Food Containers Market Size (2024 – 2030)

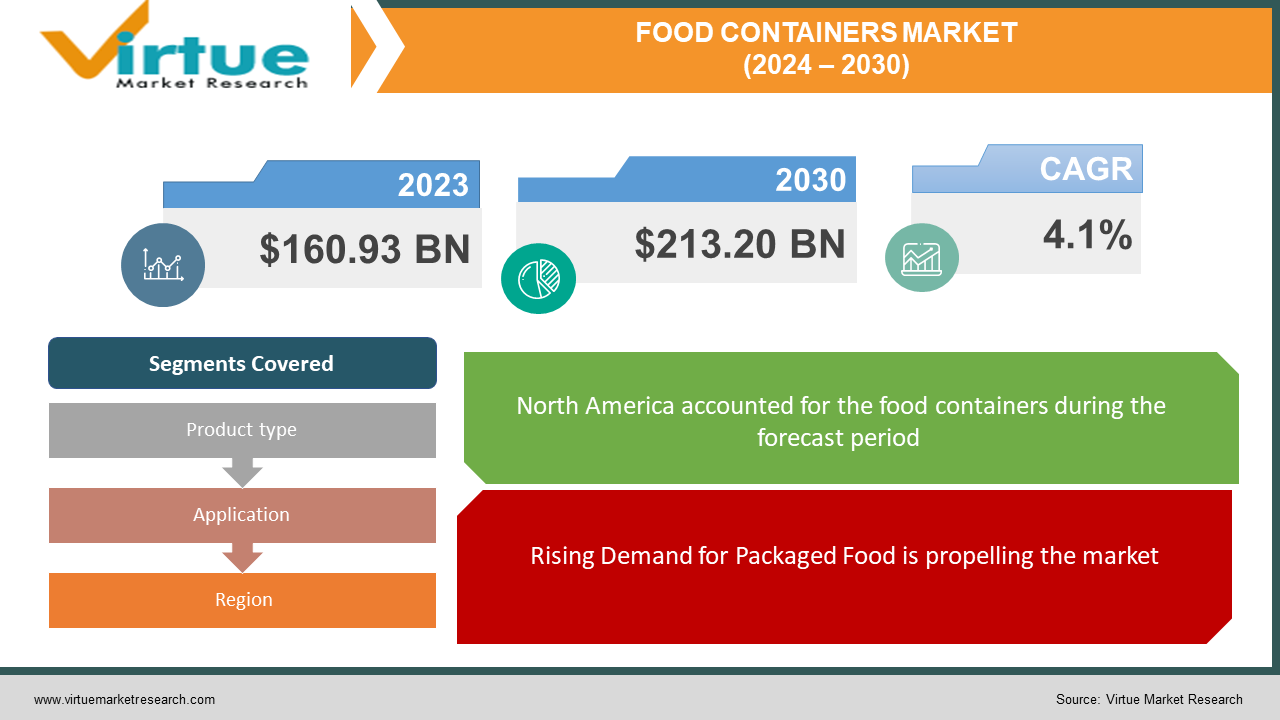

The Global Food Containers Market was valued at USD 160.93 billion in 2023 and will grow at a CAGR of 4.1% from 2024 to 2030. The market is expected to reach USD 213.20 billion by 2030.

The food container market encompasses various packaging solutions used to store, transport, and preserve food products. It caters to both household and commercial needs, offering containers made from materials like plastic, glass, and metal. This market is driven by factors like increasing demand for packaged food, convenience needs, and rising disposable income, particularly in developing regions. It is also experiencing trends towards sustainable materials and innovative functionalities like smart packaging for enhanced food safety and shelf life.

Key Market Insights:

The global food container market is experiencing a dynamic shift, driven by several key trends. Firstly, sustainability concerns are pushing the demand for eco-friendly materials like biodegradable plastics and paper, prompting the decline of traditional plastic containers. Secondly, convenience remains a major factor, with consumers seeking easy-to-use and resealable options for on-the-go meals and portion control. This is fueling the growth of single-serve and microwavable containers. Thirdly, e-commerce and online food delivery are creating new opportunities for leak-proof and tamper-evident containers that can withstand transportation and ensure food safety. Additionally, rising disposable incomes in developing nations are increasing the demand for premium and aesthetically pleasing food containers, while growing health awareness is driving the preference for BPA-free and toxin-free options. As these trends evolve, the global food container market is expected to witness continued innovation and diversification, catering to the evolving needs of consumers and businesses alike.

Global Food Containers Market Drivers:

Rising Demand for Packaged Food is propelling the market

The global food container market is thriving thanks to our fast-paced lifestyles. The ever-growing popularity of convenient, ready-to-eat meals, along with the increasing preference for packaged snacks and frozen foods, is creating a surge in demand for innovative food containers. These containers play a crucial role in the entire food supply chain, ensuring safe storage, efficient transportation, and proper preservation of these popular food items. From single-serve portions for on-the-go consumption to larger containers for bulk purchases, the food container market caters to the diverse needs of both consumers and food manufacturers. This trend is expected to continue as busy lifestyles and the desire for convenient meal options become even more prevalent across the globe. Food containers are no longer simply a means of storage – they are a vital part of the modern food industry, ensuring food safety, minimizing waste, and keeping pace with our ever-evolving eating habits.

Shifting Consumer Preferences is propelling the market

Convenience reigns supreme in today's world, and this extends to how we consume food. Consumers are ditching traditional packaging in favor of single-serve and portion-controlled options, fueling a significant shift in the global food container market. This trend is driven by several factors. Firstly, busy lifestyles and increased on-the-go consumption necessitate convenient and portable packaging solutions. Single-serve containers like lunchboxes and snack packs address this need perfectly, offering individual portions that are easy to carry and consume outside the home. Secondly, a growing emphasis on portion control and healthy eating is propelling the demand for containers that help people manage their calorie intake. These containers come in pre-determined sizes, preventing overconsumption and promoting mindful eating habits. Finally, the rise of microwaveable meals and snacks has created a demand for packaging that can withstand the heat of a microwave without compromising food safety or quality. Additionally, resealable options are gaining popularity, allowing for the storage and consumption of food in multiple sittings, reducing waste and promoting convenience. This consumer preference for single-serve, microwavable, and resealable packaging is expected to continue shaping the evolution of the food container market, with manufacturers innovating to meet the diverse needs of today's convenience-driven consumers.

Rising Disposable Incomes is propelling the market

The economic tides are turning in developing nations, and with them comes a shift in consumer preferences for food containers. As disposable incomes rise, individuals are no longer solely focused on functionality, but are increasingly drawn to premium and aesthetically pleasing food containers. This trend is driven by several factors. Firstly, growing disposable income allows consumers to invest in products that go beyond basic functionality. They are now looking for containers that enhance the overall product image, reflecting their evolving tastes and preferences. Secondly, branded containers are seen as a symbol of quality and trust, particularly appealing to consumers who are willing to pay a premium for perceived value and enhanced user experience. Additionally, the rise of social media and food photography has heightened the desire for visually appealing food storage solutions. Consumers want their food containers to not only be functional but also aesthetically pleasing, allowing them to showcase their culinary creations online. This growing demand for premium and visually captivating food containers presents a significant opportunity for manufacturers in developing economies to cater to the evolving needs of their increasingly affluent customer base.

Market Opportunities:

The food container market presents exciting opportunities across various segments. Firstly, the growing concern for sustainability is driving demand for eco-friendly materials like bamboo, bioplastics, and recycled content plastics. This shift presents an opportunity for manufacturers to develop innovative and sustainable packaging solutions that meet consumer preferences and comply with evolving regulations. Secondly, the rising popularity of convenience food and online food delivery services is creating a demand for leak-proof, portion-controlled, and microwave-safe containers. Manufacturers can cater to this trend by developing innovative packaging solutions that meet the specific needs of these growing sectors. Thirdly, the increasing focus on health and wellness is driving demand for containers that promote healthy food choices and portion control. This opens doors for the development of containers with built-in portion control markers or compartments, catering to the growing health-conscious consumer base. Finally, advancements in smart packaging technologies like temperature indicators and anti-microbial properties offer the potential to enhance food safety and extend shelf life, creating a valuable proposition for both consumers and food manufacturers. By capitalizing on these emerging trends and focusing on innovation, sustainability, and functionality, companies can unlock significant growth opportunities within the food container market.

FOOD CONTAINERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor Limited, Berry Global Group, Inc, Reynolds Group Holdings Limited, Sealed Air Corporation, Huhtamaki Oyj, Pactiv Corporation, Dart Container Corporation, Sonoco Products Company, Mondi plc, The Rexam Group PLC |

Food Containers Market segmentation - by Product Type

-

Bottles & Jars

-

Cans

-

Cups & Tubs

-

Boxes & Trays

-

Pouches & Sachets

Bottles and jars, the most commonly used type, are ideal for storing liquids and semi-liquids like beverages, sauces, and jams. These are the most dominant. Cans, Cups and tubs, pouches and sachets are moderately used. They are available in various materials, shapes, and sizes. Finally, boxes and trays are rarely used.

Food Containers Market segmentation -By Application

-

Food & Beverage

-

Cosmetics & Personal Care

-

Pharmaceuticals

-

Industrial

The food container market caters to various applications beyond just food and beverages. While food and beverage remains the dominant segment, encompassing containers for storing, transporting, and preserving a wide range of products, its reach extends further. Cosmetics and personal care, pharmaceutical industry, industrial settings are moderately used.

Food Containers Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The global food container market exhibits diverse growth patterns across regions. North America, a mature market, prioritizes convenience and single-serve options. Europe, driven by stringent regulations and environmental concerns, focuses on sustainable solutions. Asia Pacific, with its booming economy, urbanization, and rising demand for packaged food, is expected to witness the fastest growth, fueled by increasing disposable incomes. Latin America shows steady progress due to economic expansion and rising consumer spending, while the Middle East and Africa (MEA) region boasts significant growth potential due to rising disposable incomes and a growing food industry. This highlights the dynamic nature of the global food container market, with established regions focusing on specific needs and emerging regions experiencing rapid growth driven by economic and social factors.

COVID-19 Impact Analysis on the Global Food Containers Market

The COVID-19 pandemic delivered a mixed bag of impacts for the global food container market. On the one hand, there was a surge in demand for disposable food containers due to the closure of restaurants and the shift towards takeout and delivery services. This trend benefited manufacturers of single-serve containers, microwavable packaging, and leak-proof options ideal for food delivery. However, there were also challenges. Supply chain disruptions caused temporary shortages of certain materials, and lockdowns hampered production in some regions. Additionally, the heightened focus on hygiene during the pandemic led to an increased use of disposable containers, raising concerns about environmental impact and propelling the demand for sustainable and biodegradable options. Looking ahead, the market is expected to witness a return to a more balanced scenario. While takeout and delivery will likely remain popular, the focus on sustainability is expected to continue driving innovation in eco-friendly food containers. Overall, the COVID-19 pandemic has accelerated pre-existing trends in the market, emphasizing the need for convenience, hygiene, and sustainability in food packaging solutions.

Latest trends/Developments

The food container market is brimming with innovative trends and developments. Sustainability is a top priority, with consumers increasingly demanding eco-friendly materials like bioplastics, recycled content plastics, and bamboo, pushing manufacturers to develop innovative and compliant packaging solutions. The evolving online food delivery and convenience food sectors are driving the need for leak-proof, portion-controlled, and microwave-safe containers, presenting an opportunity for manufacturers to cater to these specific needs. Health and wellness considerations are influencing the market, with a growing demand for containers that promote healthy portion control and choices. This opens doors for containers with built-in portion control markers or compartments, catering to the health-conscious consumer base. Additionally, advancements in smart packaging technologies are making waves, offering temperature indicators and anti-microbial properties to enhance food safety and extend shelf life, benefiting both consumers and food manufacturers. These trends collectively point towards a future for the food container market that not only prioritizes functionality and convenience but also embraces sustainability, health, and technological advancements.

Key Players:

-

Amcor Limited

-

Berry Global Group, Inc.

-

Reynolds Group Holdings Limited

-

Sealed Air Corporation

-

Huhtamaki Oyj

-

Pactiv Corporation

-

Dart Container Corporation

-

Sonoco Products Company

-

Mondi plc

-

The Rexam Group PLC

Chapter 1. Food Containers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Containers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Containers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Containers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Containers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Containers Market – By Product Type

6.1 Introduction/Key Findings

6.2 Bottles & Jars

6.3 Cans

6.4 Cups & Tubs

6.5 Boxes & Trays

6.6 Pouches & Sachets

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Food Containers Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverage

7.3 Cosmetics & Personal Care

7.4 Pharmaceuticals

7.5 Industrial

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Food Containers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Food Containers Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Amcor Limited

9.2 Berry Global Group, Inc.

9.3 Reynolds Group Holdings Limited

9.4 Sealed Air Corporation

9.5 Huhtamaki Oyj

9.6 Pactiv Corporation

9.7 Dart Container Corporation

9.8 Sonoco Products Company

9.9 Mondi plc

9.10 The Rexam Group PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Food Containers Market was valued at USD 160.93 billion in 2023 and will grow at a CAGR of 4.1% from 2024 to 2030. The market is expected to reach USD 213.20 billion by 2030.

Rising Disposable Incomes, Shifting Consumer Preferences, Rising Demand for Packaged Food these are the reasons which is driving the market.

Based on product type it is divided into five segments – Bottles & Jars, Cans, Cups & Tubs, Boxes & Trays, Pouches & Sachets

North America is the most dominant region for the Food Containers Market.

Amcor Limited, Berry Global Group, Inc., Reynolds Group Holdings Limited, Sealed Air Corporation