Fucoxanthin Market Size (2025 – 2030)

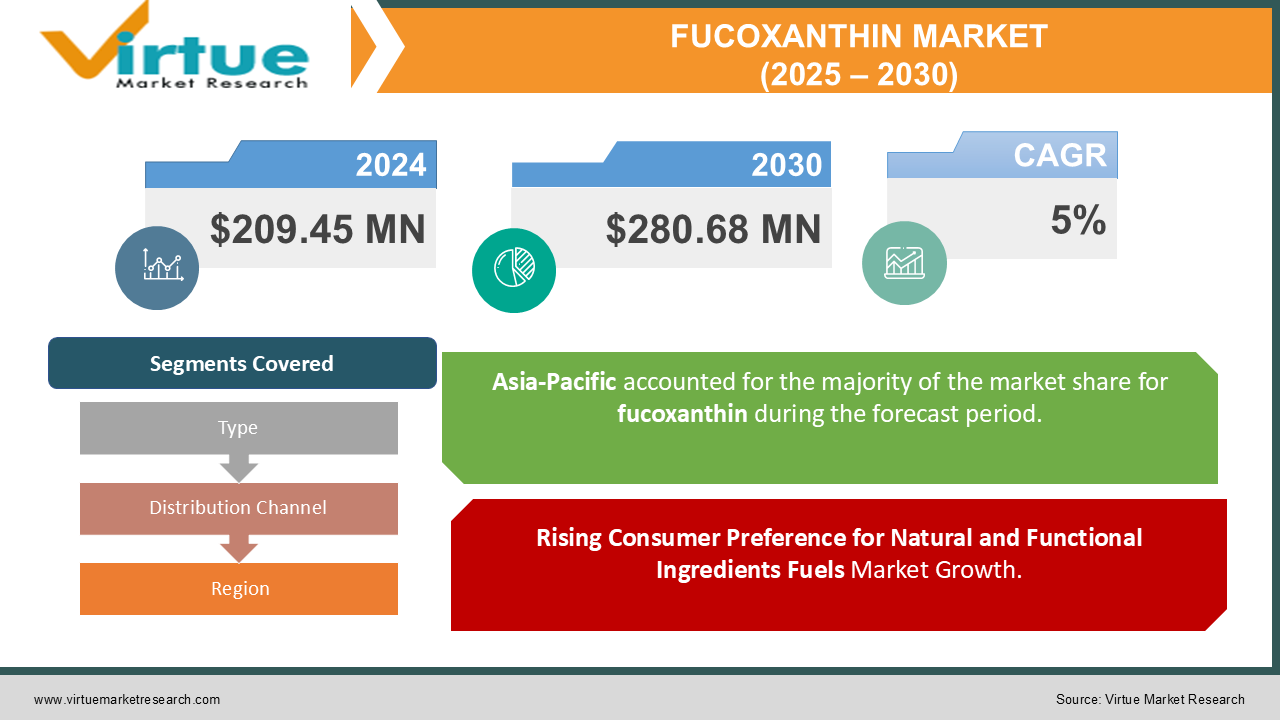

The Fucoxanthin Market was valued at USD 209.45 Million in 2024 and is projected to reach a market size of USD 280.68 Million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5%.

The fucoxanthin market is gaining momentum as it emerges as a key component in the global nutraceutical, cosmetic, and pharmaceutical industries. Fucoxanthin, a carotenoid derived primarily from brown seaweed, has garnered significant attention due to its exceptional health benefits, which include anti-obesity, anti-inflammatory, and antioxidant properties. This natural compound is increasingly recognized for its role in promoting metabolic health and supporting weight management, making it a highly sought-after ingredient in dietary supplements and functional foods.

Key Market Insights:

-

Over 45% of the total demand for fucoxanthin came from the dietary supplements sector. The pharmaceutical applications of fucoxanthin accounted for approximately 22% of the market share. The cosmetic industry utilized nearly 18% of the total fucoxanthin produced in 2023. Fucoxanthin sales in the food and beverage industry grew by 28% compared to the previous year.

-

Around 30% of the fucoxanthin extracted globally in 2023 was derived using enzymatic extraction techniques.

-

Approximately 60% of consumers purchasing fucoxanthin supplements cited weight management as their primary motivation.

-

The global production capacity for fucoxanthin increased by 15% in 2023 due to advancements in seaweed farming techniques.

-

The purity levels of fucoxanthin extracts improved to 85-95% in 2023 with modern extraction technologies.

-

Around 10 million consumers globally purchased fucoxanthin-based supplements in 2023.

-

The average cost of high purity fucoxanthin extract ranged between USD 1,500 and USD 2,000 per kilogram in 2023.

-

Brown seaweed such as Undaria pinnatifida and Laminaria japonica accounted for 70% of the raw materials used for fucoxanthin extraction.

Market Drivers:

Rising Consumer Preference for Natural and Functional Ingredients Fuels Market Growth.

Modern consumers are becoming increasingly health-conscious, seeking products that offer tangible health benefits without synthetic additives or preservatives. Fucoxanthin, derived from brown seaweed, fits perfectly into this narrative. Its natural origin, coupled with scientifically backed health benefits, positions it as a premium ingredient in dietary supplements, functional foods, and cosmetics. The rising awareness of fucoxanthin’s unique properties—such as its ability to aid in weight management, improve metabolic health, and act as a powerful antioxidant—has further fueled its demand. Consumers are drawn to products that can address lifestyle-related health concerns, including obesity, diabetes, and oxidative stress. As a result, manufacturers are increasingly incorporating fucoxanthin into their product lines to cater to this growing demand.

The Growing Use of Fucoxanthin in Nutraceutical and Pharmaceutical Applications is Propelling Market Growth.

Research into its bioactive properties has unveiled a wide array of potential health benefits, including anti-inflammatory, anti-obesity, anti-diabetic, and neuroprotective effects. These findings have led to a surge in its use in dietary supplements aimed at improving overall health and managing chronic conditions. The pharmaceutical industry is also exploring fucoxanthin for its therapeutic potential. Studies have shown that fucoxanthin exhibits anti-cancer properties, making it a promising candidate for the development of novel treatments. Furthermore, its role in enhancing immunity and reducing inflammation has garnered interest for potential applications in combating infectious diseases and autoimmune disorders. The growing body of evidence supporting fucoxanthin’s efficacy is likely to drive further investment in research and development, unlocking new opportunities in the pharmaceutical sector.

Market Restraints and Challenges:

Despite the promising outlook for the fucoxanthin market, several restraints and challenges need to be addressed to unlock its full potential. One of the most significant barriers is the high production cost associated with fucoxanthin extraction and purification. Unlike other widely used bio actives, fucoxanthin extraction requires advanced technological processes due to its low natural concentration in seaweed. This contributes to a higher price point, making it less accessible to price-sensitive markets and limiting its adoption in cost-driven industries. While advancements in biotechnology are gradually reducing these costs, widespread affordability remains a challenge. Another critical challenge is the limited availability of raw materials. Fucoxanthin is primarily derived from brown seaweed, the cultivation and harvesting of which are heavily dependent on environmental factors, seasonal variations, and regional constraints. These limitations can lead to supply chain disruptions, particularly during adverse weather conditions or environmental changes such as ocean acidification. Additionally, the increasing demand for seaweed in other industries, such as food, feed, and biofuels, creates competition for this finite resource, potentially affecting the fucoxanthin supply chain. Regulatory hurdles also pose a significant challenge. Fucoxanthin is subject to varying regulations across regions, particularly in its applications within the nutraceutical, pharmaceutical, and cosmetic sectors. Inconsistencies in global standards regarding the permissible limits, safety, and efficacy claims can create uncertainties for manufacturers and impede market growth. Moreover, the need for extensive clinical trials to substantiate health claims adds to the cost and time required for market entry.

Market Opportunities:

The fucoxanthin market is brimming with opportunities, driven by shifting consumer preferences, technological advancements, and the increasing global focus on sustainability. One of the most prominent opportunities lies in the nutraceutical sector. As health-conscious consumers seek natural solutions for weight management, metabolic health, and immunity enhancement, fucoxanthin’s unique properties position it as an ideal ingredient for dietary supplements. The growing demand for plant-based, clean-label supplements further amplifies this opportunity, particularly among vegan and vegetarian consumers. The cosmetics industry also presents significant growth potential for fucoxanthin. Its antioxidant and anti-aging properties make it a valuable addition to skincare formulations, catering to the increasing demand for natural and effective cosmetic products. As consumers prioritize sustainability and transparency in their purchasing decisions, fucoxanthin’s marine origin and environmentally friendly profile enhance its appeal in this sector. Moreover, fucoxanthin’s ability to protect skin from UV-induced damage opens doors for its application in sunscreens and after-sun care products. In the pharmaceutical industry, ongoing research into fucoxanthin’s anti-inflammatory, anti-cancer, and neuroprotective effects is unlocking new therapeutic applications. These discoveries pave the way for innovative drug formulations targeting chronic diseases, thereby expanding the market’s scope. Collaborations between pharmaceutical companies and academic institutions can further accelerate the development of fucoxanthin-based treatments, creating a win-win scenario for both stakeholders. Functional foods and beverages are another promising avenue for fucoxanthin. As consumers increasingly seek health benefits from everyday foods, incorporating fucoxanthin into products such as smoothies, yogurts, and snack bars can attract a broader audience. The convenience factor associated with functional foods adds to their appeal, particularly among urban populations with busy lifestyles. Sustainability initiatives and advancements in biotechnology offer additional opportunities for the fucoxanthin market. Innovations in algae cultivation, such as vertical farming and closed-loop systems, can enhance raw material availability while minimizing environmental impact. Furthermore, developments in enzymatic and biotechnological extraction methods can improve yield and reduce costs, making fucoxanthin more accessible to a wider audience. Emerging markets, particularly in Asia, Latin America, and the Middle East, present untapped potential for fucoxanthin. These regions are witnessing a surge in health awareness and disposable incomes, driving demand for premium nutraceutical and cosmetic products. Tailoring marketing strategies to align with regional preferences and investing in localized production facilities can help manufacturers capitalize on these opportunities.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kornit Digital, Mimaki Engineering, EFI Reggiani, Durst Group, Roland DG Corporation, Epson Corporation, Mutoh Europe, Ricoh Company, Atexco, Brother Industries |

Fucoxanthin Market Segmentation: by Type

-

Purified Fucoxanthin

-

Crude Fucoxanthin

Purified Fucoxanthin is the most dominant and fastest-growing segment due to its higher potency, purity, and suitability for precise applications in nutraceuticals and pharmaceuticals. It is widely used in premium dietary supplements and skincare products.

Crude Fucoxanthin, while less expensive, is predominantly used in functional foods and beverages where lower concentrations are acceptable.

Fucoxanthin Market Segmentation: by Distribution Channel

-

Online Retail

-

Specialty Health Stores

-

Pharmacies and Drug Stores

-

Supermarkets and Hypermarkets

Online Retail is the fastest-growing channel, propelled by the convenience of e-commerce platforms and the growing preference for direct-to-consumer purchases.

Specialty Health Stores remain the most dominant channel, as they provide tailored advice and cater to informed consumers seeking high-quality supplements.

Fucoxanthin Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Asia-Pacific: Accounts for the largest market share, driven by abundant seaweed resources and established algal industries.

North America: The fastest-growing region, fueled by increasing health awareness and a strong preference for clean-label supplements.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a dual impact on the fucoxanthin market. On the positive side, the heightened focus on health and immunity boosted demand for dietary supplements and functional foods containing fucoxanthin. The pandemic underscored the importance of preventive healthcare, driving consumers to seek bioactivity with proven health benefits. However, the supply chain disruptions caused by lockdowns, labor shortages, and logistical challenges impacted seaweed harvesting and fucoxanthin production. The temporary closure of production facilities further exacerbated these challenges, creating a ripple effect across the supply chain. On the flip side, the recovery phase post-pandemic has opened new opportunities for the market. Manufacturers are investing in advanced extraction technologies and diversifying their sourcing strategies to mitigate future disruptions. The e-commerce boom during the pandemic also provided a significant boost to online retail channels for fucoxanthin products, a trend that continues to gain traction.

Latest Trends and Developments:

The fucoxanthin market is at the forefront of innovation, with several key trends shaping its trajectory. Advances in extraction technologies are a major highlight, with companies exploring enzymatic and biotechnological methods to improve yield and reduce production costs. Co-extraction of fucoxanthin alongside other valuable seaweed compounds, such as omega-3 fatty acids and polysaccharides, is emerging as a popular strategy to maximize resource utilization and create multifunctional products. Another noteworthy trend is the rising demand for fucoxanthin-enriched functional foods and beverages, driven by consumers’ preference for convenient and health-boosting options. In the cosmetics industry, fucoxanthin is gaining traction as a sustainable and effective ingredient for anti-aging and UV-protection products, aligning with the broader shift toward natural skincare. Finally, sustainability initiatives, such as vertical algae farming and closed-loop systems, are redefining raw material sourcing and production processes, ensuring long-term growth and environmental responsibility.

Key Players in the Market:

-

Kornit Digital

-

Mimaki Engineering

-

EFI Reggiani

-

Durst Group

-

Roland DG Corporation

-

Epson Corporation

-

Mutoh Europe

-

Ricoh Company

-

Atexco

-

Brother Industries

Chapter 1. Fucoxanthin Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fucoxanthin Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fucoxanthin Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fucoxanthin Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fucoxanthin Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fucoxanthin Market – By Type

6.1 Introduction/Key Findings

6.2 Purified Fucoxanthin

6.3 Crude Fucoxanthin

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Fucoxanthin Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online Retail

7.3 Specialty Health Stores

7.4 Pharmacies and Drug Stores

7.5 Supermarkets and Hypermarkets

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Fucoxanthin Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fucoxanthin Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Kornit Digital

9.2 Mimaki Engineering

9.3 EFI Reggiani

9.4 Durst Group

9.5 Roland DG Corporation

9.6 Epson Corporation

9.7 Mutoh Europe

9.8 Ricoh Company

9.9 Atexco

9.10 Brother Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the fucoxanthin market include rising consumer demand for natural and plant-based health solutions, its proven benefits in weight management and antioxidant properties, advancements in sustainable extraction technologies, increasing adoption in dietary supplements, cosmetics, and functional foods, and the growing emphasis on clean-label, vegan-friendly products globally.

Main concerns about the fucoxanthin market include the high cost of extraction and production, limited availability of raw materials like brown seaweed, challenges in maintaining purity and bioavailability, regulatory hurdles in health claims, lack of consumer awareness in certain regions, and competition from alternative carotenoids and synthetic substitutes.

Kornit Digital, Mimaki Engineering, EFI Reggiani, Durst Group, Roland DG Corporation, Epson Corporation.

Asia Pacific currently holds the largest market share, estimated around 35%.

North America has shown significant room for growth in specific segments.