Fuel Card Market Size (2024 – 2030)

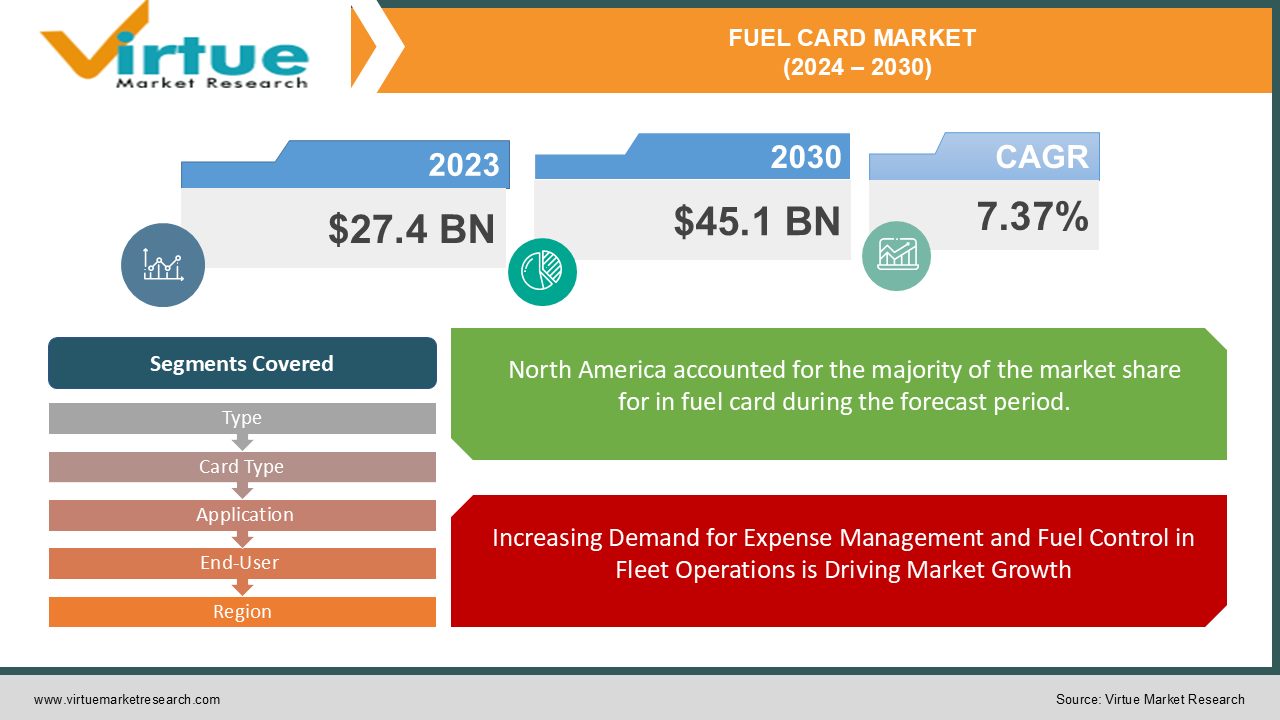

In 2023, the global fuel card market was valued at USD 27.4 billion and is expected to reach USD 45.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.37% during the forecast period.

The proliferation of fuel card programs across developed and developing countries, along with the integration of telematics and digital platforms, is expected to further fuel market expansion. Businesses primarily use fuel cards to monitor fuel purchases, track vehicle-related expenses, and reduce unauthorized spending. With features such as real-time transaction data, control over fueling limits, and discounts on fuel, they provide essential support to companies looking to optimize their transportation operations. The demand for universal fuel cards, which offer broader acceptability at various fuel stations, has also contributed to market growth.

Key Market Insights:

Branded fuel cards dominate the market, accounting for over 40% of the total revenue share, as they are widely accepted at specific fuel station networks and offer loyalty rewards to users.

Commercial fleet management is the largest end-user segment, representing more than 55% of the market demand, as fuel cards help companies in the transportation and logistics sector reduce costs and manage fuel consumption effectively.

The universal fuel card segment is expected to witness the highest growth rate due to its broader acceptance across multiple fuel retailers and additional functionalities such as vehicle maintenance and toll payments.

North America and Europe are leading regions in the fuel card market, contributing over 60% of total market revenues. The widespread adoption of fuel cards by large fleet operators and the presence of well-established digital infrastructure are key drivers in these regions.

Integration of telematics with fuel cards is an emerging trend, offering fleet operators enhanced data insights, including fuel consumption patterns and vehicle performance metrics, resulting in improved operational efficiency.

Global Fuel Card Market Drivers:

Increasing Demand for Expense Management and Fuel Control in Fleet Operations is Driving Market Growth The rising need for effective fuel management solutions is a primary driver of the fuel card market. Fleet operators, transport companies, and logistics providers are increasingly adopting fuel cards to gain better control over fuel expenditures. These cards provide detailed reporting and analytics, allowing companies to monitor fuel consumption, prevent fuel fraud, and set spending limits. Additionally, they help businesses streamline administrative processes, reducing the need for manual tracking and expense reconciliation. With growing fleet sizes across industries like transportation, logistics, and construction, the demand for fuel cards is expected to rise as companies seek to manage operational costs and enhance overall efficiency. Fuel cards also offer businesses cost savings through fuel rebates, discounts, and loyalty programs provided by fuel station networks.

Advancements in Digital Payment Technologies and Telecommunication are Driving Market Growth The fuel card industry has significantly benefited from advancements in digital payment technologies and telecommunications. The integration of fuel cards with mobile apps, cloud-based platforms, and telematics systems has enhanced the overall user experience and provided fleet operators with real-time data on fuel transactions. These digital solutions allow companies to monitor vehicle locations, driving behavior, and fuel consumption in real time, optimizing fleet efficiency. Additionally, the widespread adoption of contactless payments and mobile wallets has further boosted the appeal of fuel cards, offering a seamless and convenient payment experience. As businesses increasingly prioritize digital transformation, the fuel card market is expected to grow rapidly due to the integration of advanced payment technologies, improved data analytics capabilities, and enhanced security features.

Growing Adoption of Universal Fuel Cards is Driving Market Growth Universal fuel cards are gaining significant traction in the global market due to their flexibility and broader acceptance across multiple fuel station networks. Unlike branded fuel cards that are tied to specific fuel companies, universal cards provide fleet operators with the freedom to purchase fuel at various locations, ensuring better convenience for drivers. These cards also come with additional benefits, such as the ability to pay for vehicle maintenance, parking, tolls, and other related expenses, making them a one-stop solution for fleet management. The demand for universal fuel cards is expected to increase, especially among businesses that operate across regions or have diverse fleet requirements. As the global fleet management industry grows, the need for universal fuel cards that offer wider functionality and cost-saving opportunities is expected to drive market growth.

Global Fuel Card Market Challenges and Restraints:

Risk of Fuel Card Fraud and Data Breaches is Restricting Market Growth One of the major challenges facing the global fuel card market is the risk of fraud and data breaches. Fuel cards, like any other digital payment method, are susceptible to fraudulent activities such as unauthorized transactions, fuel skimming, and cloning of cards. While many fuel card providers have implemented security measures like PIN authentication and real-time transaction monitoring, the growing sophistication of cyber-attacks poses a threat to the market. Businesses are becoming more concerned about the security of their fuel card programs, especially in regions with less developed digital infrastructures. In response, fuel card providers are investing in advanced fraud detection and prevention technologies to mitigate these risks. However, the ongoing threat of cybercrime remains a key restraint for the market's growth, particularly in industries that are highly sensitive to financial and data security.

Limited Acceptance of Branded Fuel Cards in Some Regions is Restricting Market Growth Another challenge for the fuel card market is the limited acceptance of branded fuel cards in certain regions or locations. Branded fuel cards are typically linked to specific fuel station networks, which can limit their usability for fleet operators who travel across multiple regions. This creates challenges for businesses operating in areas with fewer fuel station options or regions where branded fuel networks do not have a strong presence. While universal fuel cards offer a solution to this problem, the limited acceptance of branded cards can still restrict their adoption, particularly among small and medium-sized enterprises (SMEs) that rely on specific fuel networks for cost savings. Additionally, businesses with smaller fleets may not see the full value of adopting fuel cards if they operate in regions where fuel stations accepting these cards are sparse.

Market Opportunities:

The Global Fuel Card Market presents several lucrative opportunities, particularly in telematics integration, SME adoption, and the development of multi-functional fuel cards. The integration of telematics with fuel card services offers significant growth potential as fleet operators increasingly prioritize real-time data insights to optimize fuel consumption, reduce operational costs, and improve fleet performance. Telematics-enabled fuel cards can provide a comprehensive view of vehicle operations, helping businesses track driver behavior, vehicle maintenance needs, and fuel efficiency. There is also a growing opportunity for fuel card providers to target small and medium-sized enterprises (SMEs), which have traditionally been underserved by the fuel card market. As SMEs increasingly adopt digital payment solutions and seek ways to reduce fuel costs, there is substantial potential for fuel card companies to offer tailored solutions that cater to the unique needs of smaller fleets. Additionally, the development of multi-functional fuel cards that can cover a wider range of expenses, such as vehicle maintenance, toll payments, parking fees, and insurance premiums, presents a significant growth opportunity. By offering value-added services, fuel card providers can differentiate themselves in the market and attract a broader customer base.

FUEL CARD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.37% |

|

Segments Covered |

By Type, Card Type, Application, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BP Plc, ExxonMobil Corporation, Shell Fleet Solutions, WEX Inc., Fleetcor Technologies Inc., Comdata Inc., Arval BNP Paribas Group, Voyager Fleet Systems Inc., Engen Petroleum Ltd., Total S.A. |

Fuel Card Market Segmentation - By Type

-

Branded

-

Universal

-

Merchant

Branded fuel cards remain dominant in terms of market share, driven by their association with specific fuel networks and loyalty programs. However, the universal fuel card segment is expected to grow at a faster rate due to its broader acceptance across different fuel stations.

Fuel Card Market Segmentation - By Card Type

-

Business

-

Individual

Business fuel cards are the leading segment, driven by their extensive use in managing commercial fleets and logistics operations. These cards provide businesses with real-time tracking, expense management, and reporting tools, making them essential for fleet operators.

Fuel Card Market Segmentation - By Application

-

Fuel Refill

-

Parking

-

Toll Charges

-

Others (Maintenance, Insurance)

The fuel refill segment accounts for the largest share of the market, as fuel cards are primarily used to cover fuel expenses for fleet operators. However, the toll charges and parking segments are also growing, particularly with the rise of multi-functional fuel cards that offer additional services beyond fuel purchases.

Fuel Card Market Segmentation - By End-User

-

Transport Companies

-

Logistics

-

Commercial Fleets

-

Others (Construction, Government)

Commercial fleets are the largest end-user segment, as fuel cards are widely used to manage fuel costs and optimize vehicle operations in this sector. The transport and logistics industries also represent significant market demand due to their reliance on efficient fuel management systems.

Fuel Card Market Segmentation - Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is the largest regional market for fuel cards, driven by the high adoption of digital payment systems, widespread use of fleet management solutions, and the presence of large fleet operators. The fuel card market in Europe is growing steadily, with increasing demand from commercial fleets and logistics companies. The region is also experiencing a shift towards digitalization and integration with telematics. Rapidly expanding, especially in countries like China, India, and Japan, where the growth of the transportation and logistics sectors is driving demand for fuel management solutions. Witnessing moderate growth, driven by increasing adoption of fuel cards in the transport sector, particularly in Brazil and Mexico.

COVID-19 Impact Analysis on the Global Fuel Card Market:

The COVID-19 pandemic had a mixed impact on the Global Fuel Card Market. In the initial stages of the pandemic, lockdowns and travel restrictions significantly reduced fuel consumption and fleet activity, leading to a decline in fuel card transactions. However, as economies reopened and transportation activities resumed, the market witnessed a recovery, particularly in sectors such as logistics, transportation, and e-commerce. Moreover, the pandemic accelerated the adoption of digital payment solutions and contactless fuel card systems, as businesses sought to reduce physical interactions and improve hygiene standards. Post-pandemic, the fuel card market is expected to grow steadily as companies prioritize cost-saving measures, digital payment platforms, and fleet management solutions to enhance operational efficiency.

Latest Trends/Developments:

The fuel card market is undergoing significant transformation, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Key trends include the rise of digital fuel cards, which offer greater convenience, security, and real-time tracking capabilities. The integration of fuel cards with fleet management software enables businesses to optimize fuel consumption, reduce costs, and improve operational efficiency. Additionally, the increasing adoption of electric vehicles is creating new opportunities for fuel card providers to offer charging solutions and expand their product offerings. Furthermore, advancements in payment technologies, such as contactless payments and mobile wallets, are simplifying the fuel card experience for both consumers and businesses. Overall, the fuel card market is evolving to meet the changing needs of consumers and businesses, with a focus on digitalization, sustainability, and convenience.

Key Players:

-

BP Plc

-

ExxonMobil Corporation

-

Shell Fleet Solutions

-

WEX Inc.

-

Fleetcor Technologies Inc.

-

Comdata Inc.

-

Arval BNP Paribas Group

-

Voyager Fleet Systems Inc.

-

Engen Petroleum Ltd.

-

Total S.A.

Chapter 1. Fuel Card Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fuel Card Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fuel Card Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fuel Card Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fuel Card Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fuel Card Market – By Type

6.1 Introduction/Key Findings

6.2 Branded

6.3 Universal

6.4 Merchant

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Fuel Card Market – By Card Type

7.1 Introduction/Key Findings

7.2 Business

7.3 Individual

7.4 Y-O-Y Growth trend Analysis By Card Type

7.5 Absolute $ Opportunity Analysis By Card Type, 2024-2030

Chapter 8. Fuel Card Market – By Application

8.1 Introduction/Key Findings

8.2 Fuel Refill

8.3 Parking

8.4 Toll Charges

8.5 Others (Maintenance, Insurance)

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Fuel Card Market – By End-User

9.1 Introduction/Key Findings

9.2 Transport Companies

9.3 Logistics

9.4 Commercial Fleets

9.5 Others (Construction, Government)

9.6 Y-O-Y Growth trend Analysis By End-User

9.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. Fuel Card Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By Card Type

10.1.3 By Application

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Card Type

10.2.4 By Application

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Card Type

10.3.4 By Application

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Card Type

10.4.4 By Application

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Card Type

10.5.4 By Application

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Fuel Card Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 BP Plc

11.2 ExxonMobil Corporation

11.3 Shell Fleet Solutions

11.4 WEX Inc.

11.5 Fleetcor Technologies Inc.

11.6 Comdata Inc.

11.7 Arval BNP Paribas Group

11.8 Voyager Fleet Systems Inc.

11.9 Engen Petroleum Ltd.

11.10 Total S.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Fuel Card Market was valued at USD 27.4 billion in 2023 and is projected to reach USD 45.1 billion by 2030, growing at a CAGR of 7.37%.

Key drivers include the rising demand for expense management in fleet operations, advancements in digital payment technologies, and the growing adoption of universal fuel cards.

The market is segmented by type (branded, universal, merchant), card type (business, individual), application (fuel refill, parking, toll charges, others), and end-user (transport companies, logistics, commercial fleets, others).

North America is the largest regional market, driven by high adoption rates of digital payment systems and the presence of large fleet operators.

Leading players include BP Plc, ExxonMobil Corporation, Shell Fleet Solutions, and WEX Inc.