Fuel Injection System Market Size (2024 –2030)

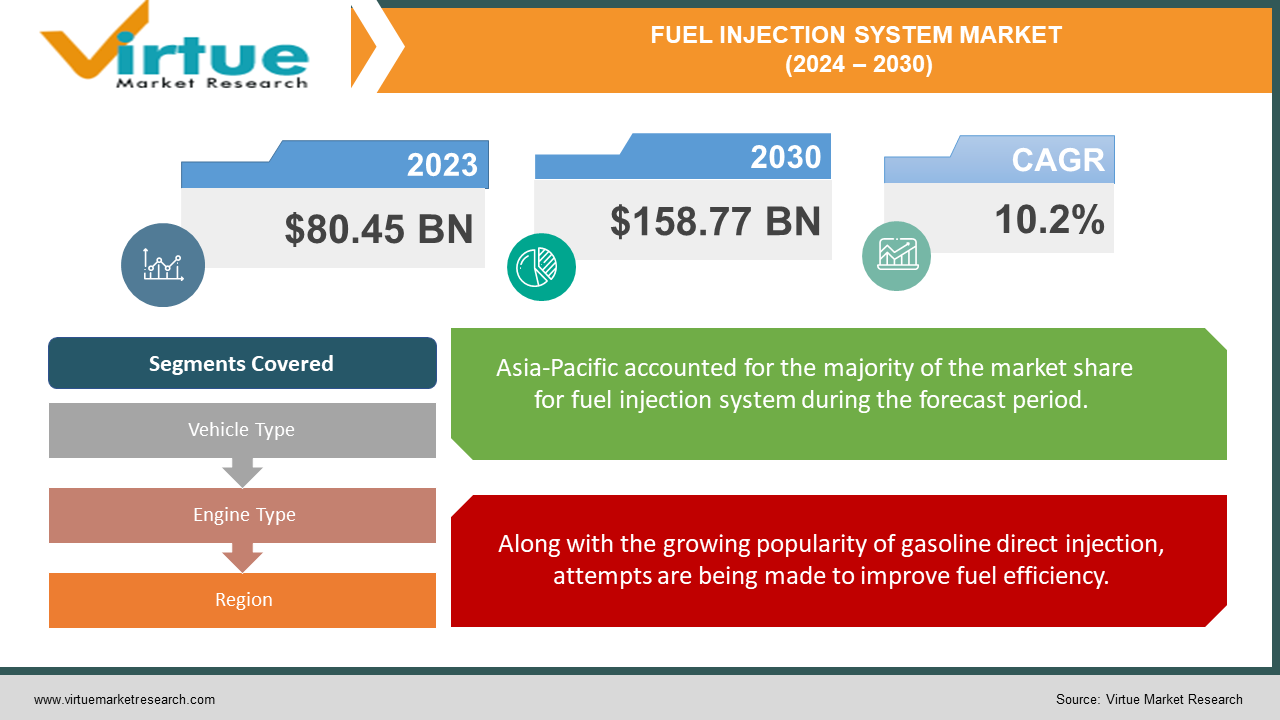

The Global Fuel Injection System Market was valued at USD 80.45 billion and is projected to reach a market size of USD 158.77 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.2%.

An engine's fuel injection system is comparable to its heart. It is in charge of supplying the engine with the proper amount of fuel so that it can operate smoothly. These systems come in a variety of forms, each with unique benefits. Selecting the appropriate one according to the engine's requirements is crucial. Automobiles, aircraft, military vehicles, and mining machinery all use these systems. They function by pressurizing the mixture of fuel and air. An efficient fuel injection system makes an engine run smoother, consumes fuel more effectively, and emits fewer pollutants. Thus, selecting the appropriate system is essential for both maintaining a clean environment and a well-performing engine.

Key Market Insights:

The global fuel injection system market is estimated to be around $80 billion in value, driven by the increasing demand for efficient and clean combustion systems in automobiles.

Asia-Pacific region accounts for nearly 30% of the global fuel injection system market share, attributed to the presence of major automotive manufacturing hubs and the growing demand for fuel-efficient vehicles.

The gasoline direct injection (GDI) segment holds a market share of over 30% in the fuel injection system market, owing to its ability to improve fuel efficiency and reduce emissions in gasoline-powered vehicles.

The passenger cars segment contributes to around 55% of the overall fuel injection system market, driven by the increasing production and sales of passenger vehicles globally.

The common rail direct injection (CRDi) is expected to grow at a rate of around 6% annually, driven by the growing adoption of diesel engines in commercial vehicles and the need for efficient and clean diesel combustion systems.

Global Fuel Injection System Market Drivers:

Along with the growing popularity of gasoline direct injection, attempts are being made to improve fuel efficiency.

The goal of automakers is to create vehicles that emit fewer harmful gases, such as carbon dioxide, and use less gasoline. Modern technology has made it possible to increase engine power without sacrificing fuel efficiency. One widely used technology that they employ is known as gasoline direct injection (GDI). It is excellent because it increases engine power and aids in the regulation of harmful emissions from engines that burn fuel. Because of how excellent this technology is, many cars and trucks today use it. This demonstrates that fuel injection directly into engines is the way of the future. Additionally, the market for fuel injection systems is expanding quickly due to its popularity.

Another development that has affected the adoption of electronic fuel injection systems is the combination of intelligence and low fuel consumption.

Installing electronic fuel injection systems in automobiles is no longer novel or exceptional. They help the car use fuel very efficiently regardless of the driving conditions, which is why more and more cars are using them. These systems are now found in even the most basic models of cars made by major automakers. The fact that governments are enacting laws to lessen pollution is one of the reasons these systems are so well-liked.

Fuel Injection System Market Challenges and Restraints:

Globally, the number of people utilizing shared transportation services is steadily increasing. This is due to the ease of access to these services, the widespread use of smartphones and the internet, and the fact that it is more practical than owning a car. Fewer people are purchasing cars as a result of rising gas prices and rising car costs. As a result, it is anticipated that automobile sales will decline in the upcoming years, particularly in North America and Europe. Due to the decline in sales, some automakers are even ceasing to produce automobiles. This implies that automobile parts, such as fuel injectors, are also less in demand than they formerly were.

Fuel Injection System Market Opportunities:

There are lots of opportunities in the market for fuel injection systems. Cars with efficient fuel consumption are in high demand as concerns over pollution and rising fuel prices grow. Fuel injection system manufacturers now have more room to develop more advanced, more effective systems. More people are purchasing cars in nations with expanding economies, which increases the demand for fuel injection systems. Additionally, there is a possibility that businesses will create fuel systems that are compatible with emerging fuels, such as hydrogen, as these fuels gain popularity. Advancements in fuel injection technology, such as electronic controls, present opportunities for manufacturers to develop more efficient systems that contribute to cleaner and smoother engine operation. Governments are also regulating the amount of pollution automobiles can produce, which means automakers can develop systems to help their vehicles comply with the regulations. There are many opportunities for companies in the fuel injection system market if they collaborate with other businesses and concentrate on offering high-quality service for cars that are already in production.

FUEL INJECTION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.2% |

|

Segments Covered |

By Vehicle Type, Engine Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robert Bosch GmbH, Delphi Automotive PLC, Denso Corporation, Hitachi Limited, Carter Fuel System, Edelbrock, LLC, NGK Spark Plug Co., Ltd., Magneti Marelli, Infineon Technologies AG, Keihin Corporation |

Global Fuel Injection System Market Segmentation: By Vehicle Type

-

Passenger Vehicles

-

Commercial Vehicles

-

Heavy Trucks

-

Buses

-

Two-Wheelers

The fuel injection systems market is divided into distinct segments according to the kinds of vehicles that utilize them, such as cars, trucks, buses, and motorcycles. The automobile category is anticipated to be the largest and expand at the fastest rate among them. This is a result of the fact that an increasing number of urban dwellers are becoming wealthier and prefer cars with the newest features, safety features, and comfort levels. All of this results in a high demand for automobile fuel injection systems.

Global Fuel Injection System Market Segmentation: By Engine Type

-

Gasoline Engines

-

Diesel Engines

Nowadays, gasoline engines are more common in cars than diesel engines because they burn less fuel, are less expensive to operate, and produce less pollution. Both wealthy and developing nations are seeing this trend as a result of consumer demand for cleaner, more fuel-efficient vehicles. The older port fuel injection systems are losing ground to gasoline engines in terms of popularity. Diesel engine usage is still prevalent and is predicted to grow gradually in the future. Because more vehicles with these engines are being produced, the market for gasoline and diesel engine systems is expanding.

Global Fuel Injection System Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The increased production of automobiles in the Asia-Pacific area is driving up demand for fuel injection systems. In China, India, and Thailand, for example, people are purchasing more fuel-efficient vehicles due to rising income levels and stringent government regulations limiting the amount of pollution that automobiles can emit. Fuel injection systems are in high demand in Europe as well due to stringent regulations regarding the amount of pollution that automobiles, particularly diesel vehicles, are allowed to produce. This encourages manufacturers to produce higher-quality auto parts. France, the United Kingdom, and Germany are at the forefront of this demand. The increasing use of trucks and off-road vehicles in North America, along with rising consumer spending on these vehicles, is driving up demand for fuel injection systems. Because more cars are being produced and consumers want cleaner, better cars, the global market for fuel injection systems is expanding overall.

COVID-19 Impact on the Global Fuel Injection System Market:

2019 was a difficult year for the auto industry, with fewer new vehicles produced in major auto markets like China, India, and Germany. 2020 was supposed to be a better year, but things got worse when the COVID-19 pandemic struck. Those in the automotive industry have found this to be extremely unsettling. On the other hand, the automotive industry, which produces parts like fuel systems for automobiles, is expected to continue growing, much like the auto industry itself.

Latest Trend/Development:

Market trends for fuel injection systems are changing significantly. Although the number of electric cars is increasing, conventional fuel systems are still being innovated, particularly for hybrid vehicles. Additionally, researchers are examining novel fuels such as methane and hydrogen. This implies that these fuels must be handled safely and effectively by fuel systems. To save fuel and reduce pollution, a lot of effort is being put into improving fuel systems that deliver fuel directly to gas-powered vehicles' engines. Additionally, new technologies are being added to improve fuel delivery control and smooth out engine operation. Worldwide governments are enacting legislation to reduce pollution; therefore, in order to comply with these regulations, fuel systems must be more efficient and cleaner. Additionally, there's a push for digital technology to simplify the monitoring and maintenance of fuel systems. Businesses are collaborating to generate fresh concepts and maintain their competitive edge. Moreover, the need for fuel systems is rising in nations where a greater proportion of people own automobiles.

Key Players:

-

Robert Bosch GmbH

-

Delphi Automotive PLC

-

Denso Corporation

-

Hitachi Limited

-

Carter Fuel System

-

Edelbrock, LLC

-

NGK Spark Plug Co., Ltd.

-

Magneti Marelli

-

Infineon Technologies AG

-

Keihin Corporation

Chapter 1. Fuel Injection System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fuel Injection System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fuel Injection System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fuel Injection System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fuel Injection System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fuel Injection System Market – By Vehicle Type

6.1 Introduction/Key Findings

6.2 Passenger Vehicles

6.3 Commercial Vehicles

6.4 Heavy Trucks

6.5 Buses

6.6 Two-Wheelers

6.7 Y-O-Y Growth trend Analysis By Vehicle Type

6.8 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 7. Fuel Injection System Market – By Engine Type

7.1 Introduction/Key Findings

7.2 Gasoline Engines

7.3 Diesel Engines

7.4 Y-O-Y Growth trend Analysis By Engine Type

7.5 Absolute $ Opportunity Analysis By Engine Type, 2024-2030

Chapter 8. Fuel Injection System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Vehicle Type

8.1.3 By Engine Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Vehicle Type

8.2.3 By Engine Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Vehicle Type

8.3.3 By Engine Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Vehicle Type

8.4.3 By Engine Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Vehicle Type

8.5.3 By Engine Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fuel Injection System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Robert Bosch GmbH

9.2 Delphi Automotive PLC

9.3 Denso Corporation

9.4 Hitachi Limited

9.5 Carter Fuel System

9.6 Edelbrock, LLC

9.7 NGK Spark Plug Co., Ltd.

9.8 Magneti Marelli

9.9 Infineon Technologies AG

9.10 Keihin Corporation\

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The performance of the engine depends on the efficiency of the fuel injection system, which must supply, meter, inject, and atomize the gasoline, it is the most crucial component of the engine mechanism.

The Global Fuel Injection System Market was estimated to be worth USD 80.45 billion in 2023 and is projected to reach a value of USD 158.77 billion by 2030, growing at a CAGR of 10.2% during the forecast period 2024-2030.

In addition to gasoline direct injection's rising popularity, efforts are being made to increase fuel efficiency and the pairing of intelligence with low fuel consumption is another development that has impacted the adoption of electronic fuel injection systems are the driving factors of the Global Fuel Injection System Market.

The decline in vehicle production will provide a significant obstacle to the expansion of the worldwide market for fuel injectors.

The diesel engine type is the fastest growing in the Global Fuel Injection System Market.