Food Glazing Agents Market Size (2023 - 2030)

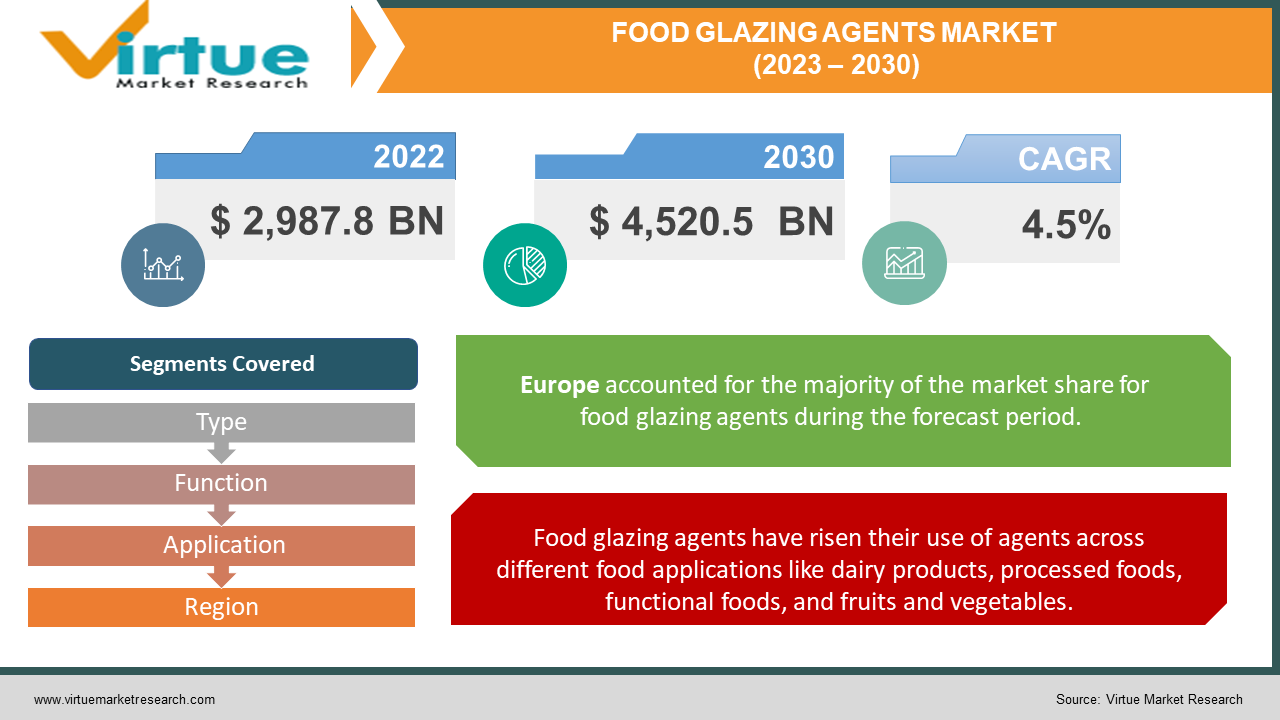

The global food glazing agents market size is growing with a CAGR of 4.5% from 2022 to 2030. The market is expected to reach USD 4,520.5 billion by 2030 from USD 2,987.8 billion in 2022 during the forecasted period.

Industry Overview:

Food glazing agents are the food additives applied on the outer layer of the food products providing a glowing look and protective coating. Food glazing agents act as a sealer to avoid moisture loss, develop structure, and oil retention. Also, the agent acts as a lubricant. These food glazing agents are used in supplements, capsules, and tablets in the nutraceuticals and pharmaceutical sectors.

Glazing agents are mainly used in the confectionery sector hugely in hard-boiled candies as a coating and other different types of candy. The market players are introducing alternative products concerning ongoing variations.

COVID-19 Impact:

The sudden outburst of the novel coronavirus (COVID-19) has created a negative impact on the food glazing agents market. Several countries have imposed restrictions on trade worldwide to control the COVID-19 spread. The quick spread of the virus has affected transportation and global logistics has affected the food glazing agents market. The COVID-19 outburst has affected the food and beverages sector. The pandemic has affected the food glazing agent market in terms of sales and revenue.

However, the sales of the food glazing agents market have witnessed tremendous growth. Online sales have increased as consumers have shown much interest in purchasing products with rising health concerns. These factors have multiplied the market growth during the pandemic crisis.

Market Drivers:

Food glazing agents have risen their use of agents across different food applications like dairy products, processed foods, functional foods, and fruits and vegetables. The bakery and confectionery industry is demanding high for food glazing agents which fuel the market growth. The demand for texture and look of the food products is increased by the consumer and the growing consumer base for glazing agents in the food industry has helped the market to grow further strongly.

The rising selection of consumers for better and dishy food across the developing countries is advancing the surging demand for the food glazing agents market.

Market Restraints:

However, the growing competition from other processing forms and increasing expectations by the consumers create obstacles for the food glazing agents market.

Recent Market Developments:

On May 04, 2021, Capol Group extended its patented natural colors product for confectionery for creating a new customer experience. The company has created an online platform named Vivapigments with new and fresh designed food products. The company is expertise in finishing gummies, jellies, and more. https://www.confectioneryproduction.com/news/34848/capol-creates-new-vivapigments-online-resource-for-confectionery-sector/

FOOD GLAZING AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Function, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mantrose-Haeuser (U.S.), Capol (Germany), Strahl & Pitsch (U.S.), Masterol Foods (Australia) |

Segment Analysis

As per the research report, the global Food Glazing Agents Market is based on type, function, and application.

Food Glazing Agents Market - By Type

-

Stearic acid

-

Beeswax

-

Carnauba wax

-

Candelilla wax

-

Shellac

-

Paraffin wax

-

Others (montan and lanolin wax)

Carnauba wax type segment is heading the food glazing agents market with a revenue share of 26.3% during the prognostic period. The segment is likely to continue its dominance over the mentioned period. The segment is gaining traction. The carnauba wax is used as a food-grade polish and gelling agent across many food products and pharmaceutical pills. Moreover, the wax is used as a thickener in solvents and oils. The consumer's demand for vegan and organic sources of food additives is surging and used in food products. The stearic acid segment is anticipated to grow at a quicker rate, it used is used as an ingredient in diet supplements. Factors like increasing perception over health issues boost the diet supplements demand propelling the segment growth.

The shellac is the second-largest segment dominating the food glazing agents market. Shellac is used as dry flakes and mixed with ethanol for preparing liquid shellac. Shellac is used for wood finish and as a brush-on colorant.The candelilla wax segment held a revenue share of 17.7% and is scheduled to grow with a considerable growth rate. The demand for candelilla wax is increasing in the food and cosmetics sector during the foreseen period. Paraffin wax is prepared for exhibiting significant growth recently. The surging application for the scope of paraffin wax in the cosmetics, packaging, and candle industry hikes the market growth.

Food Glazing Agents Market - By Function

-

Coating agents

-

Surface finishing agents

-

Firming agents

-

Film agents

-

Others (binding agents and stabilizing agents)

The coating agents function segment is steering the market with a share of 38.8% in terms of revenue. The segment share attributes to lifestyle changes that led to the growing demand for confectioneries and bakery products used for all kinds of occasions. Coating agents intensify the taste and look of the food products.The firming agent is proposed to experience the quickest growth during the foretold period. Firming agents are used for other functions like expanding the product lifecycle. These factors accentuate the market growth. The film agents are associated with modern cooking like head-on beers, bread dough, and whipped cream. The increasing number of food industries is strengthening worldwide.

Food Glazing Agents Market - By Application

-

Bakery

-

Confectionery

-

Processed meat, poultry & fish

-

Fruits & vegetables

-

Functional foods

-

Others (dairy products & convenience foods)

The confectionery application segment dominated the global food glazing agents market. The confectionery industry is increasing, which heightens the market demand. Glazing agents are used in the confectionery segments. In particular, manufacturers use these glazing agents for preparing cakes, chocolates, pastries, and dragees to improve the look and expand the life of the product. The bakery application is the second-largest that held 22.2% in terms of revenue. The lifestyle changes and growing consumption of processed foods are mounting resulting in achieving significant traction for the segment to grow further. Bakery food items consist of food glazing agents to improve the texture, design, taste, and shiny surfaces accumulating the segment growth. The fruits and vegetables segment is said to have a moderate growth pace during the foreseen period. The major vendors use food glazing agents giving a sparkling look to fruits and vegetables. Moreover, the glazing agents help in maintaining the product's freshness. The functional food products segment by application is anticipated to grow with the highest CAGR and the growth is ascribed due to the health assets for the overall development of the human body.

Food Glazing Agents Market - key players

-

Mantrose-Haeuser (U.S.)

-

Capol (Germany)

-

Strahl & Pitsch (U.S.)

-

Masterol Foods (Australia)

Food Glazing Agents Market - By Regional Analysis

-

Based on the regional analysis, Europe is governing the food glazing agents market with the highest share during the foreseen period.

-

Italy, Germany, France, and the UK are account for the major considerable share in the global food glazing agents market. The organic food products demand is increasing due to health issues.

-

Advisable cost of production and market price accompanying the growing demand for confectionery and bakery application industries multiply the market growth.

-

The food glazing agents market in North America is said to have brilliant growth during the forecasted period.

-

The market growth in the region owes to growing urbanization and the high expensiveness of consumers accelerates the food glazing agents market.

-

Asia-Pacific is approximated to have quick and continuous growth at a swift pace and growing with the highest CAGR rate throughout the foretold period. China and India are scheduled to have a reasonable consumer base for beeswax and paraffin wax. Also, quick urbanization and mounting consumption of beverages develop the market growth in the region.

-

India and Indonesia are two major countries in exporting shellac.

-

Latin America and the Middle East and the African region are expected to have remarkable growth in the food glazing agents market during the forecasted period. Brazil and South Africa are leading the regions with the highest share during the timeline period.

Chapter 1. Food Glazing Agents Market- Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Glazing Agents Market- Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Food Glazing Agents Market- Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Food Glazing Agents Market- Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Food Glazing Agents Market- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Glazing Agents Market- By Type

6.1 Stearic acid

6.2 Beeswax

6.3 Carnauba wax

6.4 Candelilla wax

6.5 Shellac

6.6 Paraffin wax

6.7 Others (montan and lanolin wax)

Chapter 7. Food Glazing Agents Market- By Function

7.1 Coating agents

7.2 Surface finishing agents

7.3 Firming agents

7.4 Film agents

7.5 Others (binding agents and stabilizing agents)

Chapter 8. Food Glazing Agents Market- By Application

8.1 Bakery

8.2 Confectionery

8.3 Processed meat, poultry & fish

8.4 Fruits & vegetables

8.5 Functional foods

8.6 Others (dairy products & convenience foods)

Chapter 9. Food Glazing Agents Market– By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. Food Glazing Agents Market– Key players

10.1 Mantrose-Haeuser (U.S.)

10.2 Capol (Germany)

10.3 Strahl & Pitsch (U.S.)

10.4 Masterol Foods (Australia)

Download Sample

Choose License Type

2500

4250

5250

6900