Food & Agriculture Technology and Products Market Size (2024 – 2030)

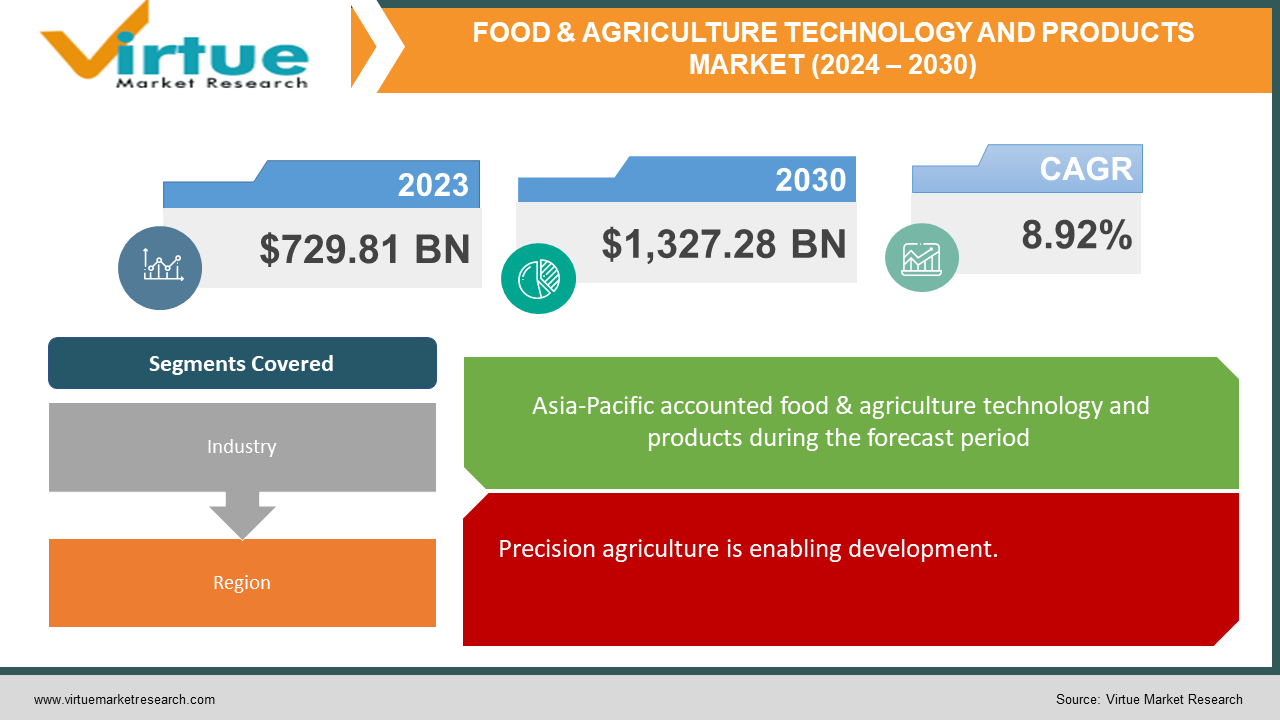

The global food & agriculture technology and products market was valued at USD 729.81 billion in 2023 and is projected to reach a market size of USD 1,327.28 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.92%.

A wide range of inventions and solutions targeted at completely changing the production, processing, and distribution of food are included in the food and agricultural technology and goods industries. This industry addresses issues with food security, sustainability, and efficiency throughout the food supply chain by utilizing state-of-the-art technologies, scientific discoveries, and sustainable practices.

Key Market Insights:

The food & agriculture technology market is on a trajectory of significant change, driven by the need to address global food security concerns and fueled by exciting technological advancements.

Smaller farms may be negatively impacted by high installation costs, and privacy and data security concerns require effective solutions. Other issues include handling customer skepticism and effectively integrating new technology. Encouraging government policies and well-defined laws are essential for promoting responsible conduct and market expansion.

Artificial intelligence and big data hold immense potential for personalized recommendations that optimize resource use for farmers. Blockchain technology offers a solution for enhanced transparency throughout the food chain, building consumer trust. Growing investments in AgTech startups are pushing the boundaries of innovation, and advancements in areas like personalized nutrition and sustainable practices like vertical farming can revolutionize the food system.

Food & Agriculture Technology and Products Market Drivers:

Precision agriculture is enabling development.

Technological advancements like sensor-equipped drones and data analytics are paving the way for precision agriculture. Farmers can now gather real-time data on soil conditions, crop health, and weather patterns. This allows for targeted applications of water, fertilizer, and pesticides, maximizing yield and minimizing waste.

The rise of automation is driving market growth.

Robotics and automation are increasingly playing a role in food production. From automated milking machines to robotic harvesters, these technologies are addressing labor shortages, improving efficiency, and enhancing food safety.

Indoor and vertical farming are contributing to the success:

As urban populations grow and land becomes scarce, indoor and vertical farming techniques are gaining traction. These methods use controlled environments and innovative lighting systems to grow crops year-round, even in densely populated areas.

Alternative protein sources are elevating the demand:

Concerns about the environmental impact of traditional meat production are driving the development of alternative protein sources. Plant-based meats, insect protein, and even lab-grown meat are emerging as viable options, offering consumers new choices while potentially reducing their environmental footprint.

E-commerce and direct-to-consumer models are boosting the market:

Online grocery shopping is on the rise, and the food & agricultural tech market is adapting. Direct-to-consumer models that connect farmers to consumers are growing, offering increased transparency and potentially fresher produce for consumers.

Food & Agriculture Technology and Products Market Restraints and Challenges:

The cost of implementing tech solutions is a major challenge.

Many innovative food & agriculture technology solutions, such as advanced sensor technology or automation equipment, come with a hefty price tag. This initial investment can be prohibitive for small and medium-sized farms, potentially creating an uneven playing field and hindering wider adoption.

Data security and privacy concerns can hinder the market's growth.

The increasing reliance on data collection in precision agriculture raises concerns about data security and privacy. Farmers need assurances that their sensitive data is protected from cyberattacks or unauthorized access. Additionally, consumer privacy regarding data collected through online food purchases or loyalty programs needs to be addressed.

Infrastructure and integration challenges are faced by the market.

Integrating new technologies into existing agricultural practices can be challenging. Rural areas may lack the necessary infrastructure, such as reliable internet connectivity, to fully utilize certain food & agriculture technology solutions. Additionally, ensuring seamless integration of new technologies with existing farm management systems requires careful planning and technical expertise.

Lack of consumer acceptance and education can create losses.

Not all consumers readily embrace new technologies in their food. Skepticism regarding the safety of genetically modified organisms (GMOs) or lab-grown meat, for example, can pose hurdles. Educating consumers about the benefits and safety of food & agriculture technology solutions will be crucial for their wider acceptance.

A complex regulatory landscape and policy support can create obstacles.

The regulatory landscape surrounding food & agricultural tech products is still evolving. Establishing clear and efficient regulations for novel technologies, such as alternative protein sources, is essential to ensure consumer safety and market growth. Additionally, government policies that incentivize the adoption of sustainable farming practices or provide support for infrastructure development in rural areas can significantly aid the food & agricultural technology market.

Food & Agriculture Technology and Products Market Opportunities:

Artificial intelligence (AI) and big data integration provide the market with many possibilities.

By harnessing the power of AI and big data analytics, Food & Ag Tech can reach new heights. AI can analyze vast datasets on weather patterns, soil conditions, and crop health, allowing for hyper-personalized recommendations for farmers, optimizing resource management, and maximizing yields.

Blockchain technology for transparency and traceability is beneficial.

Blockchain technology offers a secure and transparent way to track food from farm to fork. This can enhance consumer trust by providing verifiable information about the origin, production methods, and sustainability practices employed throughout the food chain.

The rise of agritech startups and venture capital is increasing profits.

Investment in food & agriculture technology is flourishing, with a growing number of startups developing innovative solutions. This influx of venture capital fuels research and development, pushing the boundaries of what's possible and accelerating breakthroughs in the field.

Personalized nutrition is aiding the expansion.

Food & Ag Tech has the potential to personalize our food choices through advancements in precision nutrition. By analyzing individual health data, technology can recommend customized diets and products tailored to specific needs, paving the way for food-as-medicine approaches to preventive healthcare.

Combating food waste and promoting sustainability are helping meet the demand.

Technologies like AI-powered inventory management systems and smart packaging can significantly reduce food waste throughout the supply chain. Additionally, advancements in vertical farming and regenerative agriculture practices can minimize environmental impact and create a more sustainable food system for future generations.

FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.92% |

|

Segments Covered |

By Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ADM (US), Evonik (Germany), DSM (Netherlands), United Technologies (US) Deere & Company (US), Daikin (Japan), Signify Holdings (Netherlands), SGS SA (Switzerland), Zoetis (UK), GEA (Germany) |

Food & Agriculture Technology and Products Market Segmentation: By Industry

-

Animal

-

Agriculture

-

Cold Chain

-

Food & Beverage

-

Cannabis

The agriculture industry represents the largest segment within the market, with several factors contributing to its dominance. One key aspect is the broader applicability of agricultural technologies, which cater to a wide range of crop production practices. Precision agriculture tools and automation solutions, for example, are relevant across diverse agricultural activities. Additionally, the agriculture industry attracts substantial investments due to its pivotal role in ensuring global food security and meeting the increasing demands for food. This influx of investment fosters a rapid pace of innovation and higher adoption rates of new technologies in agriculture compared to other segments. Furthermore, the industry benefits from its maturity and well-established infrastructure, which facilitates the smoother implementation and broader scalability of new food & agricultural technology solutions. The cold chain is the fastest-growing segment. There is a greater requirement than ever for effective cold chain logistics due to customer demands for fresher goods and tighter laws controlling food safety. This sector includes a variety of products and services, including temperature monitoring systems, storage facilities, and refrigerated transportation. The cold chain industry is expanding rapidly and attracting substantial investment as the demand for perishable items rises globally and the significance of preserving product quality along the whole supply chain is realized.

Food & Agriculture Technology and Products Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In the market for food and agriculture technology and products, Asia-Pacific is the largest growing market. The area has tremendous development potential in this field because of its sizable population base, rising rates of urbanization, rising disposable incomes, and government investments in agricultural technology. Farmers are particularly proactive in adopting precision agriculture technologies like sensor-based systems and data analytics, further solidifying the region's leadership in the market. North America is the fastest-growing market. This dominance can be attributed to several key factors. Firstly, North America has a strong legacy of innovation in agriculture, supported by a well-established research and development infrastructure, which attracts leading AgTech companies and talent. Additionally, governments in North America provide significant financial support and incentives for the development and adoption of food & agriculture technology solutions, creating a favorable environment for startups and established players alike. Moreover, the region boasts a large and technologically advanced agricultural sector, making it more receptive to integrating new technologies into farming practices.

COVID-19 Impact Analysis on the Global Food & Agriculture Technology and Products Market:

The COVID-19 pandemic delivered a mixed impact on the market. Initial disruptions were undeniable, with restrictions on movement hindering supply chains and causing labor shortages. This, coupled with the closure of restaurants and food service establishments—significant consumers of agricultural products—led to a decline in demand for some technologies. However, the market also demonstrated remarkable resilience. Technologies facilitating remote monitoring and management, like sensor-based systems and data analytics, proved valuable tools during lockdowns. Additionally, a shift towards home cooking could potentially benefit technologies related to indoor farming or vertical farming as consumers seek alternatives to traditional grocery shopping. The pandemic also accelerated the adoption of e-commerce platforms for both farmers and consumers. This trend, combined with the growing focus on supply chain transparency, can create opportunities for blockchain technology in the food & agriculture tech space. Overall, the COVID-19 pandemic's long-term impact on the food & agriculture technology market is still unfolding. However, the market's adaptability and the potential for certain technologies to thrive in a post-pandemic landscape suggest continued growth in the years to come.

Latest Trends/ Developments:

In April 2022, with the use of machine learning, AI perception, and robotics technology, Verdant Robotics unveiled a robotic farming system that can assist in spraying and weeding concurrently.

Key Players:

-

ADM (US),

-

Evonik (Germany)

-

DSM (Netherlands)

-

United Technologies (US)

-

Deere & Company (US)

-

Daikin (Japan)

-

Signify Holdings (Netherlands)

-

SGS SA (Switzerland)

-

Zoetis (UK)

-

GEA (Germany)

Chapter 1. FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET – By Industry

6.1 Introduction/Key Findings

6.2 Animal

6.3 Agriculture

6.4 Cold Chain

6.5 Food & Beverage

6.6 Cannabis

6.7 Y-O-Y Growth trend Analysis By Industry

6.8 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 7. FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Industry

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Industry

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Industry

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Industry

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Industry

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. FOOD & AGRICULTURE TECHNOLOGY AND PRODUCTS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 ADM (US),

8.2 Evonik (Germany)

8.3 DSM (Netherlands)

8.4 United Technologies (US)

8.5 Deere & Company (US)

8.6 Daikin (Japan)

8.7 Signify Holdings (Netherlands)

8.8 SGS SA (Switzerland)

8.9 Zoetis (UK)

8.10 GEA (Germany)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global food & agriculture technology and products market was valued at USD 729.81 billion and is projected to reach a market size of USD 1,327.28 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.92%.

Precision agriculture, the rise of automation, indoor and vertical farming, alternative protein sources, and e-commerce & direct-to-consumer models are propelling the global food & agriculture technology and products market.

Based on industry, the global food & agriculture technology and products market is segmented into animal, agriculture, cold chain, food & beverage, and cannabis.

Asia-Pacific is the most dominant region for the global food & agriculture technology and products market.

ADM, Evonik, and DSM are the key players operating in the global food & agriculture technology and products market.