Food Soak Tanks Equipment Market Size (2024 – 2030)

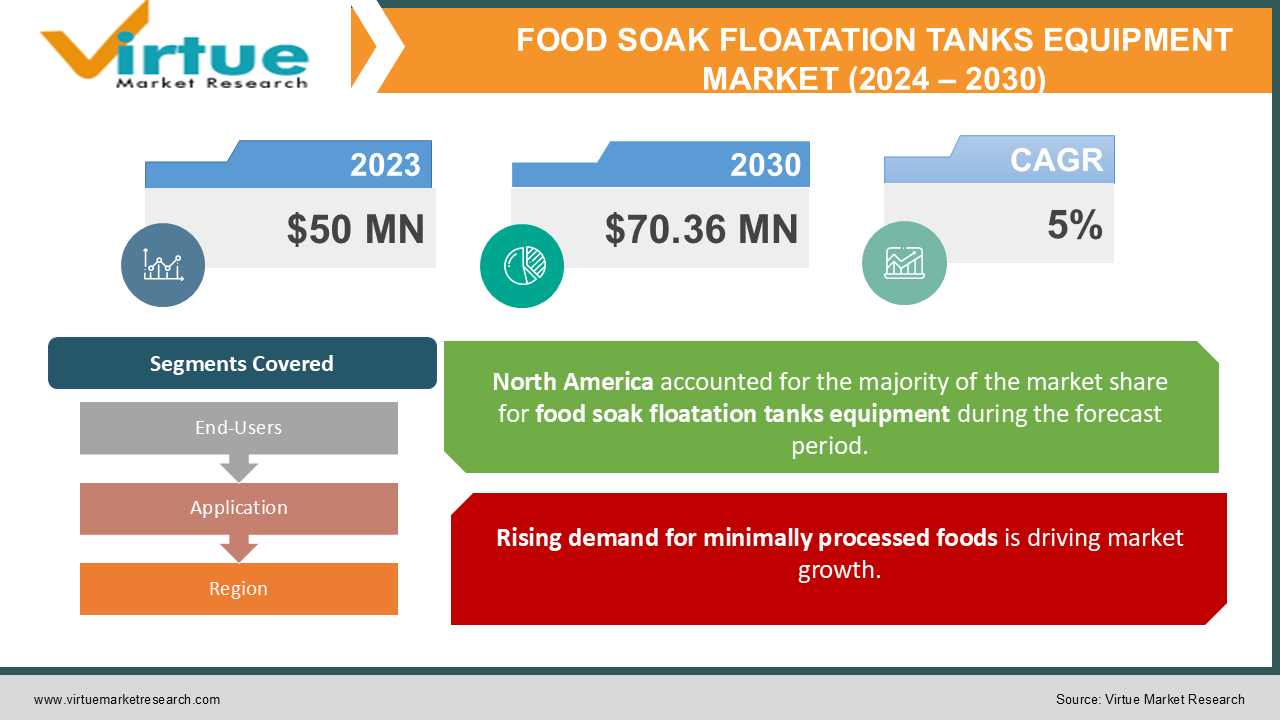

The global food soak/floatation tank equipment market was valued at USD 50 million in 2023 and will grow at a CAGR of 5% from 2024 to 2030. The market is expected to reach USD 70.36 million by 2030.

The food soak/floatation tanks equipment market caters specifically to the food processing industry, providing tanks used to clean and prep ingredients. These tanks play a crucial role in ensuring food safety and hygiene during the initial processing stages, with applications like washing fruits and vegetables, removing impurities from meat and seafood, and soaking grains and legumes.

Key Market Insights:

The primary factors driving market expansion are the growing demand for minimally processed foods, the emphasis on food safety and cleanliness, and the rise in automation in food processing facilities. Market expansion is hindered by a lack of segment-specific scientific research, broad categorization in market reports, and expensive initial investment expenditures. Stricter rules spurring innovation, the trend toward automation, and rising consumer desire for minimally processed goods all point to potential market expansion. The need for alternative therapies and relaxation techniques is driving growth in North America, which is the largest expanding market. Asia-Pacific is the market with the quickest rate of growth. This is due to expanding food processing industries and rising demand for processed foods.

Global Food Soak/Floatation Tank Equipment Market Drivers:

Rising demand for minimally processed foods is driving market growth.

The surge in consumer demand for fresh, minimally processed foods presents a significant opportunity for the market. These tanks play a critical role in the initial stages of processing, ensuring the cleanliness and safety of food products without compromising their natural appeal. Soak/flotation tanks can be used to effectively wash fruits, vegetables, and other ingredients, removing dirt, debris, and potential contaminants. This initial cleaning step is crucial for ensuring food safety without resorting to harsh chemicals or excessive processing techniques. Additionally, minimally processed foods are often pre-cut or prepped for convenience. Soak/flotation tanks can be used in these preparation stages to maintain freshness and minimize damage to the product, preserving the natural qualities that consumers seek. As the minimally processed food trend continues to grow, soak/flotation tanks will be increasingly sought after by food processors looking to meet consumer demands for safe, fresh, and minimally altered ingredients.

The focus on food safety and hygiene is boosting the market.

Heightened scrutiny of food safety, driven by stricter regulations and consumer anxieties, is pushing the food processing industry towards innovative equipment solutions. Soak/flotation tanks are at the forefront of this movement, playing a vital role in establishing a more hygienic processing environment. These tanks function as the first line of defense against contaminants by effectively removing dirt, debris, and potential pathogens during the crucial washing and cleaning stages. The ability to customize soak/flotation tank settings, including water pressure, temperature, and the use of minimal, food-safe sanitizers, allows for targeted cleaning based on the specific product. This targeted approach minimizes the risk of damage to delicate items like leafy greens while ensuring a thorough removal of contaminants. Additionally, the enclosed nature of soak/flotation tanks prevents cross-contamination between food items, a critical factor in maintaining hygiene throughout the processing line. As food safety concerns continue to be a top priority, soak/flotation tanks will remain a cornerstone in ensuring a clean and safe food processing environment, meeting the demands of both regulatory bodies and health-conscious consumers.

Increased automation in food processing is facilitating the expansion.

The burgeoning trend of automation in food processing facilities presents a golden opportunity for the soak/flotation tank segment. As facilities embrace automation to streamline operations, reliable and well-designed soak/flotation tanks become even more crucial. Automation promises significant benefits like improved efficiency and consistent cleaning processes, but these advantages hinge on the seamless integration of equipment like soak and flotation tanks. Manufacturers who can develop tanks that seamlessly integrate with automated systems, potentially featuring features like automatic loading and unloading mechanisms or sensors for monitoring cleaning cycles, will be well-positioned to capitalize on this trend. Additionally, automation often demands a high degree of precision and consistency in equipment performance. Soak/flotation tanks designed with these factors in mind, ensuring consistent water flow, temperature control, and cleaning cycles, will be highly sought after. By meeting the demands of automation, soak/flotation tank manufacturers can position themselves as key partners in the future of food processing, enabling facilities to achieve the efficiency and consistency gains promised by automation.

Global Food Soak/Floatation Tank Equipment Market Challenges and Restraints:

Limited scientific research is a significant hurdle.

A significant hurdle for the market lies in the difficulty of isolating data specific to this segment. Because market research reports tend to focus on the broader food processing equipment market, which encompasses a wide range of equipment types, soak and flotation tanks get lumped in with other categories. This lack of granular data makes it a challenge to accurately gauge the market size, its true growth potential, and the specific trends impacting soak and flotation tanks. Without this detailed information, it's difficult to assess the market's overall health and identify lucrative opportunities for manufacturers. Additionally, limited data makes it challenging to predict future growth patterns and tailor product development accordingly. This lack of transparency can hinder investment and innovation within the soak and flotation tank segment, potentially slowing down its progress in meeting the evolving needs of the food processing industry.

High initial investment costs create hurdles.

A major hurdle for wider adoption in the market is the significant initial investment cost, particularly for advanced models boasting automation features. These high-tech tanks can carry a hefty price tag, creating a substantial barrier for smaller food processors. While the long-term benefits like improved efficiency, consistency, and hygiene might be attractive, the upfront financial burden can be difficult to justify, especially for businesses with tighter margins. This can lead to a situation where only larger processors with more resources can afford to invest in these advanced models, limiting the overall market penetration of soak and flotation tanks. To overcome this challenge, manufacturers could explore offering financing options or developing more affordable, basic models that cater to the needs of smaller processors. Additionally, highlighting the return on investment through factors like reduced water usage, labor costs, and product waste could incentivize smaller players to consider adopting soak/flotation tank technology.

Global Food Soak/Floatation Tank Equipment Market Opportunities:

The market presents exciting opportunities fueled by the evolving food processing landscape. Firstly, the burgeoning demand for minimally processed foods creates a perfect niche for soak/flotation tanks. These tanks excel at cleaning and preparing ingredients without compromising their natural appeal, aligning perfectly with consumer preferences. Secondly, stricter regulations and heightened consumer anxieties regarding food safety are driving innovation in processing equipment. Soak/flotation tanks play a critical role here, acting as the first line of defense by effectively removing contaminants during the washing stages. Their ability to customize cleaning based on specific products ensures thoroughness without damaging delicate items. Thirdly, the trend towards automation in food processing facilities is a boon for soak and flotation tanks. Seamless integration with automated systems, potentially featuring features like automatic loading and unloading or sensor-monitored cycles, will be highly sought-after. Manufacturers who can meet these demands will become key partners in the future of food processing. However, challenges remain. The lack of granular market data makes it difficult to gauge the market size and specific trends impacting soak and flotation tanks. Additionally, the high initial investment cost, especially for advanced models, can be a barrier for smaller processors. Integration challenges and ongoing maintenance requirements add to the complexity. Overcoming these hurdles will require a multi-pronged approach. Manufacturers can address the data gap by collaborating with research firms to isolate soak/flotation tank data within broader reports. Offering financing options or developing more affordable models can address cost concerns for smaller players. Finally, highlighting the long-term benefits like improved efficiency, hygiene, and return on investment can incentivize wider adoption. By capitalizing on the existing opportunities and addressing the challenges, the food soak and flotation tank equipment market is poised for significant growth in the years to come.

FOOD SOAK TANKS EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By End-Users, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Buhler Group, GEA Group, Tetra Pak, Alfa Laval, Niro Soavi, Heat and Control Inc., Marel Group, JBT Corporation, LyondellBassell , Mepaco (Marel) |

Food Soak/Floatation Tanks Equipment Market Segmentation: By End-Users

-

Residential

-

Commercial

The commercial segment is the largest and fastest-growing end-user. Businesses, including spas, wellness centers, health clubs, and flotation therapy centers, are included in the commercial sector. Because floating tanks are so widely used in commercial settings for relaxation, stress alleviation, and therapeutic purposes, this sector frequently makes up the greatest percentage of the market. These specialized establishments provide flotation tank sessions as a wellness service, drawing clients looking for non-traditional approaches to pain care, stress reduction, and mental health. Growth in this market is anticipated as demand for specialized flotation facilities rises in response to growing knowledge of floatation therapy and the increasing recognition of its advantages. Businesses that provide floatation tank services are entering new markets to serve a wider range of customers. They frequently spend money on marketing campaigns to spread the word about the benefits of flotation therapy.

Food Soak/Floatation Tanks Equipment Market Segmentation: By Application

-

Meat and Poultry Processing

-

Seafood Processing

-

Fruit and Vegetable Processing

-

Dairy Processing

-

Others

Meat and poultry processing is the largest growing application. Because meat products are consumed so widely over the world, one of the biggest divisions of the food processing business has always been meat and poultry processing. Several reasons, including population growth, urbanization, rising incomes, and shifting dietary patterns, are driving the demand for meat and poultry products. This industry includes a range of operations such as butchering, chopping, deboning, packing, and producing products with added value. Many cultures and cuisines consider meat and poultry products to be basic foods, which explains the steady demand for them in both established and emerging nations. Seafood processing is one of the fastest-growing applications. Seafood items were in greater demand worldwide as a result of expanding disposable incomes and perceived health benefits, especially in emerging economies. Aquaculture's rapid expansion was a response to the rising demand for seafood, which it was supplying with a steady and sustainable supply of fish and marine products.

Food Soak/Floatation Tanks Equipment Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is the largest growing market. The United States and Canada are at the forefront. There is a strong demand for alternative therapies and relaxation techniques in the area, which has a well-established wellness sector. Due to several causes, including increased consumer desire for stress relief and holistic wellness experiences, expanding knowledge of the benefits of flotation therapy, and its growing adoption by commercial wellness facilities, flotation therapy has become more and more popular in North America, particularly in urban centers and metropolitan areas. Asia-Pacific is the fastest-growing market. This potential is driven by factors like rapidly expanding food processing industries in countries like China and India, along with a growing demand for processed foods fueled by a rising middle class. More commercial wellness facilities, spas, and resorts are adding floating tanks to their menus as word of the advantages of floatation treatment grows throughout the region. The Asia-Pacific market is developing as a result of this increasing adoption.

COVID-19 Impact Analysis on the Global Food Soak/Floatation Tanks Equipment Market

The COVID-19 pandemic caused a ripple effect on the market, impacting both challenges and opportunities. On the one hand, supply chain disruptions due to lockdowns and travel restrictions hampered the manufacturing and delivery of soak/flotation tanks, especially for models with imported components. Additionally, with the initial focus on stockpiling shelf-stable staples, demand from processors catering to the restaurant and hospitality sectors dwindled. However, the pandemic also presented unforeseen opportunities. The surge in demand for packaged and frozen foods due to home-cooking trends increased pressure on food safety. This highlighted the importance of hygiene in processing facilities, potentially boosting the demand for soak/flotation tanks as a crucial sanitation step. Furthermore, the growing awareness of health and immunity during the pandemic heightened consumer interest in fresh, minimally processed foods. Soak/flotation tanks play a vital role in ensuring the cleanliness and safety of these minimally processed items without compromising their natural appeal, potentially creating a new growth avenue in the market. As the food processing industry adjusts to the post-pandemic landscape, the long-term impact of COVID-19 on the food soak and flotation tank equipment market remains to be seen.

Latest trends/Developments

The market is experiencing a wave of innovation driven by evolving food processing needs. Firstly, a focus on minimally processed foods is driving the development of tanks with gentler cleaning mechanisms that preserve the natural qualities of ingredients. Secondly, automation is a major trend, with manufacturers creating soak/flotation tanks that seamlessly integrate with automated systems, featuring features like automatic loading/unloading or sensor-monitored cleaning cycles. Thirdly, sustainability is gaining traction, with eco-friendly soak/flotation tanks emerging that boast water conservation features or integrated water recycling systems. These advancements cater to processors seeking to minimize their environmental impact. However, challenges remain. The lack of granular market data specific to soak/flotation tanks makes it difficult to gauge the true market size and growth potential. Additionally, the high initial cost of advanced models can be a barrier for smaller processors. To address this, manufacturers are exploring financing options and developing more affordable basic models. Overall, the market is poised for growth, driven by innovation, automation, and sustainability trends. Overcoming data limitations and cost hurdles will be crucial for wider adoption in the food processing industry.

Key Players:

-

Buhler Group

-

GEA Group

-

Tetra Pak

-

Alfa Laval

-

Niro Soavi

-

Heat and Control Inc.

-

Marel Group

-

JBT Corporation

-

LyondellBassell

-

Mepaco (Marel)

Chapter 1. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET – By End-Users

6.1 Introduction/Key Findings

6.2 Residential

6.3 Commercial

6.4 Y-O-Y Growth trend Analysis By End-Users

6.5 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 7. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET – By Application

7.1 Introduction/Key Findings

7.2 Meat and Poultry Processing

7.3 Seafood Processing

7.4 Fruit and Vegetable Processing

7.5 Dairy Processing

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Users

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Users

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Users

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Users

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Users

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. FOOD SOAK/FLOATATION TANKS EQUIPMENT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Buhler Group

9.2 GEA Group

9.3 Tetra Pak

9.4 Alfa Laval

9.5 Niro Soavi

9.6 Heat and Control Inc.

9.7 Marel Group

9.8 JBT Corporation

9.9 LyondellBassell

9.10 Mepaco (Marel)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global food soak/floatation tank equipment market was valued at USD 50 million in 2023 and will grow at a CAGR of 5% from 2024 to 2030. The market is expected to reach USD 70.36 million by 2030.

Rising demand for minimally processed foods, a focus on food safety and hygiene, and increased automation in food processing are the reasons that are driving the market.

Based on end-users, the market is divided into residential and commercial.

North America is the most dominant region for the global food soak/floatation tank equipment market.

Buhler Group, GEA Group, Tetra Pak, Alfa Laval, and Niro Soavi are the major players in the global food soak/floatation tank equipment market.