Food Sorting Machines Market Size (2024 – 2030)

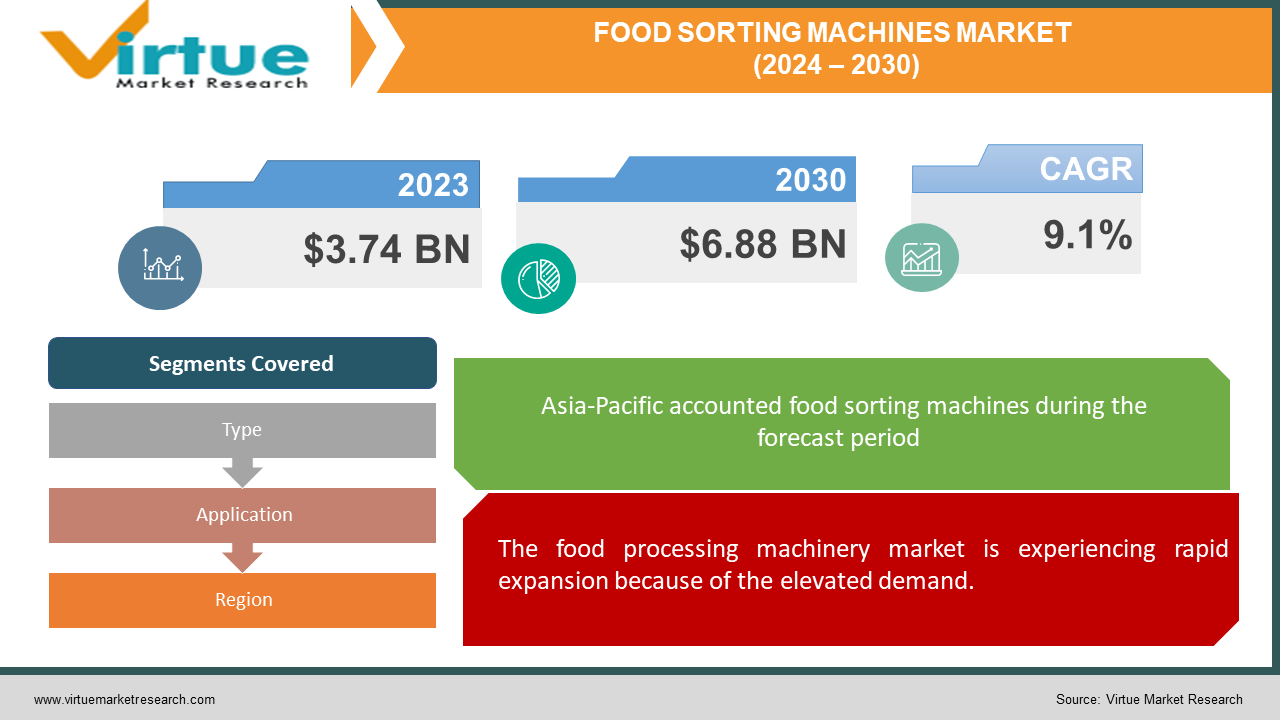

The food sorting machines market was valued at USD 3.74 billion in 2023 and is projected to reach a market size of USD 6.88 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9.1%.

Fruits, vegetables, fats and oils, packaged and dried food items, dairy products, and meat are all categorized and sorted using food sorting machines. Items are sorted according to color using color sorters, also known as optical sorters. These machines play a vital role in sorting, separating, and processing different food products according to their size, shape, color, and quality, thus ensuring compliance with quality standards and improving food security.

Key Market Insights:

Due to the increased global attention to food safety regulations and the advancement of technology that allows for exact sorting based on color, size, and quality factors, optical sorting machines have become the market leader. AI integration, a focus on sustainability, modular design, and the use of sensor technology are some recent developments in the food sorting machine market that are propelling innovation and changing the course of the sector. Asia-Pacific is leading the way in terms of market growth, driven by the region's rising expenditures on food safety and quality regulations as well as the food industry's broad use of automation.

Food Sorting Machines Market Drivers:

The food processing machinery market is experiencing rapid expansion because of the elevated demand.

The food processing machinery market is witnessing a dramatic rise due to several key reasons. First, global population growth and changing food preferences have led to an increase in processed food products, requiring better processing. In addition, strict food safety regulations mandated by governments around the world have promoted the adoption of food processing machinery to ensure product quality and reduce the risk of contamination. Technological advances, such as the integration of artificial intelligence and machine learning algorithms, have increased the accuracy and speed of processing, thereby promoting market growth. Also, increasing awareness among food producers about the benefits of automation to reduce labor costs and improve productivity is driving the demand for food processing machines in various sectors, including fruits, vegetables, grains, and seafood. market structure in the foreseeable future.

Food Sorting Machines Market Restraints and Challenges:

Despite the remarkable progress in the field of food processing machinery, the market faces many obstacles and challenges. One of the obstacles is the large initial investment required to acquire and install these sophisticated systems, making them inaccessible to small food producers or those working on a tight budget. In addition, the complexity of these machines often requires skilled professionals for their operation and maintenance, leading to increased costs. The variety of food products poses challenges in organizing the processing system, requiring flexible methods of processing. Issues such as handling soft or irregular materials make the design process difficult, requiring the creation of new materials to solve these problems effectively. Compliance with food safety regulations and standards also adds a layer of complexity, requiring manufacturers to ensure that their machines meet these requirements. Overcoming these barriers will be essential for the continued growth and adoption of food processing technology in the global market.

Meeting these challenges requires a balance between cost, environmental considerations, and technological progress, making it necessary for food sorting machine marketers to manage these complexities for sustainable growth in market penetration.

Food Sorting Machines Market Opportunities:

The food processing machinery market is poised to witness significant growth, creating opportunities for industry players. With the increasing demand for quality food processing solutions resulting from the increase in the world population and changing consumer preferences, the food processing machinery market is witnessing significant growth. These machines offer precision, speed, and versatility in processing different food products based on their size, shape, color, and quality, thus improving productivity and reducing waste. in the food processing industry. In addition, strict food safety regulations enforced by governments around the world promote the acceptance of these machines, ensuring that quality standards are met and reducing the risk of contamination. Technological advances, including the integration of artificial intelligence and machine learning algorithms, are changing the power of food processing machines, resulting in greater accuracy and efficiency. As food manufacturers strive to improve efficiency, productivity, and quality assurance, the food processing machinery market offers a good opportunity for investment in innovation, fostering a strong landscape that has opportunities for growth and expansion.

FOOD SORTING MACHINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.1% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

A/S Cimbria, Aweta, Bühler AG, Greefa, Hefei Meyer Optoelectronic Technology, Inc.., Key Technology (Duravant), Raytec Vision SpA, Satake Corporation, Sesotec GmbH, TOMRA |

Food Sorting Machines Market Segmentation: By Type

-

Belt Sorter

-

Freefall Sorter

-

Channel Sorter

-

Automated Defect Removal Systems

-

Optical Sorting Machine

-

Others

Based on type, the optical sorting machine is the largest and fastest-growing segment. These machines use distance with high-quality technology to identify foods, such as their color, appearance, size, quality, and speed. One of the main factors driving the adoption of optical processing machines is the increasing focus on food safety and quality standards across the world. Strict regulations and consumer demand for safe and healthy food products have led to a demand for these machines in the food industry. In addition, increasing food reduces food and the need for the process of organizing what is good to satisfy the people who are still helpful and growing. As a result, the machine market is typical and has a large, optimal structure that works, which is important for balance and security regulations.

Food Sorting Machines Market Segmentation: By Application

-

Grains

-

Fruits & Vegetables

-

Dry Food

-

Dairy Products

-

Others

Based on the application, fruits and vegetables are the largest growing category, reflecting the diversity of agriculture, climate, and consumer preferences around the world. The growing demand for fresh produce comes from health awareness and a preference for nutritious, natural foods. Factors such as population growth, urbanization, and increasing disposable income are contributing to the expansion of the fruit and vegetable market. However, challenges such as inconsistent quality standards, spoilage, and post-harvest losses will require proper planning and management. In response, the global food processing machinery market enjoys a symbiotic relationship with the fruit and vegetable sector as technological advances meet the changing needs of the industry. These machines enable quick and accurate sorting based on parameters such as size, shape, and color, ensuring quality standards are met and reducing waste. Therefore, the growth of the fruit and vegetable market is driving the demand for advanced processing technology, increasing innovation, and expanding the global food processing machinery market. Grains are the fastest-growing segment. They play an important role in global food security, providing staple food for a significant portion of the world's population. Factors such as population growth, dietary changes, and increasing urbanization are driving the demand for grain, requiring better planning and processing. The growing demand for grain, along with the need to meet stringent standards, has boosted the adoption of advanced food processing machinery in the agricultural sector. These machines use advanced technology to process grains based on different parameters such as size, shape, and quality, thus ensuring consistency and improving food safety. Additionally, as the global food industry faces challenges related to pollution and waste reduction, food processing machinery is emerging as an important tool to improve efficiency and productivity. Therefore, the growing demand for grain and the need for quality assurance are driving the expansion of the food processing machinery market, with significant implications for its growth and development worldwide.

Food Sorting Machines Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest growing market for food sorting equipment. The need for food processing and sorting equipment is being driven by the nations of Southeast Asia, China, India, and other rapidly industrializing and urbanizing regions. The adoption of automation in the food sector and rising investments in food safety and quality are other factors driving the market's expansion in the Asia-Pacific area. North America is the fastest-growing market. The region's technologically advanced food processing industry, coupled with stringent regulatory standards for food safety and quality, serves as a significant catalyst for the adoption of sorting machines. Moreover, the increasing demand for processed foods, driven by changing consumer lifestyles and preferences, further amplifies the market's expansion. Additionally, the growing focus on sustainability and reducing food waste drives the need for efficient sorting solutions in North American food production facilities. The impact of North America's market growth resonates globally, influencing the trajectory of the food sorting machine market. As North American food producers embrace advanced sorting technologies to enhance efficiency and meet regulatory requirements, it sets a precedent for global adoption, shaping the market's dynamics and driving innovation across borders.

COVID-19 Impact Analysis on the Food Sorting Machines Market:

The COVID-19 pandemic significantly impacted the food sorting machine market, presenting a mixed bag of challenges and opportunities. Initially, disruptions in the global supply chain and manufacturing operations led to delays in the production and delivery of food sorting machinery. However, as the pandemic unfolded, the importance of food safety and hygiene gained paramount significance, driving the demand for automated sorting solutions to ensure minimal human contact and adherence to stringent health protocols. Moreover, the shift towards online grocery shopping and increased focus on food processing automation further fueled the demand for food sorting machines. Additionally, the pandemic prompted manufacturers to innovate and integrate features such as remote monitoring and contactless interfaces into their machines, enhancing their appeal in the post-pandemic landscape. Despite initial setbacks, the COVID-19 crisis acted as a catalyst for technological advancements and accelerated the adoption of food sorting machines, reshaping the market dynamics for sustained growth in the foreseeable future.

Latest Trends/ Developments:

In recent years, the food processing machinery market has seen an increase in technology and innovation, leading to significant developments in various areas. A key trend is the integration of artificial intelligence (AI) and machine learning algorithms into processing machines, enabling real-time data analysis and processing capabilities. Not only does this improve organizational performance, but it also increases efficiency and reduces product waste. In addition, there is an increased emphasis on sustainability and environmentally friendly solutions, leading to the creation of machinery that reduces energy consumption and environmental impact. Another popular trend is the modular design of processing equipment, which allows greater flexibility and scalability to meet the needs of different companies. Advances in sensor technology and imaging systems allow machine processing to identify and remove even the smallest defects or contamination, ensuring high standards of product quality and safety. These trends are driving food processing machinery costs, driving innovation, and reshaping the future of the food processing industry worldwide.

Key Players:

-

A/S Cimbria

-

Aweta

-

Bühler AG

-

Greefa

-

Hefei Meyer Optoelectronic Technology, Inc..

-

Key Technology (Duravant)

-

Raytec Vision SpA

-

Satake Corporation

-

Sesotec GmbH

-

TOMRA

Chapter 1. Food Sorting Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Sorting Machines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Sorting Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Sorting Machines Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Sorting Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Sorting Machines Market – By Application

6.1 Introduction/Key Findings

6.2 Grains

6.3 Fruits & Vegetables

6.4 Dry Food

6.5 Dairy Products

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Food Sorting Machines Market – By Type

7.1 Introduction/Key Findings

7.2 Belt Sorter

7.3 Freefall Sorter

7.4 Channel Sorter

7.5 Automated Defect Removal Systems

7.6 Optical Sorting Machine

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Type

7.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Food Sorting Machines Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Food Sorting Machines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 A/S Cimbria

9.2 Aweta

9.3 Bühler AG

9.4 Greefa

9.5 Hefei Meyer Optoelectronic Technology, Inc..

9.6 Key Technology (Duravant)

9.7 Raytec Vision SpA

9.8 Satake Corporation

9.9 Sesotec GmbH

9.10 TOMRA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The food sorting machines market was valued at USD 3.74 billion in 2023 and is projected to reach a market size of USD 6.88 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9.1%.

An increasing demand is propelling the growth of the food sorting machines market.

Based on application, the food sorting machine market is segmented into grains, fruits & vegetables, dry food, dairy products, and others.

Asia-Pacific is the most dominant region for the food sorting machines market.

TOMRA, Buhler, GREEFA, Key Technology, BBC Technologies, NIKKO, Raytec Vision, Sesotec, Cimbria, Multiscan Technologies, Brovind-GBV Impianti, Reemoon Technology Holdings, Anhui Color Sort Technology, Satake Corporation, and Orange Sorting Machines are the key players in the food sorting machines market.