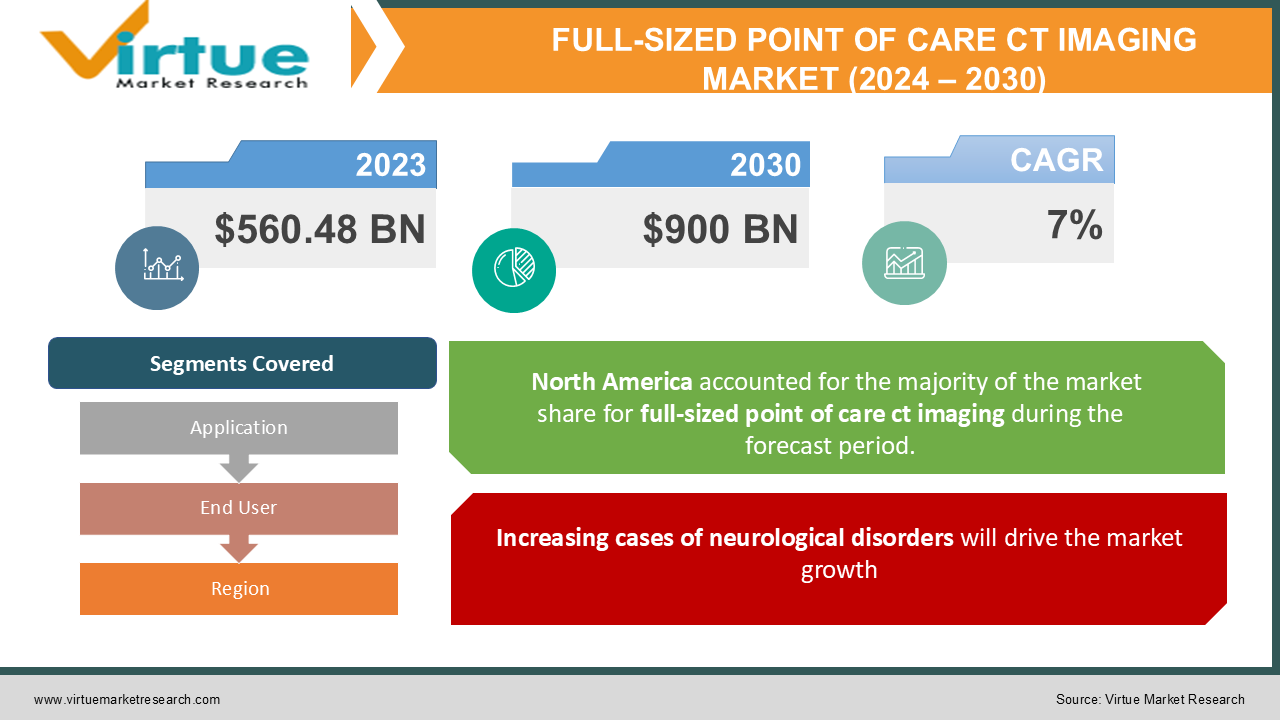

Global Full-sized Point of Care CT Imaging Market Size (2024 – 2030)

The Global Full-sized Point of Care CT Imaging Market was valued at USD 560.48 billion and is projected to reach a market size of USD 900 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

Industry Overview

Point-of-care imaging offers immediate diagnosis and treatment, which reduces the frequency of trips to the doctor's office. The market for these systems is anticipated to increase in the next years due to the effectiveness of point-of-care CT imaging in providing quick findings. Additionally, a rise in neurological conditions including brain tumours is anticipated to fuel market expansion. According to the National Brain Tumour Society, there will be 700,000 brain tumour cases in the United States in 2020, and 87,000 new cases are anticipated. The demand is anticipated to increase over the projected period as a result of quick technical development and an increase in collaborations to create enhanced Computed Tomography (CT) imaging for emergency treatment.

The corporations will provide financial assistance to the Weight-Bearing CT International Study Group, which brings together orthopedic researchers from American and European academic institutions. Point-of-care computed tomography imaging equipment is frequently installed in outpatient settings to deliver precise and quick results. The CARESTREAM Onsight 3D Extremity system was installed at Cobalt's Imaging Centre in October 2017 to offer point-of-care testing. The OnSight 3D Extremity system installation will facilitate the capture of sharp 2D and 3D images of patient extremities. Additionally, doing extremities exams is made possible by the device's large door and simple patient access, which are not available with conventional CT scanners. The mobile CT OmniTom was displayed by NeuroLogica, a Samsung Electronics subsidiary, at the Radiological Society of North America in November 2017. (RSNA). Omnicom aids in providing the best CT angiography, non-contrast CT, and CT perfusion scans and is primarily utilized for cranial treatments.

Impact of Covid-19 on the industry

The need for imaging services has increased significantly all around the world. However, challenges in manufacturing and production have hurt the worldwide POC CT market. Due to the rising number of active coronavirus cases reported in emerging economies, the major market participants have postponed the launch of some products there. For instance, businesses like Siemens have seen a 20% decline in the revenue from sales of imaging modalities. On the other hand, the lack of locally sourced raw materials or parts has had an impact on the production activities of some market participants.

Additionally, the disruptions in the export and import of raw materials and completed goods caused by the coronavirus pandemic have upset manufacturers and important players due to the shifting and uncertain geopolitical scenario globally. Due to this, the market's traditional supply and value chains have been re-examined by the players.

Market Drivers

Increasing cases of neurological disorders will drive the market growth

Some of the key factors that are anticipated to boost the revenue growth of the global point-of-care CT imaging market over the next 10 years include the rising incidence of neurological disorders such as brain tissues, etc., as well as the proven effectiveness of point-of-care CT scans in providing prompt results. Furthermore, if a standard CT scanner had been used, it would not have been able to conduct a full examination of a patient's extremities due to the simplicity of patient access and convenience of use of these sorts of devices. As it would encourage a wider acceptance of these gadgets, this factor is also anticipated to positively impact the future market expansion of this global business.

Rising R&D will drive the market growth

To further understand the effectiveness and efficiency of PoC computed tomography imaging systems in the diagnosis of various diseases, numerous clinical trial studies are being done. As a result, many research centers and institutions are establishing the equipment needed to carry out these studies.

Market Restraints

The pandemic has impacted to market negatively

However, due to lockdowns and other restrictions imposed by the relevant regulating bodies in the wake of the recent COVID-19 breakout, the activities of many industries have either temporarily ceased or are operating with small personnel. This issue will likely hurt market growth in the future for the global point-of-care CT imaging sector. Furthermore, point-of-care testing is significantly more expensive than standard CT systems, and this feature might slow the expansion of this worldwide industry's market in the future.

FULL-SIZED POINT OF CARE CT IMAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Application, End- User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Xoran Technologies, LLC Carestream Health, CurveBeam, Planmed, NeuroLogica Corp., Siemens Healthcare GmbH |

Global Full-Sized of Care CT Imaging Market- By Application

-

Neurology

-

Musculoskeletal

-

Respiratory

-

ENT

-

Others

In the point of care CT imaging market in 2021, neurology held the greatest revenue share of 29.5%. In contrast to other imaging technologies, CT imaging offers reliable diagnosis at a reduced cost, making it a popular choice in the field of neurology. Also, because CT offers quick imaging, it is less sensitive to patient movements. The critical care unit's workflow is improved by CT imaging equipment. Point-of-care computed tomography is preferred for this because it offers quick and precise imaging. The segment is also anticipated to grow as a result of an increase in traumatic brain injury (TBI) hospitalizations and emergency department (ED) visits.

CT imaging is in greater demand, and there are benefits to using it at the point of care. The market players are concentrating on creating improved point-of-care computed tomography imaging devices for neurology as a result of CT imaging. A transportable point-of-care CT scanner from Siemens Healthineers called SOMATOM Onsite offers premium picture quality at the point of care. The device's portability aids in avoiding the difficulties involved in moving patients from the intensive care unit to the radiology department.

During the projected period, the respiratory category is anticipated to develop at the fastest rate. The element anticipated to spur the segment's growth is the respiratory issues seen during the pandemic event. The majority of market participants are creating point-of-care CT imaging tools and using them to identify respiratory issues to make disease identification easier. For immediate care, Xoran Technologies has developed point-of-care computed tomography imaging equipment. To provide same-day point-of-care service and reduce patient travel and exposure, they have incorporated their point-of-care CT imaging devices, such as the MiniCAT IQ and MiniCAT 2020, into their COVID-19 plan.

Global Full-Sized of Care CT Imaging Market- By End- User

-

Hospitals

-

Ambulatory Surgery Centers

-

Clinics

-

Others

With a market share of 35.3%, the hospital sector dominated the industry in 2021. The category is anticipated to develop as neurological and respiratory problems become more common. To deliver CT imaging to a large patient pool, CT imaging equipment is primarily installed in hospitals. Rady Children's Hospital in San Diego began using the Carestream OnSight 3D Extremity imaging technology to offer point-of-care diagnoses in July 2020. Additionally, industry participants are creating portable point-of-care CT imaging systems to streamline hospital operations by preventing patient transfers between departments. BodyTom is a full-body portable point-of-care computed tomography scanner developed by NeuroLogica.

During the projection period, the Ambulatory Surgery Centers (ASCs) sector is anticipated to increase at the quickest rate. The segment is anticipated to be driven by the expanding development of portable point-of-care CT imaging systems for use in ASCs and other outpatient settings. Additionally, patients choose ASCs to avoid the added expense of a hospital stay. Compact point-of-care computed tomography scanners from Xoran Technologies, the MiniCAT 2020, and MiniCAT IQ can be added to these ASCs to provide improved imaging.

Additionally anticipated to develop significantly during the predicted period is the clinic category.

Point-of-care computed tomography imaging devices are increasingly being installed in clinics due to the escalating pandemic conditions and rising demand for early diagnosis. A few portable points of care CT imaging systems that are simple to install in clinics for offering computed tomography imaging are the MiniCAT 2020, MiniCAT IQ, and SOMATOM Onsite. Solo practitioners, satellite offices, research institutes, imaging centers, and research centers are some more end users.

Global Full-Sized of Care CT Imaging Market- By Geography & Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

In 2021, North America dominated the market and generated 26.4% of global revenues. The market in the area is being driven by the existence of significant market players including Carestream Health, Xoran Technologies, CURVEBEAM, and NeuroLogica. These industry participants are creating cutting-edge PoC computed tomography imaging systems. The FDA approved CurveBeam's InReach CT scanner in May 2017. The equipment, an ultra-compact scanner, offers improved imaging in point-of-care settings.

The market in Europe had a sizable market share in 2021 and is anticipated to expand moderately over the projected period. The region's market expansion is anticipated to be aided by the rising prevalence of neurological illnesses including brain trauma. According to a study that was published, 1.5 million hospital admissions in the European Union occur each year as a result of TBI. The point-of-care computed tomography imaging is preferred by these patients because they want an early and correct diagnosis; this preference is predicted to drive the market in Europe.

The market is anticipated to develop at its fastest rate over the forecast period in the Asia Pacific. To address the region's increasing need for computed tomography imaging, worldwide market participants are accelerating the development of portable point-of-care CT scanners. The rise in demand for computed tomography imaging has also been influenced by the pandemic breakout in China. NeuroLogica accelerated the manufacture of BodyTom, a portable point-of-care CT scanner, in February 2020. BodyTom will be distributed in China by the corporation with the help of Chindex, a Chinese distributor, to combat the pandemic's worsening state.

Global Full-Sized of Care CT Imaging Market- By Companies

-

Xoran Technologies, LLC

-

Carestream Health

-

CurveBeam

-

Planmed

-

NeuroLogica Corp.

-

Siemens Healthcare GmbH

NOTABLE HAPPENINGS IN THE GLOBAL FULL-SIZED POINT OF CARE CT IMAGING MARKET IN THE RECENT PAST:

-

Product Launch: - In 2021, According to a release from NeuroLogica Corp., commercial sales of the SmartMSU with OmniTom Elite CT scanner have begun. With the OmniTom Elite multi-slice computer tomography, this gadget improves the technology available for stroke imaging in ambulances and produces images with great resolution.

-

Government Investment: - In 2021, The All India of Medical Sciences in Patna now has a portable head and neck CT scanner called OmniTom, according to SCHILLER India (India). The first OmniTom to ever be installed in Asia is this one. It is a portable 16-slice CT scanner with 360-degree rotation.

-

Merger & Acquisition: - In 2020, In 26 of the 38 nations where Carestream Health conducts business, Philips has fully acquired the Healthcare Information Systems division. The cloud-enabled enterprise imaging platform from Carestream HCIS will add to Philips' current enterprise diagnostic informatics product line-up.

Chapter 1. Full-sized Point of Care CT Imaging Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Full-sized Point of Care CT Imaging Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Full-sized Point of Care CT Imaging Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Full-sized Point of Care CT Imaging Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Full-sized Point of Care CT Imaging Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Full-sized Point of Care CT Imaging Market– By Application

6.1 Introduction/Key Findings

6.2 Neurology

6.3 Musculoskeletal

6.4 Respiratory

6.5 ENT

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Full-sized Point of Care CT Imaging Market– By End user

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Ambulatory Surgery Centers

7.4 Clinics

7.5 Others

7.6 Y-O-Y Growth trend Analysis By End user

7.7 Absolute $ Opportunity Analysis By End user, 2024-2030

Chapter 8. Full-sized Point of Care CT Imaging Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By End user

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By End user

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By End user

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By End user

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By End user

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Full-sized Point of Care CT Imaging Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Xoran Technologies, LLC

9.2 Carestream Health

9.3 CurveBeam

9.4 Planmed

9.5 NeuroLogica Corp.

9.6 Siemens Healthcare GmbH

Download Sample

Choose License Type

2500

4250

5250

6900