 – 2030)

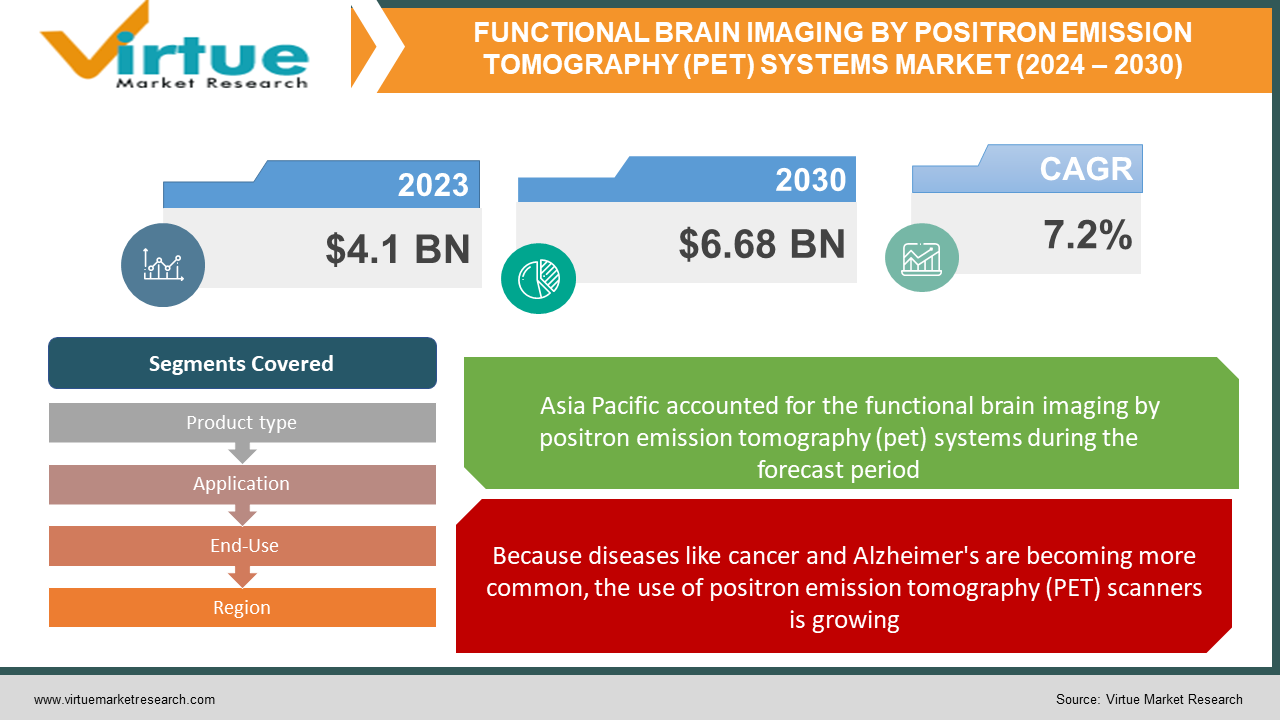

The Global Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market was estimated to be worth USD 4.1 Billion in 2023 and is projected to reach a value of USD 6.68 Billion by 2030, growing at a CAGR of 7.2% during the forecast period 2024-2030.

Physicians can use PET (Positron Emission Tomography) to see how your body's cells are functioning. You will be given an injection of a particular type of material that emits a very small amount of radiation during a PET scan. A PET scanner can identify this material as it passes through your body and produce images that indicate the specific parts of your body that the substance is using. PET scans are particularly useful for researching diseases and their effects on the body, as well as for learning about the functioning of the brain. For medical professionals and researchers looking into diseases like cancer, Alzheimer's, and heart disease, they are an invaluable resource.

Key Market Insights:

The increased number of people dealing with neurological disorders that impair brain function is driving growth in the global market for functional brain imaging systems. Businesses are spending money on research and creating new tools for brain imaging. These technologies aid in physicians' better understanding of brain disorders. Nevertheless, the cost of these systems is high, and there aren't always enough skilled personnel to operate them. Strict regulations also make it challenging for businesses to market these systems. The advantages of these systems are not well-known to many people. However, there are chances for expansion, particularly in nations like China, Japan, and India. Businesses in this sector are also benefiting from the introduction of new brain imaging technologies such as SPECT and functional MRI. Reports on this market generally examine the key participants, market trends, and laws to assist businesses in understanding and making plans.

Global Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Drivers:

Because diseases like cancer and Alzheimer's are becoming more common, the use of positron emission tomography (PET) scanners is growing.

Because PET imaging can reveal significant changes occurring in the brain at a molecular and functional level, it is becoming increasingly popular in the study of brain-related conditions. It supports our ability to recognize possible disease indicators, monitor the course of diseases, and assess the efficacy of treatments. Researchers can learn more about the etiology of brain diseases and how the environment and genetics influence brain function by utilizing PET imaging. Additionally, this technology aids in the development of novel medications and therapies for brain disorders as well as their safety and efficacy testing.

Positron Emission Tomography (PET) Systems for Functional Brain Imaging are driving the market thanks to technological advancements in PET imaging.

Advances in PET imaging technology are continuously enhancing the accuracy and detail of brain studies. By raising the resolution, sensitivity, and reliability of PET images, researchers are creating new methods to improve their quality. Additionally, more varieties of radiotracers—special compounds that aid in highlighting particular brain processes and functions during imaging—are being developed. To better comprehend the data obtained from PET scans, new methods of data analysis are being employed, such as kinetic modeling and machine learning. Furthermore, to obtain a more comprehensive image of the structure and function of the brain, PET is frequently used in conjunction with other imaging techniques like CT and MRI.

Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Challenges and Restraints:

There are still issues when combining PET with other brain imaging techniques like fMRI or fUS. However, a brand-new area known as bimodal functional neuroimaging has emerged as a result of the advancement of hybrid imaging techniques. For instance, PET/fMRI demonstrates how these techniques can work in concert rather than just superimposing anatomical and functional images. This hybrid method can enhance brain imaging and advance our understanding of how the brain functions in both healthy and diseased conditions. We can create new hybrid neuroimaging approaches that maximize the benefits of each imaging modality by educating researchers in a variety of imaging modalities and encouraging cooperation amongst neuroimaging communities.

Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Opportunities:

Due to its rapid growth, the global market for functional brain imaging systems presents excellent business opportunities. Medical professionals can now see inside the brain and comprehend its functioning more easily thanks to new technologies. This aids in the better diagnosis and management of brain disorders. The market is expanding as a result of an increase in the number of elderly individuals, brain disorders, and the need for early diagnosis and treatment. Additionally, more people are becoming aware of the advantages of brain imaging. Businesses have even more opportunities as technology advances to create new goods and services or provide healthcare professionals with training. All things considered, it's a promising market for businesses in the medical imaging sector.

FUNCTIONAL BRAIN IMAGING BY POSITRON EMISSION TOMOGRAPHY (PET) SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Product type, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens Healthineers AG, Koninklijke Philips N.V., GE Healthcare, Bruker, Mediso Ltd, MR Solutions, Cubresa Inc, Aspect Imaging, Agfa Healthcare, Neusoft Medical Systems |

Global Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Segmentation: By Application

-

Neurotransmitter receptors

-

Neuroinflammation

-

Brain tumors

-

Alzheimer's disease

-

Parkinson's disease

-

Schizophrenia

-

Bipolar disorder

-

Others

The International Parkinson and Movement Disorder Society projected that by 2023, there will be 9.4 million people worldwide living with Parkinson's disease, up from 6 million in 2022. This number is anticipated to continue rising because neurological disorders are more common in older adults. The PET system market segment with the fastest rate of growth is Parkinson's disease. In addition, the September 2021 release of the World Alzheimer Report 2021 projected that over 55 million individuals globally would have dementia in 2021, with nearly 60% of those individuals residing in low- and middle-income nations. According to the report, there will be 78 million cases of dementia by 2030 and 139 million cases by 2050. It is anticipated that the number of neurological diseases will rise globally, necessitating more early detection, observation, and care. Functional near-infrared optical brain imaging, which presently holds the largest share of the PET system market, is expected to grow as a result of this.

Global Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Segmentation: By Product Type

-

Traditional PET system

-

Helium-free PET system

-

PET-CT system

-

PET-MRI system or PET insert

Due to the growing need for multimodal imaging, which offers both functional and anatomical information about various organs and tissues, the PET-MRI systems or PET inserts category is anticipated to grow at a rapid rate in the global PET systems market. Because PET-CT scanners are widely accessible and provide exceptional spatial resolution and accuracy for a variety of applications, including cardiology, neurology, and cancer, it is anticipated that they will dominate the global PET systems market. As of right now, PET-CT systems account for 52.3% of the market. The rising incidence of chronic illnesses that need PET-CT imaging for diagnosis and treatment monitoring is one factor driving this market's expansion.

Global Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Segmentation: By End-Use

-

Hospitals

-

Clinics

-

Diagnostic centers

-

Research institutes

-

Others

A wide range of users, including medical facilities, clinics, diagnostic centers, academic institutions, and others, are catered to by the PET systems market. Because of their increased efforts in research and development concerning PET imaging for cancer, neurology, cardiology, and other fields, research institutions are predicted to grow at the fastest rate in this market. Hospitals make up the largest segment of the PET systems market since they are the primary users of these systems for disease monitoring and diagnosis. 45.6% of the world market was held by them. The increasing incidence of chronic illnesses requiring PET imaging and the reimbursement programs for PET scans in many nations are factors propelling growth in this industry.

Global Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

The market for PET-based functional brain imaging is predicted to grow at the fastest rate in the Asia Pacific area. This is a result of the area's expanding population, rising income, improved healthcare infrastructure, increased medical tourism, and increased PET imaging research. However, it is anticipated that North America will hold the biggest market share for PET systems used in functional brain imaging. This is because numerous PET systems are already in use there for a variety of applications, including research on cancer, heart disorders, and the brain. Presently, with 38.6% of the market share, North America leads the world. This is because of several things, including the high prevalence of neurological illnesses, the first-rate healthcare system, the reimbursement guidelines for PET scans, and the continuous advancements in PET imaging research and development.

COVID-19 Impact on the Global Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market:

One major effect on the positron emission tomography (PET) industry was the COVID-19 pandemic. To stop the virus from spreading, clinics and scanning centers stopped offering their services. Because they were afraid of the virus, fewer people had scans. Research presented at the 2021 Annual Meeting of the Society of Nuclear Medicine and Molecular Imaging (SNMMI) demonstrated that PET is a reliable tool for assessing the brain effects of COVID-19. A few patients experienced long-term disability six months following COVID-19 infection. The use of PET during the pandemic has been thoroughly examined, and it might be applied in other epidemics as well.

Latest Trend/Development:

A novel technique for calculating cerebral blood flow (CBF) was created in January 2022. This method makes use of a deep neural network and dynamic PET data. It was discussed in a study published in the Neuroimage journal. The study demonstrated that this method, which does not require a blood sample from an artery, can measure CBF with accuracy and reliability using a variety of radiotracers and PET systems. Philips and Microsoft joined forces to use artificial intelligence (AI) to develop healthcare solutions. Microsoft and GE Healthcare joined forces to create healthcare solutions powered by AI. After that, Siemens Healthineers and Microsoft partnered with the same goal in mind: developing healthcare solutions driven by artificial intelligence.

Key Players:

-

Siemens Healthineers AG

-

Koninklijke Philips N.V.

-

GE Healthcare

-

Bruker

-

Mediso Ltd

-

MR Solutions

-

Cubresa Inc

-

Aspect Imaging

-

Agfa Healthcare

-

Neusoft Medical Systems

Chapter 1. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market – By Product Type

6.1 Introduction/Key Findings

6.2 Traditional PET system

6.3 Helium-free PET system

6.4 PET-CT system

6.5 PET-MRI system or PET insert

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market – By End-Use

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Clinics

7.4 Diagnostic centers

7.5 Research institutes

7.6 Others

7.7 Y-O-Y Growth trend Analysis By End-Use

7.8 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market – By Application

8.1 Introduction/Key Findings

8.2 Neurotransmitter receptors

8.3 Neuroinflammation

8.4 Brain tumors

8.5 Alzheimer's disease

8.6 Parkinson's disease

8.7 Schizophrenia

8.8 Bipolar disorder

8.9 Others

8.10 Y-O-Y Growth trend Analysis By Application

8.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-Use

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-Use

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-Use

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-Use

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-Use

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Siemens Healthineers AG

10.2 Koninklijke Philips N.V.

10.3 GE Healthcare

10.4 Bruker

10.5 Mediso Ltd

10.6 MR Solutions

10.7 Cubresa Inc

10.8 Aspect Imaging

10.9 Agfa Healthcare

10.10 Neusoft Medical Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Positron-emitting radionuclides must be able to be precisely detected and imaged for PET to work. Short-lived radionuclides are intravenously injected during this procedure, and the patient is subsequently imaged using a specialized detection system.

The Global Functional Brain Imaging by Positron Emission Tomography (PET) Systems Market was estimated to be worth USD 4.1 Billion in 2023 and is projected to reach a value of USD 6.68 Billion by 2030, growing at a CAGR of 7.2% during the forecast period 2024-2030

The technological advancements in PET imaging and the use of positron emission tomography (PET) scanners are drivers of the Functional Brain Imaging by Positron Emission Tomography (PET) Systems market.

In the market for PET systems, the technological challenges of combining PET with other functional imaging modalities, such as MRI or ultrasound, might be difficult.

Some of the major players are Siemens Healthineers AG, Koninklijke Philips N.V., GE Healthcare, Bruker, Mediso Ltd, MR Solutions, Cubresa Inc, Aspect Imaging, Agfa Healthcare, Neusoft Medical Systems