Freighter Aircraft Market Size (2025-2030)

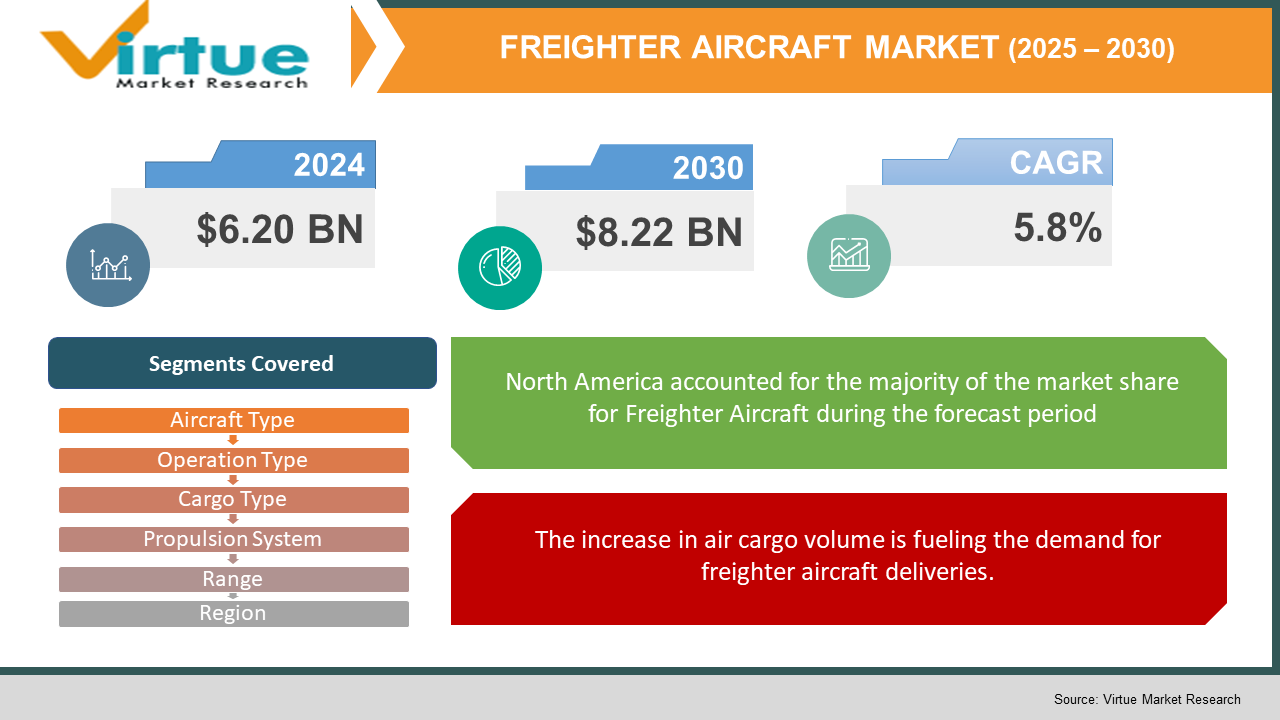

The Freighter Aircraft Market was valued at USD 6.20 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 8.22 billion by 2030, growing at a CAGR of 5.8%.

Key Market Insights:

The global market for freighter aircraft is experiencing significant growth, driven by the increasing demand for air cargo services and the need for more efficient worldwide logistics. Freighter aircraft are specifically designed for the transportation of cargo or freight. Unlike standard passenger planes, these aircraft are not equipped with seats or passenger amenities. Instead, their interiors are modified to optimize space for cargo storage. Freighter aircraft are also equipped with large cargo doors for convenient loading and unloading, as well as reinforced floors and tie-downs to secure the cargo during transit. Air cargo is a preferred method for transporting a diverse range of goods, such as raw materials, perishables, vehicles, heavy machinery, and other high-value items. It is particularly suited for time-sensitive transportation needs. Freighter aircraft are primarily utilized by logistics companies, cargo airlines, and military organizations.

Freighter Aircraft Market Drivers:

The increase in air cargo volume is fueling the demand for freighter aircraft deliveries.

The growth of the global economy and the rise in air cargo volumes are driving substantial investments in freighter aircraft deliveries worldwide. As reported by the International Air Transport Association (IATA), global air freight traffic reached 60.3 million metric tons in 2022, reflecting the strong demand for cargo aircraft services. This sustained demand has led various airlines to expand their freighter aircraft fleets through new acquisitions and passenger-to-freighter conversions. For example, in July 2023, Atlas Air received a Boeing B777-200 Freighter, which will operate on behalf of MSC Mediterranean Shipping Company SA, marking the second of four planned B777-200 Freighters under a long-term ACMI agreement.

The surge in air cargo volumes has spurred numerous fleet expansion initiatives across the industry in 2023. UPS Airlines took delivery of a new Boeing B767-300F freighter in July 2023, bringing its total freighter aircraft purchases to 75 units. Additionally, in June 2023, Air Tanzania received its first Boeing B767-300 Freighter, marking the first direct B767 Freighter delivery from Boeing to an African airline. The Cargo Management team, a subsidiary of Air Transport Services Group (ATSG), further exemplified the industry's growth by leasing six converted freighters in August 2023 to customers around the world, with notable placements at operators such as Raya Airways, Cargojet, Georgian Airlines, and Amerijet.

Freighter Aircraft Market Restraints and Challenges:

The high cost of freighter aircraft remains a significant constraint on market growth.

Freighter aircraft are generally more expensive than passenger aircraft due to their specialized design and the higher maintenance costs associated with the frequent loading and unloading of cargo. Additionally, the emissions generated by freighter aircraft are significantly higher compared to passenger planes. Factors such as rising fuel costs, trade disputes, and geopolitical instability further restrict air cargo routes, adding to the challenges faced by the market.

Freighter Aircraft Market Opportunities:

The establishment of bilateral trade agreements is playing a key role in promoting air cargo volumes.

The formation of new bilateral trade agreements and the strengthening of existing ones have become essential drivers for the growth of air cargo, creating more opportunities for air freighter operations. According to global trade data from the United Nations, trade growth remained positive for both goods and services during the first quarter of 2023, with global goods trade increasing by 1.9% compared to Q4 2022. This growth has been driven by the recovery of China’s economic activity and the rising demand for pharmaceuticals, both of which have contributed to a surge in air cargo requirements.

Recent trade agreements have had a direct influence on air cargo operations and infrastructure development. In March 2023, the United States and Japan entered into a strategic agreement to strengthen critical mineral supply chains, building on their 2019 trade deal and promoting greater air cargo movement between the two countries. This trend is evident in regional developments, such as Delhi Air Cargo’s expansion in reefer cargo exports in April 2023, which leverages newly formed bilateral free trade agreements to boost Indian air freight shippers' access to global markets. The geographical patterns of international trade have remained stable, with significant growth in the proximity of trade since late 2022. At the same time, there has been a concentration of global trade around major trade relationships, highlighting the need for strong air cargo capabilities to support these evolving trade dynamics.

FREIGHTER AIRCRAFT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Aircraft Type, By Operation Type, By Cargo Type, By Propulsion System, Range, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Boeing, Tupolev and Xian Aircraft. |

Freighter Aircraft Market Segmentation

Freighter Aircraft Market Segmentation: By Aircraft Type:

- Narrow-body

- Wide-body

Narrow-body freighters, typically converted from passenger aircraft, have a cargo capacity ranging from 10 to 20 tons, while wide-body freighters, designed specifically for cargo, offer a capacity of over 20 tons. Currently, the narrow-body segment dominates the global freighter aircraft market revenue, driven by the higher demand for smaller, more fuel-efficient aircraft. However, the wide-body segment is expected to experience significant growth in the near future due to an anticipated increase in demand for long-haul cargo transportation.

The market is fueled by several interconnected factors, including the growth of e-commerce, the overall expansion of global trade, and the rising consumer need for specialized cargo shipping solutions. Additionally, the use of composite materials and advanced avionics has improved the performance, safety, and cost-efficiency of freighters, further contributing to market growth. The current market is led by key players such as Boeing and Airbus, as well as airlift companies like those operating the C-130J Super Hercules. These companies are heavily involved in the development, production, and after-sales support of new aircraft.

The market is also set to see the entry of new players, including COMAC from China and UAC from Russia, which are expected to influence the dynamics of the freighter aircraft market in the near future.

Freighter Aircraft Market Segmentation By Operation Type:

- Scheduled

- Charter

The scheduled segment holds a larger market share and is anticipated to maintain its dominance throughout the forecast period. This segment's growth is primarily driven by the rising demand for reliable and efficient cargo transportation services. Scheduled freighter aircraft operations provide fixed schedules and routes, ensuring the timely delivery of goods. Conversely, the charter operation segment is expected to experience significant growth due to the increasing demand for flexible and customized cargo transportation solutions.

Manufacturers in the global freighter aircraft market are addressing the needs of both scheduled and charter operations. Charter freighter aircraft services offer personalized solutions to accommodate specific cargo requirements, such as oversized or time-sensitive shipments. Both scheduled and charter operations are integral to the global supply chain, playing a vital role in the transportation of essential goods and commodities.

Freighter Aircraft Market Segmentation By Cargo Type:

- General Cargo

- Special Cargo

General Cargo, which holds a significant share of the global freighter aircraft market revenue, is typically transported in large volumes and includes items such as machinery, electronics, and consumer goods. In contrast, Special Cargo requires specialized handling and includes temperature-sensitive goods, live animals, and hazardous materials. The demand for Special Cargo transportation is expected to rise substantially in the coming years, driven by the increasing global trade of perishable goods and the expanding pharmaceutical industry.

Freighter Aircraft Market Segmentation By Propulsion System:

- Jet

- Turbo Prop

The dominance of jet propulsion systems in the global freighter aircraft market can be attributed to their superior efficiency, speed, and range compared to turbo prop systems. Jet engines offer higher thrust, enabling aircraft to operate at greater altitudes and speeds, making them ideal for long-haul and heavy-duty cargo operations. In 2023, the jet propulsion system segment was valued at approximately USD 17.89 billion, with expectations of a 4.5% compound annual growth rate (CAGR) during the forecast period, reaching USD 25.4 billion by 2032.

Conversely, the turbo prop segment is anticipated to experience steady growth in the coming years. Turbo prop engines are more fuel-efficient and cost-effective than jet engines, which makes them an attractive choice for short-haul and regional cargo operations. The turbo prop segment accounted for approximately 35% of the global freighter aircraft market in 2023, valued at around USD 9.73 billion. It is expected to grow at a CAGR of 3.8% during the forecast period, reaching USD 14.7 billion by 2032.

Freighter Aircraft Market Segmentation By Range:

- Short-Haul

- Medium-Haul

- Long-Haul

The Short-Haul segment is expected to hold the largest market share, driven by the rising demand for efficient and cost-effective transportation of goods over shorter distances. Meanwhile, the Medium-Haul segment is projected to experience the highest growth rate during the forecast period, fueled by the growing need for air cargo services related to e-commerce and international trade. The Long-Haul segment is anticipated to account for a significant share of the global freighter aircraft market revenue, supported by the increasing demand for long-range transportation of high-value and perishable goods.

Freighter Aircraft Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America is expected to dominate the freighter aircraft market, experiencing substantial growth during the forecast period, due to having the world’s largest fleet of freighter aircraft. The region’s market dominance is further reinforced by its position as the leader in global cargo movement.

The Asia Pacific region is anticipated to see significant growth in the freighter aircraft market during the forecast period, with Europe following closely behind. The growth in the Asia Pacific region is primarily driven by the increasing demand for air cargo transportation from key countries like India and China. A major factor contributing to this growth is the expanding manufacturing capabilities in the South Asian region.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic brought most airline operations to a standstill, with lockdown restrictions and travel bans severely reducing passenger flights, leading to significant cargo capacity shortages. This disruption resulted in a surge in demand for air cargo transportation, and consequently, for freighter aircraft. As the shortage of cargo capacity drove air cargo rates up, the need for dedicated freighter aircraft grew. Furthermore, the global trade landscape, which had been significantly impacted by supply chain disruptions, rebounded and surpassed pre-pandemic levels, further driving the increased demand for freighter aircraft.

Latest Trends/ Developments:

In April 2023, the Indonesian carrier, RuskyAero, will acquire two freighter 737-800BCFs from AerCap, which will be operated under the name Raindo United Services. Raindo, a new customer of AerCap, believes that this move will support the growth of Indonesia's MSME (Micro, Small, and Medium Enterprises) sector.

In March 2023, Boeing India announced that over 1,700 passenger aircraft are set to be converted into freighter aircraft. This initiative aims to meet the growing demand for cargo transportation in the country, driven by the rapid expansion of manufacturing capabilities.

Key Players:

These are top 10 players in the Freighter Aircraft Market :-

- Boeing

- Tupolev

- Xian Aircraft

- ShinMaywa Industries

- Embraer

- Kawasaki Heavy Industries

- Irkut

- Sukhoi

- Ilyushin

- Mitsubishi Heavy Industries

Chapter 1 Freighter Aircraft Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2 Freighter Aircraft Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3 Freighter Aircraft Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4 Freighter Aircraft Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5 Freighter Aircraft Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 Freighter Aircraft Market – By Aircraft Type

6.1 Introduction/Key Findings

6.2 Narrow-body

6.3 Wide-body

6.4 Y-O-Y Growth trend Analysis By Aircraft Type

6.5 Absolute $ Opportunity Analysis By Aircraft Type , 2025-2030

Chapter 7 Freighter Aircraft Market – By Operation Type

7.1 Introduction/Key Findings

7.2 Scheduled

7.3 Charter

7.4 Y-O-Y Growth trend Analysis By Operation Type

7.5 Absolute $ Opportunity Analysis By Operation Type , 2025-2030

Chapter 8 Freighter Aircraft Market – By Cargo Type

8.1 Introduction/Key Findings

8.2 General Cargo

8.3 Special Cargo

8.4 Y-O-Y Growth trend Analysis Cargo Type

8.5 Absolute $ Opportunity Analysis Cargo Type , 2025-2030

Chapter 9 Freighter Aircraft Market – By Propulsion System

9.1 Introduction/Key Findings

9.2 Jet

9.3 Turbo Prop

9.4 Y-O-Y Growth trend Analysis Propulsion System

9.5 Absolute $ Opportunity Analysis Propulsion System , 2025-2030

Chapter 10 Freighter Aircraft Market – By Range

10.1 Introduction/Key Findings

10.2 Short-Haul

10.3 Medium-Haul

10.4 Long-Haul

10.5 Y-O-Y Growth trend Analysis Range

10.6 Absolute $ Opportunity Analysis Range , 2025-2030

Chapter 11 Freighter Aircraft Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Range

11.1.3. By Propulsion System

11.1.4. By Cargo Type

11.1.5. Operation Type

11.1.6. Aircraft Type

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Range

11.2.3. By Propulsion System

11.2.4. By Cargo Type

11.2.5. Operation Type

11.2.6. Aircraft Type

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.1. By Country

11.3.1.2. China

11.3.1.2. Japan

11.3.1.3. South Korea

11.3.1.4. India

11.3.1.5. Australia & New Zealand

11.3.1.6. Rest of Asia-Pacific

11.3.2. By Range

11.3.3. By Propulsion System

11.3.4. By Cargo Type

11.3.5. Operation Type

11.3.6. Aircraft Type

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.1. By Country

11.4.1.1. Brazil

11.4.1.2. Argentina

11.4.1.3. Colombia

11.4.1.4. Chile

11.4.1.5. Rest of South America

11.4.2. By Range

11.4.3. By Propulsion System

11.4.4. By Cargo Type

11.4.5. Operation Type

11.4.6. Aircraft Type

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.1. By Country

11.5.1.1. United Arab Emirates (UAE)

11.5.1.2. Saudi Arabia

11.5.1.3. Qatar

11.5.1.4. Israel

11.5.1.5. South Africa

11.5.1.6. Nigeria

11.5.1.7. Kenya

11.5.1.11. Egypt

11.5.1.11. Rest of MEA

11.5.2. By Range

11.5.3. By Propulsion System

11.5.4. By Cargo Type

11.6.5. Operation Type

11.5.6. Aircraft Type

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12 Freighter Aircraft Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Boeing

12.2 Tupolev

12.3 Xian Aircraft

12.4 ShinMaywa Industries

12.5 Embraer

12.6 Kawasaki Heavy Industries

12.7 Irkut

12.8 Sukhoi

12.9 Ilyushin

12.10 Mitsubishi Heavy Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

. The growth of the global economy and the rise in air cargo volumes are driving substantial investments in freighter aircraft deliveries worldwide.

The top players operating in the Freighter Aircraft Market are - Boeing, Tupolev and Xian Aircraft

The COVID-19 pandemic brought most airline operations to a standstill, with lockdown restrictions and travel bans severely reducing passenger flights, leading to significant cargo capacity shortages

The formation of new bilateral trade agreements and the strengthening of existing ones have become essential drivers for the growth of air cargo, creating more opportunities for air freighter operations

. Asia-Pacific is the fastest-growing region in the Freighter Aircraft Market.