Forestry and Logging Market Size (2024 – 2030)

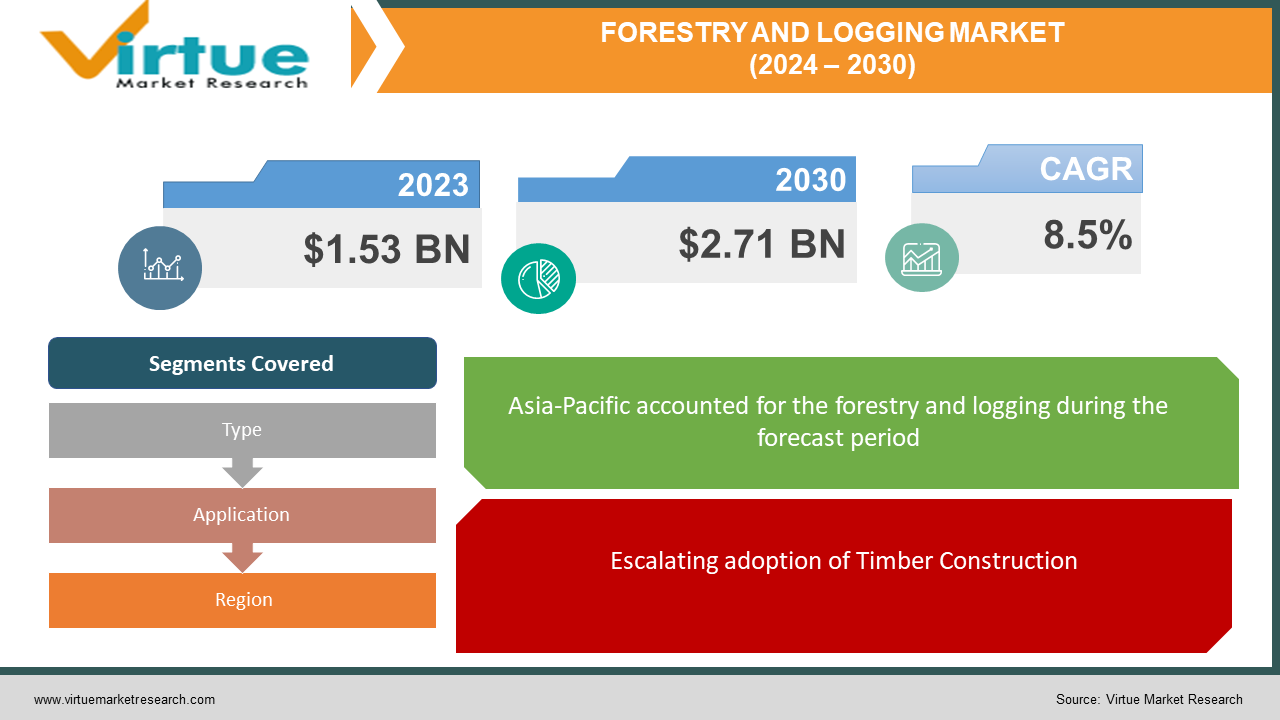

The Forestry and Logging Market was valued at USD 1.53 billion in 2023 and is projected to reach a market size of USD 2.71 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 8.5%.

The Forestry and Logging market primarily comprises deals of forestry goods and records by various objects such as administrations, sole dealers, and businesses that yield or make forestry products and records over the increasing, procedures of the wood territory, cutting and transferring of wood, budding trees for replanting and collecting forest goods such as barks, gums, and fibers. Development of the forestry and logging market in the estimated period owing to the progress in residential building action, enhancing demand for cruise boats, tissue and paper goods, and financial development in emerging markets. This development was restricted by wood fires and geopolitical pressures. The forestry and logging market consists of revenues gained by entities that generate or harvest forestry items and logs and are involved in developing, cutting, and moving timber, functions of the timber tract, growing trees for reforestation, and gathering forest products like gums, barks, and fibers. The market value constitutes the value of associated goods sold by the service provider or involved in the service offering. Only goods and services marketed between entities or sold to end consumers are involved.

Key Market Insights:

-

Rising construction projects concerning wooden buildings, the setting up of automated forest management, heightened use of biomass, and the escalating necessity for wooden furniture are estimated to strengthen the forestry and logging market. The timber utilised as a building material is growing due to the many benefits of timber buildings over concrete buildings, which is pushing the market for forest and timber producers.

-

Aerial seed bombardment is employed for planting trees in a large area. Aerial reforestation is the technique of dropping sharp containers of saplings from planes that can plant nearly a million trees daily. The declining cans are made of biodegradable products and contain a seedling constituting soil and nutrients.

-

Advanced techniques in the logging process have improved protection, fibre utilization, environmental safety, and productivity with less damage to residual trees. Logging/carrier systems, cable logging techniques, and helicopter logging are a few of the numerous improved logging techniques.

Forestry and Logging Market Drivers:

Escalating adoption of Timber Construction

Timber is utilised as a construction material and is developing owing to numerous advantages of wood constructions over concrete base, therefore influencing the market for forestry and logging manufacturers. Presently, the construction sector is manufacturing 25% of the greenhouse gas releases globally and so the thought of green building construction has transformed which is expected to lower CO2 emissions and stock carbon. Furthermore, generating structures with timber will harvest very little extra and can be created quickly when associated with a concrete structure.

As Karl-Henrik Sundström, CEO of Stora Enso expressed, wood is suitable for construction material in the future years, and to meet the enhancing demand from production activities, the business built its third manufacturing unit of industrial CLT in Sweden in 2019. Countries such as the US, Japan, and China are also experiencing an upsurge in wood production due to its financial and ecological help.

Modern techniques of Forestry

Forestry and logging processes have faced enormous alteration in the recent few times due to the escalating demand for regulator-linked products and lack of staff to meet the demands. The forestry technique is flatteringly more automatic with the application of computerization technologies and tools such as forwarders, and loggers, among others, that enhance the task's efficiency. With such importance of forestry amongst nations across the globe, the forestry engine sales are anticipated to mature, which is primarily determined by a regaining in global timber charges, rising round wood construction, and the substitution of mature, less useful forestry equipment by logging firms along with the accelerating attention on forest protection and administration that has shaped an enormous demand for forestry tools.

Forestry and Logging Market Restraints and Challenges:

Strict Environmental Regulations

Stringent rules have always been a primary challenge to the forestry and logging commodities market. Numerous countries across the world have imposed total or partial logging bans in natural forests as a response to natural calamities which are mostly caused due to deforestation. Banning or limiting timber products is thus observed as a corrective measure to encourage forest conservation and protection and to facilitate broader forest advantages for future generations.

Forestry and Logging Market Opportunities:

Enhancing Investments in Construction Activities

Numerous construction projects are coming up in the market and this factor is estimated to influence the development of the forestry and logging market going ahead. Construction activities are defined as the various tasks and operations taking part in the process of constructing, renovating, or building structures like buildings, infrastructure, and facilities. The forestry and logging industry offers raw materials necessary for numerous construction activities such as the construction of buildings, bridges, and infrastructure, and requires a major number of wooden products such as lumber, plywood, and engineered wood. Moreover, globally, it is anticipated that this will grow to $136 billion for the year 2025 as capital expenditure for multi-family residential construction activities. Therefore, the enhanced investment in construction activities is propelling the growth of the forestry and logging market.

FORESTRY AND LOGGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Acksen Ltd, Agnetix, Aiko Logi Tours, Anthelion Systems, Inc., Apply Mobile Ltd. (idenprotect), ATrillion-Semantix, BeerRightNow.com, BlackPoll Fleet International, BlikBook, BTM Resources Berhad |

Forestry and Logging Market Segmentation: By Type

-

Logging

-

Timber Tract Operations

-

Forest Nurseries

-

Gathering of Forest Products

The Logging segment was considered as the widest segment in the global market owing to its market share in 2023. Logging is the technique of cutting, processing, and transporting trees to a location for transport. Skidding, on-site processing, and moving of trees or logs onto trucks or skeleton cars might be involved in Logging. In the field of forestry, the logistics of transporting wood from the stump to somewhere outside the forest, commonly a sawmill or a lumber yard is also referred to as Logging.

Forestry and Logging Market Segmentation: By Application

-

Construction

-

Industrial Goods

-

Others

The fastest-growing segment in the global forestry and logging market is the Construction industry which has shown a share of roughly 43% of its entire market, in the year 2023. As the Construction industry is widening day by day, the demand for wood or timber is also strengthening because wood is mainly dedicated to building interiors or making furniture. Extensive applications of wood are pushing the demand for the market. There are two kinds of woods used in Construction, which are Softwood and Hardwood. Hardwoods are primarily used in the construction of walls, ceilings, and floors, whereas softwoods are often utilised to prepare doors, furniture, and window frames. Some instances of the most famous hardwoods include oak, maple, mahogany, cherry, walnut, and teak. Widely applied softwoods involve pine, hickory, beech, ash, birch, and cedar.

Forestry and Logging Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, Asia-Pacific was the dominant region in the worldwide forestry and logging industry. The growing population and increase in construction projects across various nations in Asia have led to the widest share in the industry. North America was observed to be the second-largest region, with considerable growth in the world's market. Europe is anticipated to have the greatest CAGR shortly. Growing exports and imports and heightening demand for numerous plant production are mostly to leverage the development rate of the market.

COVID-19 Impact Analysis on the Forestry and Logging Market:

The global COVID-19 pandemic has been unpredictable and staggering, with the market observing lower-than-anticipated demand across all nations compared to pre-pandemic levels. The growth in CAGR is dedicated to demand returning to pre-pandemic levels once the pandemic is over. The widening production of wood constructions, initiation of automatic forestry organization, escalating usage of biomass, and growing demand for wooden furniture are expected to drive the market. Furthermore, some of the factors that could affect the forestry and logging market development in the future years are severe guidelines, alternative building resources, labor scarcity, and the effect of COVID-19. This development was restricted by forest fires, government pressures, labour shortage, and the effect of COVID-19 area unit main concerns that might affect the strengthening of the biological science and work industry during the future period.

Latest Trends:

Technological developments in Forest Logging Methods

Advanced techniques in forest logging methods have better security, fibre utilization, environmental safety, and productivity with less damage to residual vegetation. The unique improved techniques of logging are harvester/forwarder processes, cable harvesting methods, and helicopter logging. Harvester or forwarder ways of logging are most common in northern and central Europe, and their usage is estimated to grow in the future owing to their economic, ergonomic, and ecological benefits over motor/manual (saw/skidding) harvesting. Helicopter logging is famous in environmentally constrained and remote locations whereas Cable harvesting is applied in hilly regions. As per recent research, improved logging operations result in a 30% growth in wood volume and damage to residual trees can be lowered to 20%. For example, Markit! Forestry Management has installed helicopter logging techniques for some portions of the Dry Lake Hills area as transport of logs, lumber, and cut trees was tough owing to the steep slope of the land.

Key Players:

-

Acksen Ltd

-

Agnetix

-

Aiko Logi Tours

-

Anthelion Systems, Inc.

-

Apply Mobile Ltd. (idenprotect)

-

ATrillion-Semantix

-

BeerRightNow.com

-

BlackPoll Fleet International

-

BlikBook

-

BTM Resources Berhad

Chapter 1. FORESTRY AND LOGGING MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. FORESTRY AND LOGGING MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. FORESTRY AND LOGGING MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. FORESTRY AND LOGGING MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. FORESTRY AND LOGGING MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. FORESTRY AND LOGGING MARKET – By Type

6.1 Introduction/Key Findings

6.2 Logging

6.3 Timber Tract Operations

6.4 Forest Nurseries

6.5 Gathering of Forest Products

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. ADHESIVE TAPES MARKET – By Application

7.1 Introduction/Key Findings

7.2 Construction

7.3 Industrial Goods

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. FORESTRY AND LOGGING MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. FORESTRY AND LOGGING MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Acksen Ltd

9.2 Agnetix

9.3 Aiko Logi Tours

9.4 Anthelion Systems, Inc.

9.5 Apply Mobile Ltd. (idenprotect)

9.6 ATrillion-Semantix

9.7 BeerRightNow.com

9.8 BlackPoll Fleet International

9.9 BlikBook

9.10 BTM Resources Berhad

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Forestry and Logging Market was valued at USD 1.53 billion in 2023 and is projected to reach a market size of USD 2.71 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 8.5%.

The heightened demand for construction is propelling the Forestry and Logging Market.

The forestry and Logging Market is segmented based on Type, Application, and Region.

Asia-Pacific is the most dominant region for the Forestry and Logging Market.

Acksen Ltd, Agnetix, Aiko Logi Tours, Anthelion Systems, Inc., Apply Mobile Ltd. (idenprotect), and A Trillion- Semantix are a few of the key players operating in the Forestry and Logging Market.