Food Flavors Market Size (2024 – 2030)

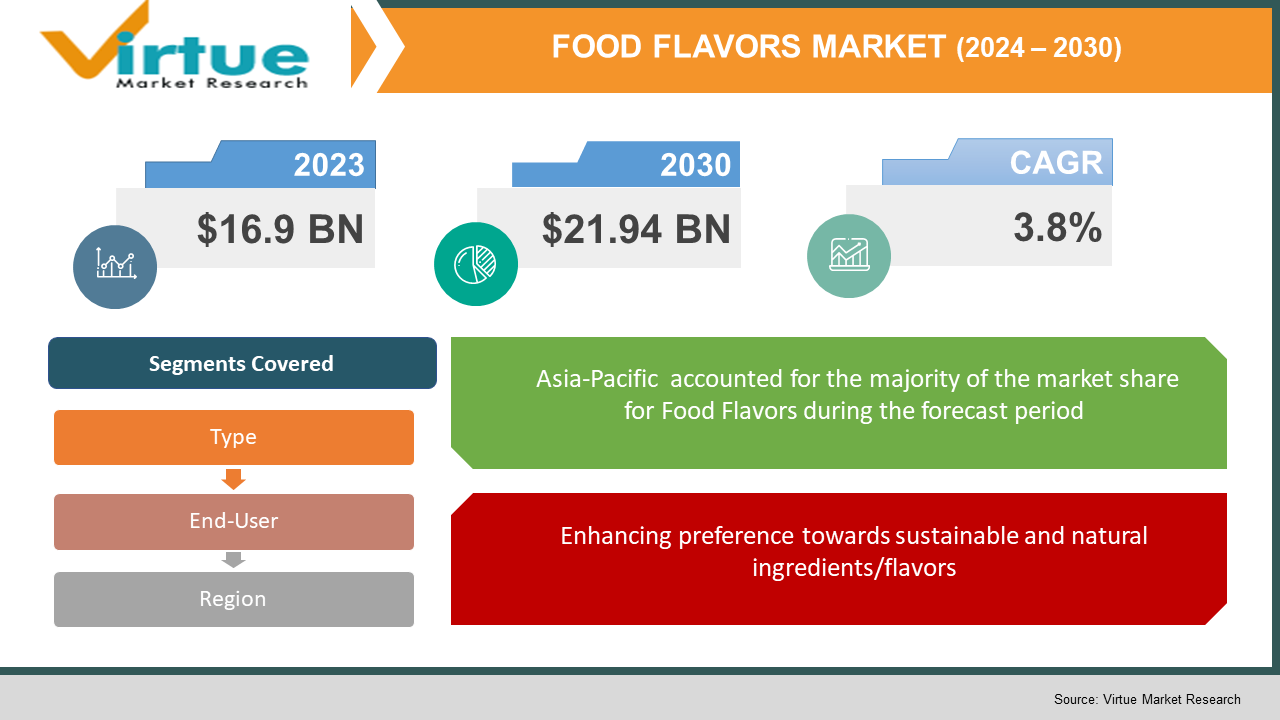

The Food Flavors Market was valued at USD 16.9 billion in 2023 and is projected to reach a market size of USD 21.94 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.8%.

One of the most significant things propelling the growth of the food flavor market is the enhanced demand for ready-to-eat foods, instant beverages, snacks, frozen meals, and other processed foods. With more people residing in cities, a higher number of women working, more middle-class people, and excess money to spend, both developed and developing parts of the globe are observing an acceleration in the demand for processed and packaged edible products. This is making the requirement for packaging and processing solutions for food develop. Because of this, food additives are added a lot in processed and ready-to-eat foods to keep the freshness and taste of the food. The demand for compounded flavors is also rising because there are additional benefits in food, exotic flavors are becoming more famous, and new products with exotic and different flavors are coming out. People all over the world are getting more concerned about how artificial ingredients and preservatives in food will affect their health in the long run. But people choose ingredients that derive from plants or are made from plants and help them survive a healthy life. So, the high production of natural flavors is aiding market growth because people love to buy ingredients that are clearly labeled and don't contain harsh chemicals.

Key Market Insights:

-

The globalization of food culture has majorly resulted in the demand for food flavors. As consumers explore and encourage cuisines from around the world, they develop a taste for diverse and unique flavors. This has generated opportunities for flavor companies to launch new and authentic international flavors in the industry. Whether it is the spicy heat of Mexican chilies, the umami richness of Japanese miso, or the flavored spices of Indian cuisine, global food flavors are earning attention and influencing market growth.

-

Modernisations in food technology have revolutionized the food flavors industry. Techniques such as encapsulation and microencapsulation have permitted for the managed release of flavors in numerous food products. This technology has strengthened the range of applications for food flavors, facilitating their use in beverages, dairy products, and even pharmaceuticals. Moreover, the usage of artificial intelligence and machine learning in flavor development has escalated the process of producing new and unique flavor profiles, pushing innovation and growth in the market.

-

The convenience or ready-to-eat and processed food sector continues to develop, fuelled by busy lifestyles and urbanization. Food flavors play a pivotal role in manufacturing these products to appeal to consumers. They increase the taste and fragrance of processed foods, ready-to-eat meals, and snacks, making them more fun. As demand for convenient food options grows globally, so does the demand for flavorings that can represent the taste of homemade and restaurant-quality items.

Food Flavors Market Drivers:

Enhancing preference towards sustainable and natural ingredients/flavors

'Clean labeling" is no longer a new wave but has become a highly rated customer demand that the global food industry is responding to by adding a focus on these aspects during the processing of a food item. Consumers are becoming more conscious of the negative health effects attached to the consumption of numerous synthetic food additives, due to various research projects as well as bans and standards introduced by governments. Such a choice shift towards clean labels and natural ingredients is mainly due to government authorities, like the WHO, FDA, EFSA, and FSSAI, who have realized the negative effects of these ingredients and laid down instructions for the use of such ingredients in food products with which food and beverage manufacturers must adhere. In addition, Natural Products Canada officially confirmed, a USD 50 billion investment fund in 2021 to assist early-stage Canadian businesses generate naturally derived alternatives for synthetic products to push the penetration of organic ingredients and substitute their synthetic counterparts. A major number of consumers have earned interest in buying clean-label goods, which provide a wide scope for naturally sourced ingredients, hence escalating the demand for natural food flavors.

Food Flavors Market Restraints and Challenges:

Standards set by Quality and Regulatory Authorities

The food flavor producers are to comply with the several regulatory standards set by the national and international food safety authorities. However, the strict regulations vary with every nation, which may cause confusion, curb the launch of new products, raise product prices, and result in product recalls, thus threatening the food flavor market growth.

Food Flavors Market Opportunities:

Adding cannabis as a natural ingredient for the development of flavor

Terpenes and cannabinoids like tetrahydrocannabinol (THC) and cannabidiol (CBD) have huge potential for use in medicine and health. Moreover, cannabis-derived chemicals have special characteristics that can exhibit distinctive flavors in food and beverages. Studies are being organized to prove that cannabis can enhance taste response and raise food sensory attractiveness. Additionally, integrating cannabis with botanicals, such as ginseng, ashwagandha, and citrus fruits, not only produces novel flavor profiles but also better the effects of cannabis on focus, sleep, and stress relief. The thought of cannabis as a flavor ingredient may create opportunities for the food flavor industry to grow significantly.

FOOD FLAVORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.8% |

|

Segments Covered |

By End-User, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Givaudan SA (Vernier, Switzerland), Symrise AG (Holzminden, Germany), Sensient Technologies Corp (Wisconsin, U.S.) Firmenich (Geneva, Switzerland), Archer-Daniels-Midland Co. (Illinois, U.S.), Kerry Group Plc (Tralee, Ireland), Corbion NV (Amsterdam, Netherlands), Koninklijke DSM NV (Herleen, Netherlands), BASF SE (Ludwigshafen, Germany) |

Food Flavors Market Segmentation: By Type

-

Natural

-

Synthetic

Based on the Type, Synthetic flavor held the dominant share in the industry. Synthetic/artificial flavors are chemical compounds that are utilised to enhance the taste of the food or increase the food flavoring properties of natural food flavors. Artificial flavors go through stringent regulatory assessments as compared to natural flavors. Chemicals utilised in artificial flavors consist less cost for processing as compared to organic flavors. Moreover, the processing time of artificial flavors is much less and is eco-friendly. Synthetic flavors are extensively used across numerous industries, particularly in the beverages and processed food industries. Similar to natural flavors, they are ready by flavorists in labs. Synthetic flavors are of two types such as natural identical flavor and artificial flavor. The key factors influencing the growth of the artificial flavor market include economic viability and easy & streamlined manufacturing process as compared to that of organic flavors.

Food Flavors Market Segmentation: By End-User

-

Beverages

-

Dairy

-

Nutrition and health

-

Savory

-

Sweet goods

Based on the End User, the beverages segment held the largest Food Flavor Market share in the market. The beverage market is popular for its unique flavors and altering flavor trends. The flavor industry is developed by advancements in beverage manufacturing technologies. Flavorists at beverage-making firms emphasize on generating a perfect blend of flavors that would add and cater to the altering preferences of customers. Usually, beverage producers do not process the flavor and outsource it to flavor companies. It involves alcoholic beverages, hot non-alcoholic beverages, cold non-alcoholic beverages, and alcoholic-free beverages. Cold non-alcoholic beverages include Ready to drink (RTD) Coffee, RTD juices, carbonated water, a flavoring agent, and a sweetener, and are held in cans or bottles post-manufacturing. Cold drinks, soda, soda pop, fizzy drinks, and others are some of the usual cold drinks consumed across the world.

Food Flavors Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on the region, Asia-Pacific held the biggest share of the market in recent years and is probably to remain the same throughout the estimated period. The global Food Flavor Market has a bigger scope for growth in the Asia-Pacific region owing to a rise in income levels and a wider consumer base for food products. The market is estimated to follow a premiumization trend due to the growth in the purchasing power of customers and demand for greater quality products. In the past 1-2 decades, various countries in the Asia-Pacific region have seen a demand in their economy due to the development of industries. China and India compete with developed nations in terms of growth due to greater productivity and a large workforce. Western fast-food chains have risen tremendously in various countries of the Asia-Pacific region. Thus, it becomes a significant region for the upcoming global food flavors market.

COVID-19 Impact Analysis on the Food Flavors Market:

The current market is estimated to be affected owing to the global pandemic caused by coronavirus disease (COVID-19). Since most of the nations faced nationwide lockdowns, the purchasing power of consumers has detrimentally impacted the growth of processed edible products. Rules and regulations imposed by several governments regarding the meeting of people in places such as all kinds of markets (hypermarkets, supermarkets, convenience stores, and others.) for buying food products have led to a slight fall in the sales of numerous edibles and beverages. Less manpower in production houses and lesser stocks of edible products in numerous underdeveloped nations have become a threat to the market. On the other hand, the shutdown of restaurants, hotels, food chains, and others has detrimentally impacted this market. Nevertheless, the market will find its speed to grow in the future years due to the regular consumption of packaged edible products.

Latest Trends:

Innovative products using Organic and Clean-label Ingredients

The latest organic trend in various developing economies and the manufacture of clean-label products are forces that aid natural and organic food flavor development. Consumers’ preference towards the consumption of natural products (chemical-free) and consciousness regarding the ingredients on labels is positively leading to the growth of natural flavoring agents. Consumers choose plant-based and plant-derived ingredients which aids them to lead a fit lifestyle. The correct amount of awareness regarding natural products among customers is also a force that helps generate demand for organic ingredients in products.

Key Players:

-

Givaudan SA (Vernier, Switzerland)

-

Symrise AG (Holzminden, Germany)

-

Sensient Technologies Corp (Wisconsin, U.S.)

-

Firmenich (Geneva, Switzerland)

-

Archer-Daniels-Midland Co. (Illinois, U.S.)

-

Kerry Group Plc (Tralee, Ireland)

-

Corbion NV (Amsterdam, Netherlands)

-

Koninklijke DSM NV (Herleen, Netherlands)

-

BASF SE (Ludwigshafen, Germany)

Chapter 1. Food Flavors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Flavors Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Flavors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Flavors Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Flavors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Flavors Market – By Type

6.1 Introduction/Key Findings

6.2 Natural

6.3 Synthetic

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Food Flavors Market – By End-User

7.1 Introduction/Key Findings

7.2 Beverages

7.3 Dairy

7.4 Nutrition and health

7.5 Savory

7.6 Sweet goods

7.7 Y-O-Y Growth trend Analysis By End-User

7.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Food Flavors Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Food Flavors Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Givaudan SA (Vernier, Switzerland)

9.2 Symrise AG (Holzminden, Germany)

9.3 Sensient Technologies Corp (Wisconsin, U.S.)

9.4 Firmenich (Geneva, Switzerland)

9.5 Archer-Daniels-Midland Co. (Illinois, U.S.)

9.6 Kerry Group Plc (Tralee, Ireland)

9.7 Corbion NV (Amsterdam, Netherlands)

9.8 Koninklijke DSM NV (Herleen, Netherlands)

9.9 BASF SE (Ludwigshafen, Germany)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Food Flavors Market was valued at USD 16.9 billion in 2023 and is projected to reach a market size of USD 21.94 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.8%.

The heightened awareness of natural ingredients is propelling the Food Flavors Market.

The Food Flavors Market is segmented based on Type, End User, and Region.

Asia-Pacific is the most dominant region for the Food Flavors Market.

Archer-Daniels-Midland Co., Kerry Group Plc, Corbion NV, Koninklijke DSM NV, and BASF SE are a few of the key players operating in the Food Flavors Market.