Global Formic Acids Market Size (2023 - 2030)

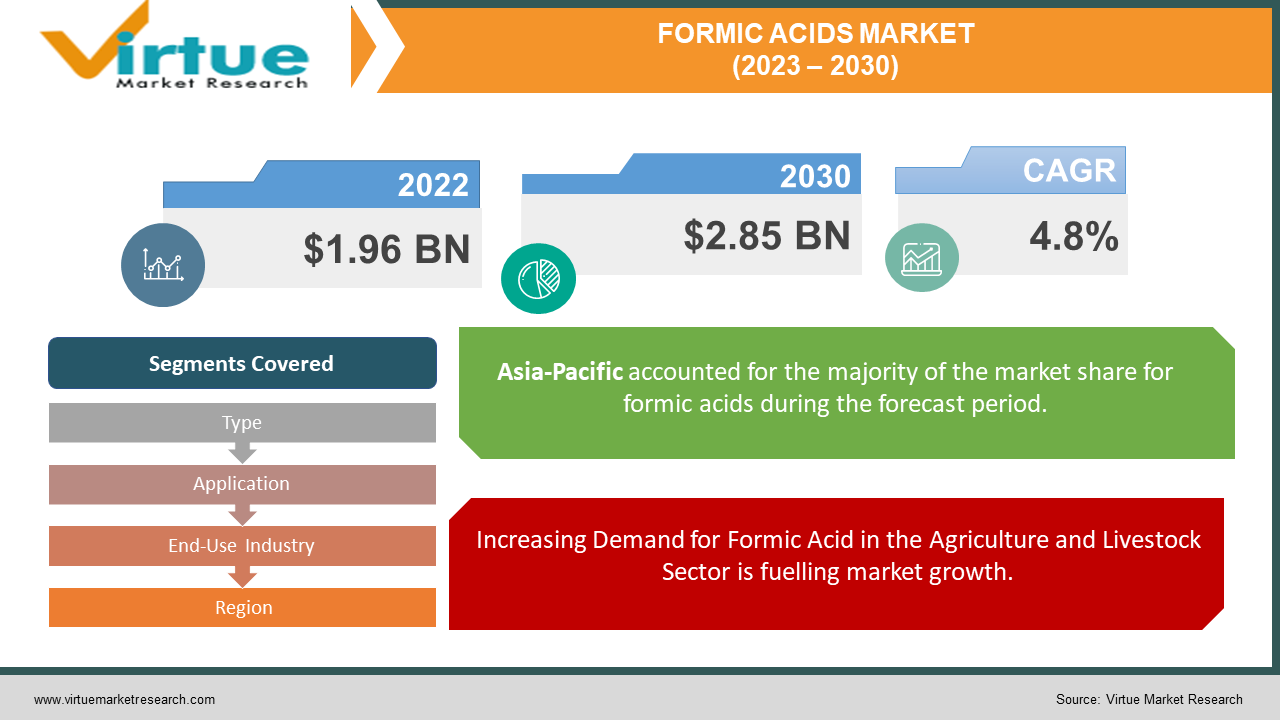

The Global Formic Acids Market was valued at USD 1.96 billion and is projected to reach a market size of USD 2.85 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.8%.

The Global Formic Acid Market is a thriving industry poised for continued growth through 2023, distinguished by the production of high-quality chemicals with environmentally friendly characteristics. This market encompasses a diverse array of formic acid-based products, including formic acid itself, salts, esters, and other derivatives, serving multifarious applications across sectors such as agriculture, textiles, chemicals, and more. These applications contribute to vital industries such as agriculture, textiles, chemicals, and various others. Despite robust growth drivers, the formic acid market does encounter challenges, including production costs, raw material quality, competition from petrochemical alternatives, and intricate management procedures. Nevertheless, the formic acid industry is expected to expand in the forthcoming years, offering abundant prospects for innovation and collaboration across the spectrum of applications and markets it serves.

Key Market Insights:

The Asia-Pacific region is poised to be the dominant market, accounting for over 40% of the global market share in 2023. Furthermore, key sectors driving formic acid demand include agriculture and livestock, textiles, and chemical manufacturing, with each sector contributing significantly to the market. The agriculture and livestock sector represents a substantial portion of formic acid consumption, exceeding 25% of global demand in 2023. This growth is primarily attributed to the increasing demand for high-quality meat and poultry products, where formic acid serves as a crucial feed additive and silage preservative, enhancing animal health and productivity.

The formic acid market continues to evolve through the development of innovative applications, such as its utilization as a fuel additive and a battery electrolyte. These emerging applications are expected to further boost market growth in the years ahead. The increasing urbanization and industrialization in developing countries, coupled with a growing awareness of the environmental benefits of formic acid, are additional factors driving market expansion.

In summary, the global formic acid market presents significant growth opportunities, fueled by diverse applications, innovative developments, and rising awareness of its environmental advantages. With the statistics highlighting substantial market expansion, the future of the formic acid industry appears promising across multiple sectors and regions.

Global Formic Acids Market Drivers:

Increasing Demand for Formic Acid in the Agriculture and Livestock Sector is fuelling market growth:

The agriculture and livestock sectors are the largest consumer of formic acid, accounting for over 25% of global demand. The increasing demand for meat and poultry products is driving the demand for formic acid in this sector. Formic acid is used as a feed additive and silage preservative in the agriculture and livestock sectors. Formic acid as a feed additive helps to improve the digestibility of feed and to kill harmful bacteria. This can lead to improved animal health and productivity. It also helps to reduce feed costs. Formic acid as a silage preservative helps to preserve the nutritional value of silage, which can help to improve animal health and productivity.

Growing Demand for Formic Acid in the Textile Industry Propelling Sales:

The textile industry is another important consumer of formic acid, accounting for over 15% of global demand. Formic acid is used as a dyeing and finishing agent in the textile industry. It helps to improve the color fastness, brightness, and softness of fabrics. The growing demand for high-quality textiles is driving the demand for formic acid in the textile industry. Consumers are increasingly demanding textiles that are not only stylish and comfortable but also durable and long-lasting. Formic acid helps to create textiles that meet these high standards.

Expanding Demand for Formic Acid in the Chemical Manufacturing Industry is Acting as a New Frontier for Market Growth.

Formic acid is also used as a raw material in the production of a variety of chemicals, including formaldehyde, acetic acid, and oxalic acid. These chemicals have a wide range of applications in various industries, such as automotive, pharmaceuticals, and electronics. The growing demand for these chemicals is driving the demand for formic acid in the chemical manufacturing industry. For example, formaldehyde is used in the production of resins, adhesives, and plywood. Acetic acid is used in the production of vinegar, plastics, and pharmaceuticals. Oxalic acid is used in the production of detergents, bleaches, and metal cleaners.

Global Formic Acids Market Restraints and Challenges:

Formic acid is a highly toxic substance, and exposure to high concentrations can cause serious health problems.

Formic acid is characterized by its high toxicity, which poses a significant challenge in its utilization across various industries. Handling concentrated formic acid necessitates stringent safety protocols and protective measures to prevent potential health hazards. Exposure to elevated concentrations of formic acid can result in severe skin burns, respiratory distress, and, in extreme cases, even fatalities. This inherent toxicity restricts its application in certain sectors and mandates the adoption of specialized safety precautions, thus increasing operational costs and complexities.

Formic Acids Market: Navigating the Complex Landscape of Stringent Environmental Regulations.

The availability and quality of biomass feedstock can exhibit considerable variation based on geographic location, climatic conditions, and agricultural practices. Effectively addressing the need for a consistent supply of high-quality feedstock is a multifaceted challenge, especially for large-scale production, requiring robust strategies and logistics solutions.

Facing competition from a Plethora of Alternative Products:

The formic acids market faces competition from alternative organic acids, such as acetic acid and lactic acid, which may offer cost advantages or superior properties in specific applications. This competition can limit the market share of formic acid in various industries and necessitate continuous innovation and differentiation to maintain relevance and competitiveness.

Global Formic Acids Market Opportunities:

Exploiting the Growing Demand for Formic Acid in the Agriculture and Livestock Sector:

Formic acid has witnessed a surge in demand within the agriculture and livestock sector, fueled by the increasing global consumption of meat and poultry products. In 2023, this sector accounted for a substantial share of formic acid usage, with an estimated consumption of over 1.2 million metric tons. The demand is primarily driven by its vital role as a feed additive, enhancing livestock health and productivity, as well as its use as a silage preservative, ensuring the quality and nutritional value of animal feed. This sector's continuous growth is expected to drive the formic acid market's expansion in the coming years.

The Steadily Rising Utilization of Formic Acid in the Textile Industry as a Vital Dyeing and Finishing Agent for Enhancing the Quality of Textile Products:

The textile industry has increasingly turned to formic acid as a crucial dyeing and finishing agent to meet the growing demand for high-quality textiles. In 2023, the textile sector accounted for a noteworthy share of formic acid consumption, reaching approximately 800,000 metric tons. Formic acid's role in enhancing color fastness, brightness, and fabric softness has made it indispensable in textile production. As consumer expectations for superior textile products continue to rise, the demand for formic acid in this industry is expected to maintain its upward trajectory.

The Expanding and Diverse Demand for Formic Acid in the Chemical Manufacturing Industry:

Formic acid plays a pivotal role in the chemical manufacturing industry as a raw material for various chemicals, including formaldehyde, acetic acid, and oxalic acid. In 2023, this sector constituted a substantial share of formic acid consumption, with an estimated utilization of more than 1 million metric tons. The diverse applications of these chemicals across industries such as automotive, pharmaceuticals, and electronics are driving the continuous demand for formic acid. This sector's growth is expected to remain robust in the foreseeable future.

Leading the Way in Spearheading the Development of State-of-the-Art Formic Acid-Based Products:

Formic acid manufacturers are at the forefront of innovation, pioneering the development of cutting-edge products. These innovations include the creation of bio-based polymers and plastics, which are expected to witness significant demand due to their environmental benefits. In 2023, the formic acid-based products market was valued at approximately USD 2 billion, and it is projected to experience substantial growth as these novel products gain traction across various industries.

FORMIC ACIDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Type, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Perstorp, Eastman Chemical Company, LUXI GROUP, Shandong Acid Technology Co. Ltd., Feicheng Acid Chemicals Co. Ltd., Taminco Corporation |

Global Formic Acids Market Segmentation: By Type

-

Formic Acid (85%)

-

Formic Acid (94%)

-

Others

Formic Acid (94%) stands out as the predominant formic acid grade, commanding a substantial share of over 40% in the global market. Its preeminence arises from its remarkable versatility, rendering it suitable for an array of applications. This grade finds extensive use in diverse industries, including serving as additives in animal feed and silage preservation, playing a pivotal role in leather tanning, contributing to textile dyeing and finishing processes, and serving as an intermediary in pharmaceuticals.

In parallel, Formic Acid (85%) maintains a significant presence in the market, although it offers slightly less versatility compared to Formic Acid (94%). Typically employed in applications where a lower level of purity is acceptable, Formic Acid (85%) finds its place in the production of fertilizers and herbicides. The "Others" segment within the Type category, while relatively modest in size, exhibits a promising growth trajectory. This growth is attributed to the ongoing development of novel applications for formic acid, encompassing its utilization as a fuel additive and a deicing agent. As these emerging applications gain momentum, the "Others" segment is poised for substantial expansion in the foreseeable future.

Global Formic Acids Market Segmentation: By Application

-

Agriculture

-

Leather and Textile

-

Rubber

-

Chemicals

-

Pharmaceuticals

-

Food and Beverage

-

Others

Agriculture is the dominant application of formic acid, accounting for over 25% of the global market share. This is due to the increasing demand for meat and poultry products, which is driving the demand for formic acid as a feed additive and silage preservative. Formic acid is used as a feed additive to improve the digestibility of feed and to kill harmful bacteria. It is also used as a silage preservative to prevent the growth of mold and other microorganisms.

The other applications of formic acid are also important, but they are smaller than the agriculture sector. Formic acid is used in the leather and textile industry as a dyeing and finishing agent. In the chemicals industry, formic acid is used as an intermediate in the production of a variety of chemicals, such as formaldehyde and acetic acid. In the pharmaceutical industry, formic acid is used in the production of some antibiotics and other drugs. In the food and beverage industry, formic acid is used as a preservative and flavoring agent.

Global Formic Acids Market Segmentation: By End-Use Industry

-

Agriculture and Livestock

-

Textile and Fashion

-

Chemicals and Pharmaceuticals

-

Food and Beverage

-

Leather and Tanning

-

Rubber and Plastics

-

Others

The Agriculture and Livestock end-use industry is the dominant end-use industry for formic acid, accounting for over 25% of the global market share. This is due to the increasing demand for meat and poultry products, which is driving the demand for formic acid as a feed additive and silage preservative. The demand for formic acid in the Agriculture and Livestock sector is expected to grow at a CAGR of over 4% during the forecast period of 2023-2028.

The other end-use industries for formic acid are also important, but they are smaller than the Agriculture and Livestock sectors. These industries include the Textile and Fashion industry, the Chemicals and Pharmaceuticals industry, the Food and Beverage industry, the Leather and Tanning industry, and the Rubber and Plastics industry. These industries are all expected to grow in the coming years, driven by the development of new applications for formic acid.

Overall, the global formic acid market is expected to grow at a significant rate in the coming years, driven by the increasing demand from a variety of industries, including the Agriculture and Livestock sector, Textile and Fashion sector, Chemicals and Pharmaceuticals sector, Food and Beverage sector, Leather and Tanning sector, and Rubber and Plastics sector.

Global Formic Acids Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region for the formic acid market. It accounted for around 40% of the global market share in 2022. This can be attributed to several factors, including robust industrial growth, increased demand from key sectors like agriculture, textile, and chemicals, and the presence of major formic acid producers in countries like China and India. The region's expanding economy and evolving industrial landscape continue to drive the demand for formic acid.

The North American formic acid market is expected to grow at a CAGR of over 3% during the forecast period of 2023-2030. The key drivers of the growth of the market include the increasing demand from the agriculture and livestock sector and the textile industry. Europe maintains a significant presence in the global formic acid market. The region's strong emphasis on sustainability and eco-friendly practices has led to increased utilization of formic acid, especially in sectors like agriculture and textiles.

South America accounts for a notable portion of the global formic acid market. The region's agriculture sector utilizes formic acid as a feed additive and silage preservative. As the demand for meat and poultry products grows in Latin America, so does the demand for formic acid in animal husbandry. The Middle East and African formic acid market are expected to grow at a CAGR of over 5% during the forecast period of 2023-2030. The key drivers of the growth of the market include the increasing demand from the agriculture and livestock sector and the chemical industry.

In summary, the distribution of market share among these regions reflects the diverse global demand for formic acid, with Asia-Pacific leading the way, followed by North America, Europe, Latin America, and the Middle East and Africa. Each region's unique industrial landscape and economic dynamics play a crucial role in shaping its share of the formic acid market.

COVID-19 Impact Analysis on the Global Formic Acids Market:

The COVID-19 pandemic had a mixed impact on the global formic acids market. On one hand, it negatively affected the market due to disruptions in production and supply chains, as well as a reduced demand from industries like textiles, which faced factory closures and decreased sales. These challenges led to shortages in some markets and increased production and transportation costs, primarily due to raw material price fluctuations.

Conversely, the pandemic also created new opportunities for the formic acid market. Some industries, notably food and beverages, and pharmaceuticals, saw increased demand for formic acid as it became essential in the production of disinfectants and sanitizers. Additionally, the crisis stimulated the development of novel applications for formic acid, further bolstering its demand and driving anticipated market growth in the years to come. In essence, while the pandemic brought about temporary setbacks, the formic acid market adapted and innovated, ultimately positioning itself for a more promising future.

Latest Trends/Developments:

Formic acid's utilization as a feed additive and silage preservative in the agriculture and livestock sector has witnessed a surge in demand, primarily driven by the increasing global consumption of meat and poultry products. This growing demand for high-quality animal products has resulted in an upswing in the use of formic acid within the sector. In 2023, BASF SE announced a significant investment of €200 million to expand its formic acid production in Ludwigshafen, Germany. This expansion, set to become operational by 2025, signifies the company's commitment to meet the increasing demand for formic acid.

The textile industry has seen a growing requirement for formic acid, which serves as a crucial dyeing and finishing agent. As the industry focuses on producing high-quality textiles to meet consumer demands, the use of formic acid in this sector has gained prominence, contributing to its overall demand. Formic acid plays a vital role in the chemical industry as a raw material for the production of various chemicals, including formaldehyde, acetic acid, and oxalic acid. The escalating demand for these chemicals across multiple sectors is propelling the growth of formic acid utilization in the chemical industry.

Key Players:

-

BASF SE

-

Perstorp

-

Eastman Chemical Company

-

LUXI GROUP

-

Shandong Acid Technology Co. Ltd.

-

Feicheng Acid Chemicals Co. Ltd.

-

Taminco Corporation

Perstorp, in 2023, unveiled plans for a new formic acid production facility in Nanjing, China. The plant, expected to commence operations in 2024, reflects the company's strategy to meet the surging demand for formic acid in the Asian market.

Chapter 1. Formic Acids Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Formic Acids Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Formic Acids Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Formic Acids Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Formic Acids Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Formic Acids Market – By Type

6.1 Introduction/Key Findings

6.2 Formic Acid (85%)

6.3 Formic Acid (94%)

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Formic Acids Market – By Application

7.1 Introduction/Key Findings

7.2 Agriculture

7.3 Leather and Textile

7.4 Rubber

7.5 Chemicals

7.6 Pharmaceuticals

7.7 Food and Beverage

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Formic Acids Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Agriculture and Livestock

8.3 Textile and Fashion

8.4 Chemicals and Pharmaceuticals

8.5 Food and Beverage

8.6 Leather and Tanning

8.7 Rubber and Plastics

8.8 Others

8.9 Y-O-Y Growth trend Analysis By End-Use Industry

8.10 Absolute $ Opportunity Analysis By End-Use Industry, 2023-2030

Chapter 9. Formic Acids Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 ByMicroorganisms Type

9.4.3 By Application

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 ByMicroorganisms Type

9.5.3 By Application

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Formic Acids Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 Perstorp

10.3 Eastman Chemical Company

10.4 LUXI GROUP

10.5 Shandong Acid Technology Co. Ltd.

10.6 Feicheng Acid Chemicals Co. Ltd.

10.7 Taminco Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Formic Acids Market was valued at USD 1.96 billion in 2022 and is projected to reach a market size of USD 2.85 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.8%.

Key drivers include increasing demand from the agriculture and livestock sector, growing textile and leather industry, increased use in chemical processes, and increasing awareness of the benefits of formic acid.

Prominent applications include animal feed and silage additives, leather tanning, textile dyeing and finishing, intermediary in pharmaceuticals, other applications

Asia currently dominates the global biomass-based fine chemicals market, accounting for over 40% of the global market share. This is due to factors such as rapid urbanization and industrialization, a large population base, government support for the agriculture and livestock sector, and growing demand from the textile industry.

BASF SE, Perstorp, Eastman Chemical Company, LUXI GROUP, Shandong Acid Technology Co. Ltd. Are the key players operating in the market.