Fuel System Icing Inhibitor Market Size (2024 – 2030)

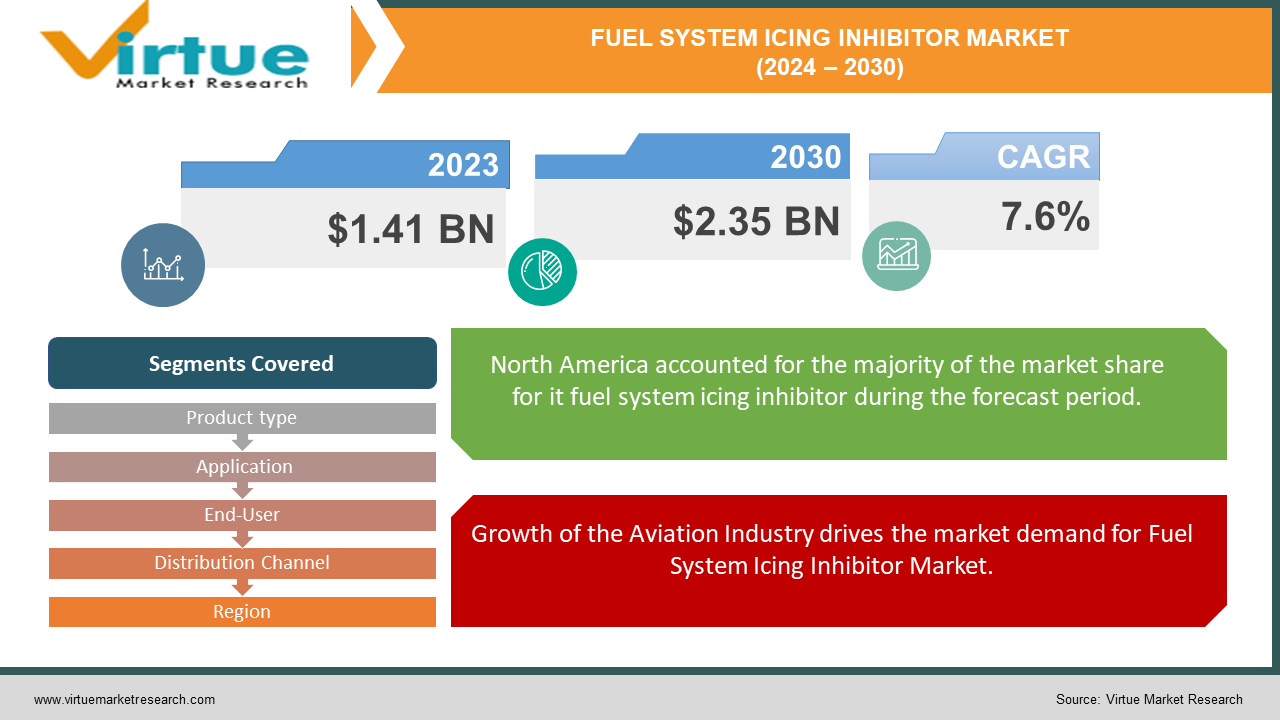

The Global Fuel System Icing Inhibitor Market is valued at USD 1.41 Billion and is projected to reach a market size of USD 2.35 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.6%.

A key long-term driver for the FSII market is the growth of the aviation industry. As air travel becomes more popular and accessible, the demand for safe and efficient aircraft increases. Modern aircraft require advanced fuel systems to operate in diverse and sometimes harsh weather conditions. FSII products play a critical role in ensuring that fuel systems function smoothly without the risk of ice formation, which can cause serious malfunctions. This demand for reliable fuel additives is expected to continue growing as the aviation industry expands globally. An exciting opportunity in the FSII market lies in the development of advanced bio-based inhibitors. Traditional FSII products are often derived from petrochemicals, which can be harmful to the environment. Bio-based inhibitors, on the other hand, are made from renewable resources and have a lower environmental footprint. The shift towards bio-based FSII products presents a lucrative opportunity for manufacturers to tap into the growing demand for sustainable solutions. This shift aligns with global efforts to reduce carbon emissions and promote green technologies.

A notable trend observed in the FSII industry is the integration of smart technologies into fuel management systems. Companies are investing in research and development to create intelligent fuel systems that can monitor and adjust FSII levels in real-time.

Key Market Insights:

The Fuel System Icing Inhibitor Market is projected to expand at a compound annual growth rate of over 7.6% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Innospec Inc. - United States, BASF SE – Germany, Clariant AG – Switzerland are some example of Fuel System Icing Inhibitor Market.

North America and Europe & Asia-Pacific and Latin America accounts for approximately 65-70 % of the Fuel System Icing Inhibitor Market, driven by Growth of the Aviation Industry, Environmental Regulations and Sustainability Initiatives, Advancements in Fuel Management Technologies & Rising Demand for Bio-Based Inhibitors.

Fuel System Icing Inhibitor Market Drivers:

Growth of the Aviation Industry drives the market demand for Fuel System Icing Inhibitor Market.

The aviation industry is a significant long-term driver for the FSII market. As global air travel increases, so does the demand for more aircraft. Modern aircraft need advanced fuel systems to ensure safe and efficient operations, especially in varying weather conditions. FSII products are essential in preventing ice formation in these fuel systems, which can lead to serious operational issues. The ongoing expansion of commercial aviation, coupled with the rise in air cargo and private aviation sectors, ensures a steady demand for FSII, driving market growth.

Environmental Regulations and Sustainability Initiatives drive the market demand for Fuel System Icing Inhibitor Market.

In recent years, there has been a growing emphasis on environmental sustainability across various industries, including aviation and automotive. Governments and regulatory bodies worldwide are enforcing stricter environmental standards to reduce emissions and promote cleaner technologies. This has led to increased demand for eco-friendly FSII products that not only prevent fuel system icing but also have minimal environmental impact. Manufacturers are developing new formulations that comply with these regulations, driving innovation and growth in the FSII market.

Advancements in Fuel Management Technologies drive the market demand for Fuel System Icing Inhibitor Market.

Technological advancements in fuel management systems are another key driver for the FSII market. Modern fuel systems are becoming more sophisticated, incorporating smart technologies that monitor and adjust various parameters in real-time. These smart systems optimize the use of FSII, ensuring that the right amount is used to prevent icing without wasting the additive. The integration of sensors, data analytics, and automation in fuel management systems enhances the efficiency and reliability of these systems, increasing the demand for advanced FSII products that can work seamlessly with these technologies.

Rising Demand for Bio-Based Inhibitors drives the market demand for Fuel System Icing Inhibitor Market.

There is a growing trend towards the use of bio-based inhibitors in the FSII market. Traditional FSII products are typically derived from petrochemicals, which have a higher environmental impact. Bio-based inhibitors, on the other hand, are made from renewable resources and are more environmentally friendly. As awareness of sustainability issues increases, both consumers and industries are looking for greener alternatives. This shift presents a significant opportunity for FSII manufacturers to develop and market bio-based products. The rising demand for sustainable and eco-friendly solutions is driving growth in the FSII market, as companies strive to meet these new expectations.

Fuel System Icing Inhibitor Market Restraints and Challenges:

One of the major restraints in the FSII market is the high production cost of advanced inhibitors. Developing FSII products that are both effective in preventing ice formation and environmentally friendly requires significant investment in research and development. The raw materials used, especially for bio-based inhibitors, can be expensive. Additionally, the manufacturing processes often involve sophisticated technologies and stringent quality control measures to meet regulatory standards. These factors contribute to higher production costs, which can lead to increased prices for end-users.

The high cost can be a barrier for some industries, particularly in regions where budget constraints are a significant concern. Smaller airlines or automotive companies may find it challenging to afford the latest and most efficient FSII products, potentially limiting the market's growth. To overcome this challenge, companies need to focus on cost-effective production methods and explore ways to reduce raw material costs without compromising on quality and performance.

Fuel System Icing Inhibitor Market Opportunities:

One of the most promising opportunities for the FSII market lies in the expansion into emerging markets. Regions such as Asia-Pacific, Latin America, and parts of Africa are experiencing rapid economic growth and urbanization, leading to increased demand for air travel and automotive transportation. As these regions develop their infrastructure, the need for advanced fuel systems and additives like FSII becomes critical.

In the aviation sector, emerging markets are seeing a surge in the number of new airports, airlines, and flight routes. Governments are investing heavily in aviation infrastructure to support tourism, business travel, and cargo transport. This expansion creates a substantial demand for FSII products to ensure the safety and reliability of fuel systems in varying climatic conditions.

FUEL SYSTEM ICING INHIBITOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By Product type, Application, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Innospec Inc. - United States, BASF SE - Germany, Clariant AG - Switzerland, Afton Chemical Corporation - United States, Eastman Chemical Company - United States, TotalEnergies SE - France, Chevron Oronite - United States, Glycol Products LLC - United States, The Chemours Company - United States, SABIC (Saudi Basic Industries Corporation) - Saudi Arabia, LyondellBasell Industries - United States, Huntsman Corporation - United States, Solvay S.A. - Belgium, Trek Chemical Corporation - United States, Cognis Corporation - Germany, Azelis Group - Belgium, Kraton Polymers - United States, Arkema S.A. - France, Rivertop Renewables - United States, Fuel Additive Technologies LLC - United States |

Fuel System Icing Inhibitor Market Segmentation: By Product Type

-

Diethylene Glycol Monomethyl Ether (DiEGME)

-

Ethylene Glycol Monomethyl Ether (EGME)

-

Triethylene Glycol Monomethyl Ether (TriEGME)

-

Other Inhibitors

The largest segment in the Fuel System Icing Inhibitor (FSII) market by product type is Diethylene Glycol Monomethyl Ether (DiEGME). DiEGME is widely recognized for its efficacy in preventing ice formation in fuel systems, particularly in the aviation sector. Its popularity stems from its superior performance in extreme cold conditions, making it a preferred choice for commercial airlines and military aviation. The aviation industry’s stringent safety standards and the critical need for reliable fuel additives drive the demand for DiEGME. Additionally, DiEGME’s compatibility with various fuel types and its ability to maintain fuel system integrity under diverse environmental conditions contribute to its dominance in the market. Moreover, DiEGME's established track record and widespread acceptance among major airlines and defense organizations further cement its position as the largest segment. Its consistent performance and regulatory compliance make it a trusted additive for ensuring operational safety. As air travel continues to grow globally, the demand for DiEGME remains robust, supported by its proven effectiveness and reliability in preventing fuel system icing.

The fastest-growing segment in the FSII market is bio-based inhibitors. As industries increasingly prioritize sustainability and environmental responsibility, bio-based FSII products are gaining significant traction. These inhibitors, derived from renewable resources, offer an eco-friendly alternative to traditional petrochemical-based additives. The growing awareness of environmental impacts and the push for greener technologies have led to a surge in demand for bio-based FSII, especially among environmentally conscious consumers and organizations. Bio-based inhibitors are not only attractive for their reduced environmental footprint but also for their potential to meet stringent regulatory requirements aimed at minimizing pollution and enhancing fuel efficiency. Advances in biotechnology and green chemistry are facilitating the development of these sustainable additives, which perform effectively while aligning with global sustainability goals. As the market continues to evolve, the shift towards bio-based inhibitors reflects a broader trend towards environmentally sustainable solutions, positioning this segment for rapid growth in the coming years.

Fuel System Icing Inhibitor Market Segmentation: By Application

-

Aviation

-

Commercial Aviation

-

Military Aviation

-

General Aviation

-

Automotive

-

Marine

-

Industrial

The aviation segment stands as the largest application segment in the Fuel System Icing Inhibitor (FSII) market. This dominance is primarily due to the critical role that FSII plays in ensuring the safety and efficiency of aircraft operations. In aviation, the risk of ice formation in fuel systems can lead to severe operational disruptions and safety hazards, making the use of FSII indispensable. Both commercial and military aviation sectors rely heavily on FSII products to maintain optimal performance in cold weather conditions. The sheer volume of global air traffic, combined with the stringent safety regulations governing the aviation industry, drives the substantial demand for FSII in this application segment. Furthermore, the aviation industry's continuous expansion, marked by the increasing number of flights and the introduction of new aircraft, further bolsters the demand for FSII. As airlines strive to enhance operational reliability and safety, the consistent use of FSII becomes crucial. This reliance on FSII is evident in both routine commercial operations and critical military missions, underscoring the segment's significance in the overall market landscape. The aviation sector’s focus on safety and efficiency ensures that it remains the largest application segment for FSII.

The automotive segment is emerging as the fastest-growing application segment in the FSII market. This growth is driven by the increasing adoption of advanced fuel systems in vehicles, coupled with the rising need for additives that can prevent icing and ensure smooth engine performance in cold climates. As automotive manufacturers innovate to enhance fuel efficiency and performance, the integration of FSII products becomes more prevalent. This is particularly important in regions with harsh winters, where vehicle fuel systems are susceptible to ice formation, potentially leading to engine stalling and other issues. Additionally, the growing consumer awareness of the benefits of FSII in maintaining vehicle reliability and extending engine life is contributing to the segment’s rapid expansion. The trend towards eco-friendly and high-performance vehicles also supports the increased use of FSII, as these additives help in achieving the desired fuel efficiency and emission standards. The automotive industry's push towards advanced, resilient, and efficient fuel systems is a key factor driving the fast-paced growth of the FSII market within this segment, reflecting a broader shift towards improving vehicle performance and safety in all weather conditions.

Fuel System Icing Inhibitor Market Segmentation: By End-User

-

Airlines

-

Military

-

Automotive Manufacturers

-

Maritime Operators

-

Fuel Suppliers

The largest end-user segment in the Fuel System Icing Inhibitor (FSII) market is airlines. Airlines rely heavily on FSII to ensure the safety and reliability of their aircraft, particularly during winter months and in regions with cold climates. The primary concern for airlines is the prevention of ice formation in fuel systems, which can lead to blockages, engine malfunctions, and serious safety risks. With a vast number of flights operating daily and the critical nature of maintaining uninterrupted service, airlines constitute the largest demand base for FSII products. The regulatory requirements for aviation safety further emphasize the need for consistent and effective use of FSII, making it a vital component in airline operations. Moreover, the commercial aviation sector's continuous growth, with increasing passenger numbers and expanding flight routes, reinforces the substantial demand for FSII. Airlines are constantly adding new aircraft to their fleets, and each of these aircraft requires FSII to operate safely in varying weather conditions. The operational scale and the stringent safety standards of the airline industry ensure that this end-user segment remains the largest in the FSII market. The continuous expansion of global air travel, driven by both business and leisure, keeps the demand for FSII robust and steadily growing.

The fastest-growing end-user segment in the FSII market is automotive manufacturers. This growth is fueled by the increasing complexity and sophistication of modern fuel systems, which require advanced additives to prevent icing and ensure optimal performance. Automotive manufacturers are incorporating FSII products into their vehicles to enhance reliability, especially in cold weather conditions. The rise in consumer demand for vehicles that perform well in all climates, coupled with the emphasis on fuel efficiency and engine longevity, drives the rapid adoption of FSII in the automotive industry. Additionally, the automotive sector's push towards innovation and sustainability is accelerating the growth of this segment. As manufacturers develop new models and technologies, including electric and hybrid vehicles, the need for effective fuel additives that can operate under diverse conditions becomes more critical. The growing awareness among consumers about the benefits of FSII in maintaining vehicle performance and preventing costly engine damage also contributes to this trend. With a focus on delivering high-quality, resilient vehicles, automotive manufacturers are increasingly integrating FSII into their production processes, making this the fastest-growing end-user segment in the market.

Fuel System Icing Inhibitor Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Online Sales

The largest distribution channel for the Fuel System Icing Inhibitor (FSII) market is direct sales. This channel dominates due to the nature of the FSII market, where bulk purchases and long-term contracts are common. Direct sales involve manufacturers selling directly to end-users, such as airlines, military organizations, and large automotive manufacturers, without intermediaries. This direct relationship allows for customized solutions, better pricing, and efficient logistics, all of which are crucial for large-scale users who require consistent and reliable supply. The direct sales model also facilitates strong customer support and technical service, which are essential in ensuring that the FSII products meet the stringent performance and safety standards required by these end-users. Additionally, the direct sales channel benefits from the trust and reliability built over years of direct interaction and tailored services. For example, airlines and military units prefer to engage directly with FSII manufacturers to ensure that the products they receive are of the highest quality and comply with all regulatory standards. This direct approach also helps in the timely delivery of large quantities, which is critical for maintaining the operational readiness of aircraft and vehicles. Consequently, the direct sales channel remains the largest in the FSII market due to its ability to meet the specific needs of major end-users effectively.

The fastest-growing distribution channel for the FSII market is online sales. This growth is driven by the increasing digitalization of the supply chain and the rising preference for convenient and quick purchasing options. Online sales platforms provide a broader reach and easier access to a wide range of FSII products for various end-users, including smaller aviation operators, automotive service providers, and individual consumers. The ability to compare products, read reviews, and make informed decisions from the comfort of their offices or homes has significantly contributed to the popularity of online sales. Moreover, the COVID-19 pandemic has accelerated the shift towards online purchasing as businesses and individuals seek contactless and efficient ways to procure necessary products. E-commerce platforms and dedicated manufacturer websites offer detailed product information, certifications, and technical support, making it easier for customers to select the right FSII products for their needs. The convenience of online sales, coupled with advancements in logistics and delivery services, ensures that products are delivered quickly and reliably. This trend is expected to continue growing as digital transformation becomes more entrenched in the procurement processes across industries, making online sales the fastest-growing distribution channel in the FSII market.

Fuel System Icing Inhibitor Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

The largest regional segment in the Fuel System Icing Inhibitor (FSII) market is North America. This dominance is largely due to the significant presence of the aviation industry in the region, which is a major consumer of FSII products. North America, particularly the United States and Canada, is home to a vast number of commercial airlines, military aviation units, and general aviation operators. These organizations rely on FSII to ensure the safety and efficiency of their aircraft in various weather conditions, especially during the cold winter months when fuel system icing is a major concern. The high volume of flights, frequent severe weather conditions, and stringent safety regulations contribute to North America's leading position in the FSII market. In addition to the aviation sector, North America also has a well-established automotive industry that uses FSII to enhance vehicle performance and reliability. The region's strong infrastructure for both aviation and automotive sectors, combined with a high level of technological advancement and regulatory enforcement, supports the large demand for FSII products. The presence of major FSII manufacturers and suppliers in North America, coupled with the region’s robust distribution networks and high standards for product quality, solidifies North America's status as the largest market for FSII.

The fastest-growing regional segment in the FSII market is the Asia-Pacific region. This rapid growth is driven by several factors, including the region’s expanding aviation industry, increasing automotive production, and rising awareness of fuel system maintenance. Countries such as China, India, and Japan are experiencing substantial growth in their aviation sectors, with new airlines, airports, and flight routes being developed. This expansion increases the demand for FSII products as airlines and aviation operators in these countries seek reliable solutions to manage fuel system icing and ensure the safety of their flights. Additionally, the automotive industry in Asia-Pacific is also growing at a significant pace. As the number of vehicles on the roads increases, so does the need for effective fuel additives, including FSII, to maintain engine performance and prevent icing issues in colder regions. The region’s focus on enhancing fuel efficiency and complying with environmental regulations further fuels the demand for advanced FSII solutions. Moreover, the rise of e-commerce and online retail platforms in Asia-Pacific has made it easier for customers to access FSII products, contributing to the rapid growth of the market. This combination of expanding aviation and automotive sectors, along with increased accessibility through digital channels, positions Asia-Pacific as the fastest-growing region in the FSII market.

COVID-19 Impact Analysis on Fuel System Icing Inhibitor Market:

The COVID-19 pandemic had a profound and multifaceted impact on the Fuel System Icing Inhibitor (FSII) market. At the onset of the pandemic, global lockdowns and travel restrictions caused a significant decline in both the aviation and automotive sectors, the two largest consumers of FSII products. Airlines faced unprecedented reductions in flight frequencies, and automotive sales plummeted as people stayed home and postponed vehicle purchases and maintenance. This immediate drop in demand led to a slowdown in the FSII market as the industry grappled with decreased fuel consumption and the suspension of routine maintenance activities. For instance, major airlines deferred or canceled fuel purchases, and automotive manufacturers adjusted their production schedules in response to the lower demand for FSII. The pandemic also disrupted global supply chains, causing delays in the production and distribution of FSII products, which further compounded the challenges faced by the market.

Latest Trends/ Developments:

One of the latest trends in the Fuel System Icing Inhibitor (FSII) market is the increasing shift towards sustainable and bio-based additives. Traditionally, FSII products have been derived from petrochemicals, but there is a growing demand for eco-friendly alternatives that minimize environmental impact. Bio-based FSII additives, made from renewable resources such as plant-based materials, are gaining traction as industries seek greener solutions. These products offer similar performance benefits as their petrochemical counterparts but with a reduced carbon footprint. For instance, manufacturers are now developing FSII formulations that incorporate bio-derived glycols or other natural compounds. This shift is driven by stricter environmental regulations and a heightened awareness of sustainability among consumers and businesses. The move towards bio-based FSII is part of a broader industry trend towards reducing environmental impact and improving the sustainability of aviation and automotive technologies.

Key Players:

-

Innospec Inc. - United States

-

BASF SE - Germany

-

Clariant AG - Switzerland

-

Afton Chemical Corporation - United States

-

Eastman Chemical Company - United States

-

TotalEnergies SE - France

-

Chevron Oronite - United States

-

Glycol Products LLC - United States

-

The Chemours Company - United States

-

SABIC (Saudi Basic Industries Corporation) - Saudi Arabia

-

LyondellBasell Industries - United States

-

Huntsman Corporation - United States

-

Solvay S.A. - Belgium

-

Trek Chemical Corporation - United States

-

Cognis Corporation - Germany

-

Azelis Group - Belgium

-

Kraton Polymers - United States

-

Arkema S.A. - France

-

Rivertop Renewables - United States

-

Fuel Additive Technologies LLC - United States

Chapter 1. Fuel System Icing Inhibitor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fuel System Icing Inhibitor Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fuel System Icing Inhibitor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fuel System Icing Inhibitor Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fuel System Icing Inhibitor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6.Fuel System Icing Inhibitor Market – By Product Type

6.1 Introduction/Key Findings

6.2 Diethylene Glycol Monomethyl Ether (DiEGME)

6.3 Ethylene Glycol Monomethyl Ether (EGME)

6.4 Triethylene Glycol Monomethyl Ether (TriEGME)

6.5 Other Inhibitors

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Fuel System Icing Inhibitor Market – By Application

7.1 Introduction/Key Findings

7.2 Aviation

7.3 Commercial Aviation

7.4 Military Aviation

7.5 General Aviation

7.6 Automotive

7.7 Marine

7.8 Industrial

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Fuel System Icing Inhibitor Market – By End-User

8.1 Introduction/Key Findings

8.2 Airlines

8.3 Military

8.4 Automotive Manufacturers

8.5 Maritime Operators

8.6 Fuel Suppliers

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Fuel System Icing Inhibitor Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Direct Sales

9.3 Distributors

9.4 Online Sales

9.5 Y-O-Y Growth trend Analysis By Distribution Channel

9.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Fuel System Icing Inhibitor Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By ApplicationApplication

10.1.3 By End-User

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By ApplicationApplication

10.2.4 By End-User

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By ApplicationApplication

10.3.4 By End-User

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By ApplicationApplication

10.4.4 By End-User

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By ApplicationApplication

10.5.4 By End-User

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Fuel System Icing Inhibitor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Innospec Inc. - United States

11.2 BASF SE - Germany

11.3 Clariant AG - Switzerland

11.4 Afton Chemical Corporation - United States

11.5 Eastman Chemical Company - United States

11.6 TotalEnergies SE - France

11.7 Chevron Oronite - United States

11.8 Glycol Products LLC - United States

11.9 The Chemours Company - United States

11.10 SABIC (Saudi Basic Industries Corporation) - Saudi Arabia

11.11 LyondellBasell Industries - United States

11.12 Huntsman Corporation - United States

11.13 Solvay S.A. - Belgium

11.14 Trek Chemical Corporation - United States

11.15 Cognis Corporation - Germany

11.16 Azelis Group - Belgium

11.17 Kraton Polymers - United States

11.18 Arkema S.A. - France

11.19 Rivertop Renewables - United States

11.20 Fuel Additive Technologies LLC - United States

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Fuel System Icing Inhibitor Market is valued at USD 1.41 Billion and is projected to reach a market size of USD 2.35 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.6%.

Growth of the Aviation Industry, Environmental Regulations and Sustainability Initiatives, Advancements in Fuel Management Technologies & Rising Demand for Bio-Based Inhibitors.

Direct Sales, Distributors & Online are the segments under the Fuel System Icing Inhibitor Market by distribution channel.

North America is the most dominant region for the Fuel System Icing Inhibitor Market.

Asia-Pacific is the fastest-growing region in the Fuel System Icing Inhibitor Market.