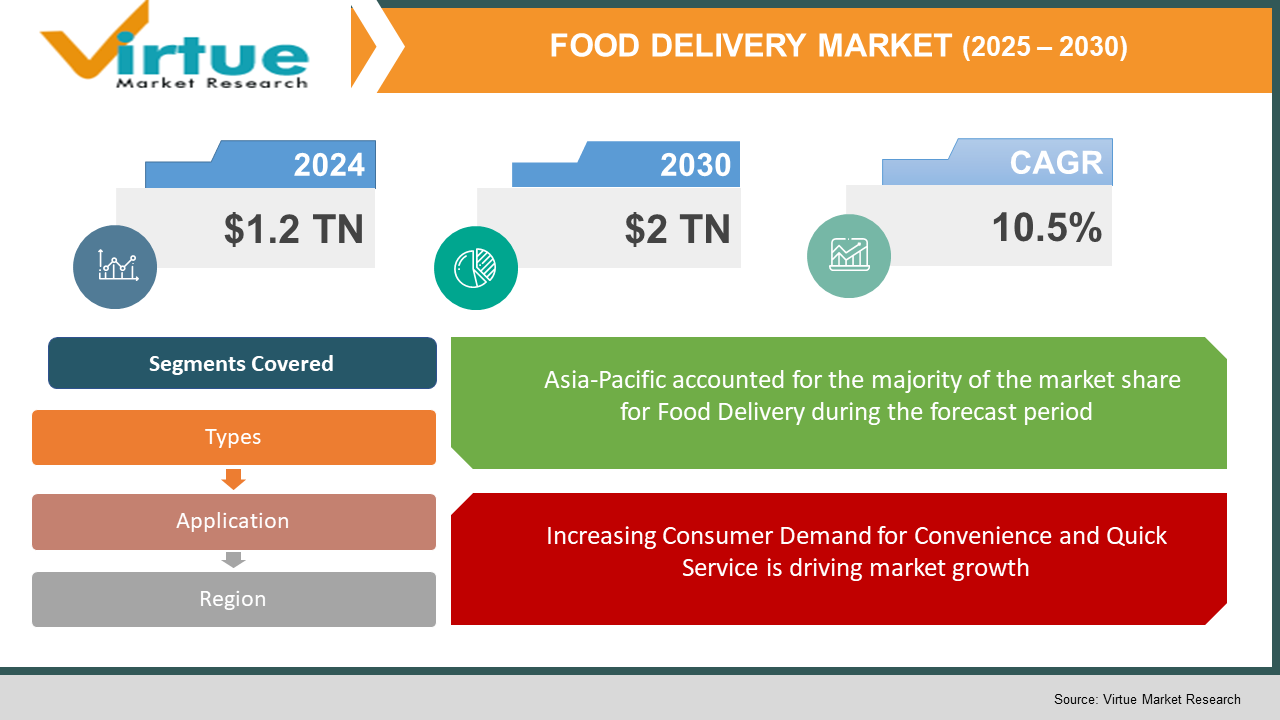

Food Delivery Market Size (2025-2030)

The Global Food Delivery Market was valued at USD 1.2 trillion in 2024 and will grow at a CAGR of 10.5% from 2025 to 2030. The market is expected to reach USD 2 trillion by 2030.

The Food Delivery Market encompasses online and offline services that enable consumers to order food from restaurants, cloud kitchens, and grocery stores. The market has expanded significantly due to the increasing penetration of smartphones, the rise of digital payment solutions, and changing consumer preferences for convenience. The growing adoption of subscription-based meal services, coupled with advancements in AI-driven logistics and delivery networks, is driving the industry forward. Additionally, the market benefits from the increasing number of partnerships between restaurants and third-party delivery service providers.

Key Market Insights:

-

The online segment dominates the market, accounting for more than 65% of total food delivery sales due to the increasing use of mobile apps and digital platforms.

-

North America and Asia-Pacific are the largest markets, contributing to more than 60% of the total revenue, driven by urbanization, high disposable incomes, and the availability of multiple delivery service providers.

-

Cloud kitchens are gaining significant traction, with the segment expected to grow at a CAGR of 13% from 2025 to 2030, reducing operational costs for food businesses.

-

Contactless payment options and AI-driven order recommendations are reshaping customer preferences and enhancing the overall user experience.

-

The rise of healthy eating trends has fueled demand for organic meal deliveries, with subscription-based services increasing by 20% year-over-year.

-

Third-party delivery services like Uber Eats, DoorDash, and Zomato dominate the market, capturing more than 50% of the total food delivery share.

Global Food Delivery Market Drivers:

Increasing Consumer Demand for Convenience and Quick Service is driving market growth:

The modern lifestyle has shifted consumer behavior towards convenience-driven purchasing patterns, leading to increased reliance on food delivery services. With the expansion of work-from-home models and fast-paced urban living, consumers prefer ordering food rather than cooking. Food delivery services offer a wide variety of cuisines, real-time tracking, and customized ordering options, making them an attractive choice. The availability of user-friendly mobile applications and AI-powered recommendation engines further enhances customer engagement. Subscription-based meal services and loyalty programs are also gaining popularity, enabling platforms to retain customers and drive repeat purchases. Additionally, businesses are investing in data analytics to understand customer preferences and optimize offerings, further fueling market growth. The emergence of 24/7 delivery services has also contributed to higher order volumes, particularly among young professionals and students.

Technological Advancements in Delivery Services and Logistics is driving market growth: Technological innovations have revolutionized the food delivery industry, making it more efficient and cost-effective. The use of AI-driven predictive analytics helps companies optimize delivery routes, reducing wait times and operational expenses. Autonomous delivery vehicles, such as drones and robotic couriers, are being tested and implemented to expedite deliveries while reducing labor costs. GPS tracking and IoT integration provide customers with real-time updates, enhancing the overall experience. Cloud kitchens, which operate without a physical dine-in space, have emerged as a profitable model by lowering rental and operational costs. The introduction of AI-powered chatbots for customer service and voice-activated ordering through smart assistants like Alexa and Google Assistant have also improved efficiency and engagement.

Rising Digital Payment Penetration and Contactless Transactions is driving market growth: The shift towards cashless transactions and the growing adoption of digital payment methods have positively impacted the food delivery market. Mobile wallets, UPI payments, and cryptocurrency options have streamlined the ordering process, making it faster and more secure. Contactless payments became essential during the COVID-19 pandemic and have remained a preferred option among consumers. Loyalty-based rewards and cashback offers from fintech companies further encourage digital transactions. The integration of AI-driven fraud detection mechanisms ensures the security of digital payments, increasing consumer trust. The collaboration between food delivery platforms and financial service providers has led to exclusive discounts and promotions, further boosting transaction volumes and revenue generation.

Global Food Delivery Market Challenges and Restraints:

High Operational Costs and Thin Profit Margins is restricting market growth: The food delivery business operates on tight profit margins due to high logistics, packaging, and customer acquisition costs. Delivery platforms often struggle with balancing commission fees for restaurants and delivery charges for consumers while maintaining affordability. The dependency on third-party delivery service providers increases operational expenses, and companies frequently offer heavy discounts to attract customers, further impacting profitability. Fluctuating fuel prices and labor costs add another layer of financial strain. Moreover, the sustainability of food packaging remains a challenge, with eco-friendly alternatives increasing operational expenses. As competition intensifies, companies must find cost-effective solutions without compromising service quality, making profitability a constant struggle.

Regulatory Challenges and Workforce Management Issues is restricting market growth: Government regulations regarding labor rights, food safety, and taxation pose significant hurdles for food delivery platforms. Many regions have imposed strict regulations on gig economy workers, requiring delivery companies to provide benefits like health insurance, paid leaves, and minimum wages. Compliance with these labor laws increases operational costs and affects the scalability of the business. Additionally, fluctuating food safety standards across different markets create challenges for multinational delivery services. The classification of delivery personnel as independent contractors rather than full-time employees remains a contentious issue, leading to legal battles and financial penalties for major service providers.

Market Opportunities:

The food delivery market presents significant opportunities for growth through expansion into untapped regions and diversification of services. Emerging economies with growing internet penetration and smartphone adoption offer lucrative opportunities for food delivery platforms. By investing in local partnerships and infrastructure, companies can expand their reach and increase their customer base. The integration of AI-driven personalized meal recommendations can improve user engagement and encourage higher order values. Sustainability initiatives, such as eco-friendly packaging and carbon-neutral delivery options, can enhance brand reputation and attract environmentally conscious consumers. The rise of grocery delivery and meal kit services adds another revenue stream, allowing companies to cater to health-conscious individuals and those looking for convenience. Expanding into rural areas through cloud kitchen networks can bridge the gap between demand and supply, fostering market growth. Subscription-based models that offer daily or weekly meal plans are gaining traction, reducing customer churn rates. Companies investing in localized content, language support, and cultural-specific meal options can enhance customer engagement and expand their presence in diverse regions.

FOOD DELIVERY MARKET REPORT COVERAGE:

|

REPORT METRIC

|

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Uber Eats, DoorDash, Zomato, Swiggy, Deliveroo, and Just Eat Takeaway. |

Food Delivery Market Segmentation:

Food Delivery Market Segmentation By Type:

• Online food delivery

• Offline food delivery

• Cloud kitchen services

• Meal subscription services

The online food delivery segment dominates the market. The growing adoption of mobile apps, digital wallets, and AI-powered recommendation systems has fueled this segment’s rapid expansion. Consumers prefer online platforms due to their convenience, wide variety of choices, and personalized promotions.

Food Delivery Market Segmentation By Application:

• Individual consumers

• Corporate orders

• Institutional catering

• Special event catering

The individual consumer segment holds the largest share in this category. The demand for on-demand food delivery services among young professionals, students, and busy households has significantly contributed to its dominance. The availability of multiple cuisine options and real-time tracking enhances the customer experience, further driving growth.

Regional Segmentation:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

Asia-Pacific is the most dominant region in the global food delivery market. The presence of large-scale urbanization, high smartphone penetration, and an increasing middle-class population have driven the market’s growth. Countries like China, India, and Japan have witnessed an exponential rise in food delivery services, primarily due to changing consumer lifestyles and a growing preference for convenience. The region has also seen a surge in local food delivery startups, further intensifying market competition. The widespread use of digital wallets and cashless payment methods has contributed to seamless transactions, enhancing consumer confidence.

COVID-19 Impact Analysis on the Food Delivery Market:

The COVID-19 pandemic significantly boosted the food delivery market as lockdowns and social distancing measures forced consumers to rely on online ordering. Restaurants shifted to delivery-only models to sustain operations, leading to a surge in cloud kitchen establishments. The demand for contactless payment methods increased, driving digital payment adoption. Grocery and meal kit deliveries also gained traction as people sought convenient and safe food options. However, operational challenges, including supply chain disruptions and labor shortages, impacted service efficiency. Many platforms implemented strict hygiene protocols and safety measures to build consumer trust. Post-pandemic, the trend of online food delivery remains strong as consumers continue to prioritize convenience and safety.

Latest Trends/Developments:

The food delivery market is undergoing significant transformations driven by technological advancements and shifting consumer preferences. One of the most notable innovations is the integration of artificial intelligence (AI) and machine learning, which are helping to enhance customer experiences by predicting order preferences and offering personalized meal recommendations. This technology is making it easier for platforms to cater to the unique tastes and dietary needs of users, while also improving operational efficiency. Additionally, the introduction of autonomous delivery vehicles, such as drones and robotic couriers, is revolutionizing the logistics of food delivery. These innovations are expected to improve delivery times, reduce costs, and increase overall efficiency, offering a futuristic solution to last-mile delivery challenges. As the market moves toward sustainability, eco-friendly packaging solutions are becoming increasingly important. Many companies are now investing in biodegradable and recyclable materials, addressing the growing demand for environmentally responsible practices within the industry. Health-conscious consumers are also influencing the market, with a rise in subscription-based meal plans and delivery services offering nutritious, diet-focused meals. These services cater to those looking for convenience without compromising on their health goals. Virtual and cloud kitchens are further reshaping the landscape by reducing overhead costs associated with physical locations, allowing food businesses to operate more efficiently while expanding their reach.

Key Players:

-

Uber Eats

-

DoorDash

-

Zomato

-

Swiggy

-

Deliveroo

-

Postmates

-

Grubhub

-

Just Eat Takeaway

-

Glovo

-

Foodpanda

Chapter 1. FOOD DELIVERY MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. FOOD DELIVERY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. FOOD DELIVERY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. FOOD DELIVERY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. FOOD DELIVERY MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. FOOD DELIVERY MARKET – By Type

6.1 Introduction/Key Findings

6.2 Online food delivery

6.3 Offline food delivery

6.4 Cloud kitchen services

6.5 Meal subscription services

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. FOOD DELIVERY MARKET – By Application

7.1 Introduction/Key Findings

7.2 Individual consumers

7.3 Corporate orders

7.4 Institutional catering

7.5 Special event catering

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. FOOD DELIVERY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. FOOD DELIVERY MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Uber Eats

9.2 DoorDash

9.3 Zomato

9.4 Swiggy

9.5 Deliveroo

9.6 Postmates

9.7 Grubhub

9.8 Just Eat Takeaway

9.9 Glovo

9.10 Foodpanda

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global food delivery market was valued at USD 1.2 trillion in 2024 and is projected to reach USD 2 trillion by 2030, growing at a CAGR of 10.5%.

Key drivers include rising demand for convenience, technological advancements, and increasing digital payment adoption

The market is segmented by type (online delivery, offline delivery, cloud kitchens) and application (individual consumers, corporate orders, catering services).

Asia-Pacific is the dominant region due to urbanization, high smartphone penetration, and increasing digital adoption

Key players include Uber Eats, DoorDash, Zomato, Swiggy, Deliveroo, and Just Eat Takeaway.