Fuel Cell Balance of Plant (BOP) Market Size (2024-2030)

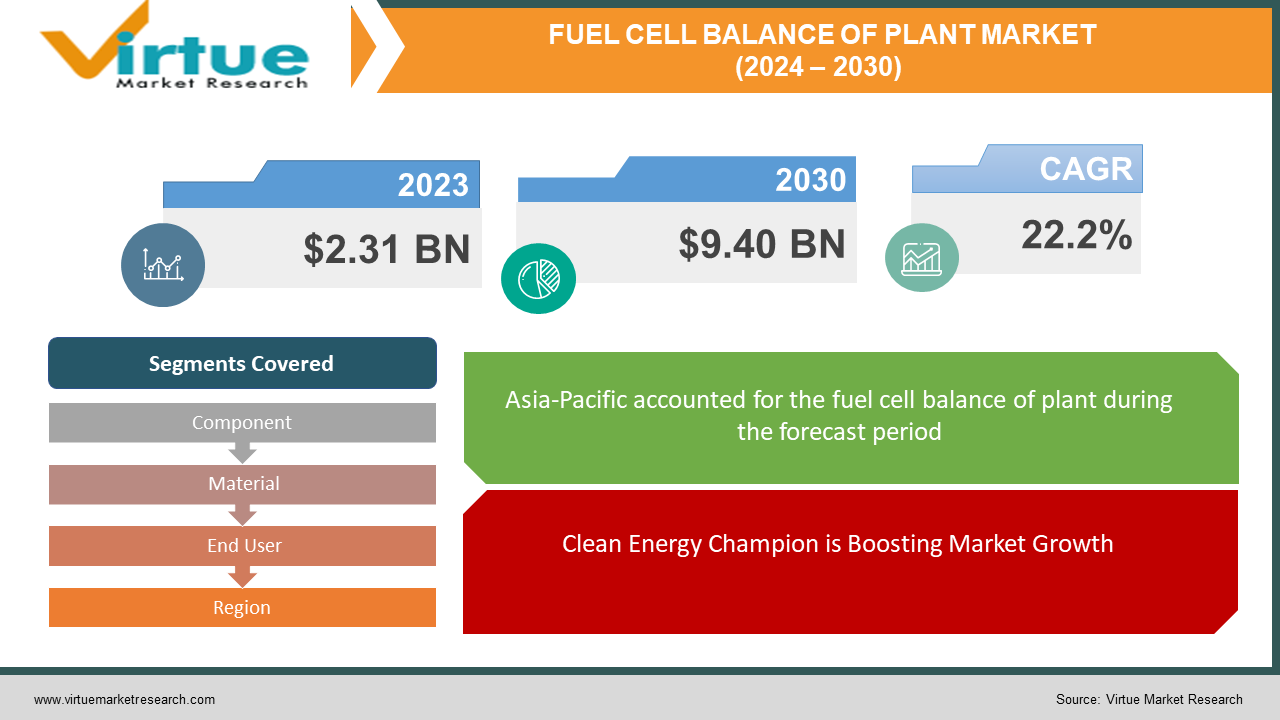

The fuel cell balance of plant (BOP) market was valued at USD 2.31 billion in 2023 and is projected to reach a market size of USD 9.40 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 22.2%.

The fuel cell BOP market's journey towards a clean energy future isn't a smooth ride. While its potential shines brightly, several roadblocks need to be tackled. The hefty price tag compared to traditional options can make investors flinch, and the technology, though advanced, and still faces questions about its long-term performance. Filling up the tanks of the future also presents a challenge, with the hydrogen infrastructure lagging behind demand and hindering broader adoption. Furthermore, a lack of standardized components can be a potential hurdle. The skills gap adds another hurdle, as qualified personnel to handle these systems are scarce. The regulatory landscape is still evolving with uncertainties, and this process can demotivate investors. Finally, public perception is filled with misconceptions about safety and environmental impact that need to be addressed.

Key Market Insights:

The fuel cell balance of the plant (BOP) market gleams with promise, illuminating a cleaner energy future. Asia, led by China's powerhouse investments and diverse applications, currently holds the crown. Europe and North America, though facing Asia's competitive glare, are experiencing their green shoots through supportive policies and a focus on hydrogen-powered mobility that is fueling their engines. However, the high cost of entry can create barriers for smaller firms, and the lack of a robust hydrogen infrastructure leaves some vehicles yearning for a full tank.

Standardized components can streamline integration and maintenance, while workforce training programs can cultivate the skilled hands that are needed. Clear government policies help attract investments, subsequently leading to growth. To clear public perception, education and outreach to embrace the clean energy potential are vital.

So, while challenges remain, the future of the fuel cell BOP market shines bright. Continuous innovation in materials, AI, and system optimization acts like a self-charging engine, propelling the market toward a cleaner and brighter future.

The Fuel Cell Balance of Plant (BOP) Market Drivers:

Clean Energy Champion is Boosting Market Growth.

The fuel cell balance of plant (BOP) market is on a charge to power a cleaner future, fueled by its champion status in the fight against climate change. Unlike traditional fossil energies that spew dangerous emigrations, energy cells operate fairly, generating electricity without compromising the terrain. This eco-friendly edge aligns impeccably with global decarbonization sweats, making energy cells the darling of clean energy enterprises. Governments are taking notice and enforcing probative programs like feed-in tariffs and duty breaks to incentivize relinquishment.

Beyond Backup Power Feature is Contributing to Market Growth.

As a temporary power source for isolated areas, energy cells are losing their reputation. They are now stepping into the limelight, powering electric vehicles that zip down thoroughfares, vessels that navigate across abysses, and promoting the idea of clean energy. This versatility creates a ripple effect, generating a swell in demand for the sophisticated BOP systems that ensure their effective operation.

Technological Advancements are Driving Market Growth.

The world of energy cells is witnessing a technological revolution, and the BOP request is reaping the benefits. Inventions in BOP factors are dicing down costs, making energy cell systems more accessible than ever. Lighter accouterments are replacing their larger counterparts, while effective heat exchangers squeeze every ounce of energy from the energy cell process.

Asia Pacific presently reigns supreme, fueled by probative government programs and rapid-fire profitable growth. China, Japan, and South Korea are at the top, demonstrating the immense eventuality of energy cells in this dynamic husbandry.

Collaborative Ecosystems are Augmenting Demand Fueling Growth.

The energy cell BOP request thrives on collaboration. Experimenters, manufacturers, and policymakers are coming together to partake in knowledge, troubleshoot challenges, and drive technological advancements. This cooperative ecosystem is pivotal for ensuring that the latest inventions reach the request quickly and effectively. Besides, an increase in funds from various business tycoons and investors is fueling the growth.

The Fuel Cell Balance of Plant (BOP) Market Restraints and Challenges:

Compared to traditional power generation options, the upfront cost of installing a fuel cell system, including the BOP components, remains higher. This can deter potential investors and hamper wider adoption, particularly in cost-sensitive sectors.

While fuel cell technology has advanced significantly, it's still evolving compared to established options like combustion engines. This can lead to concerns about reliability, durability, and long-term performance, further impacting investment decisions.

Widespread adoption of fuel cells, especially in transportation, hinges on readily available and accessible hydrogen fueling stations. The current infrastructure lags behind demand, creating a hurdle for broader market penetration.

The BOP market currently lacks standardized components across different manufacturers, making integration and maintenance challenging. This inconsistency can also inflate costs and hinder system optimization.

Implementing and maintaining fuel cell systems requires specialized skills and knowledge. The current gap in qualified personnel across various disciplines, from installation to maintenance, needs to be addressed to support market growth.

While supportive policies are emerging, the regulatory landscape for fuel cells is still evolving in many regions. Lack of clear and consistent policies can create uncertainty for investors and impede market predictability.

The Fuel Cell Balance of Plant (BOP) Market Opportunities:

The fuel cell balance of plants (BOP) market reach extends beyond Asia Pacific's current lead, with Europe and North America rapidly joining the global expansion. Diversifying applications have been beneficial, as fuel cells power not just stationary systems but also electric vehicles, ships, and even homes, demanding BOP expertise across diverse sectors. Emerging markets with ambitious electrification goals add another layer of potential. Technological advancements play a crucial role in reducing costs through innovative materials. This opens doors to new market segments and attracts investors. Supportive government policies are creating a favorable investment climate. Specialized skillsets in BOP installation and maintenance become highly sought-after, presenting lucrative opportunities for training programs and service providers. The environmental-friendly status of fuel cells has been helping with the acceleration. Perfectly aligned with global decarbonization efforts, they offer a sustainable and emission-free alternative, making BOP companies beacons of clean energy progress.

FUEL CELL BALANCE OF PLANT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

22.2% |

|

Segments Covered |

By Component, Material, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Doosan Fuel Cell Co., Ltd., Cummins, Inc., Ballard Power Systems, Elcogen AS, HORIBA FuelCon GmbH, SFC Energy AG, Bloom Energy, Dana Limited |

Fuel Cell Balance of Plant (BOP) Market Segmentation: By Component

-

Power Supply

-

Water Circulation

-

Hydrogen Processing

-

Cooling

-

Other Components

Within the fuel cell BOP market by component segmentation, the power supply segment is the largest market segment due to its crucial role in managing and delivering electrical power. However, the hydrogen processing segment is the fastest-growing segment, fueled by the rapid expansion of hydrogen infrastructure. This presents exciting opportunities for companies specializing in processing and managing hydrogen fuel within BOP systems.

Fuel Cell Balance of Plant (BOP) Market Segmentation: By Material

-

Structural Plastics

-

Elastomers

-

Coolants

-

Metals

-

Other Materials

When it comes to materials in the fuel cell BOP market, structural plastics are the largest segment. Their affordability, ease of use, and versatility across various BOP components, like enclosures and ducts, solidify their dominance. However, the fastest-growing category is that of elastomers. Their essential role in sealing and vibration dampening, crucial for reliable operation, is creating an upsurge in their CAGR.

Fuel Cell Balance of Plant (BOP) Market Segmentation: By End User

-

Stationary Power

-

Transportation

-

Portable Power

-

Industrial

-

Residential

The stationary power segment is the largest market segment in the fuel cell BOP market based on end users. This is because of its established applications in backup power and distributed generation. However, the transportation sector is showing the fastest growth. The booming electric vehicle, truck, and even ship markets are fueling this surge, creating a massive demand for BOP systems tailored for mobile applications.

Fuel Cell Balance of Plant (BOP) Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is both the largest and fastest-growing, holding a share of around 50%. This is propelled by the region's rapid economic growth, supportive government policies, and ambitious clean energy goals. China acts as the regional engine, driven by government investments and large-scale hydrogen infrastructure projects. This dedication to clean energy translates into diverse applications across the board, from stationary power and transportation to even residential fuel cells.

Europe is experiencing a surge in its fuel cell BOP market, fueled by growing government support and ambitious decarbonization targets. Germany, with its strong automotive industry and focus on hydrogen mobility, leads the charge, setting the pace for the rest of the region. Transportation, particularly heavy-duty vehicles and buses, is a major focus area, alongside stationary power applications.

North America boasts a mature fuel cell BOP market, fueled by a well-established industry and a robust supply chain. Supportive government policies like the Hydrogen Energy Roadmap and tax credits act as tailwinds, incentivizing the adoption of fuel cell technology. While stationary power applications in data centers and distributed generation remain the mainstay, the transportation sector is gaining traction, particularly with growing interest in electric vehicles and fuel-cell buses.

In South America, with hydropower leading the charge and solar and wind gaining momentum, immense potential for integrating these clean sources with fuel cell technology is possible. This opens doors for distributed generation solutions, particularly in remote areas where access to traditional electricity grids is limited.

The Middle East and Africa's fuel cell BOP market boasts active pilot projects and initiatives exploring fuel cell applications. Additionally, significant infrastructure and policy challenges have been creating an impact. However, the region's abundant sunshine and vast renewable resources offer a lot of possibilities, particularly in the realm of green hydrogen production. Integrating this clean fuel with fuel cell technology holds immense potential, not only for power generation but also for applications in sectors like mining and transportation.

COVID-19 Impact Analysis on the Fuel Cell Balance of Plant (BOP) Market:

The COVID-19 pandemic caused disruptions to the fuel cell balance of the plant (BOP) market like a double-edged sword. Initial disruptions were a bit hard, with lockdowns stalling production and supply chains, causing project delays and dampening market growth. Investment jitters and shifting priorities further added to the woes, putting clean energy initiatives like fuel cells on the back burner. But amidst the gloom, glimmers of opportunity flickered. The pandemic's harsh spotlight exposed the vulnerabilities of traditional energy systems, igniting a renewed interest in sustainable solutions like fuel cells. Governments, recognizing the need for resilient and clean energy options, incorporated fuel cell projects into their economic recovery plans, providing much-needed tailwinds. Moreover, the pandemic's acceleration of digitalization opened doors for distributed power solutions like fuel cells, where BOP systems play a vital role. While the initial blow was undoubtedly harsh, the long-term outlook for the fuel cell BOP market seems brighter. The pandemic's push for sustainability, coupled with government support and technological advancements, gives a promising picture of the future of this clean energy technology. The impact, however, wasn't uniform in all areas. Asia-Pacific, the market leader, stumbled initially but is poised for a swift recovery fueled by government initiatives and sustained investments. Europe, though experiencing a slowdown, remains committed to its decarbonization goals, boding well for the BOP market in the long run. North America, too, is expected to bounce back, propelled by government incentives and increasing private investments.

Latest Trends/ Developments:

The fuel cell BOP market has been continuously working on various innovations. Systems are shrinking and modularizing, making them adaptable and installation-friendly for diverse applications. AI is stepping in, optimizing performance, and predicting maintenance needs, translating to cost savings and smoother operations. New materials are boosting durability, reducing weight, and improving thermal management, opening doors to harsher environments and higher efficiency. The hydrogen party is helping, with expanding infrastructure fueling wider adoption, particularly in transportation, directly benefiting BOP demand. Green hydrogen, produced from renewable sources, adds another layer of environmental appeal, aligning perfectly with global decarbonization goals. Supportive policies like tax credits and stricter emission regulations provide favorable outcomes, while collaborations between research, manufacturers, and users accelerate innovation and knowledge sharing. Fuel cells are no longer confined to stationary roles; they're powering electric vehicles, ships, portable units, and even homes, broadening the BOP market's reach. Cost reduction remains a key focus, making fuel cells more competitive with traditional options. Apart from this, sustainability is being woven into the fabric of the market, from material sourcing to end-of-life management.

Key Players:

-

Doosan Fuel Cell Co., Ltd.

-

Cummins, Inc.

-

Ballard Power Systems

-

Elcogen AS

-

HORIBA FuelCon GmbH

-

SFC Energy AG

-

Bloom Energy

-

Dana Limited

Chapter 1. Fuel Cell Balance of Plant (BOP) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fuel Cell Balance of Plant (BOP) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fuel Cell Balance of Plant (BOP) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fuel Cell Balance of Plant (BOP) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fuel Cell Balance of Plant (BOP) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fuel Cell Balance of Plant (BOP) Market – By Component

6.1 Introduction/Key Findings

6.2 Power Supply

6.3 Water Circulation

6.4 Hydrogen Processing

6.5 Cooling

6.6 Other Components

6.7 Y-O-Y Growth trend Analysis By Component

6.8 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Fuel Cell Balance of Plant (BOP) Market – By Material

7.1 Introduction/Key Findings

7.2 Structural Plastics

7.3 Elastomers

7.4 Coolants

7.5 Metals

7.6 Other Materials

7.7 Y-O-Y Growth trend Analysis By Material

7.8 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Fuel Cell Balance of Plant (BOP) Market – By End-User

8.1 Introduction/Key Findings

8.2 Stationary Power

8.3 Transportation

8.4 Portable Power

8.5 Industrial

8.6 Residential

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Fuel Cell Balance of Plant (BOP) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Material

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Material

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Material

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Material

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Material

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Fuel Cell Balance of Plant (BOP) Market – Company Profiles – (Overview, By Component Portfolio, Financials, Strategies & Developments)

10.1 Doosan Fuel Cell Co., Ltd.

10.2 Cummins, Inc.

10.3 Ballard Power Systems

10.4 Elcogen AS

10.5 HORIBA FuelCon GmbH

10.6 SFC Energy AG

10.7 Bloom Energy

10.8 Dana Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The fuel cell balance of plant (BOP) market was valued at USD 2.3 billion in 2023 and is projected to reach a market size of USD 9.40 billion by the end of 2030. Throughout 2024–2030, the request is projected to grow at a CAGR of 22.2%.

Clean energy champions, beyond backup power, technological advancements, regional powerhouses, and collaborative ecosystems are the main drivers in this market.

Power supply, water circulation, hydrogen processing, cooling, and others are the main segments based on components in this market.

The crown for fuel cell BOP market dominance rests with Asia-Pacific, holding nearly half the market share, mainly because of China's investments and diverse applications across the region.

Doosan Fuel Cell Co., Ltd., Cummins, Inc., Ballard Power Systems, Elcogen AS, HORIBA FuelCon GmbH, SFC Energy AG, Bloom Energy, and Dana Limited are the prominent players in the market.