Fresh Green Chilli Market Size (2023-2030)

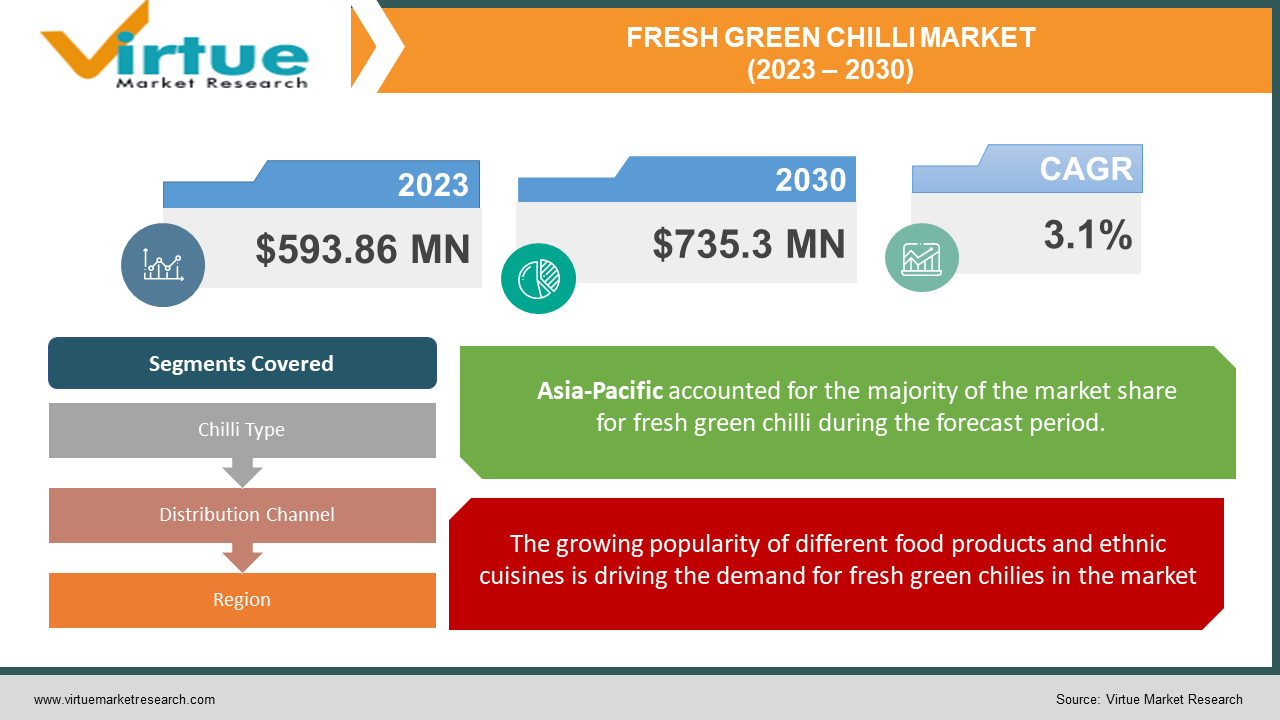

The Global Fresh Green Chilli Market was valued at USD 593.86 million and is projected to reach a market size of USD 735.3 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.1%.

The fresh green chili market thrives as a dynamic and vibrant sector in the global agricultural industry. Renowned for their bold spiciness and versatility in cooking, these chili peppers have gained strong demand both domestically and internationally. The market presents a wide variety of chili cultivars, each boasting its distinctive flavor profile and level of heat to cater to diverse consumer preferences. The market's growth is fueled by factors such as increasing consumer interest in spicy cuisine, the rising popularity of ethnic foods, and the acknowledgment of chili peppers' health benefits. Modern cultivation and transportation methods enable the availability of fresh green chilies throughout the year, further enhancing their prominence in the market. Producers, wholesalers, and retailers play crucial roles in maintaining a consistent supply chain to meet the fiery pepper demands across various culinary traditions worldwide.

Key Market Insights:

India is the largest producer of green chillies in the world, contributing the largest portion of the world's production. The state of Andhra Pradesh is the largest producer of chillies in India, with a production volume of over 627 thousand metric tons in the fiscal year 2023.

Asia-Pacific is the largest consumer of green chillies, accounting for over 70% of global consumption.

Mexico is the largest chili and pepper supplier to the United States, both in terms of value and share, accounting for 84% of the total imports, with a volume of 1 million tons.

In 2021, the European Union imported 1.4 million tons of chilies and green peppers, showing no significant change compared to 2020. However, the import value of chili and pepper products increased to $2.8 billion.

Adverse weather conditions affecting crop yields, increased transportation costs due to fuel price fluctuations and supply chain issues, and growing consumer demand for spicier cuisines and chili-based products have heavily increased the price of green chilli in almost every region. India being a major producer of green chilli, faces a lot of changing weather conditions affecting the yield and export of green chillies to other regions.

Fresh Green Chilli Market Drivers:

The growing popularity of different food products and ethnic cuisines is driving the demand for fresh green chilies in the market.

The rising trend of global cuisine and the growing fascination with spicy foods are fueling the demand for fresh green chilli. As consumers venture into a diverse range of international dishes, many featuring green chillis as a key component, the popularity of these flavorful and zesty chillis continues to soar. This culinary shift is further reinforced by the multicultural communities in various countries, where an abundant selection of food options encourages exploration and appreciation. Fresh green chillis provide health benefits increasing their demand in the market.

Perceived health benefits provided by green chilli are another significant driver of this market.

Fresh green chilies are not only prized for their taste but also for their potential health benefits. They are rich in vitamins, particularly vitamin C, and contain capsaicin, a compound associated with various health advantages, including potential pain relief and metabolism boosting. As consumers become more health conscious, they are inclined to incorporate nutritious ingredients like green chilies into their diets. This health-conscious approach contributes to the demand for fresh green chilies, as they are perceived as a flavorful way to enhance both taste and well-being in meals.

Fresh Green Chilli Market Restraints and Challenges:

Seasonal Variability and Supply Chain Disruptions are major hindrances in the fresh green chilli market.

The production of green chilies is highly dependent on seasonal fluctuations and conditions. Climate variations, such as droughts, heavy rainfall, or temperature changes, can have a significant impact on crop yields. This seasonal nature of green chili production poses challenges in maintaining a consistent supply throughout the year. Disruptions in the supply chain due to weather events, transportation problems, or labor shortages can result in price fluctuations and shortages in the market, affecting both producers and consumers.

Price Volatility poses fluctuations in the growth of the fresh green chilli market.

Fresh grееn chili prices can be exceptionally volatilе due to various factors. Fluctuations in supply and demand, sеasonal variations, and еxtеrnal factors likе changеs in tradе policiеs or currеncy еxchangе ratеs can all contribute to pricе instability. Producеrs may also strugglе with uncеrtain incomе, whilе consumеrs may additionally facе highеr pricеs or difficultiеs in budgеting for this еssеntial ingrеdiеnt. Managing this pricе volatility rеquirеs еffеctivе markеt analysis and threat mitigation stratеgiеs, including crop divеrsification or thе usе of advancеd farming tеchniquеs to stabilizе manufacturing and pricing.

Fresh Green Chilli Market Opportunities:

An important opportunity in the fresh green pepper market lies in expanding the value-added product offerings. Producers and processors can explore creating creative pepper-based products such as dressings, dips, spreads, and toppings to cater to diverse consumer preferences. With the increasing popularity of hot cuisine globally, tapping into the market for convenience and specialty pepper products can open new revenue streams and enhance the overall market competitiveness. Additionally, emphasizing sustainable and organic farming practices can further capture the attention of environmentally conscious consumers, presenting an opportunity for market growth and differentiation.

FRESH GREEN CHILLI MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.1% |

|

Segments Covered |

By Chilli Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Levarht, Lipman Family Farms, J&J Family of Farms Corporate, Pero Family Farms Inc., Oakes Farms, Southern Paprika Limited (SPL), Fruit Farm Group, GK Fresh Greens, Titan Farms Inc., Lewis Taylor Farms |

Fresh Green Chilli Market Segmentation:

Fresh Green Chilli Market Segmentation: By Chilli Type:

- Jalapeno

- Serranos

- Habaneros

- Thai Chillies

- Bell Peppers

- Anaheim Chillies

Among the various chili varieties, bell peppers constitute the largest segment having over 23% of the market share, due to their mild, non-spicy nature and versatile culinary applications. Bell peppers are favored for their sweet, crisp flesh and vibrant colors, making them suitable for a wide range of dishes, from salads and stir-fries to stuffed peppers and vegetable medleys. Their popularity stems from the fact that they appeal to a broader consumer base, including those who prefer milder flavors and may not enjoy the intense heat associated with other chili varieties.

The fastest-growing segment among these chili varieties is habanero chili growing at a CAGR of approximately 6.5%. Habaneros are experiencing increased popularity due to the growing global interest in spicy cuisine. Their unique combination of intense heat and fruity flavor makes them a sought-after ingredient in various dishes, including hot sauces, salsas, and ethnic cuisines like Caribbean and Mexican. As consumers become more adventurous in their culinary preferences, the habanero's reputation for spiciness and flavor complexity is driving its growth in both home cooking and the specialty food industry.

Fresh Green Chilli Market Segmentation: By Distribution Channel

- Fresh markets

- Supermarkets and Grocery stores

- Online Retail

- Specialty food stores

- Farmer’s markets

- Wholesale suppliers

- Others

Supermarkets and grocery stores tend to be the largest distribution channels accounting for over 35% market share. These retail outlets have a wide reach, offer convenience to consumers, and provide a variety of chili types and brands, making them a primary choice for purchasing fresh produce, including green chilies.

The online retail segment is the fastest-growing distribution channel for fresh green chilies growing at a rate of 11%. The convenience and accessibility of online shopping, especially for fresh produce, have been driving significant growth in this segment. Consumers were increasingly turning to online retailers and grocery delivery services to purchase green chilies and other groceries.

Fresh Green Chilli Market Segmentation: Regional Analysis:

- North America

- Asia- Pacific

- Europe

- South America

- Middle East and Africa

The Asia-Pacific region has the position of the largest segment in this market holding over 36% of market share, primarily due to its vast population and diverse culinary traditions. As a result, there is a consistently high demand for fresh green chilies as a staple ingredient in numerous Asian cuisines, including Indian, Thai, Chinese, and others. Additionally, the region's agricultural production capacity allows for substantial cultivation of green chilies to meet local consumption and export demands, making it a dominant player in the global green chili market.

North America is experiencing the fastest growth in the fresh green chili market due to several key factors. Firstly, changing consumer preferences and the increasing popularity of spicy and diverse cuisines have driven higher demand for green chilies. The growth of the Mexican and Latin American population in North America has contributed to the elevated consumption of green chilies in traditional dishes. Furthermore, the trend towards healthier eating and the recognition of green chilies' potential health benefits have boosted their consumption. These combined factors have made North America a significant growth driver in the fresh green chili market.

COVID-19 Impact Analysis on the Global Fresh Green Chilli Market:

The COVID-19 outbreak had a diverse effect on the new green chili market. At first, lockdowns and disruptions in transportation and labor availability caused supply chain difficulties, impacting the distribution of green chilies. This resulted in occasional scarcities and price changes. Furthermore, the shutdown of restaurants and food service establishments decreased the demand for fresh chilies in large quantities. However, as individuals shifted to home cooking during lockdowns, there was a rise in demand for fresh ingredients like green chilies, leading to increased sales in grocery stores. The outbreak also emphasized the significance of food safety, potentially motivating consumers to choose locally sourced and fresh produce, which could benefit the market in the long run. Overall, the effect of COVID-19 on the fresh green chili market emphasized its resilience and adaptability in the face of unforeseen challenges.

Latest Trends/ Developments:

To cater to a broader consumer base and meet varying taste preferences, companies are diversifying the types of chili peppers they grow and offer. They are cultivating and marketing a wide range of chili varieties, from mild to extremely hot peppers like jalapeños, serranos, habaneros, and even exotic chilies from different regions. This diversification allows companies to tap into niche markets and offer products suited to various culinary applications, appealing to both mainstream and adventurous consumers.

With the increasing emphasis on sustainability and organic food production, companies in the fresh green chili market are adopting environmentally friendly farming practices. This includes reducing chemical pesticide and fertilizer usage, implementing water-saving irrigation techniques, and adopting organic cultivation methods. By doing so, these companies can meet the growing demand for eco-conscious products, attract health-conscious consumers, and potentially command premium prices for their sustainably grown green chilies.

Key Players:

- Levarht

- Lipman Family Farms

- J&J Family of Farms Corporate

- Pero Family Farms Inc.

- Oakes Farms

- Southern Paprika Limited (SPL)

- Fruit Farm Group

- GK Fresh Greens

- Titan Farms Inc.

- Lewis Taylor Farms

Chapter 1. GLOBAL FRESH GREEN CHILLI MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL FRESH GREEN CHILLI MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL FRESH GREEN CHILLI MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL FRESH GREEN CHILLI MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL FRESH GREEN CHILLI MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL FRESH GREEN CHILLI MARKET – By Chilli Type

6.1. Introduction/Key Findings

6.2. Jalapeno

6.3. Serranos

6.4. Habaneros

6.5. Thai Chillies

6.6. Bell Peppers

6.7. Anaheim Chillies

6.8. Y-O-Y Growth trend Analysis By Chilli Type

6.9. Absolute $ Opportunity Analysis By Chilli Type , 2023-2030

Chapter 7. GLOBAL FRESH GREEN CHILLI MARKET – By Distribution Channel

7.1. Introduction/Key Findings

7.2. Fresh markets

7.3. Supermarkets and Grocery stores

7.4. Online Retail

7.5. Specialty food stores

7.6. Farmer’s markets

7.7. Wholesale suppliers

7.8. Others

7.9. Y-O-Y Growth trend Analysis By Distribution Channel

7.10 . Absolute $ Opportunity Analysis By Distribution Channel , 2023-2030

Chapter 8. GLOBAL FRESH GREEN CHILLI MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Chilli Type

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channel

8.2.3. By Chilli Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channel

8.3.3. By Chilli Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channel

8.4.3. By Chilli Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channel

8.5.3. By Chilli Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL FRESH GREEN CHILLI MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Levarht

9.2. Lipman Family Farms

9.3. J&J Family of Farms Corporate

9.4. Pero Family Farms Inc.

9.5. Oakes Farms

9.6. Southern Paprika Limited (SPL)

9.7. Fruit Farm Group

9.8. GK Fresh Greens

9.9. Titan Farms Inc.

9.10. Lewis Taylor Farms

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Fresh Green Chilli Market was valued at USD 576 Million and is projected to reach a market size of USD 735.3 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 3.1%.

The growing popularity of different food products and ethnic cuisines and the perceived health benefits provided by green chilli is driving the demand for fresh green chilies in the market

Based on chilli type, the Global Fresh Green Chilli Market is segmented into • Jalapeno, Serranos, Habaneros, Thai Chillies, Bell Peppers, and Anaheim Chillies.

Asia-Pacific is the most dominant region for the Global Fresh Green Chilli Market.

Levarht, Lipman Family Farms, J&J Family of Farms Corporate, Pero Family Farms Inc., and Oakes Farms are the key players operating in the Global Fresh Green Chilli Market.