Food Grade Vegetable Polyols Market Size (2024-2030)

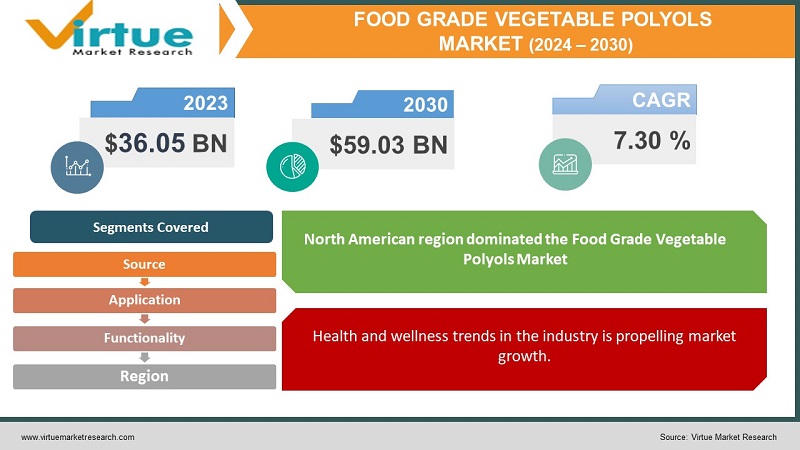

The Food Grade Vegetable Polyols Market was valued at USD 36.05 billion in 2023 and is projected to reach a market size of USD 59.03 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.30%.

Polyols are a type of organic compounds that usually contain carbon atoms bonded to other atoms, including carbon and hydrogen. They belong to the sugar alcohol class and can be obtained from sugar, through natural processes or industrial production methods. Polyols have a variety of uses in a variety of industries, including food, construction, personal care, automotive, and industrial applications. In the industrial sector, polyols are used to produce polyurethane foam, which is used in the production of various products, such as mattresses, furniture, covers and car parts.

Key Market Insights:

The edible plant polyol market is experiencing significant growth, resulting in increased consumer demand for natural and healthy products. As health and wellness awareness increases worldwide, food-grade plant polyols, such as erythritol and xylitol, are gaining popularity as sugar substitutes in a variety of foods and beverages. The market is used to emphasize increasing and decreasing sugar content in response to health concerns. The company creates new products to meet customer preferences, focusing on sustainability and meeting regulatory standards. The diversity of edible plant polyols in applications such as confectionery, baked goods and beverages contributes to widespread adoption. Regional market conditions and competition are shaping the landscape, requiring industry players to be aware of changes in consumer preferences.

The market is being driven by increasing awareness of health, conditions for reducing sugar and increasing disposable income. Sugar-killing alcohols such as erythritol, xylitol, and maltitol dominate the market, which are used for their low calories, glycemic index, and prebiotic content.

Food Grade Vegetable Polyols Market Drivers:

Health and wellness trends in the industry is propelling market growth.

Health and wellness trends continue to shape consumer preferences, fueling the appetite for functional and nutritious food options. As individuals prioritize wellness, there is a marked shift in products that support a healthier lifestyle. Food-based plant polyols play a critical role in this trend, providing a natural, low-calorie alternative to traditional sweeteners. Their adoption is in line with the growing emphasis on healthy eating, providing consumers with options that contribute to overall health and satisfy their desire for flavor and nutrition.

The surge in consumer demand for natural and clean label products is reshaping the food industry.

As discerning consumers seek transparency in ingredient lists, food-grade vegetable polyols emerge as a key player in meeting this demand. Recognized as natural sweeteners, these polyols align with the clean label trend, offering food manufacturers a wholesome alternative to traditional sweetening agents. With a focus on simplicity and authenticity, vegetable polyols contribute to the creation of products that resonate with consumers seeking pure and minimally processed options.

Food Grade Vegetable Polyols Market Restraints and Challenges:

Cost challenges present a significant hurdle in the Food Grade Vegetable Polyols Market. The production of these polyols often involves intricate processes and the use of specific raw materials, contributing to higher production costs compared to conventional sweeteners. The elevated costs may limit the widespread adoption of food-grade vegetable polyols, particularly in price-sensitive markets. Striking a balance between cost-effectiveness and maintaining product quality becomes crucial for manufacturers to ensure the market competitiveness of these healthier sweetening alternatives.

Formulation issues pose a notable challenge in the Food Grade Vegetable Polyols Market. The integration of vegetable polyols into certain food applications may encounter hurdles, impacting the seamless formulation of products. Challenges may arise in achieving the desired taste profiles, textures, or functionalities, especially in complex formulations. Overcoming these formulation issues is essential for ensuring that food-grade vegetable polyols can be effectively incorporated into a wide range of products without compromising taste, quality, or overall consumer acceptance, thus influencing their successful market penetration.

Food Grade Vegetable Polyols Market Opportunities:

The Food Grade Vegetable Polyols Market is buoyed by the prevailing wave of rising health consciousness among consumers. As individuals increasingly prioritize well-being, there is a discernible shift towards healthier dietary choices, driving the demand for alternatives to traditional sweeteners. Vegetable polyols, with their lower calorie content and reduced impact on blood sugar levels, align perfectly with health-conscious consumers' preferences. The awareness of the health benefits associated with these polyols, including their natural origins, positions them as attractive substitutes in various food and beverage products. This heightened focus on healthier lifestyles creates a conducive environment for the continued growth and acceptance of food-grade vegetable polyols in the market.

FOOD GRADE VEGETABLE POLYOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.30% |

|

Segments Covered |

By Source, application, functionality, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated, Archer Daniels Midland Company, Roquette Frres; A. B. Enterprises, AVATAR CORPORATION, Tereo, Gulshan Polyols Ltd, TREDIS, Gujarat Ambuja Exports Limited;, Tata Chemicals Ltd, Shandong Futaste Co., Jungbunzlauer Suisse AG |

Food Grade Vegetable Polyols Market Segmentation:

Food Grade Vegetable Polyols Market Segmentation: By Source:

- Sugarcane & Molasses

- Grains

- Fruits

In 2023, based on the source, the Grains segment accounted for the largest revenue share. Cereals are emerging as an important segment of the food polyols product market, contributing significantly to the growth of the industry. The use of corn, especially corn and wheat, as a source of plant polyols depends on several factors. The number of these plants, combined with the efficient extraction process, improves the economic potential of polyol production. As global consumers become more aware of healthier options, the demand for natural and low-calorie flavors is increasing. The conversion of corn helps to create different types of polyols, meeting the needs of different processing in the food and beverage industry.

The fruit segment of the polyol product market is witnessing significant growth, driven by several key factors. The global trend towards healthier food choices and increasing awareness of the health benefits associated with natural sweeteners has led to a demand for polyols from fruits. Fruits such as apples, pears and tomatoes, which contain natural sugars, are good sources for the production of these polyols. Growing consumer preference for clean label products and the practice of plant-based ingredients are driving the adoption of seed-based polyols. The impact of this trend on the global market is huge as manufacturers strive to meet consumer demand for more nutritious and natural flavors. Hence, the fruit segment is expected to play an important role in shaping the level of plant food polyol in the market, influencing product trends and contributing to overall market expansion.

Food Grade Vegetable Polyols Market Segmentation: By Application:

- Food

- Healthcare & Pharmaceutical

- Beverages

In 2023, the food segmented dominated the global market and accounted for the highest market share. The global food industry continues to undergo changes, many of which affect the food grade polyols market. One of the most popular things is that consumers are increasing health and wellness, leading them to choose healthy food options. As people increasingly seek natural, low-calorie alternatives to traditional sweeteners, demand for plant-based polyols at nutritional levels, derived from sources such as grains and fruits, is increasing. Clean label changes, emphasizing transparency and natural ingredients, boost the market, positioning plant-based polyols as a substitute. In addition, the growing population worldwide, along with urbanization and lifestyle changes, are increasing the demand for new food products, thus providing new opportunities for plant polyols in various applications. On the other hand, challenges arise from the complexity of the design and the cost of production. However, through innovation, collaboration, and strategic planning for better options, the food polyols market is poised for continued growth, playing an important role in shaping the future of food.

Food Grade Vegetable Polyols Market Segmentation: By Functionality:

- Preservative

- Coloring/Flavouring Agent

- Coatings

In 2023, the coloring/flavouring agent dominated the Food Grade Vegetable Polyols Market. Colorants and flavoring agents play an important role in the food-grade plant polyol market, affecting not only the sensory properties of food and beverages but also shaping consumer preferences. The demand for cleaner and cleaner label products has fueled the adoption of plant-based polyols as an alternative sweetener, coinciding with consumers' growing desire to make healthier choices. This trend extends to the colors and the warmers, while the preference for natural, wood-based options is gaining ground. The use of plant-based colors and flavors complements the wonderful image of food-grade plant polyols, contributing to a holistic approach to better nutrition. Manufacturers are responding to this trend by using natural ingredients such as fruits and vegetables to increase the interest of sweet products with plant polyols. The relationship between these factors reflects a significant change in the food industry for sustainability, health consciousness and the pursuit of natural and transparent food supply systems, affecting food grade polyols in the world market.

Food Grade Vegetable Polyols Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, the North American region dominated the Food Grade Vegetable Polyols Market. North America has the largest share of the biopolyol market, up to 35%. The United States is the largest market in North America for biopolyol, which accounted for the largest share of the industry. The growth of the biopolyol industry in the United States, Canada, and Mexico has a direct positive impact on the overall biopolyol market. This region is the world's largest market for soy-based biopolyols, due to the abundance of soy available. Growing awareness for the use of eco-friendly and sustainable materials for the production of polyurethane foam used in various end industries such as construction, automotive, packaging and others is expected to boost the growth of the market. biopolyol. Government policies such as the Weatherization Assistance Program (WAP) that promote the use of insulation will also stimulate demand in the sector. So, this has a positive effect on the market. Strong polyurethane foam provides energy efficiency in a variety of coatings and can significantly reduce energy costs. According to the report Financing Clean Energy Transitions in Emerging and Developing Economies, investments in clean energy will increase sevenfold - from less than $150 billion in to more than $1 trillion in 2030 to get the world on track to achieve clean energy goals. Zero emissions by 2050. The adoption of bio-sourced polyurethane foam is one step closer to this goal. Thus, it is one of the major factors driving the growth of the bio-polyol market during the forecast period.

Asia-Pacific region is expected to be the fastest growing region. The Asia Pacific region plays an important role in shaping the trajectory of the global food grade polyols market, with many factors contributing to its growth. The region's growing population, along with rising disposable income and changing food preferences, has led to an increase in demand for healthy alternatives. Asia-Pacific countries, such as China and India, are seeing a rise in healthy consumers looking for low-calorie natural sweeteners, leading to the adoption of plant-based polyols in food. In addition, the rapid expansion of the food industry in the region and the influence of Western food styles are increasing the market potential. As Asia Pacific becomes a leading consumer and producer of food-grade polyols, its impact is affecting the entire world, affecting marketing strategies, production processes and innovation strategies of leaders in the industry. It is expected that the center's activity in the area will continue as the market continues to change and adapt to customer preferences in the area of processing.

COVID-19 Impact Analysis on the Food Grade Vegetable Polyols Market:

Due to the epidemic, major sectors such as automobiles and construction are affected. Lockdowns and social distancing have led to the closure of many factories. The construction sector has been hit hard due to labor shortages and government-imposed lockdowns during the COVID-19 pandemic, adding to the issue of suppliers under financial pressure due to non-compliance with deadlines. According to a report from the European Construction Industry Federation (FIEC), the total investment in construction decreased by 5.8% in and amounted to $ 13.48 billion, which corresponds to 10.7% of the EU GDP. The cuts were threatened in Spain, France, Italy, the Czech Republic and Poland. This also affects the biopolyol market.

Latest Trends/ Developments:

The food-grade plant polyols market has seen several notable trends and developments in recent times. Notable is the acceptance of food-enhancing plant polyols, such as erythritol and xylitol, as an alternative to traditional sweeteners, which is motivated by health awareness and global efforts to reduce sugar consumption. Producers focus on innovation by introducing new techniques that improve flavor profiles and meet changing consumer preferences. Sustainability has become a key factor, with increasing emphasis on sourcing plant-based polyols from environmentally friendly and renewable sources. A clean labeling system affects product design, leading to the rise of clear labeling practices and fewer inventory listings. Also, there is a notable increase in research and development activities to expand the application of food-grade polyols in various food and beverage products, contributing to the overall market growth. As consumers increasingly seek natural and healthier options, the food polyol product market is poised for expansion as companies strive to support these changing preferences and take advantage of emerging opportunities.

Key Players:

- Cargill, Incorporated

- Archer Daniels Midland Company

- Roquette Frres; A. B. Enterprises

- AVATAR CORPORATION

- Tereo

- Gulshan Polyols Ltd

- TREDIS

- Gujarat Ambuja Exports Limited;

- Tata Chemicals Ltd

- Shandong Futaste Co.

- Jungbunzlauer Suisse AG

- In April, 2023, BASF launched the production of its first bio-based polyol named Sovermol in Mangalore, India. This speaks to the growing need for environmentally friendly products for a variety of applications in the Asia-Pacific region, including new energy vehicles (NEVs), aerospace, industrial and landscape protection. From sustainable sources, Sovermol contains no volatile organic compounds (VOCs). Sovermol materials are used to create durable coatings and adhesives for various parts, helping customers reduce their carbon footprint and save resources.

- In January 2023, Turkish chemical producer Kimpur expanded its sustainable product offering to include bio-based polyols. Kimpur polyurethane systems are used in many industries including automotive, footwear, furniture, heating, insulation-building and security. Kimpur has increased its commitment to support and strengthen its competitiveness in the global polyol market with the addition of new polyols based on its product range.

Chapter 1. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET– BY SOURCE

6.1. Introduction/Key Findings

6.2. Sugarcane & Molasses

6.3. Grains

6.4. Fruits

6.5. Y-O-Y Growth trend Analysis By Source

6.6. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 7. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Food

7.3. Healthcare & Pharmaceutical

7.4. Beverages

7.5. Y-O-Y Growth trend Analysis By APPLICATION

7.6. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET– BY FUNCTIONALITY

8.1. Introduction/Key Findings

8.2 Preservative

8.3. Coloring/Flavouring Agent

8.4. Coatings

8.5. Y-O-Y Growth trend Analysis Functionality

8.6. Absolute $ Opportunity Analysis Functionality , 2024-2030

Chapter 9. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By APPLICATION

9.1.3. By Source

9.1.4. By Functionality

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By APPLICATION

9.2.3. By Source

9.2.4. By Functionality

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By APPLICATION

9.3.3. By Source

9.3.4. By Functionality

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Source

9.4.4. By Functionality

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Source

9.5.4. By Functionality

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL FOOD GRADE VEGETABLE POLYOLS MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Cargill, Incorporated

10.2. Archer Daniels Midland Company

10.3. Roquette Frres; A. B. Enterprises

10.4. AVATAR CORPORATION

10.5. Tereo

10.6. Gulshan Polyols Ltd

10.7. TREDIS

10.8. Gujarat Ambuja Exports Limited;

10.9. Tata Chemicals Ltd

10.10. Shandong Futaste Co.

10.11. Jungbunzlauer Suisse AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Food Grade Vegetable Polyols Market was valued at USD 36.05 billion and is projected to reach a market size of USD 59.03 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7.3%.

The increasing awareness towards health is one of the major drivers of the Food Grade Vegetable Polyols Market.

Based on Application, the Food Grade Vegetable Polyols Market is segmented into Food, Healthcare & Pharmaceutical and Beverages

North America is the most dominant region for the Food Grade Vegetable Polyols Market.

Cargill, Incorporated, Archer Daniels Midland Company, Roquette Frres; A. B. Enterprises, AVATAR CORPORATION, Tereo, Gulshan Polyols Ltd, TREDIS, Gujarat Ambuja Exports Limited, Sunar MSR, Tata Chemicals Ltd, Shandong Futaste Co., Jungbunzlauer Suisse AG are the key players operating in the Food Grade Vegetable Polyols Market.