Fructose Market Size (2024 – 2030)

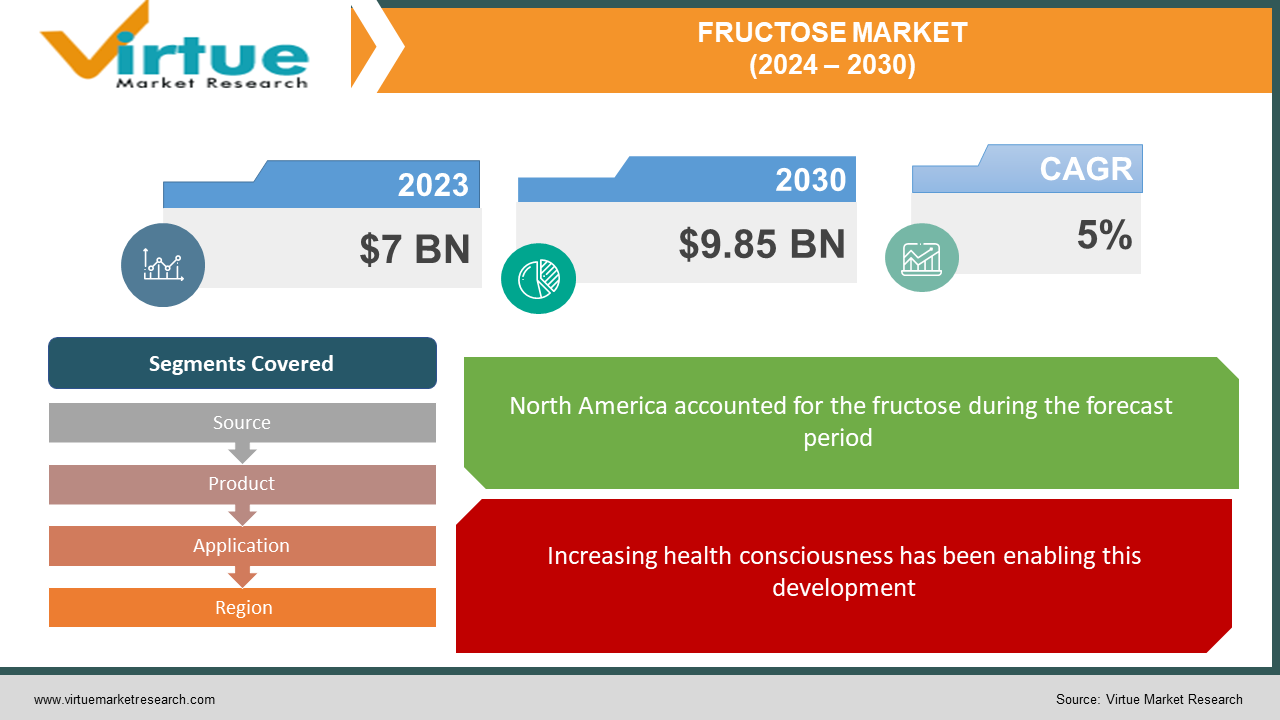

The global fructose market was valued at USD 7 billion and is projected to reach a market size of USD 9.85 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5%.

Fructose is a type of sugar that is a monosaccharide. Similar to other sugars, one gram of fructose has four calories. Because it mostly exists naturally in a variety of fruits, fructose is often referred to as fruit sugar. Other plant foods, including honey, sugar beets, sugar cane, and vegetables, also naturally contain it. This market has had good scope in the past. This was widely used in the food and beverage industry. Presently, the market has seen considerable expansion owing to economic growth. Advances in processing technologies have helped with better innovations. In the future, with a focus on product diversification and rising health consciousness, the market is anticipated to witness a drastic elevation.

Key Market Insights:

Fructose makes up 54.7 grams of the typical American diet per day. This is equivalent to 10.2% of total calories. Drinks with added sugar account for 30% of total fructose intake, with cereals coming in second at 22% and fruit or fruit juice at 19%. About 6.6 million short tonnes of high fructose corn syrup were provided by the United States to the country's food and beverage industry in 2022. By 2031, it is anticipated that the European Union will have consumed over 785,000 metric tons of high-fructose corn syrup, with a 26.02% increase in production volume between 2023 and 2032. People who consume two or more servings of sweetened drinks daily may have a 35% higher risk of heart disease. To prevent this, organizations are focusing on the nutrition labeling of fructose content for better awareness. Additionally, strategies for reducing fructose-related health risks are being taken by using food processing techniques that minimize fructose content.

Fructose Market Drivers:

Increasing health consciousness has been enabling this development.

Growing awareness among consumers about the disadvantages of high calories has led to a shift towards natural sweeteners. Additionally, fructose is a preferred sugar over others because it has fewer calories and total sugar content. This low glycemic index makes it an ideal choice due to the rising cases of diabetes and heart disease. Secondly, fructose has been shown to improve endurance and sports performance. According to studies, the combination of fructose and glucose, or maltodextrin, boosts fat burning, spares glycogen reserves, and increases the pace at which carbs are burned—from 60 to 90 grams per hour. Thirdly, due to its effects on hunger, dietary preferences, and non-insulin-dependent thermogenesis, fructose may aid with weight control. Moreover, it differs from glucose in terms of texture, taste, digestion, and degree of absorption. Furthermore, only fructose gives the liver fresh glycogen, which helps with recuperation and endurance training. Besides, there is evidence that fructose contributes to increased hydration.

Rising demand from the food and beverage industry is contributing to its success.

Fructose is a flexible sweetener that increases sweetness without altering flavor. Since fructose is one of the most soluble sugars, it mixes well into drinks and food applications.Due to its hygroscopic nature, fructose easily absorbs water from its surroundings. This property helps in holding onto moisture for a long time at low relative humidity, acting as a humectant. Additionally, it also helps in maintaining osmotic stability. Furthermore, breads and other bakery products can have their shelf life increased by fructose because it has a lower water activity. This prevents microbial growth. Moreover, foods that include fructose have a lower freezing point due to its tiny molecular weight. This aids in preventing undesired crystallization. For dairy sweets that are hard-frozen or soft-served, this feature is necessary.

Fructose Market Restraints and Challenges:

Overconsumption associated with health disorders and intense competition are the main issues that the market is currently experiencing.

Even though fructose has advantages when compared to other sugars, excessive consumption is associated with many illnesses. Consuming large amounts of fructose may raise the risk of non-alcoholic fatty liver disease (NAFLD), which can cause inflammation and damage to the liver. Insulin sensitivity is lowered by consuming high-fructose corn syrup and sucrose, which increases the risk of type 2 diabetes. Intestinal cells that undergo excessive fructose metabolism may produce fewer proteins necessary to maintain the gut barrier. There may be a connection between fructose consumption and hypertension, according to epidemiological research. Secondly, alternatives like stevia, erythritol, and monk fruit extract are also some of the healthy options. These substitutes are well-established in the market owing to their taste and flavor. Additionally, some markets sell them at a lower price when compared to fructose. Consumers can shift towards these options as a result.

Fructose Market Opportunities:

Product innovations provide the industry with numerous possibilities. Researchers are working on sugar-free options to reach a broader consumer base. This sugar is being incorporated with functional ingredients to add health benefits. This includes their use in energy bars, protein snacks, oats, and other such options. Nutraceuticals and dietary supplements are also changing their formulations. Vitamins, vital amino acids, minerals, and other significant substances are used with fructose. Secondly, clean-label products are well appreciated by the public. Manufacturers are capitalizing on this trend by eliminating artificial sweeteners and utilizing natural sweeteners instead. Thirdly, the growing popularity of veganism is boosting the market. Vegans follow a plant-based diet. Fructose fits well in this category. This is leading to an increase in adoption.

FRUCTOSE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Source, Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Cargill, Incorporated, Tate & Lyle PLC, Ingredion Incorporated, DuPont de Nemours, Inc., Galam Group, Atlantic Chemicals Trading GmbH, Dulcette Technologies LLC, Dulcette Global Pte Ltd, Gulshan Polyols Limited |

Fructose Market Segmentation: By Source

-

Sugarcane

-

Sugar beet

-

Corn

-

Others

Corn is the largest and fastest-growing source. High-fructose corn syrup (HFCS) is made from maize because it contains glucose, which can be converted chemically into fructose. Corn starch is broken down into individual glucose molecules to create corn syrup, which is 100% glucose. This process is used to make HFCS, a liquid sweetener. High-temperature enzymes are then introduced to the sugars to help them become fructose. Biotechnology, processing technologies, and farming techniques have advanced. These developments have resulted in higher maize yields, better extraction techniques, and more uses for fructose compounds derived from maize.

Fructose Market Segmentation: By Product

-

High-Fructose Corn Syrup

-

Fructose Syrups

-

Fructose Solids

High-fructose corn syrup is the largest growing product, with a share of around 63%. Made from 76% carbs and 24% water, high fructose corn syrup (HFCS) is a sweetener derived from maize starch. Food makers benefit from the fact that, when compared to sucrose, the free monosaccharides in HFCS improve food flavor, stability, freshness, texture, color, pourability, and consistency. Brewing, baking, medicines, food detergents, and sweetened drinks are the applications that employ HFCS. It is used in place of sucrose, or table sugar, in confections, drinks, sweets, packaged and tinned foods, sauces, jams, yogurts, and other items that need to be sweetened. HFCS increases production quality, is less expensive, and is simpler to utilize. Fructose syrup is the fastest-growing segment. This can easily blend with other ingredients. It improves the flavors of fruit and spices, keeps products fresher longer, helps with fermentation, stabilizes products, and encourages baked goods' cooked flavors and surface browning.

Fructose Market Segmentation: By Application

-

Beverages

-

Processed Foods

-

Dairy Products

-

Confectionary

-

Bakery & Cereals

-

Others

Beverages are the largest growing application. Soft drinks, energy drinks, protein shakes, and juice have become very popular over the years. There is a very high demand for different flavor options. Beverages need sugar to impart the necessary taste. Being one of the most soluble sugars, fructose mixes well with drinks, which is why it's utilized in them. Drinks absorb fructose more quickly than complete meals like fruits and vegetables. This quick absorption may speed up the hepatic fructose extraction process as well as de novo lipogenesis and lipid synthesis. Processed foods are the fastest-growing application. This expansion may be attributed to several causes, including the rising demand for prepackaged meals and snacks and higher investment levels from major firms. Because of its sweetness and ability to improve flavor, fructose is utilized in processed foods. Numerous processed foods, such as baked products, fizzy drinks, canned fruits, and jellies, include it. Packaged meals include fructose added in place of sucrose (table sugar). It enhances production quality, is less expensive, and is simpler to utilize.

Fructose Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest market, with the United States and Canada in the lead. Because it produces a significant amount of maize, a necessary raw material for the manufacturing of fructose, North America is a leading player in the fructose industry. The need for fructose as a sweetening ingredient in various products is driven by the region's well-established food and beverage sector and sophisticated food processing infrastructure. Further propelling market expansion is customer desire for natural, low-calorie sweeteners like fructose due to increased health consciousness. Asia-Pacific is the fastest-growing market. Countries like China, India, Japan, and South Korea are at the forefront. The fructose market is seeing significant growth in the Asia-Pacific region due to many causes, such as fast-paced urbanization, evolving lifestyles, and the thriving food and beverage sector. A sufficient supply of maize and improvements in processing techniques have made the area a key hub for the production of fructose. Asia-Pacific consumers' growing health consciousness has increased demand for better substitutes for refined sugars, which has fueled fructose's acceptance in a variety of food and beverage applications.

COVID-19 Impact Analysis on the Global Fructose Market:

The virus outbreak damaged the market. The new norms included social isolation, movement restrictions, and lockdowns. This had an impact on supply chain management, transportation, and logistics. Import-export activities suffered as a result. The closure of all factories and restaurants was necessary to prevent the virus from spreading. This resulted in the suspension of production and other activities. The emphasis was on remote work to stop the infection from spreading. In many sectors of the economy, layoffs were prevalent due to the unpredictable nature of the economy. A large number of people lost their jobs. The bulk of the investments went towards essentials and low-cost utilities. Money was allocated for medical uses, including immunizations, hospital beds, masks, oxygen tanks, and PPE kits. This caused delays in collaborations and launches. Several research studies that were conducted showed that high fructose intake could increase the risk of respiratory diseases and be associated with hospitalization and mortality. People started to cut out foods like desserts, junk food, and other beverages due to various health and wellness trends. The market has begun to improve since the outbreak. The market is currently adapting to sustainable practices. With the updates to the guidelines and the relaxation of the requirements, normal operations have resumed. Because it is more convenient to purchase online, online retail has contributed to higher profitability.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Sustainable sourcing and manufacturing processes have potential for the fructose sector as consumer awareness of environmental problems grows. Investments in eco-friendly packaging, water conservation, and renewable energy may raise the sustainability profile of fructose products and draw in customers who care about the environment.

Key Players:

-

Archer Daniels Midland Company

-

Cargill, Incorporated

-

Tate & Lyle PLC

-

Ingredion Incorporated

-

DuPont de Nemours, Inc.

-

Galam Group

-

Atlantic Chemicals Trading GmbH

-

Dulcette Technologies LLC

-

Dulcette Global Pte Ltd

-

Gulshan Polyols Limited

-

In July 2023, the US-based natural supplement business INFINIT Nutrition introduced PREMIUM Fructose Fuel. This is a drink combination with a lot of carbohydrates that is meant to be used for longer workouts—up to three hours. Five single-serving packets and an isotonic solution for optimal absorption and simple digestion are included in the beginning box. Additionally, it has protein, which helps control blood sugar levels and reduce appetite.

-

In January 2023, the fourth test on the Sentia wine testing platform, the fructose biosensor test, was released by Universal Biosensors, Inc. The quantity of sugar that is accessible to the yeast for conversion into ethanol is represented by the quantities of glucose and fructose, which are significant markers of grape quality.

Chapter 1. Fructose Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fructose Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fructose Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fructose Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fructose Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fructose Market – By Source

6.1 Introduction/Key Findings

6.2 Sugarcane

6.3 Sugar beet

6.4 Corn

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Source

6.7 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Fructose Market – By Product

7.1 Introduction/Key Findings

7.2 High-Fructose Corn Syrup

7.3 Fructose Syrups

7.4 Fructose Solids

7.5 Y-O-Y Growth trend Analysis By Product

7.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 8. Fructose Market – By Application

8.1 Introduction/Key Findings

8.2 Beverages

8.3 Processed Foods

8.4 Dairy Products

8.5 Confectionary

8.6 Bakery & Cereals

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Fructose Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Product

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Product

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Product

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Product

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Product

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Fructose Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer Daniels Midland Company

10.2 Cargill, Incorporated

10.3 Tate & Lyle PLC

10.4 Ingredion Incorporated

10.5 DuPont de Nemours, Inc.

10.6 Galam Group

10.7 Atlantic Chemicals Trading GmbH

10.8 Dulcette Technologies LLC

10.9 Dulcette Global Pte Ltd

10.10 Gulshan Polyols Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global fructose market was valued at USD 7 billion and is projected to reach a market size of USD 9.85 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5%.

Increasing health consciousness and rising demand from the food and beverage industry are the main factors propelling the global fructose market.

Based on the source, the global fructose market is segmented into sugarcane, sugar beet, corn, and others.

North America is the most dominant region for the global fructose market.

Archer Daniels Midland Company, Cargill, Incorporated, and Tate & Lyle PLC are the key players operating in the global fructose market.