Food Encapsulation Market Size (2024 – 2030)

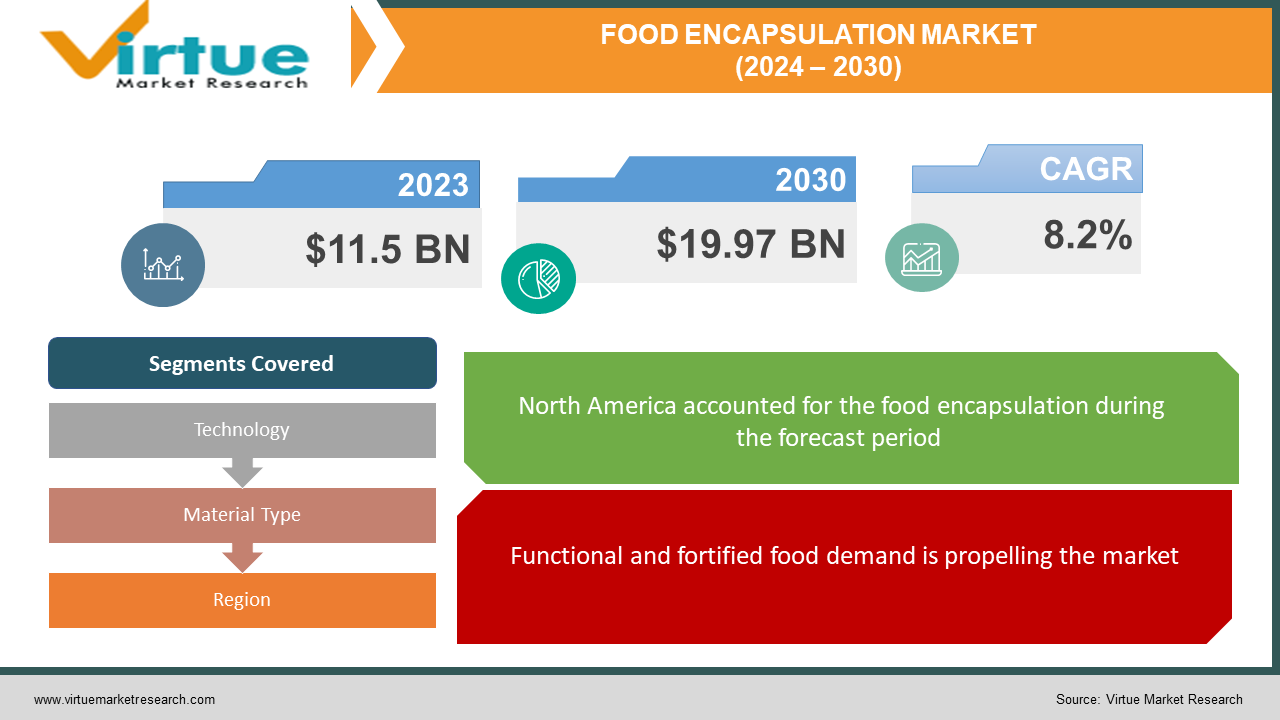

The global food encapsulation market was valued at USD 11.5 billion in 2023 and will grow at a CAGR of 8.2% from 2024 to 2030. The market is expected to reach USD 19.97 billion by 2030.

The food encapsulation market deals with technology that encases various food components, like vitamins, flavors, and colors, within a protective shell. This serves multiple purposes: masking unpleasant tastes or odors, extending shelf life, controlling the release of active ingredients, and targeting delivery within the body. This technology plays a crucial role in developing functional foods enriched with specific nutrients, enhancing convenience by masking undesirable tastes, and improving food safety by protecting perishable components.

Key Market Insights:

The food encapsulation market is booming, expected to reach USD 19.97 billion by 2030, driven by several key insights. Firstly, the demand for functional foods enriched with vitamins, probiotics, and other beneficial ingredients is propelling the market, as encapsulation helps incorporate these components while masking their potentially unpleasant taste. Secondly, the growing focus on convenience food and extending shelf life fuels the market, as encapsulation protects ingredients from degradation and improves product stability. Thirdly, the increasing demand for natural flavors and clean-label products is driving the development of natural encapsulation materials made from starches, proteins, and lipids. Finally, the market is witnessing advancements in nanotechnology and controlled release techniques, opening exciting possibilities for targeted delivery of nutrients and enhanced bioavailability. These key trends, coupled with rising consumer awareness about healthy eating and food safety, paint a promising picture for the future of the food encapsulation market.

Global Food Encapsulation Market Drivers:

Functional and fortified food demand is propelling the market.

Today's health-conscious consumers are actively seeking food that goes beyond basic nutrition, demanding products enriched with functional ingredients like vitamins, probiotics, and omega-3s. These ingredients offer a multitude of health benefits, but they are often sensitive to factors like light, oxygen, and heat, which can degrade their potency and limit their effectiveness. This is where food encapsulation comes into play. This innovative technology involves surrounding these delicate ingredients with a protective shell, shielding them from environmental threats, and ensuring they reach the body intact. By encapsulating these functional ingredients, food manufacturers can create products that deliver the desired health benefits consistently and effectively, meeting the evolving demands of a health-focused consumer market. This approach not only empowers consumers to make informed choices about their well-being but also opens doors for the development of innovative and functional food products.

The dietary market is helping the market grow.

As the focus on health and well-being intensifies, the demand for dietary supplements continues to soar. Consumers are actively seeking ways to optimize their health, making precise and effective supplement intake crucial. Encapsulation technology plays a vital role in this pursuit by addressing two key challenges associated with traditional supplements. Firstly, encapsulation ensures an accurate dosage. By precisely controlling the amount of active ingredients encapsulated within each delivery unit, manufacturers can guarantee consistent dosing across supplement batches. This eliminates inconsistencies and inaccuracies often associated with traditional powdered or liquid supplements, where precise measurement can be challenging. Secondly, encapsulation facilitates improved absorption of the active ingredients. The protective shell shields the ingredients from degradation by stomach acids and enzymes, ensuring they reach the target site in the intestine intact. This targeted delivery significantly improves bioavailability, allowing the body to absorb and utilize a greater portion of the active ingredients, maximizing the benefits of the supplement.

Increasing food safety awareness is facilitating the expansion.

In the ongoing battle against foodborne illnesses, food encapsulation offers an additional line of defense. This innovative technology acts as a shield against harmful pathogens, safeguarding food products and promoting consumer safety. By surrounding the core ingredient with a microscopic barrier, encapsulation creates a physical obstacle that hinders the growth and spread of bacteria, viruses, and other harmful microorganisms. This protective layer can significantly reduce the risk of contamination during processing, transportation, and storage, contributing to a safer food supply chain. Furthermore, encapsulation can also target specific foodborne pathogens by incorporating antimicrobial properties into the shell material. This targeted approach offers an extra layer of protection against specific threats, further enhancing food safety. Additionally, encapsulation can improve the efficacy of existing food preservation methods like refrigeration and freezing by minimizing the impact of environmental factors that can favor the growth of pathogens.

Global Food Encapsulation Market Restraints and Challenges:

Costs, consumer perception, regulatory compliance, and sustainability are the main issues that the market is currently facing.

One of the biggest barriers in the market is the associated expenses. Developing and implementing these technologies can drain smaller and medium-sized firms financially. Additionally, maintenance charges are applicable. Secondly, a lot of people might have prejudices about the nutritional value of these foods. This can create losses for the market. Thirdly, meeting stringent regulations is a hurdle. Care should be taken during the manufacturing process. Besides, the rules are different in every nation, which can create more complexities. Furthermore, certain encapsulating materials could not be recyclable or biodegradable, which would increase waste production and contamination of the environment. An increasing issue for the sector is minimizing environmental effects through process optimization and the search for eco-friendly alternatives.

Global Food Encapsulation Market Opportunities:

The food encapsulation market presents a treasure trove of exciting growth opportunities. The rising demand for functional foods enriched with targeted nutrients like probiotics and omega-3 fatty acids creates a strong demand for encapsulation solutions that can effectively incorporate these ingredients while masking their potentially unpleasant flavors. Furthermore, the ever-growing preference for convenient food options necessitates advancements in encapsulation technologies to prolong shelf life and maintain product quality. Additionally, the increasing consumer awareness of natural and clean-label products presents an opportunity for the development of eco-friendly encapsulation materials derived from plant-based sources like starches and proteins. Moreover, advancements in nanotechnology and targeted release mechanisms offer exciting possibilities for delivering specific nutrients to desired locations within the body, enhancing their bioavailability and potential health benefits. Finally, the growing focus on personalized nutrition opens doors for the development of customized encapsulation solutions tailored to individual dietary needs and preferences. By capitalizing on these opportunities and addressing the challenges of cost-effectiveness and scalability, the food encapsulation market is poised for significant expansion and innovation in the years to come.

FOOD ENCAPSULATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Technology, Material Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated, BASF SE, DuPont, FrieslandCampina Kievit, Sensient Technologies Corporation, Balchem Corporation, International Flavors & Fragrances, Inc., LIPO Technologies, Inc., ABCO Laboratories Inc, Advanced Bionutrition Corp |

Food Encapsulation Market Segmentation: By Technology

-

Microencapsulation

-

Nanoencapsulation

-

Hybrid Technologies

The food encapsulation market utilizes various technologies to encase food components like vitamins, flavors, and colors within a protective shell. Microencapsulation is the largest and fastest-growing technology. This method employs microscopic shells to provide controlled release, taste masking, and enhanced stability. This is ideal for preserving sensitive ingredients and masking unpleasant flavors. Emerging technologies like nanoencapsulation utilize even smaller shells, enabling targeted delivery of nutrients directly to desired locations within the body, potentially improving their bioavailability and health benefits. Additionally, hybrid technologies combine different techniques, like microencapsulation and coating, to achieve specific functionalities, offering greater control over ingredient release and taste profiles. As the market evolves, these advancements have the potential to revolutionize food processing and product development.

Food Encapsulation Market Segmentation: By Material Type

-

Polysaccharides

-

Proteins

-

Lipids

-

Emulsifiers

The food encapsulation market utilizes various materials to create protective shells around core food components. Polysaccharides are the largest growing segment. They include starches, gums, and cellulose. They reign supreme due to their biodegradability, safety, and cost-effectiveness. This makes them ideal for a wide range of applications. Proteins are the fastest-growing segment. They include gelatin and whey protein, which are another option, offering excellent film-forming properties and controlled release capabilities, but they tend to be more expensive. Because they have useful qualities including emulsification, gelling, and encapsulation, they are frequently used to encapsulate different bioactive substances in food items. Lipids, such as fats and oils, are suitable for encapsulating fat-soluble ingredients but pose challenges in terms of stability and potential oxidation. Finally, emulsifiers play a crucial role in stabilizing and dispersing the core material within the encapsulation matrix, ensuring a uniform and functional final product. Each material offers unique advantages and considerations, and the choice depends on the specific application and desired functionalities.

Food Encapsulation Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The global food encapsulation market flourishes in distinct regions, each offering unique growth trajectories. North America currently reigns supreme, holding the largest market share due to the presence of major technology providers and a strong consumer base seeking functional foods. Europe follows closely, showcasing steady growth driven by stringent food safety regulations and a preference for natural ingredients. However, the fastest growth rate is observed in the Asia-Pacific region, fueled by a combination of factors. Rising disposable income, increasing awareness of health benefits, and a booming food processing industry are helping the market. Latin America exhibits promising potential for future growth, driven by an expanding middle class and their growing demand for convenient and enriched food products. While the Middle East and Africa represent a developing market with growth potential, they currently hold the slowest growth rate among the mentioned regions. As the market evolves, these regional dynamics are expected to shift, with continued advancements and increasing consumer awareness shaping the future landscape of food encapsulation across the globe.

COVID-19 Impact Analysis on the Global Food Encapsulation Market

The COVID-19 pandemic had a multifaceted impact on the global food encapsulation market. While initially causing supply chain disruptions and fluctuating ingredient availability, the pandemic ultimately highlighted the critical role food encapsulation plays in the food industry. The surge in demand for shelf-stable, functional foods fueled by stay-at-home orders and a greater focus on health became a significant driver. Encapsulation technologies help incorporate immune-boosting nutrients like vitamins and probiotics into packaged goods, appealing to health-conscious consumers. On the other hand, the economic downturn and temporary closure of food service businesses somewhat hindered growth. However, as the industry adapts, the pandemic has accelerated trends that could benefit the market. The emphasis on food safety, longer-lasting products, and convenient home-prepared meals highlights the importance of encapsulation technologies. Additionally, the need for targeted delivery of nutrients and personalized nutrition offers potential growth opportunities for the market as it looks toward recovery in the post-pandemic era.

Latest trends/Developments

The food encapsulation market is buzzing with exciting trends and advancements, driven by innovation and evolving consumer preferences. Firstly, a focus on sustainability is gaining traction with the development of biodegradable and eco-friendly encapsulation materials derived from plant-based sources like starches and cellulose. Secondly, nanotechnology is making significant progress, offering the potential for targeted delivery systems that release nutrients directly to desired locations within the body, potentially enhancing their effectiveness. Thirdly, the growing interest in personalized nutrition is driving the development of customizable encapsulation solutions tailored to individual dietary needs and preferences. Additionally, controlled release mechanisms are being refined to offer precise timing and dosage of active ingredients, allowing for enhanced functionality and potential health benefits. Finally, the market is witnessing the exploration of encapsulation in novel applications beyond traditional food products, venturing into areas like nutraceuticals, pharmaceuticals, and cosmetics. These trends highlight the dynamic nature of the market and its potential to play an increasingly crucial role in the future of food technology and personalized health solutions.

Key Players:

-

Cargill, Incorporated

-

BASF SE

-

DuPont

-

FrieslandCampina Kievit

-

Sensient Technologies Corporation

-

Balchem Corporation

-

International Flavors & Fragrances, Inc.

-

LIPO Technologies, Inc.

-

ABCO Laboratories Inc

-

Advanced Bionutrition Corp

Chapter 1. Food Encapsulation Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Encapsulation Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Encapsulation Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Encapsulation Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Encapsulation Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Encapsulation Market – By Technology

6.1 Introduction/Key Findings

6.2 Microencapsulation

6.3 Nanoencapsulation

6.4 Hybrid Technologies

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Food Encapsulation Market – By Material Type

7.1 Introduction/Key Findings

7.2 Polysaccharides

7.3 Proteins

7.4 Lipids

7.5 Emulsifiers

7.6 Y-O-Y Growth trend Analysis By Material Type

7.7 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 8. Food Encapsulation Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Technology

8.1.3 By Material Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Technology

8.2.3 By Material Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Technology

8.3.3 By Material Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Technology

8.4.3 By Material Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Technology

8.5.3 By Material Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Food Encapsulation Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Incorporated

9.2 BASF SE

9.3 DuPont

9.4 FrieslandCampina Kievit

9.5 Sensient Technologies Corporation

9.6 Balchem Corporation

9.7 International Flavors & Fragrances, Inc.

9.8 LIPO Technologies, Inc.

9.9 ABCO Laboratories Inc

9.10 Advanced Bionutrition Corp

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global food encapsulation market was valued at USD 11.5 billion in 2023 and will grow at a CAGR of 8.2% from 2024 to 2030. The market is expected to reach USD 19.97 billion by 2030.

Functional and fortified foods, the growing dietary supplement market, and increasing food safety awareness are the reasons that are driving the market.

Based on technology, it is divided into three segments: microencapsulation, nanoencapsulation, and hybrid technologies.

Asia-Pacific is the most dominant region for the global food encapsulation market.

BASF SE, DuPont, FrieslandCampina Kievit, and Sensient Technologies Corporation are the major players.