Food Starch Market Size (2024 – 2030)

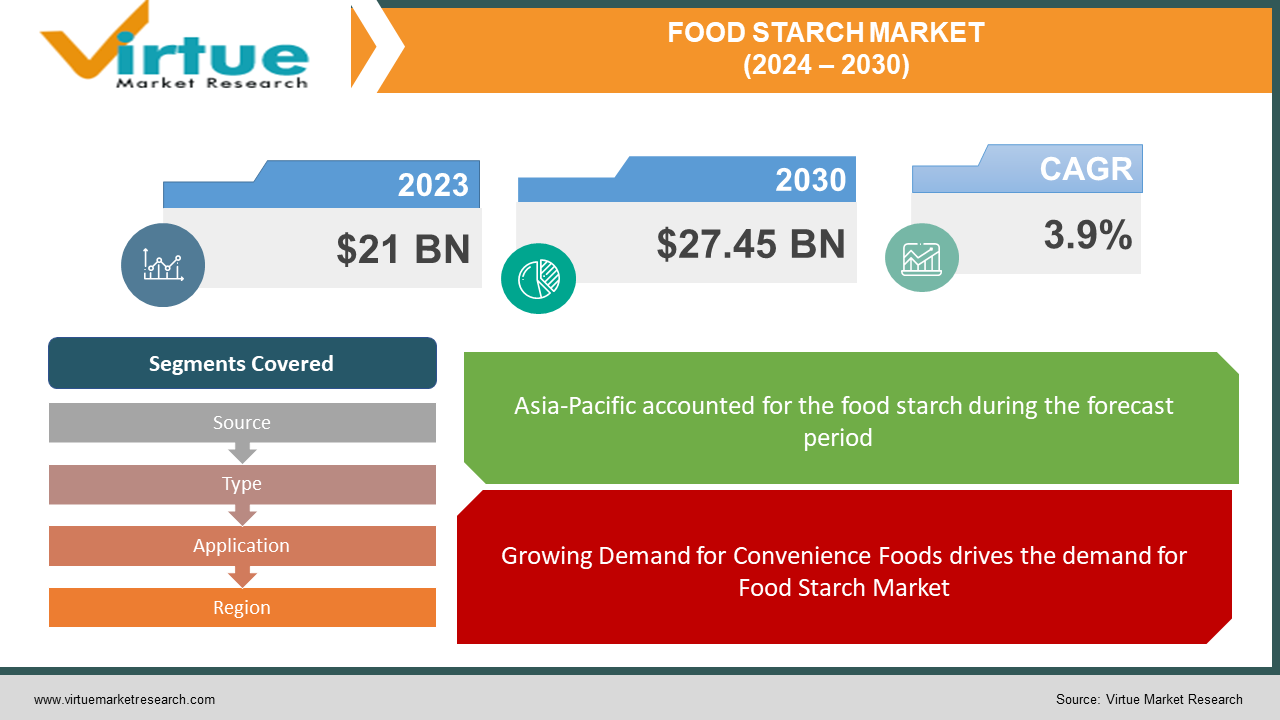

The Global Food Starch Market was valued at USD 21 billion and is projected to reach a market size of USD 27.45 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.9%.

Food starch is a carbohydrate extracted from agricultural raw materials such as corn, rice, wheat, potato, and cassava. It is commonly used as a thickening agent, stabilizer, or texture enhancer in a wide range of food products. The Food Starch Market is expected to grow significantly in the coming years due to increasing demand from various industries such as food and beverage, pharmaceuticals, and personal care. The major well-established key players in the Food Starch Market are Cargill, Ingredion, ADM, Tate & Lyle, and Roquette.

Key Market Insights:

There is a rising interest in food starches that offer enhanced properties such as improved texture, stability, and nutritional benefits. Specialty starches, including gluten-free, resistant starches, and pre-gelatinized starches are also popular among consumers seeking healthier and more versatile ingredients for their food products. Convenience foods, the expanding food and beverage industry, health awareness, technological advancements, and gluten-free demand are propelling the Food Starch Market. The restraints on the Food Starch Market include health concerns and regulatory constraints, substitute ingredients and alternatives, volatility in raw material prices, and environmental and sustainability concerns. Ongoing advancements in technology have led to product innovation in the field of starch processing. Asia-Pacific occupies the highest share of the Food Starch Market. North America is the fastest-growing segment during the forecast period

Food Starch Market Drivers:

Growing Demand for Convenience Foods drives the demand for Food Starch Market

Convenience foods such as ready-to-eat meals, snacks, and processed foods, have a huge demand globally. This is mainly due to changing lifestyles, urbanization, and increasing disposable incomes. Consumers are seeking for quick and easy meal solutions. Food starch is a key ingredient in many convenience food products. Food starch provides texture, stability, and consistency. It also enhances the overall sensory attributes of convenience foods. Consumers prioritize convenience without compromising on taste and quality. Thus demand for convenience foods is continuously growing. This further increases the demand for food starch.

Expansion of the Food and Beverage Industry is propelling the Food Starch Market

The food and beverage industry is one of the largest consumers of food starch. Food starch is used in a wide array of products such as soups, sauces, bakery items, and beverages. The food and beverage industry industry is expanding rapidly. This is mainly due to population growth, changing dietary preferences, and the introduction of innovative product offerings. Food starch enhances the texture, mouthfeel, and stability of various food and beverage products. Food starch plays an important role in their overall appeal and shelf life. The expansion of the food and beverage industry into emerging markets drives the food starch market. The increasing consumer spending on packaged and processed foods, further fuels the demand for food starch.

Food Starch Market Restraints and Challenges

The major challenges faced by the Food Starch Market are health concerns and regulatory constraints. Consuming excessive amounts of food starch, particularly in processed foods raises health concerns. High intake of starch, such as refined starches, may contribute to health issues like obesity, diabetes, and metabolic disorders. Regulatory bodies have implemented stringent regulations ensuring product quality and consumer safety. Manufacturers should follow these regulations in labeling, particularly in terms of allergen declarations and permissible levels of additives. The other restraints to the Food Starch Market include substitute ingredients and alternatives, volatility in raw material prices, and environmental and sustainability concerns.

Food Starch Market Opportunities:

The Food Starch Market has various opportunities in the market. With the increasing interest in functional starches that offer enhanced properties such as improved texture, stability, and nutritional benefits capabilities, the Food Starch Market is anticipated to witness significant growth in the coming years. Manufacturers are developing starches tailored to specific applications, such as gluten-free, resistant starches with prebiotic properties, or modified starches for high-temperature processing. Other Opportunities in the Food Starch Market include Clean label and natural ingredients, emerging applications in non-food industries, sustainable sourcing and production, market expansion in emerging economies, technological advancements, and product innovation.

FOOD STARCH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Source, Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated, Ingredion Incorporated, Archer Daniels Midland Company (ADM), Tate & Lyle PLC, Roquette Frères, Grain Processing Corporation, Avebe U.A., Emsland Group, Tereos S.A., AGRANA Beteiligungs-AG |

Food Starch Market Segmentation: By Source

-

Corn

-

Wheat

-

Potato

-

Cassava

-

Other sources (rice, tapioca, etc.)

In 2023, based on market segmentation by source, Corn occupies the highest share of the Food Starch Market. This is mainly due to its widespread applications and consistent demand across industries. Corn starch is widely used due to its abundance, versatility, and relatively low cost. Corn starch is used in various food products such as soups, sauces, bakery items, and snacks. However, potato is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 14%. This is due to its natural properties, clean label trends, gluten-free preferences, and expanding applications in specialty food products. Potato starch is commonly used in a variety of food products, including processed meats, sauces, and gluten-free baked goods.

Food Starch Market Segmentation: By Type

-

Native Starch

-

Modified Starch

-

Esterified Starch

-

Etherified Starch

-

Cross-Linked Starch

-

In 2023, based on market segmentation by type, the Modified starches segment occupies the highest share of the Food Starch Market. This is mainly due to the diverse applications and enhanced properties of modified starches compared to native starches. Modified starches are used in various food products such as soups, sauces, dressings, bakery items, and processed meats.

However, the Native starches are the fastest-growing segment during the forecast period. This is mainly due to the increasing consumer demand for clean labels and natural ingredients. Native starches are derived directly from natural sources without any chemical alterations.

Food Starch Market Segmentation: By Application

-

Food & Beverages

-

Bakery & Confectionery

-

Processed Foods

-

Beverages

-

Dairy Products

-

Others

-

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Industrial (adhesives, paper, textiles, etc.)

In 2023, based on market segmentation by applications, the food & beverages segment occupies the highest share of the Food Starch Market. This is mainly due to its extensive applications and widespread use of food starch in various food products. Food starch is used as a thickening agent, stabilizer, texture enhancer, and binder in various food items such as soups, sauces, gravies, dressings, snacks, and ready-to-eat meals.

However, Bakery and confectionery is the fastest-growing segment during the forecast period. This growth is driven by rising consumer demand for indulgent and innovative bakery and confectionery products, as well as the development of starch-based alternatives to traditional ingredients such as fats and sugars. Starches are used in baked goods such as bread, cakes, cookies, and pastries to improve structure, crumb softness, and overall quality.

Food Starch Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, Asia-Pacific occupies the highest share of the Food Starch Market. It has a market share of 45%. This growth is due to the increasing population, changing dietary patterns, and economic development. Countries like China and India have significant market shares due to growing demand for processed foods and convenience products, and a rising awareness of clean-label ingredients.

However, North America is the fastest-growing segment during the forecast period. This is mainly due to the growing demand for food starch across various applications, including processed foods, beverages, and industrial applications. North America is a technologically advanced region with a mature food industry, strong consumer demand for convenience foods, and advanced food processing technologies. The United States is a major producer and consumer of food starch. Food starch is widely used in various food products such as baked goods, snacks, soups, sauces, and beverages. Innovation in product formulations, clean label trends, and the growing popularity of gluten-free and natural ingredients contribute to the growth of the market in this region.

COVID-19 Impact Analysis on the Global Food Starch Market:

The COVID-19 pandemic had a significant impact on the Food Starch Market. There were lockdowns, border closures, transportation limitations, labor shortages, and other restrictions. This led to disruptions in global supply chains and affected the sourcing, production, and distribution of food starch and related products. The closure of restaurants, cafes, and other food service establishments impacted and declined the demand for food starch used in food service applications. The pandemic accelerated the adoption of e-commerce, online grocery shopping, and demand for functional and clean-label ingredients. Thus, the pandemic accelerated certain trends in the Food Starch Market.

Latest Trends/ Developments:

One of the developments, in the Food Starch Market is the adoption of sustainable sourcing and production practices within the food starch industry. Manufacturers are using eco-friendly alternatives and investing in renewable energy technologies to minimize their environmental footprint. There is a growing consumer trend for clean-label and natural food products. This increases demand for food starch derived from organic and non-GMO sources. Rising disposable incomes, urbanization, and changing dietary habits are driving increased consumption of processed and convenience foods. This creates opportunities for food starch manufacturers to expand their presence in emerging markets.

Key Players:

-

Cargill, Incorporated

-

Ingredion Incorporated

-

Archer Daniels Midland Company (ADM)

-

Tate & Lyle PLC

-

Roquette Frères

-

Grain Processing Corporation

-

Avebe U.A.

-

Emsland Group

-

Tereos S.A.

-

AGRANA Beteiligungs-AG

Market News:

In 2023, numerous snack producers introduced novel items utilizing starch as a primary component. These offerings comprised popped potato crisps, cassava-based puffs, and sweet potato crackers. Tailored to accommodate diverse dietary preferences, including gluten-free and plant-based diets, these snacks leveraged starch's properties to achieve crisp textures and delicious flavors. This strategy resonated strongly with health-conscious consumers, fostering increased demand for these innovative snack alternatives.

Chapter 1. Food Starch Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Starch Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Starch Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Starch Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Starch Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Starch Market – By Source

6.1 Introduction/Key Findings

6.2 Corn

6.3 Wheat

6.4 Potato

6.5 Cassava

6.6 Other sources (rice, tapioca, etc.)

6.7 Y-O-Y Growth trend Analysis By Source

6.8 Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 7. Food Starch Market – By Type

7.1 Introduction/Key Findings

7.2 Native Starch

7.3 Modified Starch

7.4 Esterified Starch

7.5 Etherified Starch

7.6 Cross-Linked Starch

7.7 Y-O-Y Growth trend Analysis By Type

7.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Food Starch Market – By Application

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Bakery & Confectionery

8.4 Processed Foods

8.5 Beverages

8.6 Dairy Products

8.7 Others

8.8 Pharmaceuticals

8.9 Personal Care & Cosmetics

8.10 Industrial (adhesives, paper, textiles, etc.)

8.11 Y-O-Y Growth trend Analysis By Application

8.12 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Food Starch Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Type

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Food Starch Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill, Incorporated

10.2 Ingredion Incorporated

10.3 Archer Daniels Midland Company (ADM)

10.4 Tate & Lyle PLC

10.5 Roquette Frères

10.6 Grain Processing Corporation

10.7 Avebe U.A.

10.8 Emsland Group

10.9 Tereos S.A.

10.10 AGRANA Beteiligungs-AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Food Starch Market was valued at USD 21 billion and is projected to reach a market size of USD 27.45 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.9%.

Convenience foods, the expanding food and beverage industry, health awareness, technological advancements, and gluten-free demand are the market drivers of the Global Food Starch Market.

Corn, Wheat, Potato, Cassava, and Other sources (rice, tapioca, etc.) are the segments under the Global Food Starch Market by Source.

Asia-Pacific is the most dominant region for the Global Food Starch Market.

Cargill, Ingredion, ADM, Tate & Lyle, and Roquette are the key players in the Global Food Starch Market.