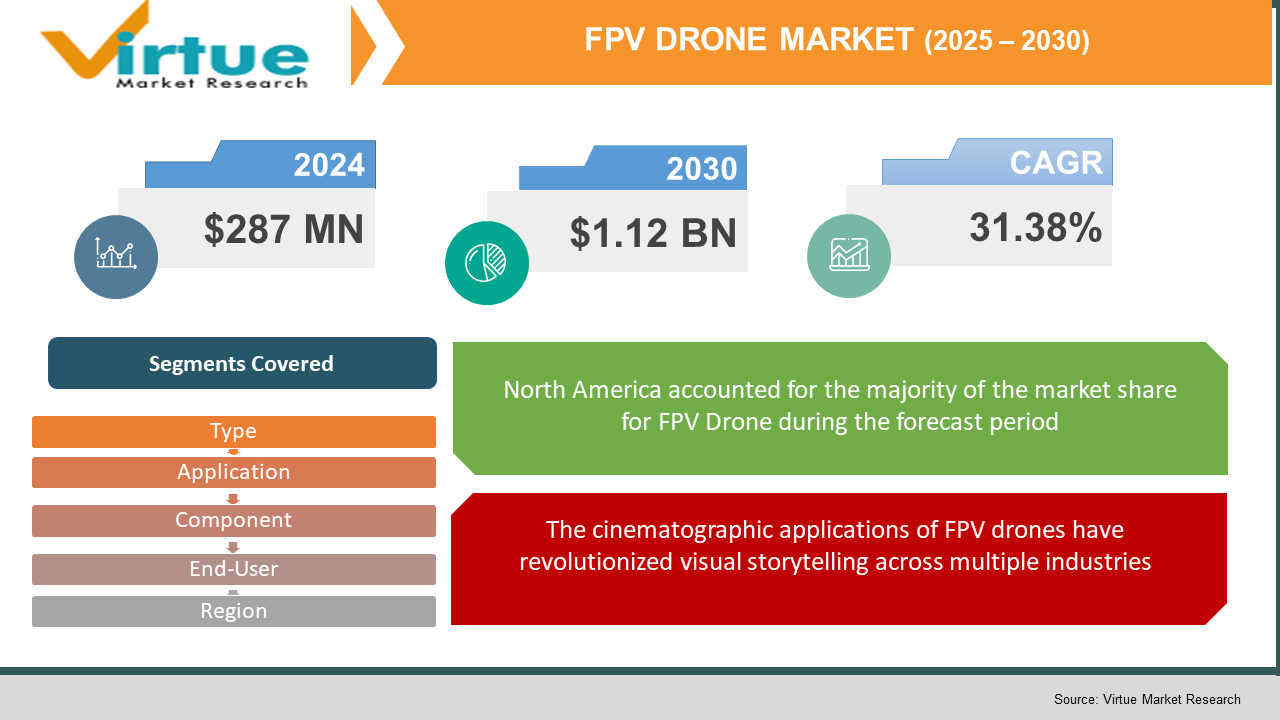

FPV Drone Market Size (2025-2030)

The FPV Drone Market was valued at USD 287 million in 2024 and is projected to reach a market size of USD 1.12 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 31.38%.

The FPV Drone Market represents a revolutionary convergence of cutting-edge aviation technology, immersive virtual reality experiences, and democratized aerial cinematography. Unlike traditional unmanned aerial vehicles, FPV drones create an unprecedented pilot experience by transmitting real-time video feeds directly to specialized goggles or display screens, effectively placing operators in the virtual cockpit of their aircraft. This technological paradigm shift has catalyzed the emergence of entirely new industries, recreational activities, and professional applications that were previously inconceivable. The market's foundation rests upon the seamless integration of multiple sophisticated technologies, including high-definition video transmission systems, ultra-low latency communication protocols, precision flight control algorithms, and miniaturized camera systems capable of delivering broadcast-quality footage. These components work harmoniously to create an immersive flying experience that bridges the gap between remote operation and actual piloting, offering users an adrenaline-fueled perspective that traditional drones simply cannot match. The contemporary FPV drone ecosystem encompasses a diverse spectrum of applications, from high-octane racing competitions that have evolved into internationally recognized sports, to cinematic applications that are revolutionizing the film and television industry. Hollywood productions increasingly rely on FPV drones to capture dynamic sequences that would be impossible or prohibitively expensive to achieve through traditional filming methods. These nimble aircraft can navigate through tight spaces, perform complex maneuvers, and deliver stunning aerial choreography that adds unprecedented visual depth to storytelling. Manufacturing trends within the FPV drone industry reflect a shift toward modular design philosophies that allow users to customize and upgrade their aircraft according to specific requirements. This approach has fostered a vibrant aftermarket ecosystem of specialized components, ranging from high-performance motors and propellers to advanced camera systems and transmission equipment. The modularity also enables rapid repair and maintenance, addressing one of the primary concerns of intensive FPV operations.

Key Market Insights:

- The FPV drone market exhibits significant analytical diversity, with 2024 valuations ranging from USD 139.30 million to USD 335.62 million across different research methodologies, reflecting the emerging nature of this specialized sector and varying approaches to market categorization and measurement techniques.

- Professional FPV racing represents approximately 45-50% of the total market engagement, with organized competitions generating substantial revenue streams through sponsorships, prize money, and equipment sales, establishing drone racing as a legitimate motorsport category.

- The cinematic and commercial filming segment accounts for roughly 30-35% of market applications, driven by Hollywood productions, advertising agencies, and content creators seeking dynamic aerial footage previously impossible with traditional camera systems.

- Flight controllers and video transmission systems constitute 25-30% of total drone cost, while high-performance motors and propellers represent 20-25% of the expense, indicating the critical importance of these specialized components in overall system performance.

- Current lithium polymer battery technology limits average flight times to 3-8 minutes for racing configurations, creating a significant market opportunity for energy storage innovations that could extend operational duration and enhance user experience.

- North American and European markets collectively account for approximately 65-70% of global FPV drone sales, with the United States leading in both consumer adoption and professional racing league development.

- The FPV piloting learning curve requires an average of 15-25 hours of practice to achieve basic proficiency, creating demand for trainer drones, simulation software, and educational programs that facilitate skill development.

- Typical FPV racing drones experience crashes every 10-15 flights on average, generating a robust aftermarket for replacement parts, repair services, and crash-resistant components that represent 40-45% of ongoing operational costs.

- Modern FPV systems support 4K recording at 60fps with transmission latencies as low as 20-30 milliseconds, representing a dramatic improvement over early systems that offered limited resolution and higher latency.

- Professional FPV operations require licensing, insurance, and compliance measures that can add 15-20% to operational expenses, driving demand for simplified regulatory frameworks and standardized certification processes.

Market Drivers:

The emergence of FPV drone racing as a legitimate competitive sport has fundamentally transformed the market landscape.

Professional racing leagues, including the Drone Racing League (DRL) and MultiGP, have established international circuits with substantial prize pools, television coverage, and corporate sponsorship opportunities that rival traditional motorsports. This competitive ecosystem drives continuous innovation in drone performance, with manufacturers investing heavily in developing faster, more agile aircraft capable of withstanding the rigorous demands of professional racing. The spectator appeal of FPV racing, aided by immersive broadcast technologies that let spectators to experience the pilot's point of view, has sparked mainstream media interest and investment, propelling market expansion.

The cinematographic applications of FPV drones have revolutionized visual storytelling across multiple industries.

These versatile aircraft enable filmmakers to capture dynamic sequences that were previously impossible or prohibitively expensive, including high-speed chases, interior building flights, and complex aerial choreography that adds unprecedented visual depth to productions. The democratization of professional-quality aerial cinematography has empowered independent content creators, real estate professionals, and marketing agencies to produce compelling visual content at a fraction of traditional costs. Major streaming platforms and production companies increasingly recognize FPV technology as an essential tool for creating engaging content that captures audience attention in an increasingly competitive entertainment landscape.

Market Restraints and Challenges:

The FPV drone market faces significant obstacles including steep learning curves that require extensive pilot training and practice, regulatory complexities that vary across jurisdictions and create compliance challenges for operators, and safety concerns related to high-speed operations in populated areas. Technical limitations such as short battery life, susceptibility to weather conditions, and the fragility of racing configurations result in frequent crashes and high maintenance costs that can deter potential users from market entry.

Market Opportunities:

The market presents substantial opportunities in emerging applications such as emergency response operations, where FPV drones can navigate confined spaces and provide real-time reconnaissance in hazardous environments. The integration of artificial intelligence and autonomous capabilities offers potential for developing self-piloting systems that could expand market accessibility. Additionally, the growing demand for immersive entertainment experiences and virtual reality integration creates opportunities for developing next-generation FPV systems that blur the lines between reality and simulation.

FPV DRONE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

31.38% |

|

Segments Covered |

By Type, application, component, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DJI, TBS (Team BlackSheep), ImmersionRC, Walkera, Eachine, HGLRC, iFlight, BetaFPV, GEPRC, Holybro, NewBeeDrone, TMotor, FrSky, Fat Shark, and Caddx, |

FPV Drone Market Segmentation:

FPV Drone Market Segmentation by Type:

- Racing Drones

- Freestyle Drones

- Cinematic Drones

- Training Drones

- Long Range Drones

Freestyle Drones represent the fastest-growing segment, driven by the creative flexibility they offer pilots and the growing community of content creators who showcase spectacular aerial maneuvers on social media platforms. These versatile aircraft bridge the gap between racing performance and cinematographic capabilities, attracting both recreational users and professional pilots.

Racing Drones maintain dominance as the most established segment, commanding the largest market share due to the organized competitive infrastructure, professional leagues, and dedicated enthusiast communities that drive consistent demand for high-performance aircraft and specialized components.

FPV Drone Market Segmentation by Application:

- Sports and Recreation

- Cinematography and Photography

- Industrial Inspection

- Agriculture and Surveillance

- Military and Defense

Cinematography and Photography applications are experiencing the fastest growth, fueled by the increasing demand for dynamic aerial content across entertainment, marketing, and social media platforms. The ability to capture unique perspectives and perform complex camera movements has made FPV drones indispensable tools for modern content creators.

Sports and Recreation remains the most dominant application, encompassing both competitive racing and recreational flying that form the foundation of the FPV community. This segment includes organized competitions, casual flying clubs, and individual enthusiasts who drive the majority of consumer purchases.

FPV Drone Market Segmentation by Component:

- Frame

- Flight Controller

- Motors and Propellers

- Camera and Gimbal

- Video Transmission System

Video Transmission Systems are the fastest-growing component segment, driven by demand for higher resolution, lower latency, and more reliable wireless video links that enhance the immersive flying experience. Advances in digital transmission technology and antenna design continue to push the boundaries of real-time video quality.

Motors and Propellers represent the most dominant component segment by replacement frequency and performance impact, as these high-stress components require regular maintenance and upgrades to maintain optimal performance in demanding FPV applications.

FPV Drone Market Segmentation by End-User:

- Professional Pilots

- Hobbyist Enthusiasts

- Content Creators

- Commercial Operators

Content Creators are the fastest-growing end-user segment, as social media platforms and digital marketing create increasing demand for unique aerial footage that can only be captured through FPV technology. This segment includes individual creators, marketing agencies, and production companies seeking distinctive visual content.

Hobbyist Enthusiasts maintain dominance as the largest end-user group, encompassing recreational pilots who participate in racing, freestyle flying, and casual aerial photography. This segment drives the majority of consumer sales and aftermarket component purchases.

FPV Drone Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

North America commands approximately 40% of the global market share, driven by the presence of major racing leagues, technology companies, and a well-established hobbyist community with high disposable income. The region benefits from relatively permissive regulations and a strong culture of technological innovation.

Asia-Pacific demonstrates the highest growth rate, propelled by increasing disposable income, growing interest in technology hobbies, and the emergence of local manufacturing capabilities that reduce costs and improve accessibility for regional consumers.

COVID-19 Impact Analysis:

The pandemic initially disrupted FPV drone racing events and competitions, leading to reduced equipment sales and delayed product launches. However, the increased focus on outdoor recreational activities and home entertainment created new opportunities for FPV flying as a socially distanced hobby. The shift toward remote work and digital content creation also increased demand for aerial photography and videography services, partially offsetting losses in the competitive racing segment.

Latest Trends and Developments:

Current market trends focus on the integration of artificial intelligence for autonomous flight capabilities, development of longer-lasting battery technologies, and the emergence of standardized racing drone specifications. There's also growing interest in hybrid systems that combine FPV technology with traditional autonomous drones, creating versatile platforms suitable for both recreational and commercial applications. The industry is also witnessing increased collaboration between drone manufacturers and component suppliers to develop optimized systems.

Key Players in the Market:

- DJI (Da-Jiang Innovations)

- Team BlackSheep (TBS)

- Fat Shark (A division of Red Cat Holdings)

- iFlight Technology

- GEPRC

- BetaFPV

- T-Motor

- Emax Model

- CaddxFPV

- Foxeer

Chapter 1. FPV Drone Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. FPV Drone Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. FPV Drone Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. FPV Drone Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. FPV Drone Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. FPV Drone Market– By Type

6.1 Introduction/Key Findings

6.2 Racing Drones

6.3 Freestyle Drones

6.4 Cinematic Drones

6.5 Training Drones

6.6 Long Range Drones

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. FPV Drone Market– By Application

7.1 Introduction/Key Findings

7.2 Sports and Recreation

7.3 Cinematography and Photography

7.4 Industrial Inspection

7.5 Agriculture and Surveillance

7.6 Military and Defense

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. FPV Drone Market– By End-User

8.1 Introduction/Key Findings

8.2 Professional Pilots

8.3 Hobbyist Enthusiasts

8.4 Content Creators

8.5 Commercial Operators

8.6 Y-O-Y Growth trend Analysis End-User

8.7 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. FPV Drone Market– By Component

9.1 Introduction/Key Findings

9.2 Frame

9.3 Flight Controller

9.4 Motors and Propellers

9.5 Camera and Gimbal

9.6 Video Transmission System

9.7 Y-O-Y Growth trend Analysis Component

9.8 Absolute $ Opportunity Analysis Component , 2025-2030

Chapter 10. FPV Drone Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By End-User

10.1.4. By Application

10.1.5. Component

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By End-User

10.2.4. By Application

10.2.5. Component

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Component

10.3.4. By Application

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Component

10.4.3. By Application

10.4.4. By Type

10.4.5. End-User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By End-User

10.5.3. By Component

10.5.4. By Application

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. FPV DRONE MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 DJI (Da-Jiang Innovations)

11.2 Team BlackSheep (TBS)

11.3 Fat Shark (A division of Red Cat Holdings)

11.4 iFlight Technology

11.5 GEPRC

11.6 BetaFPV

11.7 T-Motor

11.8 Emax Model

11.9 CaddxFPV

11.10 Foxeer

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The primary drivers include the explosive growth of competitive drone racing as a legitimate sport with professional leagues and substantial prize pools, the revolutionary impact of FPV technology on cinematography and content creation enabling previously impossible aerial footage, and the increasing accessibility of high-performance components that make FPV flying more approachable for newcomers.

Major concerns center around the steep learning curve required for safe FPV piloting, complex and varying regulatory frameworks across different jurisdictions, safety risks associated with high-speed operations near people and property, short battery life limiting flight duration, and the fragility of racing configurations leading to frequent crashes and high maintenance costs

Key players include DJI, TBS (Team BlackSheep), ImmersionRC, Walkera, Eachine, HGLRC, iFlight, BetaFPV, GEPRC, Holybro, NewBeeDrone, TMotor, FrSky, Fat Shark, and Caddx, each contributing specialized components and complete systems to the FPV ecosystem.

North America holds the largest market share, driven by established racing leagues, technology companies, high disposable income, and a strong hobbyist community with relatively permissive regulatory environments that encourage FPV development and adoption.

Asia-Pacific demonstrates the fastest growth rate, fueled by increasing disposable income, growing interest in technology hobbies, emerging local manufacturing capabilities, and expanding access to FPV technology through improved distribution networks and reduced costs.