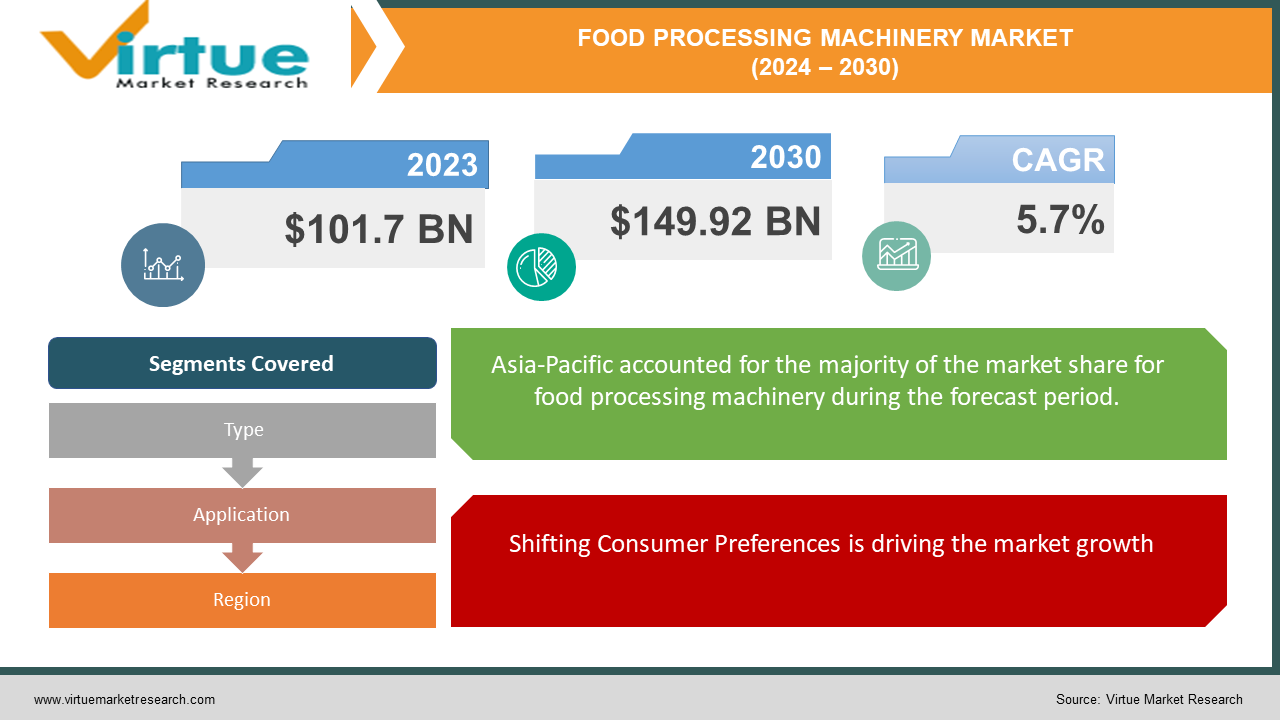

Food Processing Machinery Market Size (2024 – 2030)

The Global Food Processing Machinery Market was valued at USD 101.7 billion in 2023 and will grow at a CAGR of 5.7% from 2024 to 2030. The market is expected to reach USD 149.92 billion by 2030.

The food processing machinery market involves the development, production, and sale of equipment used to manufacture, prepare, package, and store food products. This multi-billion dollar market is driven by the growing demand for processed and packaged foods, particularly in Asia-Pacific. While the industry offers high-quality results, it faces challenges like high upfront costs for equipment and fluctuations in raw material and energy prices. However, advancements in automation, sustainability, and specialized equipment for new food trends like plant-based alternatives are paving the way for future growth.

Key Market Insights:

Rising demand for convenient, ready-to-eat food products is driving the need for sophisticated processing equipment.

Increasing urbanization leads to busier schedules and a preference for convenience, fueling the demand for processed food options.

Asia Pacific with a market share of 32.4 % is expected to witness the fastest growth due to factors like rising disposable incomes, growing populations, and increasing urbanization.

Europe currently holds a significant market share due to its well-established food processing industry.

Artificial intelligence (AI) is also making inroads, with integrated systems allowing for real-time process monitoring, predictive maintenance, and optimized production planning.

Global Food Processing Machinery Market Drivers:

Shifting Consumer Preferences is driving the market growth

The modern world's hectic pace is fueling a significant shift towards convenient food options. Busy lifestyles and growing urbanization are driving a surge in demand for ready-to-eat meals and snacks. Consumers crave quick and convenient options that fit seamlessly into their packed schedules. This translates to a growing market for food processing machinery capable of producing these convenient foods. Furthermore, rising concerns about food waste are prompting a demand for packaged and processed foods with extended shelf life. This allows consumers to stock up and reduce spoilage. Additionally, the popularity of on-the-go consumption and single-serve packaging is on the rise. These trends necessitate specialized processing equipment that can handle portion control, create single-serve packages, and cater to the unique needs of grab-and-go food options. Overall, the convenience revolution in food consumption is creating a booming market for innovative and specialized food processing machinery.

Evolving Food Safety Regulations is driving the market growth

Ensuring food safety is a top priority, and food processing machinery plays a crucial role in meeting ever-evolving regulations. Stringent government policies mandate advanced equipment that prioritizes sanitation, hygiene, and contamination control throughout the food processing cycle. This focus on safety necessitates machinery with improved cleaning capabilities, automated processes to minimize human error, and features that prevent the spread of contaminants. Furthermore, the growing emphasis on traceability and the desire to prevent foodborne illnesses are driving investment in modern machinery. This includes equipment that can track ingredients throughout the supply chain, identify potential contamination sources quickly, and implement stricter quality control measures. Finally, rising consumer awareness about food safety puts pressure on manufacturers to stay ahead of the curve. They are increasingly turning to advanced processing technologies that offer superior hygiene standards, real-time monitoring capabilities, and data-driven insights to ensure food safety and build consumer trust.

Growing Demand in Emerging Economies is driving the market growth

The developing world is witnessing a confluence of factors propelling the Food Processing Machinery Market. As disposable incomes rise in these economies, consumers have more money to spend on convenient, processed food options. This growing demand necessitates a shift towards efficient and high-capacity food processing machinery. Traditional methods struggle to keep pace with the increasing volume required to meet consumer needs. Modern machinery, with its automation and higher production capabilities, allows manufacturers to cater to this growing market effectively. Recognizing this, governments in emerging economies are actively implementing initiatives to modernize their food processing infrastructure. These initiatives involve investing in food processing plants, promoting technological advancements, and encouraging the adoption of advanced machinery. By creating a supportive environment, these governments aim to not only meet the growing demand for processed food but also strengthen their domestic food production capabilities and contribute to overall economic growth. This confluence of rising consumer spending, increasing populations, and government support is making emerging economies a hotbed for the Food Processing Machinery Market.

Global Food Processing Machinery Market challenges and restraints:

High Initial Investment Costs are restricting the market growth

High initial investment costs are a major hurdle for players in the food processing machinery market, especially for small and medium-sized enterprises (SMEs). Complex equipment for automated lines can reach staggering price points, creating a significant barrier to entry. Even established businesses struggle to justify frequent upgrades, as newer, more efficient technologies often come with hefty price tags. This can lead to a situation where businesses hold onto older machinery for extended periods, sacrificing potential efficiency gains and hindering their ability to compete with larger players who can afford cutting-edge equipment. The financial burden not only limits market participation but also stifles innovation. SMEs, which are often at the forefront of developing new food products, may be discouraged from exploring processes that require advanced machinery due to the upfront costs. This creates a cycle where high initial investments restrict market growth and hinder the adoption of potentially game-changing technologies.

Fluctuating Raw Material and Energy Costs are restricting the market growth

The food processing industry walks a tightrope between volatile raw materials and energy costs. Fluctuations in the price of agricultural commodities like wheat, corn, and sugar can significantly impact production costs. A poor harvest or unexpected rise in global demand can send these prices skyrocketing, squeezing profit margins for processors. Energy costs are another wild card. Processors rely heavily on energy for everything from operating refrigeration units to powering processing equipment. Sudden spikes in electricity or natural gas prices can drastically increase production expenses. These cost fluctuations make budgeting and planning a nightmare. Processors struggle to predict future costs, making it difficult to set stable prices for finished products. This can lead to price wars or reduced profit margins, impacting the overall profitability of the industry. The constant uncertainty caused by fluctuating costs creates a stressful environment for businesses, hindering long-term planning and investment in growth initiatives.

Market Opportunities:

The Food Processing Machinery Market presents a plethora of exciting opportunities for manufacturers and innovators. The burgeoning demand for convenient, ready-to-eat meals driven by busy lifestyles and urbanization creates a gap that specialized processing equipment can fill. Machinery capable of portion control, single-serve packaging, and handling grab-and-go options will be in high demand. Furthermore, the increasing focus on sustainability necessitates the development of energy-efficient machinery with a lower environmental footprint, appealing to both cost-conscious manufacturers and environmentally-conscious consumers. Stringent food safety regulations are another key driver, creating opportunities for advanced equipment that prioritizes sanitation, hygiene, and contamination control. Technologies like AI and IoT-integrated machinery with real-time monitoring and predictive maintenance capabilities will be attractive solutions. The rise of e-commerce also opens doors for innovative packaging solutions requiring specialized processing equipment. Looking beyond established markets, developing economies with growing populations and rising disposable incomes present a significant opportunity. Manufacturers who can cater to the need for efficient, high-capacity machinery at competitive prices will be well-positioned to tap into this burgeoning market. By focusing on innovation, sustainability, and addressing evolving consumer demands, food processing machinery manufacturers can ensure a slice of this ever-growing market.

FOOD PROCESSING MACHINERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Buhler Group, GEA Group, Tetra Laval Group, Krones AG, Alfa Laval AB, John Deere, CNH Industrial, Marel Group, Bosch Packaging Technology, Prosser & Gamble |

Food Processing Machinery Market Segmentation - by Type

-

Processing Equipment

-

Packaging Equipment

-

Utilities

The dominant segment falls under Processing Equipment. This encompasses the workhorses of food production, directly transforming raw ingredients into consumable products. Examples include mixers that combine ingredients, grinders that break down materials, homogenizers that create smooth textures, and freezers that preserve freshness. These machines play a central role in shaping the final product and are irreplaceable for food manufacturing.

Food Processing Machinery Market Segmentation - By Application

-

Bakery & Confectionery

-

Meat, Poultry & Seafood

-

Dairy & Dairy Alternatives

-

Beverages (alcoholic & non-alcoholic)

-

Fruits, Vegetables, Nuts & Grains

Fruits, Vegetables, Nuts & Grains are strong contenders for the largest segment. This segment caters to the processing needs of a vast array of products, including fresh and frozen produce, packaged salads, snack mixes, grains for cereals, and various plant-based alternatives. The rising popularity of healthy eating habits and convenience foods like pre-cut vegetables and bagged salads fuels the demand for machinery that can handle these products efficiently. Additionally, the increasing focus on minimizing food waste necessitates advanced processing equipment for sorting, cleaning, and packaging fruits, vegetables, and grains. This broad spectrum of applications and the ever-evolving needs within this segment make it a significant driver of the Food Processing Machinery Market.

Food Processing Machinery Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Currently, the Asia-Pacific region reigns supreme in the Food Processing Machinery Market. This dominance is fueled by several factors. Firstly, the burgeoning economies and exploding populations in this region create a massive demand for processed food products. This, in turn, drives the need for efficient and high-capacity food processing machinery. Secondly, government initiatives promoting food processing industries and growing disposable incomes further stimulate market growth. Finally, the presence of a robust manufacturing base and a growing middle class with a preference for convenient food options solidify Asia-Pacific's position as the dominant player in the Global Food Processing Machinery Market.

COVID-19 Impact Analysis on the Global Food Processing Machinery Market

The COVID-19 pandemic delivered a mixed bag of impacts for the Global Food Processing Machinery Market. Initially, there were disruptions due to lockdowns and travel restrictions. Supply chains were hampered, hindering the import and export of machinery and parts. Food processing facilities faced labor shortages due to illness and social distancing measures, which in turn, reduced demand for new equipment as production lines slowed. However, the pandemic also triggered a surge in demand for certain types of machinery. The rise of e-commerce grocery shopping fueled the need for equipment that could handle increased production of pre-packaged and shelf-stable food items. Additionally, a growing focus on hygiene and sanitation within food processing facilities led to increased investment in automated and touchless processing equipment. Overall, the COVID-19 pandemic's impact on the Food Processing Machinery Market was a complex interplay of disruption and opportunity. While the initial shockwaves caused a temporary setback, the long-term effects might lead to a shift towards automation and a growing demand for machinery that caters to the evolving needs of the food processing industry.

Latest trends/Developments

The Food Processing Machinery Market is witnessing a wave of innovation driven by automation, sustainability, and consumer preferences. A key trend is the rise of automation and robotics. Processors are increasingly adopting robotic systems for repetitive tasks like picking, placing, and packaging, aiming to improve efficiency, reduce labor costs, and address the shortage of skilled workers. Artificial intelligence (AI) is also making inroads, with integrated systems allowing for real-time process monitoring, predictive maintenance, and optimized production planning.

Sustainability is another major focus. Energy-efficient equipment with lower operational costs is gaining traction. Additionally, there's a growing demand for machinery that minimizes food waste and utilizes eco-friendly materials in its construction. Furthermore, the trend towards healthier and more convenient food options is influencing machinery development. Equipment for producing minimally processed, ready-to-eat meals, along with technology for portion control and single-serve packaging, is experiencing high demand. Finally, the growing popularity of plant-based alternatives to meat and dairy products is driving the development of specialized processing equipment that can handle these new ingredients efficiently. By embracing these advancements, the Food Processing Machinery Market is well-positioned to cater to the evolving needs of the food industry and ensure its continued growth in the years to come.

Key Players:

-

Buhler Group

-

GEA Group

-

Tetra Laval Group

-

Krones AG

-

Alfa Laval AB

-

John Deere

-

CNH Industrial

-

Marel Group

-

Bosch Packaging Technology

-

Prosser & Gamble

Chapter 1. Food Processing Machinery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Processing Machinery Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Processing Machinery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Processing Machinery Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Processing Machinery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Processing Machinery Market – By Type

6.1 Introduction/Key Findings

6.2 Processing Equipment

6.3 Packaging Equipment

6.4 Utilities

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Food Processing Machinery Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery & Confectionery

7.3 Meat, Poultry & Seafood

7.4 Dairy & Dairy Alternatives

7.5 Beverages (alcoholic & non-alcoholic)

7.6 Fruits, Vegetables, Nuts & Grains

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Food Processing Machinery Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Food Processing Machinery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Buhler Group

9.2 GEA Group

9.3 Tetra Laval Group

9.4 Krones AG

9.5 Alfa Laval AB

9.6 John Deere

9.7 CNH Industrial

9.8 Marel Group

9.9 Bosch Packaging Technology

9.10 Prosser & Gamble

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Food Processing Machinery Market was valued at USD 101.7 billion in 2023 and will grow at a CAGR of 5.7% from 2024 to 2030. The market is expected to reach USD 149.92 billion by 2030.

Shifting Consumer Preferences and evolving Food Safety Regulations are the reasons which is driving the market.

Based on type is divided into three segments – Processing Equipment, Packaging Equipment, Utilities

Asia Pacific is the most dominant region for the Food Processing Machinery Market.

CNH Industrial, Marel Group, Bosch Packaging Technology, Prosser & Gamble