Food and Beverages Process Control System Market Size (2024 – 2030)

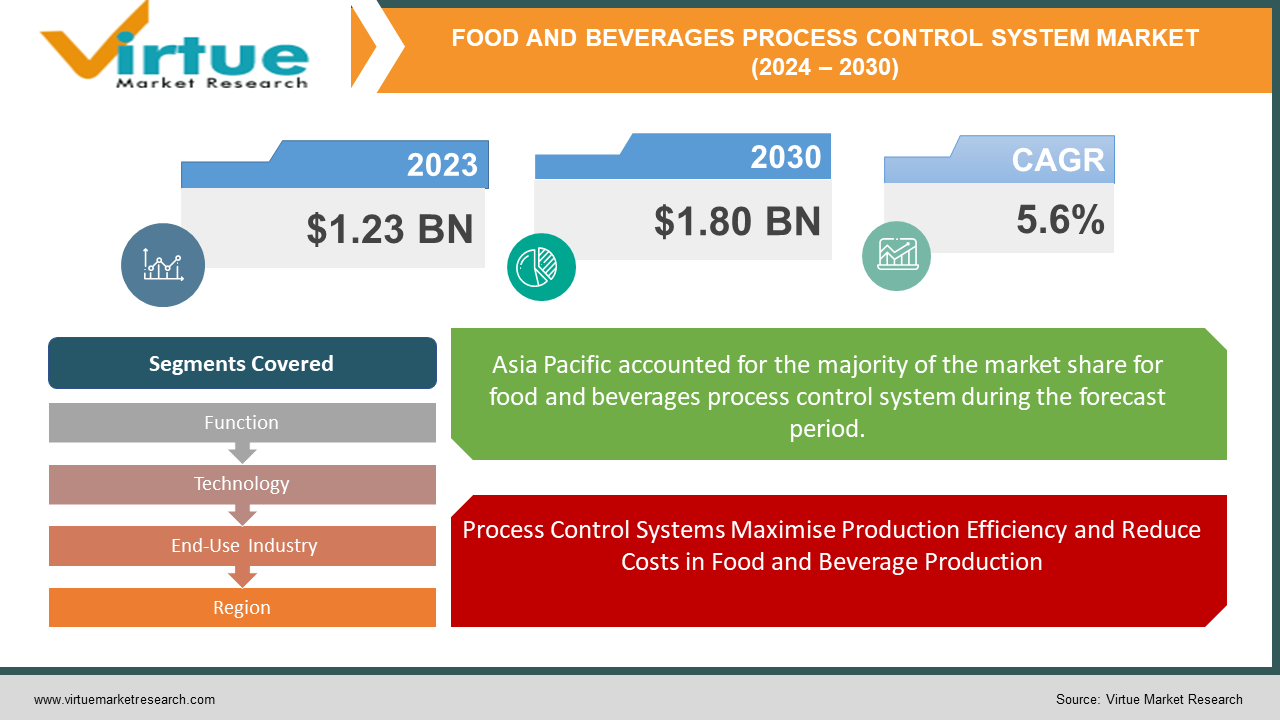

The Global Food and Beverages Process Control System Market was valued at USD 1.23 billion in 2023 and is projected to reach a market size of USD 1.80 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

Process control systems serve as the production facilities' core nervous system in the food and beverage sector. These systems use automation and data collection to monitor several manufacturing processes carefully. To control physical operations, they make use of PLCs and other industrial automation technologies. This might entail maintaining exact temperature control during brewing or baking, filling container fills at the right pace, and automating equipment to run more efficiently. In addition, the system monitors variables like temperature, pressure, and flow rates by collecting data from sensors positioned throughout the production line. via data analysis, the system can minimise waste via accurate control, maintain consistent product quality by discovering and correcting deviations, and guarantee regulatory compliance by keeping an eye on key control points.

Key Market Insights:

20% of manufacturing jobs are vacant in North America alone, the food and beverage sector is severely understaffed. Automation is increasing because of this and growing labour costs. This trend of automation is predicted to drive the global market for food and beverage process control systems, which is projected to rise at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030.

The public is becoming more conscious about food safety and traceability. 73% of consumers worldwide are prepared to pay more for goods that can be traced back to their source. This need can be met by process control systems that have strong data collection capabilities. Given the increased emphasis on food safety, the quality control systems market is projected to rise to USD 5.2 billion by 2027.

Both consumers and producers have serious concerns about sustainability. 62% of buyers are prepared to change brands in response to a company's environmental policies. Eco-friendly solutions are growing in response to the demand for process control systems. From 2023 to 2030, the energy-efficient process control systems market is expected to expand at a compound annual growth rate (CAGR) of 10.2%.

The Asia Pacific region's middle class is expanding, and its economy is developing quickly, which is driving up demand for processed foods and drinks. The food and beverage process control system market in Asia Pacific is expected to develop at the highest rate in the world by 2027, reaching a valuation of USD 18.5 billion. Urbanisation, growing disposable incomes, and government programmes supporting automation in the food and beverage industry are some of the reasons contributing to this increase.

Global Food and Beverages Process Control System Market Drivers:

To meet consumer demands for consistent quality, labour shortages, and rising costs, food and beverage production is becoming more automated thanks to process control systems.

Food and beverage industries are resorting more and more to automation in response to a combination of growing labour costs, labour shortages, and unwavering consumer demand for constant quality. The key to this transition is the use of process control systems, which automate a few production steps, including accurate container filling and temperature control during baking. In addition to addressing the labour shortage, this also yields a triple win: increased productivity by allocating human resources to higher-value duties, decreased dependency on manual labour to minimise staffing issues and expenses, and stable product quality by maintaining exact control over crucial variables. Food and beverage businesses may successfully negotiate these intricate industry problems and provide the quality and efficiency their consumers need by adopting automation with process control solutions.

Process Control Systems Maximise Production Efficiency and Reduce Costs in Food and Beverage Production

Process control systems are the new champion in the fiercely competitive food and beverage industry's never-ending quest for efficiency and cost reduction. These smart solutions function as production optimizers, going beyond simple automation. They find opportunities for waste reduction, uncover inefficiencies, and even optimise energy use by closely monitoring and managing operations. This results in a triple win in terms of cost savings: reduced energy costs, simpler production procedures, and less wasted raw resources. To put it briefly, process control systems enable food and beverage businesses to maximise their resources, which in turn improves their bottom line.

Global Food and Beverages Process Control System Market Restraints and Challenges:

Although the global market for food and beverage process control systems is promising, there are obstacles to be overcome. For smaller companies, high initial expenditures that include hardware, software, and integration may be a deterrent. Adoption may also be hampered by the requirement for staff with the necessary skills in automation, data analysis, and industry-specific knowledge. When integrating new systems with preexisting equipment, integration issues may occur, leading to delays and disruptions in production. Data breaches and other cybersecurity risks are becoming more and more of a worry as these systems are increasingly integrated. Manufacturers must make sure their systems adhere to stringent requirements set by the food and beverage sector, which increases complexity and costs. This is known as regulatory compliance. Lastly, the always-changing world of technology might make it difficult to stay up to date because changes add to the total workload.

Global Food and Beverages Process Control System Market Opportunities:

The need from consumers for food that is safe and traceable is growing, and these systems offer instruments for reliable data collection and supply chain tracking. Our fast-paced lifestyles have led to growth in the convenience food sector, which makes process management systems a great fit for ensuring reliable, effective manufacturing. The demand for processed food and drinks will increase in developing nations as disposable incomes grow, providing opportunities for vendors operating in those areas. By allowing real-time optimisation, waste minimization, and predictive maintenance, the integration of cutting-edge technologies like artificial intelligence and machine learning holds the potential to completely transform process control. Manufacturers are keen for solutions that optimise energy use, minimise water use, and decrease waste since sustainability is their top concern. And last, there is a lot of room for growth for cloud-based solutions that provide scalability, remote access, and easier data administration.

FOOD AND BEVERAGES PROCESS CONTROL SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Function, Technology, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB (Switzerland-Sweden), Emerson Electric Co. (USA),. Endress+Hauser (Switzerland), GEA Group (Germany), Honeywell International (USA), Rockwell Automation (USA), Schneider Electric (France), Siemens AG (Germany), Tetra Pak (Sweden), Yokogawa Electric Corporation (Japan) |

Global Food and Beverages Process Control System Market Segmentation: By Function

-

Production Control Systems

-

Quality Control Systems

-

Inventory Management Systems

-

Cleaning and Sanitation Systems

In the global market for process control systems for food and beverages, quality control systems are the rising stars. A few causes are driving this spike, including customer demands for safety and transparency, tighter laws, the need to safeguard brand reputation, and the incorporation of cutting-edge technology like artificial intelligence (AI) for real-time risk management. Production control systems are important, but quality control systems are emerging as the fastest-growing market category due to the unwavering focus on food safety.

Global Food and Beverages Process Control System Market Segmentation: By Technology

-

Distributed Control Systems

-

Programmable Logic Controllers

-

Supervisory Control and Data Acquisition Systems

-

Human-Machine Interface Systems

Nowadays, distributed control systems (DCS) are in charge because of their capacity to manage intricate, large-scale processes. They might reach a growth plateau, though. For certain applications, programmable logic controllers (PLCs) provide a flexible and cost-effective substitute that guarantees continuous expansion. Meanwhile, because of its emphasis on real-time data that is essential for optimisation, Supervisory Control and Data Acquisition Systems (SCADA) are becoming more and more popular. Probably neck and neck in the fastest-growing sector are SCADA and PLCs. Smaller firms entering the automation space find PLC appealing due to its price, but SCADA's strength resides in data-driven optimisation.

Global Food and Beverages Process Control System Market Segmentation: By End-Use Industry

-

Dairy Processing

-

Bakery & Confectionery

-

Meat, Poultry & Seafood

-

Fruits & Vegetables

-

Beverages (alcoholic & non-alcoholic)

Dairy processing and beverages are vying for supremacy in the global market for food and beverage process control systems by the end-use industry. Because they both need exact control and constant quality, these are the top categories. But tighter laws and a growing need for easily accessible protein sources are driving Meat, Poultry & Seafood Processing to the forefront of expansion. This market is adopting automation for jobs like packing and cutting, which is laying the groundwork for sophisticated process control systems. The market will be dynamic in the future, with every industry striving for efficiency and optimisation.

Global Food and Beverages Process Control System Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With the quickest rate of growth and the highest share soon, Asia Pacific leads the market for food and beverage process control systems. Booming economies feed the growing middle class's appetite for quick food. This desire is echoed by rapid urbanisation. The adoption of these control systems is further accelerated by government funding for automation in the food production process. The enormous Asian population generates a sizable market, and process control systems enable businesses to effectively supply safe, high-quality food to satisfy this demand. Although North America is now in the lead, Asia Pacific's rapid expansion points to a potential takeover soon.

COVID-19 Impact Analysis on the Global Food and Beverages Process Control System Market:

The global market for food and beverage process control systems was dealt a double-edged blow by the COVID-19 epidemic. Initial expansion was impeded by supply chain disruptions and economic uncertainties, leading to delays in the installation of new systems and crucial components. Companies that were experiencing financial difficulties also put off making upgrades to their process control systems. Additionally, it was difficult to maintain and run the current systems efficiently due to a labour shortage brought on by disease and social isolation. But the epidemic also brought with it unanticipated possibilities. The demand for automation solutions surged because of the need to reduce human interference on production lines owing to labour constraints. Process control systems surfaced as a workable solution, providing the capacity to oversee production with a minimum of personnel. In a similar vein, the significance of remote monitoring became evident. Businesses are looking for more and more devices that enable process monitoring and troubleshooting from remote locations. Lastly, a stronger focus on data-driven quality control resulted from the pandemic's increased worries about food safety and cleanliness. For factories, process control systems with strong monitoring features have become more significant assets.

Recent Trends and Developments in the Global Food and Beverages Process Control System Market:

Innovation abounds in the global market for process control systems for food and beverages. The emergence of "smart factories," which combine automation and data analysis, is one significant trend. Process control systems are becoming more sophisticated systems that use machine learning to optimise manufacturing processes in real-time and do predictive maintenance. Furthermore, cloud computing is laying the groundwork for cloud-based solutions, which provide manufacturers with simplified data administration, scalability, and remote access. But more connection also means more need for strong cybersecurity. It is reasonable for manufacturers to invest in measures to protect their systems from hacker assaults and data leaks. Even more accurate control and optimisation are made possible by the expanding role of the Internet of Things (IoT), which is made up of a variety of sensors and devices that input real-time data into process control systems. Lastly, systems that maximise energy utilisation, minimise waste, and lessen the environmental impact of food and beverage manufacturing are in high demand due to sustainability. Future food and beverage process control systems can expect increased efficiency, consistent product quality and safety, and a dedication to sustainable practices as these trends come together.

Key Players:

-

ABB (Switzerland-Sweden)

-

Emerson Electric Co. (USA)

-

Endress+Hauser (Switzerland)

-

GEA Group (Germany)

-

Honeywell International (USA)

-

Rockwell Automation (USA)

-

Schneider Electric (France)

-

Siemens AG (Germany)

-

Tetra Pak (Sweden)

-

Yokogawa Electric Corporation (Japan)

Chapter 1. Food and Beverages Process Control System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food and Beverages Process Control System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food and Beverages Process Control System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food and Beverages Process Control System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food and Beverages Process Control System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food and Beverages Process Control System Market – By Function

6.1 Introduction/Key Findings

6.2 Production Control Systems

6.3 Quality Control Systems

6.4 Inventory Management Systems

6.5 Cleaning and Sanitation Systems

6.6 Y-O-Y Growth trend Analysis By Function

6.7 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 7. Food and Beverages Process Control System Market – By Technology

7.1 Introduction/Key Findings

7.2 Distributed Control Systems

7.3 Programmable Logic Controllers

7.4 Supervisory Control and Data Acquisition Systems

7.5 Human-Machine Interface Systems

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Food and Beverages Process Control System Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Dairy Processing

8.3 Bakery & Confectionery

8.4 Meat, Poultry & Seafood

8.5 Fruits & Vegetables

8.6 Beverages (alcoholic & non-alcoholic)

8.7 Y-O-Y Growth trend Analysis By End-Use Industry

8.8 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Food and Beverages Process Control System Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Function

9.1.3 By Technology

9.1.4 By By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Function

9.2.3 By Technology

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Function

9.3.3 By Technology

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Function

9.4.3 By Technology

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Function

9.5.3 By Technology

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Food and Beverages Process Control System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ABB (Switzerland-Sweden)

10.2 Emerson Electric Co. (USA)

10.3 Endress+Hauser (Switzerland)

10.4 GEA Group (Germany)

10.5 Honeywell International (USA)

10.6 Rockwell Automation (USA)

10.7 Schneider Electric (France)

10.8 Siemens AG (Germany)

10.9 Tetra Pak (Sweden)

10.10 Yokogawa Electric Corporation (Japan)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Food and Beverages Process Control System Market size is valued at USD 1.23 billion in 2023.

The worldwide Global Food and Beverages Process Control System Market growth is estimated to be 5.6% from 2024 to 2030.

The Global Food and Beverages Process Control System Market is segmented By Function (Production Control Systems, Quality Control Systems, Inventory Management Systems, Cleaning and Sanitation Systems); By Technology (Distributed Control Systems, Programmable Logic Controllers, Supervisory Control and Data Acquisition Systems, Human-Machine Interface Systems); By End-Use Industry (Dairy Processing, Bakery & Confectionery, Meat, Poultry & Seafood, Fruits & Vegetables, Beverages (alcoholic & non-alcoholic)) and by region.

Owing to a few new developments, the global market for food and beverage process control systems is anticipated to rise significantly. First, customers want food that has ever-higher levels of traceability and transparency. To address these needs, sophisticated data-collecting capabilities in process control systems will be essential. Second, the sector is about to embrace cutting-edge technology like artificial intelligence and machine learning. Because of this, predictive maintenance will be possible, avoiding expensive downtime and maximising process efficiency. And last, there's a rising worry over sustainability. Eco-friendly process control systems that minimise energy use and lessen environmental effects will become more prevalent in the industry.

The worldwide market for food and beverage process control systems has been affected by the COVID-19 epidemic in several ways. On the one hand, social distancing policies and labour shortages have led to a rise in the need for automation and remote monitoring systems. However, the investment in new process control systems has slowed down due to supply chain disruptions and economic instability.