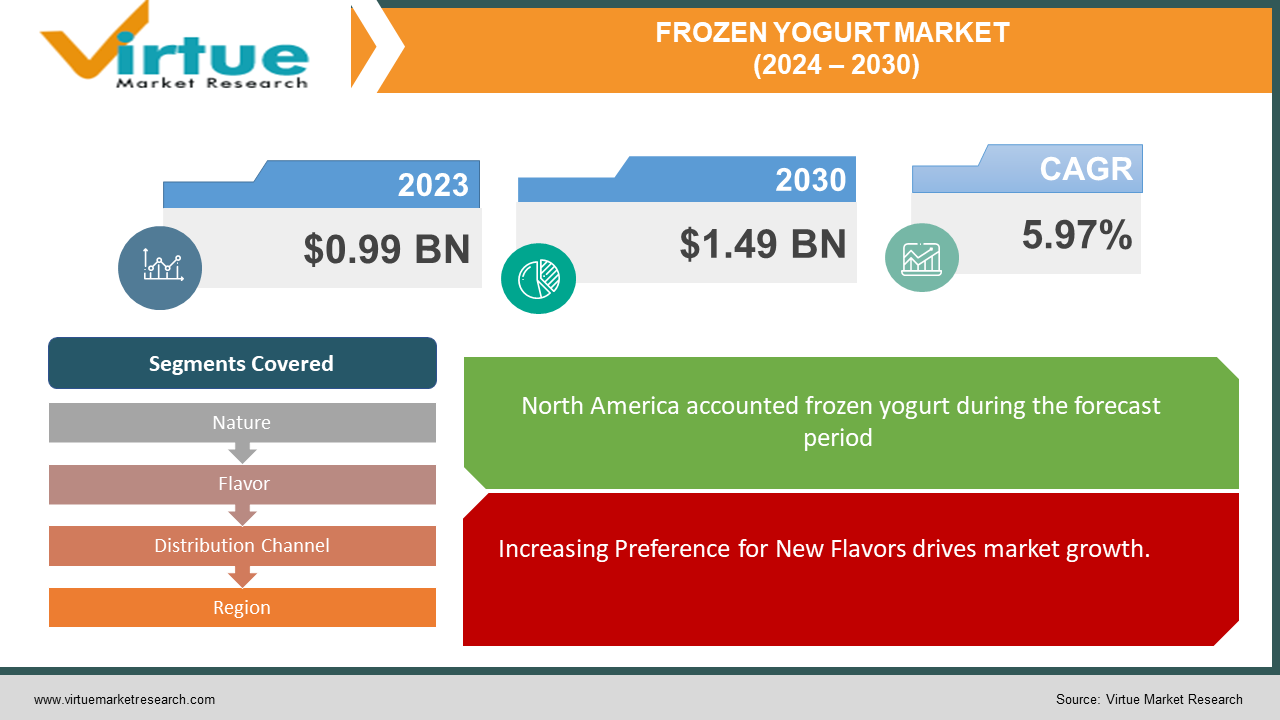

Frozen yogurt market Size (2024 – 2030)

The Frozen yogurt market was valued at USD 0.99 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 1.49 billion by 2030, growing at a CAGR of 5.97%.

Frozen yogurt, a dairy item crafted from fermented milk containing bacteria like lactobacillus bulgaricus and streptococcus thermophilus, incorporates non-dairy elements like almond milk and soymilk. This frozen delicacy, rich in calcium, potassium, and protein, enjoys popularity as a favored frozen dessert.

Key Market Insights:

In the medium term, heightened consumer preference for non-dairy, low-calorie, high-protein, and more health-conscious desserts emerges as the primary driving force behind the market. With over 6 billion servings consumed annually worldwide, frozen yogurt has become a beloved treat across cultures, celebrated for its refreshing taste, versatility, and lower calorie content compared to traditional ice cream.

On average, each American consumes approximately 6.6 pounds of frozen yogurt per year, reflecting the widespread popularity and consumption of this dessert option, according to the International Frozen Yogurt Association.

Between 2015 and 2025, the number of frozen yogurt shops in the United States is estimated to grow by 14%, demonstrating a steady expansion of the market, according to a report by IBISWorld.

Frozen yogurt market Drivers:

Increasing Preference for New Flavors drives market growth.

Consumers increasingly seek frozen yogurt conveniently packaged in bars and cups, featuring flavors preferred by the consumer base. Unique flavor combinations are gaining traction, with savory, caramel, chocolate, and fruity profiles experiencing high demand. The market continues to be propelled by the increasing preference for natural label claims.

In recent years, tart flavors have surged in popularity, rivaling traditional sweet options. Frozen yogurt brands are actively innovating to drive sales, developing new flavors and bar-style products. For instance, in July 2022, Pinkberry, a frozen yogurt establishment based in Arizona, introduced a new frozen yogurt and smoothie named Lava Swirl, blending strawberries, pineapple, and tropical coconut flavors to create an enticing offering.

Furthermore, global shifts in consumer habits are leading individuals to embrace dairy products that are not only healthy and delicious but also organic and low in calories to fulfill their nutritional requirements. Consequently, yogurt variants boasting nonfat and low-fat profiles are gaining favor among consumers due to the increasing demand for low-calorie products.

Frozen yogurt market Restraints and Challenges:

Rise in Number of Market Players and Competitors hinders Market Growth

The global surge in frozen yogurt's popularity has ushered in a wave of new entrants and companies into the market. With innovative product launches and strategic business maneuvers, these newcomers are capitalizing on the booming frozen yogurt industry to cultivate a broad customer base and amplify their operations. Consequently, the competitive terrain of the frozen yogurt sector is characterized by numerous players vying for market dominance. This intense competition offers consumers a plethora of alternatives and choices in the frozen yogurt landscape, potentially tempering market growth during the forecast period.

Frozen yogurt market Opportunities:

The escalating demand for frozen yogurt specialty stores embracing the self-serve concept presents lucrative growth avenues for key players in the frozen yogurt market. These self-serve establishments empower consumers with full control over their frozen yogurt experience, allowing them to select flavors, portion sizes, and toppings according to their dietary requirements and flavor preferences. The pay-by-weight system employed by these stores is a pivotal factor driving the increasing appeal of the self-serve model. In response to this trend, numerous frozen yogurt manufacturers are leveraging the self-serve approach by launching their own specialty stores, thus bolstering their customer reach and market presence.

FROZEN YOGURT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.97% |

|

Segments Covered |

By Nature, Flavor, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé, Yakult Honsha Co., Ltd, Chr. Hansen Holding A/S, Protexin, UAS Laboratories DANONE, DuPont, MORINAGA & CO., LTD BioGaia AB, Kerry Group plc, Daflorn Probiotics UK, Lonza |

Frozen yogurt market Segmentation: By Nature

-

Organic

-

Conventional

The conventional segment currently commands a significant share in the market and is expected to maintain its dominance throughout the forecast period for the Frozen Yogurt Market. Conventional frozen yogurt is crafted from an assortment of flavors, fruits, sweeteners, thickeners, additives, and stabilizers. Primarily, the commercial segment drives the demand for conventional frozen yogurt due to its large-scale requirements and cost-effectiveness.

Frozen yogurt market Segmentation: By Flavor

-

Chocolate

-

Mango

-

Pineapple

-

Strawberry

-

Others

The chocolate segment emerged as the leading player in the Frozen Yogurt Market, capturing the major market share. Chocolate flavor holds widespread appeal, making it the favored choice among consumers of all age groups worldwide. Meanwhile, the strawberry segment experienced notable growth during the forecast period, driven by its popularity among consumers. Renowned for its vibrant color, characteristic sweetness, and smooth texture, strawberry-flavored yogurt has garnered significant preference among consumers.

The strawberry segment is poised for further expansion in the forecast period, fueled by its status as a favored flavor globally, particularly during its peak season. The seasonal nature of strawberries enhances the taste profile of frozen yogurt, contributing significantly to market growth.

Frozen yogurt market Segmentation: By Distribution Channel

-

Supermarket and Hypermarket

-

Convenience Stores

-

Specialist retailers

-

Online stores

-

Others

The hypermarket/supermarket accounted for the highest Frozen Yogurt Market Share and is expected to grow at a significant CAGR during the forecast period. Consumers predominantly procure frozen flavored yogurt in substantial quantities through hypermarkets and supermarkets. As the demand for diverse, flavor-rich yogurt variants grows, these retail outlets offer yogurt sourced from various countries to cater to evolving preferences. The escalating transition from towns to cities and subsequently to hyper cities is amplifying the prevalence of hypermarkets and supermarkets. Consequently, frozen yogurt manufacturers stand to benefit significantly from expanded opportunities to market their products and satisfy consumer demand, given the sizable foot traffic these retail giants attract.

Frozen yogurt market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America maintains its stronghold as the leading force in the global Frozen Yogurt Market, with projections indicating continued growth in the years ahead. This growth trajectory is attributed to the increasing preference for healthier food alternatives and the perception of frozen yogurt as a readily available dessert option. While the popularity of frozen yogurt has surged in the United States and Canada, Mexico emerges as a promising market for both set yogurt and frozen yogurt, exhibiting a noteworthy growth rate during the forecast period. The anticipated growth of the frozen yogurt market outpacing that of set yogurt is primarily attributed to the emergence of frozen yogurt as a distinct dessert category and its probiotic properties, which are perceived as beneficial for health. Notably, the United States commands a significant share within North America, witnessing a substantial transition in consumer preferences from dairy-based frozen yogurt to non-dairy alternatives, particularly among affluent consumers.

In Europe, the market boasts a considerable share, propelled by factors such as the expansion of frozen yogurt distribution networks and a rising consumer demand for organic frozen yogurt. Additionally, heightened awareness regarding the adoption of healthy lifestyles and the inclination towards fitness have led consumers in this region to indulge in frozen yogurt products to a greater extent.

COVID-19 Pandemic: Impact Analysis

Initially, frozen yogurt sales experienced a decline as a result of COVID-19 restrictions imposed on brick-and-mortar stores. However, significant industry players are now strategically pivoting towards strengthening their market presence through e-commerce platforms and online marketing initiatives, aiming to engage consumers beyond traditional geographical boundaries. Moreover, the pandemic-induced shift in consumer behavior towards seeking immunity-boosting products and fortified options with health benefits has prompted major players to enhance the formulation of their yogurt offerings. This involves incorporating organic ingredients, eliminating cholesterol, and introducing vegan variants free from added preservatives or additives, aligning with evolving consumer preferences for healthier and more sustainable food choices.

Latest Trends/ Developments:

-

In June 2022, Noosa, a Colorado-based whole milk yogurt brand under Sovos Brands, ventured into new territory by launching its inaugural line of Noosa Frozen Yoghurt Gelato. This innovative product line features four enticing flavors: chocolate fudge, strawberries & cream, sea salt caramel, and honey vanilla bean, now available in grocery freezers.

-

Also in June 2022, Yogurtland, a prominent frozen yogurt company, unveiled two refreshing limited-time flavors for the summer season: strawberry mango sorbet and passion fruit mango tart. Notably, Yogurtland is exclusively offering its Strawberry Mangonada cup online through yogurt-land.com, the Yogurtland app, and DoorDash, while online-exclusive cups and summer flavors are accessible at select locations.

-

In April 2022, Yasso, renowned for its frozen Greek yogurt offerings, bolstered its brand positioning by introducing the pioneering frozen Greek yogurt Mochi. Crafted from luscious frozen Greek yogurt enveloped in sweet, airy rice dough, this delectable treat is now available in four enticing flavors: chocolate, mango, vanilla, and strawberry.

-

Furthermore, in 2022, Yasso expanded its product portfolio with the launch of "Yasso Poppables," a line of frozen Greek yogurt bites, available in coffee, sea salt caramel, vanilla bean, and mint flavors. These delectable poppables, dipped in dark chocolate and adorned with quinoa crunch, are currently accessible at participating retail outlets, including supermarkets.

Key Players:

These are top 10 players in the Frozen yogurt market :-

-

Nestlé

-

Yakult Honsha Co., Ltd

-

Chr. Hansen Holding A/S

-

Protexin

-

UAS Laboratories

-

DANONE

-

DuPont

-

MORINAGA & CO., LTD

-

BioGaia AB

-

Kerry Group plc

-

Daflorn Probiotics UK

-

Lonza

Chapter 1. Frozen yogurt market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Frozen yogurt market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Frozen yogurt market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Frozen yogurt market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Frozen yogurt market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Frozen yogurt market – By Nature

6.1 Introduction/Key Findings

6.2 Organic

6.3 Conventional

6.4 Y-O-Y Growth trend Analysis By Nature

6.5 Absolute $ Opportunity Analysis By Nature, 2024-2030

Chapter 7. Frozen yogurt market – By Flavor

7.1 Introduction/Key Findings

7.2 Chocolate

7.3 Mango

7.4 Pineapple

7.5 Strawberry

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Flavor

7.8 Absolute $ Opportunity Analysis By Flavor, 2024-2030

Chapter 8. Frozen yogurt market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarket and Hypermarket

8.3 Convenience Stores

8.4 Specialist retailers

8.5 Online stores

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Frozen yogurt market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Nature

9.1.3 By Flavor

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Nature

9.2.3 By Flavor

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Nature

9.3.3 By Flavor

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Nature

9.4.3 By Flavor

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Nature

9.5.3 By Flavor

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Frozen yogurt market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestlé

10.2 Yakult Honsha Co., Ltd

10.3 Chr. Hansen Holding A/S

10.4 Protexin

10.5 UAS Laboratories

10.6 DANONE

10.7 DuPont

10.8 MORINAGA & CO., LTD

10.9 BioGaia AB

10.10 Kerry Group plc

10.11 Daflorn Probiotics UK

10.12 Lonza

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The frozen yogurt industry stands out as a coveted dessert option, boasting a wide spectrum of flavors and sensory experience.

The top players operating in the Frozen yogurt market are - Nestlé, Yakult Honsha Co., Ltd, Chr. Hansen Holding A/S, Protexin, UAS Laboratories, DANONE, DuPont, MORINAGA & CO., LTD, BioGaia AB, Kerry Group plc, Daflorn Probiotics UK, Lonza.

Initially, frozen yogurt sales experienced a decline as a result of COVID-19 restrictions imposed on brick-and-mortar stores. However, significant industry players are now strategically pivoting towards strengthening their market presence through e-commerce platforms and online marketing initiatives, aiming to engage consumers beyond traditional geographical boundaries.

The pay-by-weight system employed by these stores is a pivotal factor driving the increasing appeal of the self-serve model. In response to this trend, numerous frozen yogurt manufacturers are leveraging the self-serve approach by launching their own specialty stores, thus bolstering their customer reach and market presence.

Europe, the market boasts a considerable share, propelled by factors such as the expansion of frozen yogurt distribution networks and a rising consumer demand for organic frozen yogurt.