Fruit and Vegetable Pieces and Powders Market Size (2025 – 2030)

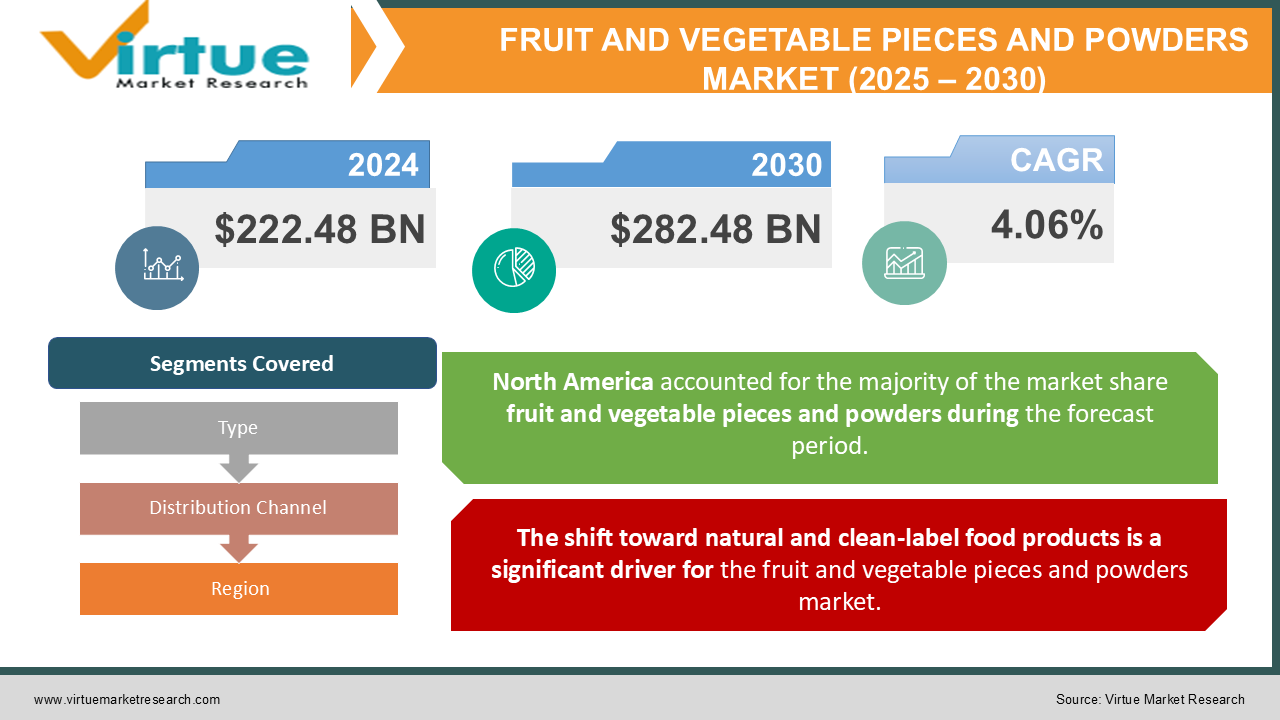

The Fruit and Vegetable Pieces and Powders Market was valued at USD 222.48 Billion in 2024 and is projected to reach a market size of USD 282.48 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4.06%.

The fruit and vegetable pieces and powders market are an integral segment of the global food industry, driven by growing consumer awareness about the importance of incorporating nutritious, plant-based ingredients into their diets. This market includes dried and powdered forms of fruits and vegetables, which are utilized across a variety of applications such as bakery products, beverages, infant nutrition, soups, sauces, snacks, and dietary supplements. With rising demand for convenience foods and clean-label products, this market is witnessing robust growth. The versatile use of these ingredients stems from their extended shelf life, high nutrient retention, and ability to enhance the flavour, colour, and texture of finished products. In an era where plant-based and health-centric trends dominate, fruit and vegetable pieces and powders are considered essential components in product formulations.

Key Market Insights:

-

The market consumed over 3 million metric tons of fruit and vegetable powders and pieces in 2023.

-

Approximately 40% of all powdered vegetable products were used in soups and sauces.

-

25% of fruit powder demand was driven by the beverage industry, including smoothies and juices.

-

The global market for organic fruit powders grew by 12% in volume in 2023 compared to 2022.

-

Over 70% of food manufacturers surveyed stated they preferred freeze-dried fruit powders for premium product lines.

-

Fruit pieces accounted for 35% of the total market share, predominantly used in snacks and cereals.

-

Beetroot powders were among the fastest-growing categories, with a 23% increase in demand from the functional beverage sector.

-

The infant nutrition segment contributed to 15% of the market’s fruit powder consumption.

-

Vegetable powders saw a surge in demand in plant-based meat products, growing by 20% in 2023.

-

18% of manufacturers used fruit powders as a natural colouring agent in 2023.

-

The average price of high-quality organic fruit powders reached $12.50 per kilogram in 2023.

-

Over 50% of all new snack launches in 2023 included vegetable or fruit powder ingredients.

-

Tomato powder was the most widely used vegetable powder, accounting for 40% of the vegetable powder market.

Market Drivers:

The shift toward natural and clean-label food products is a significant driver for the fruit and vegetable pieces and powders market.

Modern consumers are more discerning than ever, seeking transparency in ingredient sourcing and manufacturing processes. Clean-label products appeal to health-conscious buyers by avoiding artificial additives, preservatives, and synthetic colours. Fruit and vegetable powders naturally align with this trend, offering vibrant colours, rich flavours, and high nutritional value without the need for artificial enhancements. For example, beetroot and spinach powders are increasingly used as natural colorants in beverages, while apple and carrot powders are preferred as clean-label sweeteners or bulking agents in snacks and baked goods. Additionally, as consumers scrutinize ingredient lists for transparency, manufacturers have leveraged this demand to market products with simple, easily recognizable ingredients like “100% dried mango powder” or “pure spinach flakes.” This focus on clean-label formulations has driven a surge in innovation within the fruit and vegetable powders sector, pushing companies to develop highly functional, minimally processed options that retain the nutritional and sensory properties of fresh produce.

Fruit and vegetable powders are no longer confined to traditional uses in food and beverages; they are finding applications across a variety of industries, including nutraceuticals, cosmetics, and pharmaceuticals.

The health and wellness boom has amplified the demand for functional foods, dietary supplements, and energy-boosting beverages, with fruit powders like acai, blueberry, and turmeric becoming staples in these formulations. These powders are rich in antioxidants, vitamins, and minerals, offering functional benefits such as improved digestion, immunity enhancement, and anti-inflammatory properties. The cosmetics industry has also embraced these natural ingredients for their skin-enhancing properties. For instance, fruit powders like papaya and pomegranate are incorporated into face masks and scrubs, while vegetable powders like cucumber are used in soothing lotions. Meanwhile, pharmaceutical applications focus on leveraging vegetable powders for supplements aimed at addressing specific health concerns, such as carrot powder for eye health or spinach powder for iron supplementation. This cross-industry applicability has significantly broadened the market scope, providing lucrative opportunities for manufacturers to cater to diverse consumer needs.

Market Restraints and Challenges:

Despite its promising growth trajectory, the fruit and vegetable pieces and powders market face several challenges. One key issue is the high cost of advanced processing technologies, such as freeze-drying and vacuum drying, which preserve the nutritional and sensory attributes of raw produce but require substantial capital investment. This can make high-quality products unaffordable for price-sensitive consumers or small-scale manufacturers, limiting widespread adoption. Additionally, seasonal variability in raw material availability poses a challenge. Fruit and vegetable production is inherently dependent on weather conditions, which can cause supply fluctuations and impact product pricing. Another concern is the perception of processed foods. While powders and pieces are minimally processed compared to other food products, some consumers may still view them as less natural than fresh produce. Educating consumers about the nutritional integrity and sustainability of these products is crucial for overcoming this barrier. Lastly, stringent regulatory standards for food safety and labeling vary by region, complicating international trade and requiring manufacturers to adapt their processes to meet multiple compliance requirements. These challenges underscore the need for ongoing innovation and strategic planning to sustain market growth.

Market Opportunities:

The fruit and vegetable pieces and powders market presents a wealth of opportunities as global trends continue to evolve. Sustainability initiatives represent a significant area of potential growth, particularly in the use of surplus or "imperfect" produce that may not meet retail standards for appearance but remains nutritionally sound. By processing these items into powders or dried pieces, companies can reduce food waste while appealing to environmentally conscious consumers. This circular approach to production aligns with broader global goals of achieving sustainable food systems. Additionally, the market is ripe for innovation in personalized nutrition. With advancements in AI and health tracking, consumers are increasingly seeking tailored dietary solutions that meet their individual health goals. Fruit and vegetable powders offer a convenient medium for customization, whether it's creating blends targeting specific deficiencies or enhancing functional properties like energy, digestion, or mental clarity. Furthermore, the growing demand for on-the-go nutrition presents opportunities for powders to be incorporated into portable products like sachets, bars, and ready-to-mix beverages, catering to busy lifestyles. Emerging economies also provide untapped potential for growth. As disposable incomes rise in developing regions, there is increasing demand for premium and health-centric products, including organic and non-GMO fruit and vegetable powders. Brands that can offer affordable, high-quality options tailored to local tastes stand to gain a competitive edge in these markets.

FRUIT AND VEGETABLE PIECES AND POWDERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.06% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Kerry Group, Olam International, Sensient Technologies, SunOpta Inc., Diana Food, Symrise AG, Paradise Fruits, Naturipe Ingredients, Kanegrade Ltd. |

Fruit and Vegetable Pieces and Powders Market Segmentation: By Type

-

Fruit Powders (e.g., apple, banana, berry, mango)

-

Vegetable Powders (e.g., tomato, carrot, beetroot, spinach)

-

Fruit Pieces (e.g., dried mango slices, apple chips, berry clusters)

-

Vegetable Pieces (e.g., carrot sticks, tomato flakes, zucchini chips)

Beetroot powder, due to its widespread use in natural energy drinks, plant-based meat colouring, and immunity-boosting supplements. Tomato powder, extensively used across soups, sauces, and seasoning blends.

Fruit and Vegetable Pieces and Powders Market Segmentation: By Distribution Channel

-

B2B (Direct to Food and Beverage Manufacturers)

-

Retail (Supermarkets, Hypermarkets, Specialty Stores)

-

Online (E-commerce Platforms)

Online platforms, driven by the convenience of home delivery and increasing consumer reliance on e-commerce for specialty health products. Retail stores, particularly supermarkets and hypermarkets, which account for the bulk of consumer purchases.

Fruit and Vegetable Pieces and Powders Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America remains the most dominant region in the market, supported by its established food processing industry, consumer preference for clean-label products, and strong innovation ecosystem. The widespread availability of advanced drying technologies, combined with increasing demand for organic and functional foods, ensures North America’s continued leadership.

Asia-Pacific’s rapid economic growth, coupled with evolving consumer lifestyles, positions it as the fastest-growing region. The increasing adoption of Western food trends, rising middle-class population, and focus on health and wellness are key factors driving this growth. Governments in countries like China and India are also promoting food processing initiatives, further propelling the market.

COVID-19 Impact Analysis Fruit and Vegetable Pieces and Powders Market:

The COVID-19 pandemic had a profound impact on the fruit and vegetable pieces and powders market. Heightened consumer focus on immunity and overall health drove a surge in demand for superfoods and nutrient-rich powders. Lockdowns disrupted global supply chains, causing delays and increasing production costs. However, e-commerce sales boomed, providing a lifeline for manufacturers and retailers. The pandemic also spurred innovation, with companies introducing products that combined health benefits with convenience, such as instant soups and functional smoothie blends.

Latest Trends and Developments:

The market has witnessed several notable trends and developments, including the integration of superfoods like acai and goji berries into mainstream product lines. Organic and non-GMO certifications have become a key differentiator for brands, while custom blends targeting specific health needs, such as digestion or energy, are increasingly popular. Additionally, innovations in drying technologies, such as vacuum-drying and spray-drying, have enhanced product quality. Companies are also embracing sustainability initiatives, utilizing surplus produce and recyclable packaging to appeal to eco-conscious consumers.

Key Players in the Market:

-

Archer Daniels Midland Company

-

Kerry Group

-

Olam International

-

Sensient Technologies

-

SunOpta Inc.

-

Diana Food

-

Symrise AG

-

Paradise Fruits

-

Naturipe Ingredients

-

Kanegrade Ltd.

Chapter 1. Fruit and Vegetable Pieces and Powders Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fruit and Vegetable Pieces and Powders Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fruit and Vegetable Pieces and Powders Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fruit and Vegetable Pieces and Powders Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fruit and Vegetable Pieces and Powders Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fruit and Vegetable Pieces and Powders Market – By Type

6.1 Introduction/Key Findings

6.2 Fruit Powders (e.g., apple, banana, berry, mango)

6.3 Vegetable Powders (e.g., tomato, carrot, beetroot, spinach)

6.4 Fruit Pieces (e.g., dried mango slices, apple chips, berry clusters)

6.5 Vegetable Pieces (e.g., carrot sticks, tomato flakes, zucchini chips)

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Fruit and Vegetable Pieces and Powders Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 B2B (Direct to Food and Beverage Manufacturers)

7.3 Retail (Supermarkets, Hypermarkets, Specialty Stores)

7.4 Online (E-commerce Platforms)

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Fruit and Vegetable Pieces and Powders Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fruit and Vegetable Pieces and Powders Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Kerry Group

9.3 Olam International

9.4 Sensient Technologies

9.5 SunOpta Inc.

9.6 Diana Food

9.7 Symrise AG

9.8 Paradise Fruits

9.9 Naturipe Ingredients

9.10 Kanegrade Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers are increasingly seeking convenient food products that align with their health and wellness goals. Fruit and vegetable pieces and powders serve as versatile ingredients in snacks, beverages, soups, and ready-to-eat meals, offering a natural way to boost nutritional content.

The production of fruit and vegetable powders involves sophisticated drying and processing technologies such as freeze drying, spray drying, and vacuum drying. While these methods ensure high-quality output, they are capital-intensive and require significant investment in machinery and expertise. Small- and medium-scale enterprises, in particular, may struggle to adopt these technologies, limiting their ability to compete in the market.

Archer Daniels Midland Company, Kerry Group, Olam International, Sensient Technologies, SunOpta Inc., Diana Food, Symrise AG.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.