Food Chamber Vacuum Machines Market Size (2024 – 2030)

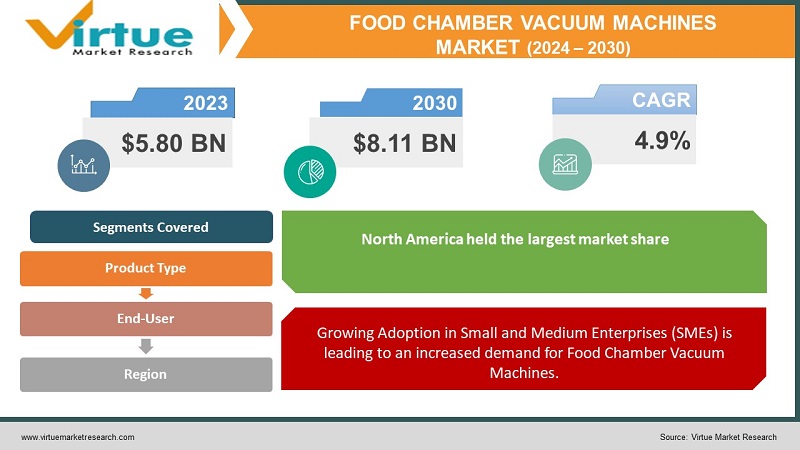

The Global Food Chamber Vacuum Machines Market was valued at USD 5.53 billion and is projected to reach a market size of USD 8.11 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.9%.

The global food chamber vacuum machines market has evolved significantly over time. In the past, these machines played a crucial role in preserving and maintaining the quality of various food products. However, in recent years, the market has experienced steady growth, driven by the increasing demand for food preservation, convenience, and extended shelf life. Looking ahead, the market is poised for continued expansion as consumers prioritize safe and hygienic food packaging. As technology advances and sustainability becomes a focus, we can expect to see further innovations and sustainable packaging solutions in this market, ensuring its continued growth in the future.

Key Market Insights:

North America has been a dominant player in the food chamber vacuum machines market, accounting for the largest revenue share in 2022. The region's strong presence in food processing industries and heightened awareness regarding food safety have contributed to its market leadership. In addition, the United States, in particular, has been a key contributor to the market's growth, with significant investments in advanced food packaging technologies.

Furthermore, the COVID-19 pandemic has accelerated the adoption of food chamber vacuum machines. Consumers and businesses have become more focused on safe and hygienic food packaging solutions, boosting demand during the pandemic. While there were some supply chain disruptions, the market quickly rebounded as the situation improved, highlighting its resilience and adaptability.

These insights underscore the market's growth trajectory, driven by the imperative need for food preservation and safety, technological advancements, and evolving consumer preferences for extended shelf life and freshness in food products.

Market Drivers:

Growing Adoption in Small and Medium Enterprises (SMEs) is leading to an increased demand for Food Chamber Vacuum Machines.

Small and medium-sized enterprises in the food industry are increasingly recognizing the benefits of Food Chamber Vacuum Machines. These machines offer cost-effective solutions for preserving and packaging food products efficiently. SMEs are leveraging vacuum packaging to extend the shelf life of their products, reduce food wastage, and maintain product quality, which is particularly crucial for businesses with limited resources. This trend is driving the market as more SMEs integrate vacuum packaging into their operations to meet consumer demands for fresher and longer-lasting food items.

Consumer Demand for fresh and minimally processed foods has increased the adaptation of Food Chamber Vacuum Machines.

Modern consumers are increasingly seeking fresh and minimally processed food products. Food Chamber Vacuum Machines play a pivotal role in meeting this demand by preserving the freshness, taste, and nutritional value of food items. By removing oxygen from packaging, these machines prevent spoilage and maintain the quality of products. As consumers prioritize health and seek natural, unaltered foods, the adoption of vacuum packaging solutions has risen significantly, driving the market's growth.

Environmental Concerns aligning with sustainability goals to reduce resource consumption and food-related emissions are leading to increased penetration in the market.

With growing environmental awareness, businesses are aligning with sustainability goals to reduce their carbon footprint. Food Chamber Vacuum Machines contribute to sustainability efforts by reducing food waste through extended product shelf life. This aligns with broader sustainability objectives to decrease resource consumption and food-related emissions. As both consumers and businesses become more environmentally conscious, the market for vacuum packaging machines is expanding as a sustainable packaging solution.

Expanding E-commerce services has boosted the demand for vacuum-sealed food products and is further driving the market.

The surge in online food retail and meal kit delivery services has fueled the demand for vacuum-sealed food products. E-commerce platforms require food items to be packaged securely for shipping while maintaining product freshness. Food Chamber Vacuum Machines provide an effective solution for meeting these requirements. As more consumers turn to online food purchases, the need for vacuum-sealed packaging solutions continues to grow, making e-commerce an influential driver in the market's expansion.

Market Challenges:

The acquisition cost of food chamber vacuum machines can be relatively high for small businesses, hindering adoption.

One of the primary challenges in the food chamber vacuum machines market is the relatively high acquisition cost, which can be a significant barrier for small businesses. These machines, while offering numerous benefits, require a considerable upfront investment that may strain the budgets of smaller enterprises. This financial hurdle can deter smaller players in the food industry from adopting vacuum packaging solutions, limiting their ability to compete effectively in the market and hindering their capacity to enhance food preservation and quality.

Maintenance and Repairs for these machines to function efficiently augment the operational costs.

Ensuring the efficient functioning of food chamber vacuum machines necessitates regular maintenance and occasional repairs. These maintenance requirements add to the operational costs incurred by businesses. While vacuum machines are valuable assets for food processing and packaging, the ongoing expenses associated with their upkeep can be burdensome for some companies. Balancing the need for maintenance with cost-efficiency becomes a crucial consideration for businesses aiming to maximize the benefits of vacuum packaging.

Adhering to food safety and packaging regulations can be complex, requiring businesses to stay updated and compliant.

Adhering to food safety and packaging regulations can be a complex and demanding task for businesses operating in the food industry. These regulations vary by region and are subject to change, requiring companies to stay consistently updated and compliant. Navigating the intricacies of regulatory compliance can be particularly challenging, as non-compliance can result in fines, recalls, and damage to a brand's reputation. Businesses must invest in resources and expertise to ensure that their vacuum packaging practices align with these stringent regulations, adding a layer of complexity to their operations and potentially increasing costs.

Market Opportunities:

Manufacturers can focus on offering customized solutions to cater to specific food industry needs creating more inclusivity.

A significant opportunity lies in the customization of food chamber vacuum machines to meet specific requirements within the food industry. Manufacturers can develop tailored solutions that cater to diverse food processing needs, whether it's optimizing packaging for fresh produce, meats, or bakery products. This approach enhances inclusivity, as businesses of all sizes and niches can benefit from vacuum packaging. Customization allows for a more precise alignment with each client's unique demands, fostering long-term partnerships and ensuring that vacuum machines seamlessly integrate into existing processes.

Exploring emerging markets presents growth opportunities, as the demand for packaged food continues to rise in these regions.

Emerging markets, particularly in Asia, Latin America, and Africa, offer substantial growth opportunities for food chamber vacuum machine manufacturers. As urbanization and changing consumer lifestyles drive the demand for packaged foods in these regions, the market for vacuum packaging solutions expands. Manufacturers can strategically tap into these markets by establishing a presence, tailoring their products to local preferences, and leveraging the rising interest in food safety and extended shelf life. By capitalizing on the growing demand in emerging markets, manufacturers can significantly boost their global footprint and revenue streams.

Automation and integration of smart technologies in food chamber vacuum machines can enhance productivity and reduce labor costs for businesses.

The integration of automation and smart technologies into food chamber vacuum machines presents a compelling opportunity for manufacturers and businesses alike. Automation streamlines packaging processes, reducing human intervention and the potential for errors. Smart technologies enable real-time monitoring and control, enhancing productivity and ensuring consistent quality. This innovation not only improves operational efficiency but also reduces labor costs. As companies seek ways to optimize production and reduce overheads, automated and smart vacuum packaging solutions become increasingly attractive, positioning manufacturers at the forefront of technological advancements in the industry.

FOOD CHAMBER VACUUM MACHINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Product Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Henkelman, Multivac, Henkovac, Promarks, Sammic VACUUBRAND, Webomatic, FoodSaver, Weston, Reber |

Food Chamber Vacuum Machines Market Segmentation: By Product Type

-

Single Chamber Vacuum Machines

-

Double Chamber Vacuum Machines

-

Rotary Vacuum Machines

In 2022, the Single Chamber Vacuum Machines segment accounted for the largest revenue share of 46.7% driven by its versatility and suitability for various food processing applications. Single-chamber vacuum machines are well-suited for small to medium-sized businesses and are used for packaging individual food items or small batches. They offer cost-effective and practical vacuum packaging solutions for a wide range of applications, making them a popular choice among businesses looking to enhance food preservation and quality.

Moreover, the Double Chamber Vacuum Machines are the fastest growing. This growth is primarily driven by their ability to enhance efficiency and productivity in medium to large-scale food production settings. As businesses seek to optimize their operations and meet the increasing demand for packaged foods, double chamber machines offer a compelling solution. Their market share is expected to continue to expand as more food processing facilities adopt them to streamline their packaging processes and reduce labor costs.

The Rotary Vacuum Machines have a smaller market share compared to single and double chamber machines, making up 17.3% of the market in 2022. While they cater to specific high-volume and automated needs, they are less commonly used due to their specialized nature.

Food Chamber Vacuum Machines Market Segmentation: By End-User

-

Flexible

-

Rigid

-

Semi-Rigid

In 2022, the Flexible segment held the largest market share of 56.8% of the food chamber vacuum machines market. Flexible packaging is highly versatile and includes materials such as plastic films, pouches, and bags. It is commonly used for vacuum packaging a wide range of food products, including snacks, fresh produce, and perishables. The flexibility and cost-effectiveness of this packaging type make it a preferred choice for various food manufacturers and retailers.

Moreover, the Semi-Rigid packaging segment is the fastest-growing at a CAGR of 7.45. While it currently holds a smaller market share of 11.3% its versatility and ability to showcase products while maintaining freshness are driving its adoption. Semi-rigid packaging falls between flexible and rigid packaging in terms of characteristics. It includes materials like clamshell containers, blister packs, and trays. Semi-rigid packaging is gaining traction in vacuum packaging, especially for products like meat cuts, seafood, and ready-to-eat meals. It offers a balance between protection and visibility, making it appealing to both consumers and businesses.

In 2022, the Industrial End-user segment held the largest market share of 43.2%. Industrial end-users encompass large-scale food manufacturers, processing plants, and facilities that require high-capacity vacuum packaging solutions. These businesses utilize food chamber vacuum machines for bulk packaging and preserving food products, including meats, dairy, and processed foods. The industrial sector heavily relies on vacuum packaging to extend shelf life, maintain product quality, and meet regulatory standards.

Moreover, the Domestic market segment is the fastest growing within the food chamber vacuum machines market. As more households recognize the benefits of vacuum packaging for preserving food freshness and reducing food waste, the demand for these machines has surged in domestic settings. Additionally, advancements in home appliance technology and increased consumer awareness of food safety have contributed to the growth of this segment. As the trend toward at-home cooking and meal preparation continues, the domestic end-user segment is expected to expand further in the coming years.

Food Chamber Vacuum Machines Market Segmentation: By Region:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, North America held the largest market share of 34.6% and therefore dominated the market. North America boasts a robust food processing industry, including meat, dairy, and packaged foods. This region's demand for vacuum packaging solutions is driven by factors like food safety regulations, the need for extended shelf life, and consumer preferences for convenience. North American businesses rely on food chamber vacuum machines to meet these demands and maintain the quality of their products.

Moreover, the Asia-Pacific is the fastest-growing segment within the food chamber vacuum machines market while holding 28.3% of the market share. Its rapid economic development, population growth, and changing consumer preferences are driving an increasing demand for packaged foods. Additionally, emerging markets within Asia-Pacific are experiencing a surge in food processing and retail industries, creating substantial opportunities for vacuum packaging solutions. As the region continues to evolve, it is expected to maintain its strong growth momentum in the food chamber vacuum machines market.

COVID-19 Impact Analysis on the Global Food Chamber Vacuum Machines Market:

The COVID-19 pandemic had a significant impact on the global food chamber vacuum machines market, triggering increased demand for food preservation and safety measures. As consumers became more conscious of food hygiene and extended shelf life during the crisis, there was a surge in the adoption of vacuum-sealed food products, bolstering the need for food chamber vacuum machines. Additionally, the trend towards home cooking and the need to preserve ingredients and leftovers at home contributed to the rise in domestic use of these machines. While the initial disruption in supply chains and manufacturing posed challenges, the food processing industry showcased resilience by implementing enhanced safety measures and automation, utilizing vacuum packaging solutions to meet the heightened demand for packaged foods. The pandemic's impact varied by region, with some areas experiencing temporary disruptions, while others, particularly in Asia-Pacific, saw continued growth in the food chamber vacuum machines market due to changing consumer behaviors and increased food production.

Latest Trends/Developments:

The food chamber vacuum machines market has witnessed a growing emphasis on sustainability and eco-friendly practices. Manufacturers are increasingly developing machines that use energy-efficient technologies and reduce resource consumption. Additionally, there is a shift towards the use of recyclable and biodegradable packaging materials in conjunction with vacuum packaging, aligning with global sustainability goals.

Automation and the integration of smart technologies continue to shape the industry. Food chamber vacuum machines are becoming more intelligent, with features like IoT connectivity, remote monitoring, and data analytics. These advancements improve operational efficiency, reduce errors, and enhance the overall performance of vacuum packaging processes.

Manufacturers are focusing on providing tailored solutions to meet specific industry needs. Whether it's a specialized vacuum packaging requirement for a particular food product or the integration of multiple functions into a single machine, customization is on the rise. This trend allows businesses to optimize their packaging processes and cater to unique product demands while maintaining efficiency and quality.

Key Players:

-

Henkelman

-

Multivac

-

Henkovac

-

Promarks

-

Sammic

-

VACUUBRAND

-

Webomatic

-

FoodSaver

-

Weston

-

Reber

In December 2022, MULTIVAC introduced the SFP Light steam flushing system, allowing the immediate vacuum packing of hot food, saving energy and extending shelf life. This innovation uses hot steam to seal food-filled cavities in plastic film without requiring cooling, eliminating residual air pockets, and killing bacteria on the food surface. It's suitable for smaller-scale kitchens and catering operations, making vacuum packing hot food more efficient and cost-effective.

Chapter 1. Food Chamber Vacuum Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Chamber Vacuum Machines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Chamber Vacuum Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Chamber Vacuum Machines Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Chamber Vacuum Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Chamber Vacuum Machines Market – By Product Type

6.1 Introduction/Key Findings

6.2 Single Chamber Vacuum Machines

6.3 Double Chamber Vacuum Machines

6.4 Rotary Vacuum Machines

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis by Product Type, 2024-2030

Chapter 7. Food Chamber Vacuum Machines Market – By END-USER

7.1 Introduction/Key Findings

7.2 Flexible

7.3 Rigid

7.4 Semi-Rigid

7.5 Y-O-Y Growth trend Analysis By END-USER

7.6 Absolute $ Opportunity Analysis By END-USER, 2024-2030

Chapter 8. Food Chamber Vacuum Machines Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By END-USER

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By END-USER

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By END-USER

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By END-USER

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By END-USER

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Food Chamber Vacuum Machines Market – Company Profiles – (Overview, Food Chamber Vacuum Machines Market Portfolio, Financials, Strategies & Developments)

9.1 Henkelman

9.2 Multivac

9.3 Henkovac

9.4 Promarks

9.5 Sammic

9.6 VACUUBRAND

9.7 Webomatic

9.8 FoodSaver

9.9 Weston

9.10 Reber

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Food Chamber Vacuum Machines Market was valued at USD 5.80 billion and is projected to reach a market size of USD 8.11 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.9%.

Key drivers include the rising demand for food preservation, growth in the food processing industry, quality assurance, technological advancements, and the impact of the COVID-19 pandemic.

Challenges include high initial costs, maintenance and repairs, and regulatory compliance.

Opportunities include customization, exploring emerging markets, and automation.

North America held the largest market share in 2022, driven by factors like food safety regulations, the need for extended shelf life, and consumer preferences for convenience.