Frozen Bakery Additives Market Size (2025 – 2030)

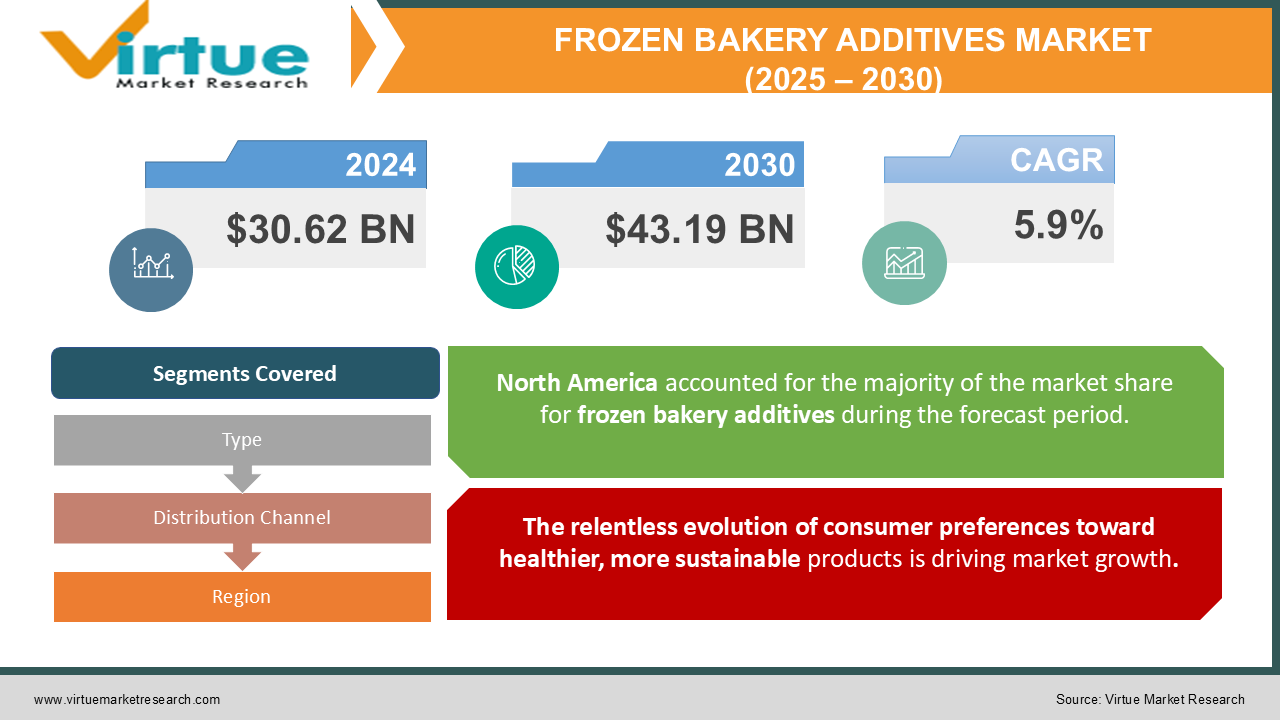

The Frozen Bakery Additives Market was valued at USD 30.62 Billion in 2024 and is projected to reach a market size of USD 43.19 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.9%.

In 2024, the frozen bakery additives market has evolved into a dynamic landscape driven by a blend of technological innovation, heightened consumer awareness, and a continual pursuit for enhanced product quality. As consumer tastes shift toward convenient yet nutritious baked goods, manufacturers are investing heavily in additives that maintain flavour, texture, and shelf-life without compromising on health benefits. The market is characterized by a rich tapestry of ingredients—ranging from natural preservatives and emulsifiers to texturizers and flavour enhancers—that meet stringent food safety standards while delivering exceptional sensory experiences. The current marketplace is defined by a blend of artisanal quality and industrial efficiency. In an environment where consumers demand both authenticity and consistency, the role of additives in frozen bakery products has assumed an increasingly prominent position. Manufacturers are experimenting with formulations that reduce fat and sugar content while preserving moisture and flavour, driven by both consumer health trends and regulatory frameworks that encourage healthier eating habits. These efforts not only reduce waste and increase efficiency but also build consumer trust in frozen bakery products. In summary, the frozen bakery additives market in 2024 is a vibrant and forward-thinking industry that blends innovation with tradition, meeting the evolving needs of consumers while maintaining robust growth prospects and offering a plethora of opportunities for both established and emerging players.

Key Market Insights:

-

The frozen bakery additives market reached a valuation of approximately USD 3.2 billion in 2024.

-

Over 75% of manufacturers reported a significant increase in consumer demand for natural additives.

-

More than 65% of new product launches in 2024 featured “clean label” additives.

-

Approximately 80% of industry stakeholders are investing in research and development for enhanced formulations.

-

Over 50 new patents for bakery additive technologies were filed during 2024.

-

Nearly 68% of frozen bakery product consumers prioritize additive safety and natural origins.

-

Around 90% of manufacturers have updated their quality assurance protocols to meet the latest food safety standards.

-

Approximately 1.5 million tons of bakery additives were processed globally in 2024.

Market Drivers:

The relentless evolution of consumer preferences toward healthier, more sustainable products is driving market growth.

Today’s consumers are increasingly informed about the nutritional composition of their foods and are actively seeking products that not only taste good but also contribute positively to their well-being. In response to this shift, manufacturers are reimagining their additive formulations, incorporating ingredients derived from natural sources and free from synthetic compounds. This movement is further bolstered by the clean-label trend, where the emphasis is on transparency and the minimal use of additives, thus meeting the demand for authenticity in food production. Manufacturers have redefined their production methodologies by integrating natural preservatives, antioxidants, and other functional additives that contribute to extended shelf-life without compromising on taste. The drive to offer healthier products has also led to investments in cutting-edge research and development, which in turn has spurred innovation and resulted in more efficient production processes. This research has yielded additive solutions that not only improve the sensory attributes of frozen bakery products but also enhance their nutritional profiles. The challenge of balancing flavour, texture, and longevity in frozen products has thus transformed into an opportunity to differentiate in a competitive market. Consequently, companies are increasingly adopting formulations that promise improved moisture retention, controlled staling, and better overall product performance.

The second major market driver is the expanding demand for premium frozen bakery products.

As urban lifestyles become more fast-paced, there is a notable increase in the consumption of convenience foods that do not compromise on taste or health benefits. Consumers are willing to invest in higher-quality frozen bakery items that are enhanced with advanced additives, leading to a premium segment that thrives on quality and innovation. This premiumization trend has encouraged manufacturers to focus on developing high-end additives that elevate the sensory experience, create unique textures, and contribute additional nutritional value to baked goods. Consequently, market players are channeling their investments into state-of-the-art processing technologies and specialized ingredient formulations that cater specifically to this upscale consumer segment.

Market Restraints and Challenges:

Despite its promising growth, the frozen bakery additives market faces several notable restraints and challenges that must be addressed by stakeholders. One significant restraint is the escalating regulatory scrutiny imposed on food additives worldwide. In 2024, regulatory bodies have tightened guidelines concerning the use of certain chemical compounds in food production, creating barriers for manufacturers that have traditionally relied on synthetic additives. Compliance with these stringent regulations demands substantial investment in research, testing, and certification processes. These increased costs and extended approval timelines often impede innovation and slow down the introduction of new additive formulations, thereby affecting the overall market dynamism. Lastly, the competitive pressure from alternative preservation and texturizing techniques also poses a challenge. Some competitors are exploring novel preservation methods that reduce or eliminate the need for traditional additives altogether. These innovations, while promising, further complicate market dynamics by introducing substitute products that might divert consumer interest away from conventional additive-based solutions. In an environment where consumer preferences and regulatory expectations are in constant flux, manufacturers must balance innovation with proven efficacy to maintain market share. Thus, while the frozen bakery additives market is buoyed by significant potential, these challenges underscore the need for strategic planning, adaptive manufacturing practices, and robust consumer communication to sustain long-term growth.

Market Opportunities:

Amid the challenges, the frozen bakery additives market is brimming with opportunities that have the potential to redefine product innovation and market penetration in 2024. One of the most compelling opportunities lies in the development and expansion of natural and clean-label additives. With consumers increasingly gravitating toward products that are perceived as healthy and environmentally friendly, there is a growing market segment that values additives derived entirely from natural sources. This shift provides manufacturers with the chance to differentiate their products in an increasingly crowded market by highlighting the purity and sustainability of their ingredients. By investing in research to discover novel natural compounds and alternative processing techniques, companies can create formulations that not only meet regulatory demands but also appeal to the eco-conscious consumer. Another opportunity is the expansion into emerging niche segments that focus on functional health benefits. The incorporation of additives that boost nutritional content—such as fiber-enriching agents, antioxidants, and probiotics—presents an avenue for manufacturers to tap into the health and wellness trend. These functional additives can be marketed not just as performance enhancers for texture and shelf-life, but also as components that contribute to overall well-being. This dual functionality creates a unique selling proposition that is especially attractive in markets where consumers are willing to pay a premium for products that offer tangible health benefits. As a result, companies can command higher margins and build brand loyalty by aligning with consumers’ health aspirations.

FROZEN BAKERY ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ingredion Inc., Kerry Group, Cargill Inc., DSM Nutritional Products, Tate & Lyle, DuPont de Nemours, Lonza Group, Balchem Corporation, Archer Daniels Midland Company, Firmenich |

Frozen Bakery Additives Market Segmentation: by Type

-

Natural Preservatives

-

Emulsifiers

-

Texturizers

-

Flavour Enhancers

-

Functional Additives

-

Nutritional Fortifiers

-

Anti-staling Agents

-

Moisture Retention Agents

Within this segmentation, the fastest-growing type is the natural preservatives category, which has seen a surge in demand driven by consumer preference for clean-label ingredients and the global shift toward healthier, minimally processed food. In contrast, the most dominant type in market share remains texturizers due to their essential role in maintaining product consistency and appeal across a variety of frozen bakery items.

Frozen Bakery Additives Market Segmentation: by Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Specialty Food Stores

-

Foodservice Outlets

In this channel segmentation, online retailers have emerged as the fastest-growing distribution channel, propelled by the convenience of e-commerce and digital purchasing trends.

However, the most dominant distribution channel remains supermarkets/hypermarkets, which continue to generate the largest share of sales due to their extensive reach and trusted reputation among consumers.

Frozen Bakery Additives Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

North America holds approximately 35% of the market share, owing to its mature food processing industry, well-established regulatory standards, and high consumer demand for premium frozen bakery products. Europe follows with a market share of around 30%, bolstered by strong consumer preferences for clean-label ingredients and sustainable production methods that drive innovation in additive formulations. Asia-Pacific, capturing nearly 25% of the market share, is witnessing rapid growth fueled by increasing urbanization, rising disposable incomes, and an expanding middle class that seeks high-quality bakery products enhanced with advanced additives.

Meanwhile, Asia-Pacific is recognized as the fastest-growing region, primarily due to its rapid industrialization, dynamic consumer base, and a robust appetite for innovative frozen bakery solutions. Manufacturers are increasingly investing in local production facilities in this region to cater to rising demand and to leverage lower manufacturing costs, thereby enhancing market penetration.

COVID-19 Impact Analysis on the Market:

The COVID-19 pandemic cast long shadows across global food sectors, and the frozen bakery additives market was not exempt from its disruptive impacts. In 2024, while the industry has largely rebounded, the pandemic’s imprint remains evident in several critical areas of market operations and consumer behaviour. Initially, COVID-19 precipitated supply chain disruptions that affected the availability of raw materials essential for additive production. Lockdowns and labour shortages in key production regions led to intermittent delays and increased production costs, forcing manufacturers to reassess and fortify their supply chain resilience. During the pandemic, consumer behaviour experienced a marked shift as well. With increased time spent at home and a heightened focus on health and immunity, consumers began seeking frozen bakery products that combined convenience with nutritional benefits. This change in consumer sentiment accelerated demand for additives that not only preserved product quality but also enhanced health benefits through fortified ingredients. Companies that were agile enough to pivot their production processes to meet these new demands found themselves at a competitive advantage, while others struggled to realign their product portfolios in response to rapidly evolving consumer preferences.

Latest Trends and Developments:

The frozen bakery additives market continues to witness transformative trends and developments that are redefining industry standards in 2024. One of the most notable trends is the accelerated shift toward clean-label formulations. Manufacturers are increasingly developing additives from natural sources, which appeal to a growing consumer segment that is highly conscious of ingredient transparency and sustainability. This trend is being driven by heightened consumer awareness and regulatory pressures that Favor reduced use of synthetic chemicals in food products. Companies are investing in innovative extraction and purification methods to harness the functional benefits of natural ingredients without compromising on performance. Another key development is the integration of advanced food processing technologies such as microencapsulation and nano emulsion techniques. These technologies are being employed to enhance the stability and bioavailability of additives, ensuring that frozen bakery products retain their quality even after prolonged storage and multiple freeze–thaw cycles. Such technological advancements have not only improved the functional efficacy of additives but have also paved the way for new product categories that offer both extended shelf-life and enhanced nutritional benefits. Overall, the latest trends and developments in the frozen bakery additives market indicate a robust and forward-looking industry landscape. With continuous investments in technology, sustainability, and consumer-focused innovations, the market is well poised to adapt to changing consumer expectations and regulatory demands, ensuring steady growth and long-term market resilience.

Key Players in the Market:

-

Ingredion Inc.

-

Kerry Group

-

Cargill Inc.

-

DSM Nutritional Products

-

Tate & Lyle

-

DuPont de Nemours

-

Lonza Group

-

Balchem Corporation

-

Archer Daniels Midland Company

-

Firmenich

Chapter 1. Frozen Bakery Additives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Frozen Bakery Additives Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Frozen Bakery Additives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Frozen Bakery Additives Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Frozen Bakery Additives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Frozen Bakery Additives Market – By Type

6.1 Introduction/Key Findings

6.2 Natural Preservatives

6.3 Emulsifiers

6.4 Texturizers

6.5 Flavour Enhancers

6.6 Functional Additives

6.7 Nutritional Fortifiers

6.8 Anti-staling Agents

6.9 Moisture Retention Agents

6.10 Y-O-Y Growth trend Analysis By Type

6.11 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Frozen Bakery Additives Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Online Retailers

7.5 Specialty Food Stores

7.6 Foodservice Outlets

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Frozen Bakery Additives Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Frozen Bakery Additives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ingredion Inc.

9.2 Kerry Group

9.3 Cargill Inc.

9.4 DSM Nutritional Products

9.5 Tate & Lyle

9.6 DuPont de Nemours

9.7 Lonza Group

9.8 Balchem Corporation

9.9 Archer Daniels Midland Company

9.10 Firmenich

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Consumer demand for clean-label, natural ingredients, coupled with technological innovations, enhanced processing techniques, and increased investments in research and development, drives the frozen bakery additives market. Additional factors include rising health consciousness, premium product demand, improved shelf-life, and regulatory standards.

Main concerns include escalating regulatory scrutiny, supply chain volatility, consumer skepticism regarding synthetic additives, high production costs for natural ingredients, ensuring consistent product quality amid technological advancements, and balancing innovation with proven efficacy to meet evolving health and safety standards.

Ingredion Inc., Kerry Group, Cargill Inc., DSM Nutritional Products, Tate & Lyle, DuPont de Nemours

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.