Food Safety Market Size (2025 – 2030)

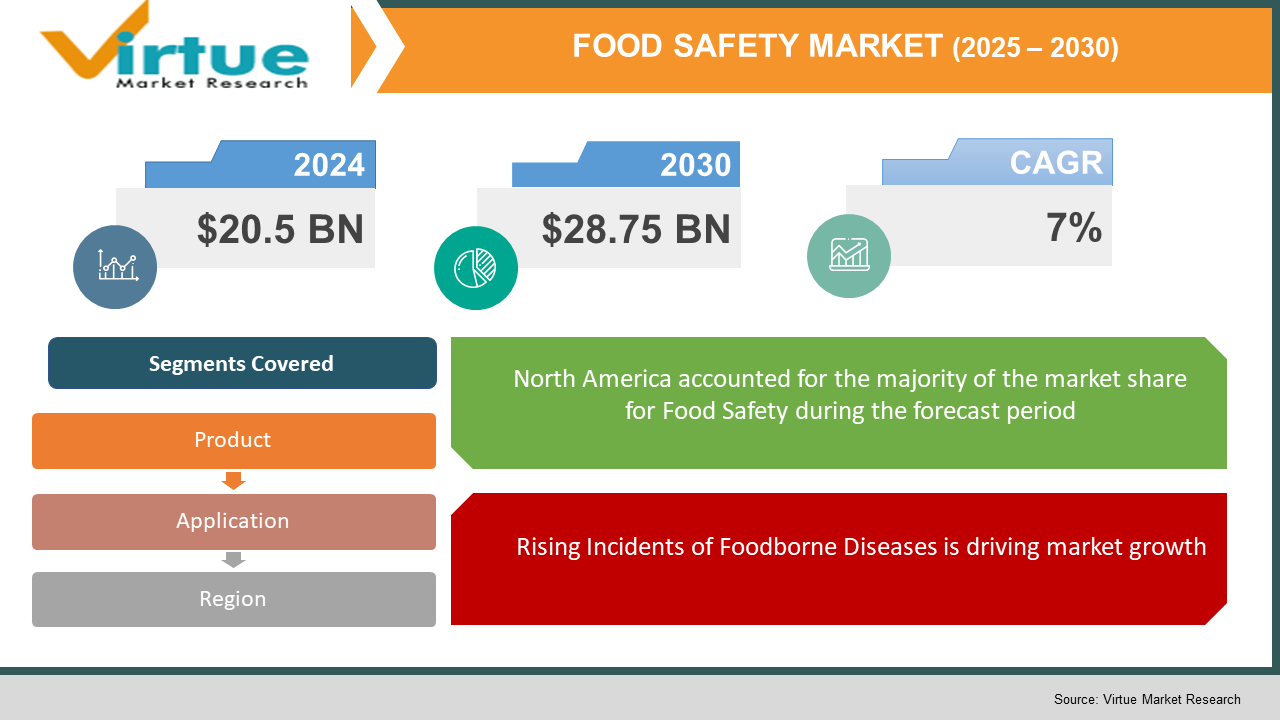

The Global Food Safety Market was valued at USD 20.5 billion in 2024 and is projected to grow at a CAGR of 7% from 2025 to 2030. The market is expected to reach USD 28.75 billion by 2030.

The Food Safety Market encompasses various measures and technologies that ensure the safety of food products from contamination, spoilage, and adulteration. As foodborne diseases and safety concerns continue to increase, the demand for food safety solutions has grown significantly. The market includes areas such as food testing, contamination detection, regulatory compliance, food traceability, and safety monitoring systems. As consumer awareness about health risks from unsafe food grows, the focus on food safety has intensified globally, creating substantial growth opportunities for this sector.

Key Market Insights:

- Technological advancements in food safety testing methods, such as rapid testing, automated detection systems, and IoT-based monitoring, are significantly transforming the industry. These innovations help in detecting pathogens, allergens, and other contaminants quickly and accurately.

- Emerging markets in Asia-Pacific and Latin America are seeing substantial growth in food safety solutions due to increasing urbanization, rising disposable incomes, and growing consumer awareness regarding foodborne diseases.

- Companies are increasingly adopting food safety software and digital tools that provide real-time monitoring, compliance reporting, and risk management, enabling better control over the safety of food products and preventing contamination.

Global Food Safety Market Drivers:

Rising Incidents of Foodborne Diseases is driving market growth:

The rising incidents of foodborne diseases are one of the primary drivers for the growth of the food safety market. According to the World Health Organization (WHO), nearly one in ten people globally suffer from foodborne diseases each year. These diseases, caused by pathogens, bacteria, viruses, and parasites in contaminated food, have led to an increased awareness among consumers about food safety. As the frequency of these outbreaks grows, food safety technologies such as pathogen detection systems, monitoring devices, and food testing services are becoming essential. Governments worldwide are also enforcing stringent food safety regulations and providing guidelines to minimize such risks. As a result, food safety solutions are now critical for food manufacturers, processors, and retailers to comply with these standards and ensure the safety of the food supply.

Technological Advancements in Food Safety Systems is driving market growth:

Technological innovation is reshaping the food safety landscape. The development of new food safety testing methods, such as rapid tests, digital sensors, automated pathogen detection, and food traceability systems, is significantly enhancing food safety practices. Technologies such as artificial intelligence (AI) and the Internet of Things (IoT) are being integrated into food monitoring systems to enable real-time tracking and detection of food contamination. These advancements not only reduce the time taken to detect contaminants but also provide more accurate and reliable results. The use of blockchain for food traceability, allowing for the transparent tracking of food products from farm to table, has also gained momentum. As these technologies evolve, they will continue to drive the demand for food safety solutions across the food industry.

Government Regulations and Standards is driving market growth:

Governments worldwide play a critical role in driving the food safety market by establishing regulations and standards that businesses must comply with to ensure food products are safe for consumption. Regulatory bodies like the FDA, EFSA, and local food safety agencies set safety thresholds, enforce rules for food testing, and require businesses to implement traceability systems. For instance, the Food Safety Modernization Act (FSMA) in the United States has pushed companies to adopt preventive controls, while the European Union enforces rigorous food safety testing procedures and controls for contaminants. These regulations have become more stringent in recent years as food safety issues have gained global attention, creating significant opportunities for businesses offering food safety services and products to stay compliant and secure food safety.

Global Food Safety Market Challenges and Restraints:

High Cost of Advanced Food Safety Solutions is restricting market growth:

One of the key challenges in the food safety market is the high cost of advanced food safety solutions. Technologies like automated pathogen detection systems, IoT-based monitoring tools, and rapid testing methods can be expensive to implement, especially for small and medium-sized businesses. These companies may find it difficult to invest in state-of-the-art food safety infrastructure, which creates a barrier to market adoption. While these technologies offer long-term benefits such as reduced contamination risks and improved compliance with regulations, the initial investment can be a significant hurdle. Additionally, the maintenance and operation costs of these advanced solutions can further burden businesses. As a result, cost remains a key challenge, particularly for companies operating on thin margins.

Complexity of Global Food Supply Chains is restricting market growth:

The complexity of global food supply chains poses a challenge to ensuring consistent food safety across all stages of production, processing, and distribution. With increasing globalization, food products often cross multiple borders and pass through various handlers before reaching consumers. This makes tracking and monitoring food safety more challenging, especially in regions with less stringent food safety regulations. Food safety risks such as contamination, spoilage, and adulteration can arise from improper handling during transit or from unregulated suppliers. Ensuring food safety across a fragmented and diverse global supply chain requires advanced solutions like traceability systems, real-time monitoring, and supply chain transparency. However, implementing these systems across an entire supply chain can be complex, time-consuming, and costly.

Market Opportunities:

The global food safety market offers significant opportunities for growth due to rising concerns about foodborne diseases, government regulations, and technological innovations. As consumer awareness of food safety increases, the demand for better food safety solutions is expected to grow, especially in emerging markets. One major opportunity lies in the development and deployment of digital solutions like AI-powered food safety monitoring systems, which can provide real-time data on the status of food products across the supply chain. Another opportunity is the rising demand for traceability solutions, which are becoming essential for ensuring the integrity of the food supply chain. Blockchain technology, for instance, can enable better tracking of food products from origin to consumption, providing transparency and building consumer trust. Furthermore, there is an increasing emphasis on organic, gluten-free, and non-GMO foods, all of which require stringent safety measures. Businesses that can provide specialized testing services to meet these demands will find substantial growth opportunities. The food safety market is also poised to benefit from the increasing use of automation and robotics in food production, as these technologies help reduce human error and improve food safety outcomes. As the global food trade continues to grow, so will the need for efficient food safety solutions, creating a wealth of opportunities for companies in this sector.

FOOD SAFETY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SGS, Intertek Group, Bureau Veritas, Eurofins Scientific, Thermo Fisher Scientific, and Danaher Corporation |

Food Safety Market Segmentation:

Food Safety Market Segmentation By Product:

- Food Safety Testing Kits

- Food Safety Inspection Systems

- Food Safety Monitoring and Detection Systems

- Food Traceability Software

- IoT-based Food Safety Solutions

- Food Safety Compliance Management Software

The most dominant segment by product is Food Safety Testing Kits, as they are crucial for detecting contaminants and pathogens in food products quickly. Their importance has grown due to increasing food safety concerns and the need for rapid testing solutions.

Food Safety Market Segmentation By Application:

- Food Processing

- Food Retail and Distribution

- Agriculture and Farming

- Food Packaging

- Food Service Industry

- Logistics and Transport

The most dominant application segment is Food Processing, as it involves various stages where contamination risks are high. Ensuring food safety in this segment is critical to preventing widespread contamination and ensuring the final product's safety for consumption.

Food Safety Market Regional Segmentation:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the food safety market, driven by stringent regulations and a high level of consumer awareness regarding food safety. The U.S. is a key player in this region, with the FDA setting standards for food safety and implementing regulations that drive the demand for food safety solutions. Additionally, the increasing number of food safety incidents, coupled with the growing demand for traceability and monitoring solutions, has contributed to the region's dominance. The presence of large food manufacturers and advanced technological infrastructure further strengthens North America's position in the global market. Furthermore, the region's early adoption of new food safety technologies, such as automated detection systems and AI-based solutions, has placed North America ahead of other regions in market growth.

COVID-19 Impact Analysis on the Food Safety Market:

The COVID-19 pandemic has had a profound impact on the food safety market. During the pandemic, the demand for food safety solutions surged due to heightened concerns about the safety and hygiene of food products. As the virus spread, there was a significant focus on ensuring the safety of food products during processing, packaging, and distribution. The need for stricter hygiene measures, testing for pathogens, and the implementation of safety protocols in food manufacturing facilities became critical. Moreover, the pandemic led to disruptions in global food supply chains, further emphasizing the need for robust food safety and traceability systems to ensure that food products were not contaminated during transportation or storage. In response to these challenges, businesses accelerated the adoption of technology-driven solutions, such as digital monitoring systems and AI-powered tools, to maintain food safety standards. However, the pandemic also posed challenges, including supply chain interruptions and shortages of food safety testing kits. Despite these challenges, the market showed resilience, and the increased focus on food safety is expected to have a lasting impact on the industry in the long term.

Latest Trends/Developments:

Recent trends in the food safety market indicate an increased reliance on automation and advanced technologies. One notable development is the integration of artificial intelligence and machine learning into food safety systems, which helps in predictive analysis and the identification of potential contamination risks before they occur. The rise of IoT devices has also revolutionized food safety by enabling real-time monitoring of food products throughout the supply chain. Another key trend is the growing use of blockchain for food traceability. This technology ensures transparency in the food supply chain, allowing consumers to track the journey of food from farm to table. In addition, there is a shift towards proactive food safety management, where businesses are investing in preventive measures such as predictive analytics and continuous monitoring to prevent food safety breaches before they occur. This trend is expected to continue as food safety becomes a key focus for both consumers and regulators.

Key Players:

- SGS

- Intertek Group

- Bureau Veritas

- Eurofins Scientific

- Thermo Fisher Scientific

- Danaher Corporation

- ALS Limited

- AIB International

- TÜV SÜD

- Mérieux NutriSciences

Chapter 1. FOOD SAFETY MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. FOOD SAFETY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. FOOD SAFETY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. FOOD SAFETY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. FOOD SAFETY MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. FOOD SAFETY MARKET – By Product

6.1 Introduction/Key Findings

6.2 Food Safety Testing Kits

6.3 Food Safety Inspection Systems

6.4 Food Safety Monitoring and Detection Systems

6.5 Food Traceability Software

6.6 IoT-based Food Safety Solutions

6.7 Food Safety Compliance Management Software

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. FOOD SAFETY MARKET – By Application

7.1 Introduction/Key Findings

7.2 Food Processing

7.3 Food Retail and Distribution

7.4 Agriculture and Farming

7.5 Food Packaging

7.6 Food Service Industry

7.7 Logistics and Transport Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. FOOD SAFETY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. FOOD SAFETY MARKET – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

9.1 SGS

9.2 Intertek Group

9.3 Bureau Veritas

9.4 Eurofins Scientific

9.5 Thermo Fisher Scientific

9.6 Danaher Corporation

9.7 ALS Limited

9.8 AIB International

9.9 TÜV SÜD

9.10 Mérieux NutriSciences

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Food Safety Market was valued at USD 20.5 billion in 2024 and is projected to grow at a CAGR of 7% from 2025 to 2030. The market is expected to reach USD 28.75 billion by 2030.

Key drivers include rising incidents of foodborne diseases, advancements in technology, and stringent government regulations and policies ensuring food safety across the supply chain.

The market is segmented by product (testing kits, inspection systems, monitoring solutions) and by application (food processing, retail, agriculture, packaging, and logistics).

North America is the dominant region, driven by stringent food safety regulations, consumer awareness, and the adoption of advanced food safety technologies.

Leading players include SGS, Intertek Group, Bureau Veritas, Eurofins Scientific, Thermo Fisher Scientific, and Danaher Corporation.