Global Food Metal Packaging Coatings Market Size (2024-2030)

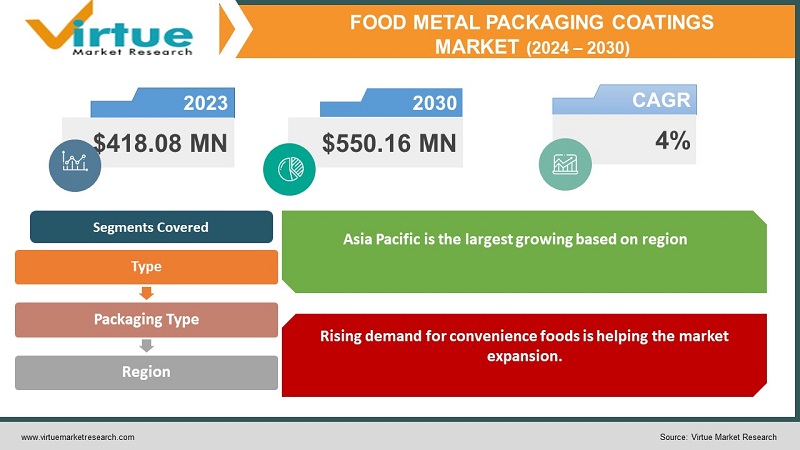

According to the report published by Virtue Market Research in Global Food Metal Packaging Coatings Market was valued at USD 418.08 million and is projected to reach a market size of USD 550.16 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%.

Food Metal Packaging Coatings have experienced substantial growth over the years. Metal has been used for a long time for packaging purposes. Presently, with economic growth and urbanization, there have been various technological advancements to improve the metal. In the future, with growing environmental concerns, sustainable alternatives will shape the market. Additionally, customization and global expansion will benefit the enlargement. During the forecast period, this market is predicted to show notable growth.

Key Market Insights:

According to Metal Packaging Europe, the overall recycling rate for aluminum cans in the EU reached a record of 76.1% in 2019.

It is estimated that 80% of metal ever produced in the world is still in use making it a right choice for packaging.

Steel is one of the most recycled materials in the world. In 2020, about 840 million metric tons of steel were recycled globally.

As of 2022, over 99 countries have banned plastic raising the need to use other packaging materials for food products.

Around 140 million metric tons of waste was generated from the packaging industry in general during 2020. To address this, companies are focusing more on implementing recycling strategies for a circular economy.

Food Metal Packaging Coatings Market Drivers:

Rising demand for convenience foods is helping the market expansion.

Over the past decade, there have been a lot of changes in lifestyle and consumer preferences. With better access to education, all genders are encouraged to prioritize study and thereby create a comfortable life. However, the dual income of couples is leading to hectic schedules and a busy lifestyle. To tackle, this and prevent time loss, ready-to-eat foods have become the go-to option. A wide range of food options including soups, meals, and beverages are available. Moreover, growing online retail has been a boon. People can order food easily from the comfort of their houses. Additionally, E-commerce gives the option to consume diverse local and international meals. This increases the need for effective packaging to preserve shelf life and to make sure that the nutrients, as well as taste, are retained.

The necessity to adhere to stringent rules & regulations is fueling the market growth.

Over the years, for consumer safety and public health concerns, there have been a lot of food safety regulation acts which are passed. These include proper packaging which is vital to preserve food quality and prevent toxic chemical reactions when exposed to the environment. Moreover, with technological advancements and better cross-border relations, import-export activity has seen a tremendous upsurge. To maintain cordial relations and to ensure food safety, it is extremely crucial for manufacturers to efficiently package all the food products that require attention. Companies have been investing in better packaging products which prevent the entry of harmful substances. Sticking to all the guidelines and protocols is necessary to trade and market for the public. This increases the need for food packaging materials.

The pros offered by metal make it a popular choice for the packaging of food products.

The packaging, whether made of aluminum or steel, is opaque and prevents sunlight from reaching the contents within. Secondly, metal is durable and may shield the contents from damage. Thirdly, Aluminum and steel are far more durable than paper and plastic. Metal is designed to be long-lasting and reusable. Some metal packing, notably aluminum, weighs significantly less than other materials. Many people want to lower their carbon footprint and live more sustainable, environmentally friendly lives. Because metal is widely acknowledged to be easy to recycle and to pose fewer threats to people and the environment than plastic, utilizing it to package items helps in making an environment-friendly choice.

Food Metal Packaging Coatings Market Restraints and Challenges:

Cost fluctuation, policies, waste management, and competition are the main concerns the market is currently facing.

Price volatility is one of the biggest issues faced which can demotivate the manufacturers resulting in alternative options. Secondly, there are certain mandatory standards to facilitate recycling, testing, and certifications. Many companies and producers can break these or not follow them because of their complexity and time consumption. Thirdly, disposal of metals is very challenging leading to waste generation. Furthermore, competition from other bio-based packaging can be a hindrance to progress.

Food Metal Packaging Coatings Market Opportunities:

With rising demand to protect our environment, there have been a lot of R&D activities taking place to develop sustainable solutions which is providing the market with an ample number of opportunities. Prominence is being given to finding reliable recycling techniques that are easy and accessible. Innovations in coatings and customizations aid the market advancement. Improvements in high-performance materials for existing and new packaging materials are being undertaken. Furthermore, Government involvement through rules, actions, and investments are helping in the progress.

FOOD METAL PACKAGING COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Type, Packaging Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PPG Industries, Inc. , AkzoNobel N.V. , The Sherwin-Williams Company , Axalta Coating Systems , Kansai Paint Co., Ltd. , Jotun , Siegwerk Druckfarben AG & Co. KGaA , Toyo Ink SC Holdings Co., Ltd. , Hexion Inc. , KCC Corporation |

Food Metal Packaging Coatings Market Segmentation:

Food Metal Packaging Coatings Market Segmentation: By Type:

- Epoxy

- Polyester

- Acrylic

- Polyurethane

- Polyester

- Others

Based on type, the epoxy segment is the largest growing segment in this market. This is because these materials are known for their chemical and corrosion resistance, durability, adhesion, versatility, appearance, performance, and cost-effectiveness. Additionally, they enhance the shelf life of the food product. The polyurethane segment is the fastest growing. They are known for their flexibility, and barrier properties, preventing chemical reactions, and few formulations are sustainable.

Food Metal Packaging Coatings Market Segmentation: By Packaging Type:

- Cans

- Caps & Closures

- Aerosols & Tubes

- Others

Based on packaging type, cans are the largest growing segment in the market. Cans are extremely convenient, easy to use, preserve shelf life, are recyclable, prevent entry of contaminants, take less space, prevent entry of contaminants, and are resistant to UV rays. Moreover, the upsurge in food products has led to an increased demand for cans. Caps & closures were the fastest-growing segment owing to preservation, freshness, easiness, customization, aesthetic appeal, identification of various brands, and versatility. Additionally, they were used for smaller meals specific for people following portion control owing to health concerns.

Food Metal Packaging Coatings Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia Pacific is the largest growing based on region. They control around 36% of the market. China, India, and Japan are at the forefront of this trend. The relevance of this area is due to factors such as demand, broad utilization of metals by various end-user industries, the presence of key companies, R&D activities, industrialization, economic development, raw material availability, and increased consumption. China is one of the biggest producers of aluminum and steel. Moreover, the demand for ready-to-eat foods has fueled the success of the region, North America is the fastest-growing region, accounting for around 29% of the total market share. This is because of the developed economy, technological improvements, and the presence of major actors, investments, and usage. Furthermore, end-user demand and growing awareness of the need for sustainable products are important drivers of the market's large share. The United States and Canada are the two most powerful countries.

COVID-19 Impact Analysis on the Global Food Metal Packaging Coatings Market:

The pandemic hurt the market. It resulted in tighter restrictions in almost every venue to keep the virus from spreading. Lockdowns, social isolation, and mobility limitations became the new normal. The supply chain, manufacturing schedules, logistics, and import-export trade were all interrupted, resulting in a recession. Approximately 85% of enterprises had supply chain disruptions. This caused an economic slowdown. Restaurants, hotels, and fast-food businesses were shut down due to safety concerns. Furthermore, a manpower deficit hampered the execution process. However, the market is gradually picking up post-pandemic, with regulatory relaxations and lockdowns being eased.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heftily to improve existing formulations alongside maintaining competitive pricing. This has further resulted in increased government engagement and further enlargement.

Integration of smart packing, greener alternatives, and anti-microbial coating is being emphasized through extensive research work. Studies about metal behaviour to understand the chemical and physical properties are expected to further broaden human understanding resulting in the invention of superior quality metal packaging remedies.

Key Players:

- PPG Industries, Inc.

- AkzoNobel N.V.

- The Sherwin-Williams Company

- Axalta Coating Systems

- Kansai Paint Co., Ltd.

- Jotun

- Siegwerk Druckfarben AG & Co. KGaA

- Toyo Ink SC Holdings Co., Ltd.

- Hexion Inc.

- KCC Corporation

In March 2023, Sherwin-Williams Packaging Coatings published a white paper titled “Can Coatings: Unlocking the Future of Sustainable Packaging” about the critical role coatings play in the future of sustainable packaging for the European food, beverage, and household goods markets. The paper illustrated why metal cans were favored by the market due to their infinite recyclability, and safety and performance benefits – contributing to a circular economy.

In June 2021, reports published the breakthrough of AkzoNobel and partners about the sealing revolution in packaging coatings. The crucial discovery was made by a Ph.D. student Jiaying Li, who was working with the Dutch Advanced Research Center Chemical Building Blocks Consortium (ARC CBBC), in collaboration with the University of Twente, Wageningen University, BASF, and AkzoNobel. The research focused on a new, recyclable coating to replace the type of metalized packaging that blocks out oxygen that’s typically used for products such as crisps and coffee.

Chapter 1. GLOBAL FOOD METAL PACKAGING COATINGS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL FOOD METAL PACKAGING COATINGS MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL FOOD METAL PACKAGING COATINGS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL FOOD METAL PACKAGING COATINGS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL FOOD METAL PACKAGING COATINGS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL FOOD METAL PACKAGING COATINGS MARKET – By Packaging Type

6.1. Introduction/Key Findings

6.2. Cans

6.3. Caps & Closures

6.4. Aerosols & Tubes

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Packaging Type

6.7. Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 7. GLOBAL FOOD METAL PACKAGING COATINGS MARKET – By Type

7.1. Introduction/Key Findings

7.2. Epoxy

7.3.Polyester

7.4. Acrylic

7.5. Polyurethane

7.6. Polyester

7.7. Other

7.8. Y-O-Y Growth trend Analysis By Type

7.9 . Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. GLOBAL FOOD METAL PACKAGING COATINGS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL FOOD METAL PACKAGING COATINGS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PPG Industries, Inc.

9.2. AkzoNobel N.V.

9.3. The Sherwin-Williams Company

9.4. Axalta Coating Systems

9.5. Kansai Paint Co., Ltd.

9.6. Jotun

9.7. Siegwerk Druckfarben AG & Co. KGaA

9.8. Toyo Ink SC Holdings Co., Ltd.

9.9. Hexion Inc.

9.10. KCC Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

According to the report published by Virtue Market Research in Global Food Metal Packaging Coatings Market was valued at USD 418.08 million and is projected to reach a market size of USD 550.16 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%.

Rising demand for convenient foods, the necessity to adhere to stringent rules & regulations, and the pros offered by metal are the major drivers propelling the Global Food Metal Packaging Coatings Market

Based on Packaging Type, the Global Food Metal Packaging Coatings Market is segmented into Cans, Caps and closures, Aerosols and tubes, and others

Asia Pacific is the most dominant region for the Global Food Metal Packaging Coatings Market

PPG Industries, Inc., AkzoNobel N.V., and The Sherwin-Williams Company are the key players operating in the Global Food Metal Packaging Coatings Market