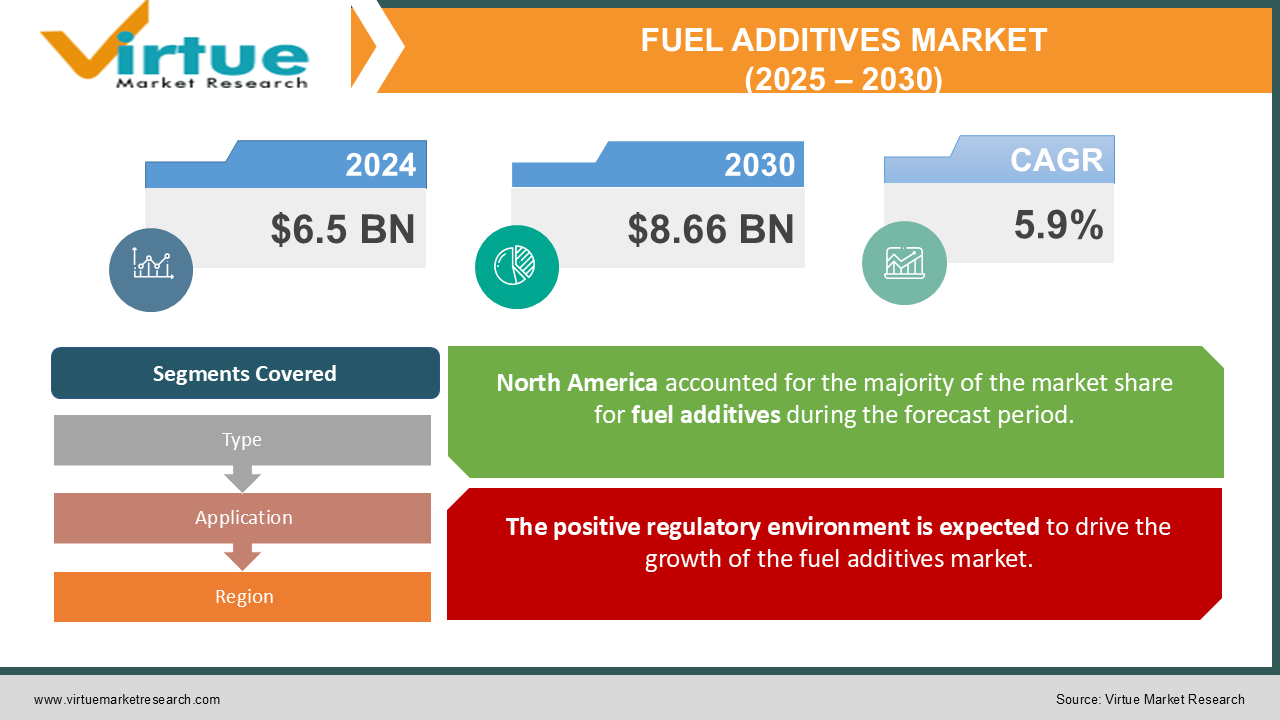

Fuel Additives Market Size (2025 – 2030)

The Fuel Additives Market was valued at USD 6.5 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 8.66 billion by 2030, growing at a CAGR of 5.9%.

Fuel additives are compounds designed to enhance the performance and quality of fuels utilized in automotive engines. These additives allow for the adoption of higher compression ratios, which leads to better fuel efficiency and power output. This is achieved by increasing the octane rating of gasoline and serving as both corrosion inhibitors and lubricants. Innovation Analysts are exploring new technologies and developing fuel additive solutions for the materials sector, thereby contributing to the growth of the fuel additive market.

Key Market Insights:

The global market is projected to experience substantial growth due to the increasing demand for advanced and enhanced products from the automotive and other end-use industries. Additionally, stringent regulations enforced by government agencies are anticipated to further drive market expansion. Moreover, supportive government policies and growing awareness regarding the reduction of carbon emissions are expected to provide significant benefits to the market.

Fuel Additives Market Drivers:

The positive regulatory environment is expected to drive the growth of the fuel additives market.

The fuel additives market is expected to grow rapidly due to the rising demand for fuel across various industries. This sector is highly dependent on research and development efforts. A diverse range of products has been developed to meet the needs of businesses that convert hydrocarbon-based fuels into heat energy for applications such as transportation, power generation, and more. According to ATC data, 95% of on-road retail fuel is treated with performance additives, which make up about half of the total volume, while the remainder is distributed to refineries and other terminals. This ensures that the fuel produced meets the standards set by the European government. Additionally, growth in the market will be driven by advancements in research and development within the Ultra-Low Sulfur Diesel industry.

Stricter emissions regulations for automobiles and refineries will further contribute to market expansion. Growing concerns over air pollution caused by the incomplete and complete combustion of hydrocarbons are also accelerating the growth of fuel additive solutions. For instance, the Clean Air Act mandates the use of detergents and deposit control additives to lower carbon monoxide emissions. Furthermore, a wide range of fuel additives tailored to different fuel types improves overall fuel performance. Common issues such as fuel inefficiency in engines and machinery can be effectively addressed through the use of additives, which are widely used in refineries, distribution systems, and storage tanks across various transportation systems and vehicles.

Fuel Additives Market Restraints and Challenges:

The growing demand for alternative fuels could potentially limit the demand for traditional fuel additives.

In recent years, various types of clean energy sources have been developed in response to growing concerns about carbon emissions and air pollution. This has significantly increased the demand for sustainable energy solutions. One of the latest innovations aimed at promoting sustainable living is the adoption of batteries in vehicles and automobiles. To support sustainability and encourage the use of clean, green energy, organizations, businesses, and governments involved in transportation are increasingly favoring Electric Vehicles (EVs).

Fuel Additives Market Opportunities:

The growing research and adoption of Ultra-Low Sulfur Diesel (ULSD) are expected to create new opportunities in the fuel additives market.

Ultra-Low Sulfur Diesel (ULSD) was developed in response to a series of regulatory measures aimed at reducing diesel fuel emissions. The 1990 amendments to the Clean Air Act introduced strict emission reduction requirements for hydrocarbons, nitrogen oxides, carbon monoxide, particulate matter, and other pollutants. The goal of reducing sulfur content in diesel has led to significant reductions in harmful emissions. However, achieving these lower sulfur levels requires extensive processing, which results in changes to the fuel's chemistry, reducing its lubricity. This has created a demand for fuel additives that improve lubricity.

Ultra-Low Sulfur Diesel is a form of diesel with minimal sulfur content, demonstrating how advanced low-emission technologies can reduce harmful gas emissions from diesel combustion. In response, European regulations mandated the reduction of diesel sulfur content and the adoption of current ULSD standards. To maintain performance, ULSD requires lubricity enhancers. The increasing demand for low-sulfur fuels is expected to be a key factor driving market growth.

FUEL ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Afton Chemical Corporation, Lanxess, Evonik Industries AG, Infineum International Limited, Eastman Chemical Corporation, Dorf Ketal Chemicals, Croda International Plc, Qatar , Fuel Additives Company (Qafac), The Dow Chemical Company, Iftex Oil & Chemicals Ltd |

Fuel Additives Market Segmentation: By Type

-

Deposit Control

-

Lubricity Improvers

-

Cetane Improvers

-

Cold Flow Improvers

-

Octane Improvers

-

Stability Improvers

-

Corrosion Inhibitors

The Cetane Improvers segment is expected to generate significant revenue due to the high demand from key end-use industries. The cetane number is an indicator of a fuel’s ignition properties compared to the standard cetane number, and cetane improvers are commonly used in diesel fuel. Their exothermic decomposition triggers fuel reactions that enable combustion to start at lower temperatures.

The Octane Improvers segment is the largest, driven by the need for higher performance fuels. The increasing demand from refineries for cost-effective solutions to meet octane number specifications is expected to boost the demand for octane improvers. Additionally, the demand for Deposit Control Additives and Stability Improvers is rising due to the declining quality of crude oil and petroleum oils.

The Corrosion Inhibitors segment is anticipated to dominate the market during the forecast period. This growth is attributed to the increasing demand for fuel additives, particularly in the transportation sector. Corrosion inhibitors are crucial for preventing rust and corrosion in fuel tanks and engines, protecting system components from moisture and contaminants. The transportation, marine, and power generation industries are the key sectors utilizing corrosion inhibitors, and as fuel quality and infrastructure improve, demand for these additives is set to rise.

The Detergents segment is expected to be the fastest-growing during the forecast period, driven by rising demand in the marine and aviation sectors. Detergents play a crucial role in removing deposits from fuel tanks and engines, which enhances fuel efficiency and reduces emissions

Fuel Additives Market Segmentation: By Application

-

Diesel

-

Gasoline

-

Aviation Fuel

The Gasoline segment is expected to hold a significant market share, driven by the growth in the automotive sector. The rising demand for gasoline fuel, fueled by increased automotive production, is a key factor contributing to this growth. Additionally, the growing demand for aviation fuel, particularly in commercial applications due to rising tourism, is anticipated to further drive the market.

The Diesel segment is projected to be the fastest-growing segment within the corrosion inhibitors market. This growth is primarily due to the increasing demand for fuel additives in the transportation sector. Diesel fuel additives, such as deposit control additives and cetane improvers, are widely used to prevent rust and corrosion in fuel tanks and engines. The extensive use of diesel fuel in the transportation, industrial, and commercial sectors also supports the demand for these additives, as they help optimize engine performance, reduce emissions, and improve fuel efficiency.

Fuel Additives Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America currently leads the market and is expected to maintain its dominance throughout the forecast period. The region’s growth is driven by an increase in petroleum exploration activities and a rising demand for fuel from various end-user industries, including transportation and power generation. Additionally, the rapidly expanding aerospace and defense sectors, along with several U.S. government projects, are set to further stimulate regional market growth.

Europe is anticipated to see substantial growth in terms of volume. The market will likely be fueled by the well-established automotive manufacturing sector and the growing demand for passenger vehicles. The presence of organizations such as the Additive Technical Committee (ATC), which promotes the development of the additive industry, is expected to have a positive impact on market expansion.

Asia Pacific is one of the most dynamic regions in terms of development and industrialization. With growing demand from countries like China and India, the fuel additives market is poised to be a significant growth driver. Increased efforts by automakers such as Tata, Bajaj, Ashok Leyland, and others to produce more advanced vehicles will further boost demand for fuel additives in the region.

COVID-19 Pandemic: Impact Analysis

The gasoline additive industry experienced a slight impact on supply during the COVID-19 pandemic. The lockdowns and disruptions caused by the pandemic significantly affected the production and supply chains within the fuel additive sector. However, as the pandemic’s impact lessened, fuel consumption in the automotive industry began to rise, leading to a stabilization of the additives market.

Latest Trends/ Developments:

In October 2023, The Lubrizol Corporation entered into a new distribution agreement with IMCD Group, a global distributor and formulator of specialty chemicals and ingredients. This partnership is aimed at supporting the growing fuel additives and lubricant market in Bangladesh.

In March 2023, Lubrizol Corporation launched FuelMax, a high-performance fuel additive designed to improve fuel efficiency, reduce emissions, and protect engines from damage.

In August 2022, BASF, a leading producer of fuel additives, began producing fuel performance additives at its Pudong facility in Shanghai, China. The new plant was established to address the growing regional demand for fuel performance additives, providing better flexibility and supply security for clients across Asia.

Key Players:

These are top 10 players in the Fuel Additives Market :-

-

Afton Chemical Corporation

-

Lanxess

-

Evonik Industries AG

-

Infineum International Limited

-

Eastman Chemical Corporation

-

Dorf Ketal Chemicals

-

Croda International Plc

-

Qatar

-

Fuel Additives Company (Qafac)

-

The Dow Chemical Company

-

Iftex Oil & Chemicals Ltd

Chapter 1. Fuel Additives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fuel Additives Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fuel Additives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fuel Additives Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fuel Additives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fuel Additives Market – By Type

6.1 Introduction/Key Findings

6.2 Deposit Control

6.3 Lubricity Improvers

6.4 Cetane Improvers

6.5 Cold Flow Improvers

6.6 Octane Improvers

6.7 Stability Improvers

6.8 Corrosion Inhibitors

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Fuel Additives Market – By Application

7.1 Introduction/Key Findings

7.2 Diesel

7.3 Gasoline

7.4 Aviation Fuel

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Fuel Additives Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fuel Additives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Afton Chemical Corporation

9.2 Lanxess

9.3 Evonik Industries AG

9.4 Infineum International Limited

9.5 Eastman Chemical Corporation

9.6 Dorf Ketal Chemicals

9.7 Croda International Plc

9.8 Qatar Fuel Additives Company (Qafac)

9.9 The Dow Chemical Company

9.10 Iftex Oil & Chemicals Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The fuel additives market is expected to grow rapidly due to the rising demand for fuel across various industries. This sector is highly dependent on research and development efforts.

The top players operating in the Fuel Additives Market are - Afton Chemical Corporation, Lanxess, Evonik Industries AG and Infineum International Limited.

The gasoline additive industry experienced a slight impact on supply during the COVID-19 pandemic. The lockdowns and disruptions caused by the pandemic significantly affected the production and supply chains within the fuel additive sector.

The growing research and adoption of Ultra-Low Sulfur Diesel (ULSD) are expected to create new opportunities in the fuel additives market.

Europe is the fastest-growing region in the Fuel Additives Market.