Food Automatic Belt Packaging Market Size (2024 – 2030)

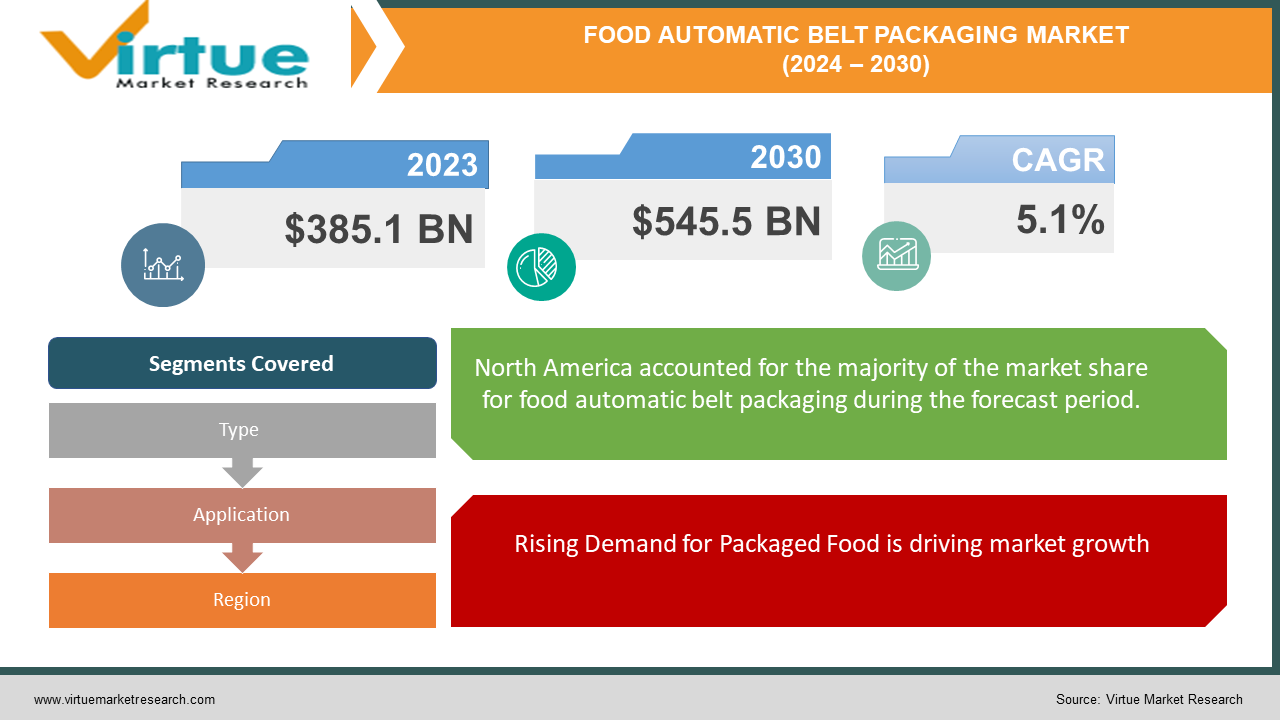

The Global Food Automatic Belt Packaging Market was valued at USD 385.1 billion in 2023 and will grow at a CAGR of 5.1% from 2024 to 2030. The market is expected to reach USD 545.5 billion by 2030.

The Food Automatic Belt Packaging Market refers to the industry focused on automated machinery that uses conveyor belts to efficiently package food products. This equipment helps streamline food processing lines, ensuring consistent and high-speed packaging for various food items. The market itself isn't readily sized independently, but its importance can be gauged by the growth of the overall food packaging market and the increasing demand for conveyor belt systems within food processing.

Key Market Insights:

The food processing industry is witnessing a rise in automation to enhance efficiency and hygiene. This trend likely translates to a growing demand for automatic belt packaging machinery within food processing facilities.

Automatic systems streamline packaging lines, reducing manual labor and ensuring consistent packaging speeds. These systems can handle various food items and package sizes, catering to diverse needs.

Automated packaging minimizes human contact with food products, promoting better hygiene standards. There's a growing need for eco-friendly packaging solutions. Manufacturers are likely developing sustainable materials for use in automatic belt packaging machines.

Global Food Automatic Belt Packaging Market Drivers:

Rising Demand for Packaged Food is driving market growth:

The rise of busy lifestyles and growing consumer preference for convenience is fueling a significant demand for automatic belt packaging systems within the food industry. This trend is driven by the increasing popularity of ready-to-eat meals, snacks, and pre-portioned ingredients. Consumers are looking for options that are quick to prepare or consume, and automatic belt packaging plays a crucial role in delivering this convenience. These systems excel at high-speed, consistent packaging for a wide variety of food products, from single-serve salads and yogurt cups to bakery goods and individually wrapped snacks. This efficiency allows manufacturers to meet the growing demand for grab-and-go options without compromising on food safety or quality. By streamlining the packaging process, automatic belt systems ensure products reach consumers quickly and in pristine condition, perfectly aligning with the fast-paced nature of modern life and the desire for effortless meal solutions.

Stringent Food Safety Regulations are driving market growth:

As global food safety regulations become increasingly stringent, automatic belt packaging systems are emerging as a vital tool for food manufacturers. These regulations are implemented to protect consumers from foodborne illnesses and ensure product quality. Traditional, manual packaging methods can introduce human error and increase the risk of contamination. Automatic belt systems, however, significantly minimize human contact with food during the packaging process. This reduces the potential for the spread of pathogens like bacteria or allergens that can occur through inadvertent hand contact. The controlled environment and automated processes within these systems also allow for the integration of sanitation protocols, such as automated cleaning and disinfection cycles, further reducing the risk of contamination. By minimizing human interaction and ensuring consistent hygiene measures, automatic belt packaging helps food manufacturers comply with evolving regulations and maintain the highest standards of food safety. This not only protects consumers but also builds brand trust and reputation within the food industry.

Labor Cost Reduction and Labor Shortages are driving market growth:

The food processing industry is facing a double whammy: rising labor costs and a shrinking pool of skilled workers. This challenge is being addressed head-on by automatic belt packaging systems. Traditionally, food packaging relied heavily on manual labor, a process that can be repetitive, demanding, and not particularly attractive to potential employees. Automatic belt packaging systems offer a solution by automating these manual tasks. By replacing human labor in repetitive tasks like product feeding, bagging, and sealing, these systems significantly reduce the number of workers needed on the packaging line. This translates to lower overall labor costs for food manufacturers. Additionally, the automation aspect makes the food processing industry a more attractive proposition for a workforce increasingly seeking less physically demanding jobs. The shift towards automated packaging allows businesses to optimize their workforce, focusing skilled workers on tasks that require human oversight and expertise, while the machines handle the high-speed, consistent packaging demands. This not only reduces costs but also helps food processors navigate the challenges of a tight labor market.

Global Food Automatic Belt Packaging Market challenges and restraints:

High Initial Investment is a significant hurdle for Food Automatic Belt Packaging:

The high initial investment cost is a significant hurdle for the wider adoption of automatic belt packaging systems, particularly for small and medium-sized food producers. These systems can be quite expensive, encompassing not just the machinery itself but also potential infrastructure modifications and integration with existing production lines. For smaller businesses with limited budgets, the upfront financial burden can be difficult to justify, especially when considering the potential return on investment. This can lead to them continuing with traditional, labor-intensive packaging methods, even if they are less efficient and potentially more prone to errors. To address this challenge, manufacturers and distributors could explore offering financing options or leasing agreements to make these systems more accessible to smaller producers. Additionally, developing modular and scalable systems that can be tailored to specific needs and production volumes would allow smaller businesses to invest in a system that grows with them, improving affordability and long-term value.

Integration Challenges are throwing a curveball at the Food Automatic Belt Packaging market:

Integrating automatic belt packaging systems into existing production lines presents a complex challenge for food processing facilities. These systems are not standalone units and require seamless coordination with existing equipment and processes. The task often involves modifying the existing infrastructure, such as conveyor belts, feeding systems, and control panels, to ensure smooth product flow and proper communication between the new and existing machinery. This customization can be a time-consuming and expensive endeavor, requiring expertise in both the existing line and the new packaging system. Additionally, the integration process often necessitates downtime for the production line, further impacting production efficiency and potentially leading to lost revenue. To mitigate these challenges, improved pre-planning, modular system designs that adapt to existing layouts, and close collaboration between system providers and food processors are crucial. By streamlining the integration process and minimizing downtime, food manufacturers can reap the benefits of automatic belt packaging systems with less disruption to their ongoing operations.

Maintenance Needs are a growing nightmare for Food Automatic Belt Packaging:

Automatic belt packaging systems, while offering efficiency and hygiene benefits, introduce a new layer of maintenance needs for food processors. To ensure these systems function optimally and avoid costly breakdowns, regular maintenance is essential. This includes tasks like cleaning, lubrication, belt adjustments, and sensor calibration. However, the cost and availability of skilled technicians to perform this maintenance can be a concern for some food manufacturers. In-house training for existing staff might be necessary, but this requires additional investment in time and resources. Alternatively, relying on external service technicians can be expensive, especially if breakdowns occur outside of regular business hours. Manufacturers should consider the long-term maintenance costs when evaluating the overall investment in automatic belt packaging systems. Potential solutions include exploring service contracts with equipment providers, offering training programs for staff, or adopting user-friendly systems with remote diagnostics capabilities that simplify troubleshooting and potentially reduce reliance on external technicians.

Market Opportunities:

The Food Automatic Belt Packaging Market presents exciting growth opportunities fueled by several key trends. The rising demand for convenient, ready-to-eat food options creates a perfect storm for these efficient packaging systems. Consumers are increasingly seeking grab-and-go meals and snacks, and automatic belt packaging excels at high-speed, consistent packaging for a wide variety of products. This caters perfectly to the fast-paced modern lifestyle and translates to faster production cycles and wider product offerings for manufacturers. Furthermore, increasingly stringent global food safety regulations necessitate minimal human contact with food during processing. Automatic belt systems address this concern by minimizing human interaction and integrating sanitation protocols, ensuring consistent hygiene and compliance with evolving regulations. This not only protects consumers but also builds brand trust and reputation. Additionally, the labor challenges faced by the food processing industry, including rising labor costs and a shrinking pool of skilled workers, are tackled by automation. These systems significantly reduce the need for manual labor in repetitive packaging tasks, lowering overall costs and making the industry more attractive to a changing workforce. However, to fully tap into this potential, the market needs to address some challenges. The high initial investment cost can be a barrier for smaller producers, and offering financing options or modular systems could improve affordability. Integration challenges can be mitigated through improved pre-planning, standardized designs, and collaboration between system providers and food processors. Maintenance needs can be addressed by exploring service contracts, staff training programs, or user-friendly systems with remote diagnostics. Finally, the growing focus on sustainability necessitates the development of eco-friendly materials compatible with these systems to minimize packaging waste. By overcoming these challenges and capitalizing on the strong growth drivers, the Food Automatic Belt Packaging Market is poised to become an even more dominant force in the food processing industry.

FOOD AUTOMATIC BELT PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Intralox (U.S.), Habasit (Switzerland), Forbo-Siegling (Switzerland), CHIORINO (Italy) ,Bühler Group (Switzerland), Syntegon (Germany), Bosch Packaging Technology (Germany), Loma Systems (U.K.), Ishida Co., Ltd. (Japan), Yamato Scale Company (Japan) |

Food Automatic Belt Packaging Market Segmentation - By Type

-

Horizontal Belt Packaging Systems

-

Vertical Belt Packaging Systems

Horizontal Belt Packaging Systems are currently the most prominent sector in the Food Automatic Belt Packaging Market. This dominance stems from their versatility in handling a wide range of food product shapes and sizes. From flat cookies to single-serve yogurt cups, horizontal systems excel at high-speed, consistent packaging. Additionally, their horizontal layout often integrates well with existing production line configurations, making them a familiar and adaptable choice for many food processors. While Vertical Belt Packaging Systems offer advantages for specific applications like bulky items, the overall dominance of horizontal systems reflects their flexibility and efficient use of space within the food processing environment.

Food Automatic Belt Packaging Market Segmentation - By Application

-

Bakery & Confectionery

-

Fruits & Vegetables

Determining the most prominent sector between Bakery & Confectionery and Fruits & Vegetables in the Food Automatic Belt Packaging Market is difficult to definitively say. Given these strengths, it's likely that the prominence between these two sectors is relatively even, with the specific market share potentially fluctuating based on consumer trends and seasonal demands. Both Bakery & Confectionery and Fruits & Vegetables are significant drivers for the Food Automatic Belt Packaging Market.

Food Automatic Belt Packaging Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Currently, North America and Europe are likely the most dominant regions in the Food Automatic Belt Packaging Market. These regions have a well-established food processing infrastructure, stricter food safety regulations driving automation adoption, and a strong presence of major food manufacturers who can readily invest in these systems. However, Asia, particularly China, is experiencing rapid growth in its food processing industry and is expected to become a significant contender in the market due to rising disposable incomes and increasing demand for convenient food options.

COVID-19 Impact Analysis on the Global Food Automatic Belt Packaging Market

The COVID-19 pandemic caused a ripple effect on the Global Food Automatic Belt Packaging Market. Initially, there were disruptions in the supply chain due to lockdowns and travel restrictions, hindering the manufacturing and delivery of these systems. However, the pandemic also accelerated some trends that benefitted the market in the long run. The surge in demand for packaged food, particularly ready-to-eat meals and shelf-stable items increased the need for efficient packaging solutions. Automatic belt systems addressed this need perfectly, ensuring hygiene and high-speed packaging. Additionally, labor shortages in the food processing industry became more pronounced during COVID-19, making automation even more attractive. As a result, the market witnessed a shift towards increased adoption of these systems in the latter half of the pandemic. Looking ahead, the focus on hygiene and efficiency in food processing is likely to remain strong, and the Food Automatic Belt Packaging Market is expected to experience continued growth as it caters to these evolving demands.

Latest trends/Developments

The Food Automatic Belt Packaging Market is witnessing exciting advancements driven by innovation and evolving consumer preferences. A significant trend is the rise of smart automatic belt packaging systems. These integrate sensors, IoT connectivity, and data analytics to provide real-time monitoring of product flow, temperature, and hygiene levels. This allows for proactive maintenance, optimizes production efficiency by identifying bottlenecks, and ensures consistent product quality. Additionally, sustainability is a growing concern. Manufacturers are developing eco-friendly packaging materials compatible with automatic belt systems. This includes bio-based films, recyclable plastics, and compostable options to minimize environmental impact. Furthermore, there's a focus on increased integration and flexibility within these systems. Manufacturers are designing modular systems that can be easily integrated with existing production lines and adapted to handle a wider variety of food product shapes and sizes. This caters to the diverse needs of food processors and allows them to adapt their packaging strategies as consumer preferences evolve. Finally, with the growing popularity of online food sales, e-commerce-friendly packaging is becoming crucial. Automatic belt systems are being designed to ensure products are securely packaged for transport and handling during delivery, minimizing damage and product loss in the online shopping experience. These trends highlight the continuous innovation and adaptation within the Food Automatic Belt Packaging Market, ensuring it remains at the forefront of efficient, hygienic, and sustainable food packaging solutions.

Key Players:

-

Intralox (U.S.)

-

Habasit (Switzerland)

-

Forbo-Siegling (Switzerland)

-

CHIORINO (Italy)

-

Bühler Group (Switzerland)

-

Syntegon (Germany)

-

Bosch Packaging Technology (Germany)

-

Loma Systems (U.K.)

-

Ishida Co., Ltd. (Japan)

-

Yamato Scale Company (Japan)

Chapter 1. Food Automatic Belt Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Automatic Belt Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Automatic Belt Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Automatic Belt Packaging Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Automatic Belt Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Automatic Belt Packaging Market – By Type

6.1 Introduction/Key Findings

6.2 Horizontal Belt Packaging Systems

6.3 Vertical Belt Packaging Systems

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Food Automatic Belt Packaging Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery & Confectionery

7.3 Fruits & Vegetables

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Food Automatic Belt Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Food Automatic Belt Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Intralox (U.S.)

9.2 Habasit (Switzerland)

9.3 Forbo-Siegling (Switzerland)

9.4 CHIORINO (Italy)

9.5 Bühler Group (Switzerland)

9.6 Syntegon (Germany)

9.7 Bosch Packaging Technology (Germany)

9.8 Loma Systems (U.K.)

9.9 Ishida Co., Ltd. (Japan)

9.10 Yamato Scale Company (Japan)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Food Automatic Belt Packaging Market was valued at USD 385.1 billion in 2023 and will grow at a CAGR of 5.1 % from 2024 to 2030. The market is expected to reach USD 545.5 billion by 2030.

The Global Food Automatic Belt Packaging Market was valued at USD 385.1 billion in 2023 and will grow at a CAGR of 5.1 % from 2024 to 2030. The market is expected to reach USD 545.5 billion by 2030.

Rising Demand for Packaged Food, Stringent Food Safety Regulations, Labor Cost Reduction, and Labor Shortages are the reasons that are driving the market.

Rising Demand for Packaged Food, Stringent Food Safety Regulations, Labor Cost Reduction, and Labor Shortages are the reasons that are driving the market.

Based on Application it is divided into two segments – Bakery & Confectionery, Fruits & Vegetables.

Based on Application it is divided into two segments – Bakery & Confectionery, Fruits & Vegetables.

North America is the most dominant region for the luxury vehicle Market.

North America is the most dominant region for the luxury vehicle Market.

Intralox (U.S.), Habasit (Switzerland), Forbo-Siegling (Switzerland), CHIORINO (Italy), Bühler Group (Switzerland).

Intralox (U.S.), Habasit (Switzerland), Forbo-Siegling (Switzerland), CHIORINO (Italy), Bühler Group (Switzerland).