FMD Vaccine Market Size (2025-2030)

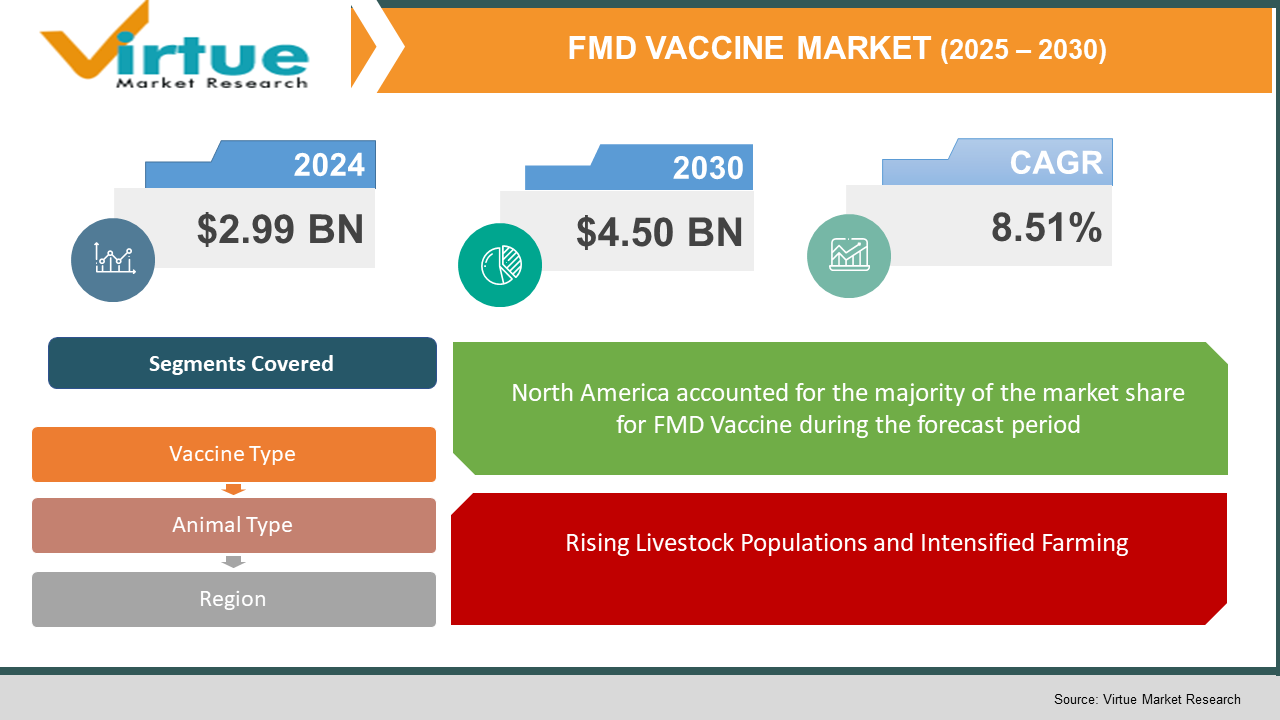

The FMD Vaccine Market was valued at USD 2.99 billion and is projected to reach a market size of USD 4.50 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.51%.

The Foot and Mouth Disease (FMD) vaccine market addresses a critical need in global animal health management, particularly in regions where the disease remains endemic. FMD is a highly contagious viral disease that affects cloven-hoofed animals such as cattle, pigs, sheep, and goats, often leading to significant economic losses due to trade restrictions and decreased productivity. Vaccination is a primary control strategy, especially in Asia, Africa, and South America, where outbreaks are more common. Governments and veterinary organizations play a central role in vaccine procurement and distribution, often through mass immunization programs. The market includes various vaccine types, with inactivated vaccines being the most widely used due to their safety and effectiveness.

Marker vaccines are gaining attention as they help differentiate between infected and vaccinated animals, supporting disease surveillance. Key market players include multinational pharmaceutical companies as well as regional manufacturers, many of whom operate under public-private partnerships. Regulatory frameworks and disease control policies significantly influence vaccine demand and distribution in different countries. Seasonal outbreaks, livestock density, and cross-border animal movement are also critical factors driving vaccine usage. The market operates within a complex ecosystem involving veterinary services, livestock producers, government agencies, and international health organizations.

Key Market Insights:

Cattle account for the majority of FMD vaccine usage, making up more than 50% of the vaccinated animal population globally. This is largely due to the economic importance of dairy and beef production, as infected cattle can suffer up to a 40% drop in milk output.

Inactivated (or killed) vaccines represent over 80% of the total FMD vaccine market. Their widespread adoption is attributed to safety, regulatory acceptance, and suitability for both routine immunization and outbreak control.

The Asia-Pacific region contributes to nearly half of the global market share, primarily due to endemic FMD presence in countries like India, China, and Southeast Asian nations. These regions routinely vaccinate hundreds of millions of livestock annually.

Despite advancements in recombinant and marker vaccines, conventional oil- or aluminum-based vaccines continue to dominate, holding more than 80% market share. These formulations offer long shelf life and are cost-effective for mass immunization programs.

While cattle dominate, vaccination rates in pigs are increasing, particularly in Asia and Latin America. Growing global pork demand and disease control mandates have pushed swine vaccines to represent approximately 20–25% of the total market volume.

FMD Vaccine Market Drivers:

High Economic Impact of FMD Outbreaks

FMD outbreaks can cause severe economic losses due to reduced meat and milk production, trade restrictions, and animal culling. Countries with significant livestock industries face billions in potential damages if FMD is not controlled. This economic threat incentivizes governments and producers to invest consistently in vaccination programs. As a result, demand for preventive vaccines remains high, especially in endemic regions.

Government-Led Mass Vaccination Campaigns

In many countries, particularly in Asia, Africa, and South America, governments implement large-scale FMD vaccination programs to contain and eradicate the disease. These initiatives are often supported by international bodies like the OIE and FAO. Regular public procurement and distribution of vaccines create a stable and recurring demand. Public-private partnerships also enhance vaccine access and coverage.

Rising Livestock Populations and Intensified Farming

Global demand for animal protein is rising, leading to growth in livestock farming, particularly in emerging economies. As farming becomes more intensive, the risk of disease spread increases due to higher animal densities. This necessitates stronger biosecurity measures, including routine vaccination against FMD. The growing livestock base directly fuels the expansion of the vaccine market.

FMD Vaccine Market Restraints and Challenges:

Cold Chain and Storage Limitations

FMD vaccines often require strict temperature control during storage and transportation to remain effective. In many developing countries, cold chain infrastructure is limited or unreliable, especially in rural or remote areas. This can lead to vaccine degradation and reduced immunization effectiveness. These logistical hurdles pose a significant barrier to widespread vaccine coverage.

Short Duration of Immunity

Most FMD vaccines provide immunity for only 4 to 6 months, requiring multiple booster doses each year. This frequent re-vaccination increases costs and logistical complexity, particularly in large-scale livestock operations. It also leads to compliance challenges among farmers. The short immunity span makes sustained disease control more difficult in endemic regions.

Limited Differentiation Between Infected and Vaccinated Animals (DIVA)

Traditional vaccines do not allow differentiation between infected and vaccinated animals, complicating disease surveillance and export certification. Countries aiming for FMD-free status face challenges in proving disease absence when conventional vaccines are used. Although marker (DIVA) vaccines address this, they are not yet widely adopted or affordable. This limits the strategic flexibility of vaccination programs in trade-sensitive regions.

FMD Vaccine Market Opportunities:

The Foot and Mouth Disease (FMD) vaccine market presents several promising opportunities driven by technological, regulatory, and demographic trends. One major opportunity lies in the development and wider adoption of marker (DIVA) vaccines, which enable differentiation between infected and vaccinated animals—critical for disease-free certification and trade. Recombinant and novel vaccine technologies also offer the potential for longer-lasting immunity and fewer doses, which could reduce costs and improve compliance. As livestock production expands in Africa and Southeast Asia, demand for preventive veterinary healthcare is expected to rise substantially.

There is also room for growth in private-sector veterinary services and vaccine distribution, particularly as small- to mid-sized farms modernize. Government and international funding support—especially from the FAO, OIE, and World Bank—continues to open up public procurement channels in lower-income nations. Expansion into cold chain infrastructure and mobile vaccination units can help overcome logistical barriers in remote regions. Finally, growing awareness of zoonotic disease risks and food security is prompting countries to strengthen animal health programs, creating a sustained, long-term need for FMD vaccination solutions.

FMD VACCINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.51% |

|

Segments Covered |

By vaccine Type, animal type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

MSD Animal Health (Merck & Co., Inc.), Boehringer Ingelheim International GmbH, Indian Immunologicals Ltd., Bayer AG (Elanco Animal Health, post-divestiture), Zoetis Inc., Biogénesis Bagó S.A., Brilliant Bio Pharma Pvt. Ltd., VETAL Animal Health Products Inc., Ceva Santé Animale, Agrovet Co. Ltd. |

FMD Vaccine Market Segmentation:

FMD Vaccine Market Segmentation: by Vaccine Type

- Conventional Vaccine

- Emergency Vaccine/Marker Vaccine

Conventional vaccines, primarily inactivated (killed) virus formulations, are the most widely used type for routine FMD prevention. These vaccines are cost-effective, relatively easy to produce in large volumes, and suitable for regular immunization programs across endemic regions. Due to their established regulatory acceptance and widespread usage, conventional vaccines account for approximately 80–85% of the global FMD vaccine market. However, they typically require multiple doses per year due to their short duration of immunity.

Marker vaccines (also known as DIVA vaccines) are designed to differentiate between infected and vaccinated animals, making them essential for outbreak control and international trade compliance. These vaccines are increasingly used in regions targeting FMD eradication or seeking disease-free certification. While still emerging, the emergency/marker vaccine segment holds an estimated 15–20% share of the market and is expected to grow with rising demand for traceability and export-friendly vaccination strategies. Their adoption is currently limited by higher production costs and limited access in low-income regions.

FMD Vaccine Market Segmentation: by Animal Type

- Cattle

- Swine

- Sheep & Goat

- Others

Cattle represent the largest segment in the FMD vaccine market due to their high economic value in both meat and dairy production. FMD outbreaks in cattle can cause severe productivity losses, including reduced milk yield and fertility. This drives widespread and regular vaccination programs, especially in Asia, Latin America, and parts of Africa. Cattle account for approximately 50–55% of the global FMD vaccine market.

Swine are increasingly being vaccinated, particularly in regions where pork is a major protein source, such as China, Vietnam, and the Philippines. FMD can spread rapidly in dense pig populations, causing severe economic disruption in the pork industry. While not as dominant as cattle, the swine segment holds around 20–25% of the market and is expected to grow steadily. Rising demand for pork and intensified farming practices are key drivers in this segment.

FMD Vaccine Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is considered FMD-free, with no recent cases reported in the U.S. or Canada. As a result, the region has a very limited market for routine FMD vaccination, focused mainly on emergency preparedness and stockpiling of vaccines. Government agencies like the USDA maintain vaccine banks for rapid response to potential outbreaks. Market activity is driven primarily by import controls, surveillance, and contingency planning, not routine use. This region has an estimated global market share of 2–3%.

Asia-Pacific holds the largest share of the global FMD vaccine market—approximately 45–50%—due to the endemic nature of the disease in countries like China, India, Vietnam, and Indonesia. Massive livestock populations and government-led mass immunization programs fuel consistent demand. The region sees high volumes of both cattle and swine vaccinations. Continuous outbreaks, coupled with increased meat consumption, keep this market in active growth mode.

COVID-19 Impact Analysis on the Global FMD Vaccine Market:

The COVID-19 pandemic had a mixed impact on the Foot and Mouth Disease (FMD) vaccine market. In the early months of 2020, disruptions in global supply chains delayed the manufacturing and distribution of veterinary vaccines, including those for FMD. Lockdowns and movement restrictions also limited access to farms and rural areas, resulting in postponed or reduced vaccination campaigns in several countries. Government focus and funding were temporarily diverted toward human health emergencies, affecting budgets for animal health programs.

However, the pandemic also highlighted the importance of biosecurity and disease prevention in both human and animal populations. This led to renewed interest in strengthening veterinary infrastructure in many countries post-COVID. Increased investment in cold chain systems and diagnostic technologies during the pandemic indirectly benefited the veterinary vaccine sector. As the situation stabilized, mass vaccination efforts resumed, and the market recovered gradually, supported by rising demand for food security and stable livestock production.

Latest Trends/ Developments:

The Foot and Mouth Disease (FMD) vaccine market is witnessing a wave of significant developments shaped by both recent outbreaks and technological advancements. Countries like South Africa and Indonesia have launched large-scale vaccination campaigns—administering hundreds of thousands to millions of doses—to contain active FMD outbreaks and prevent economic losses. Meanwhile, the industry is experiencing a shift toward next-generation vaccines, including recombinant and synthetic formulations that target multiple virus strains.

To address logistical barriers, thermostable vaccines are being developed to ensure potency in remote or high-temperature regions without strict cold chain dependence. Strategic investments and partnerships are expanding production capacity, as seen in Brazil with Biogénesis Bagó’s new manufacturing facility. Digital surveillance systems are also being integrated to track vaccination coverage and disease spread more effectively. Additionally, companies like MSD Animal Health are introducing virus-free synthetic vaccines, reducing biosafety risks and advancing scalable, modern production methods.

Key Players:

- MSD Animal Health (Merck & Co., Inc.)

- Boehringer Ingelheim International GmbH

- Indian Immunologicals Ltd.

- Bayer AG (Elanco Animal Health, post-divestiture)

- Zoetis Inc.

- Biogénesis Bagó S.A.

- Brilliant Bio Pharma Pvt. Ltd.

- VETAL Animal Health Products Inc.

- Ceva Santé Animale

- Agrovet Co. Ltd.

Chapter 1. FMD Vaccine Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Type s

1.5. Secondary Type s

Chapter 2. FMD VACCINE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. FMD VACCINE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. FMD VACCINE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. FMD VACCINE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. FMD VACCINE MARKET – By Vaccine Type

6.1 Introduction/Key Findings

6.2 Conventional Vaccine

6.3 Emergency Vaccine/Marker Vaccine

6.4 Y-O-Y Growth trend Analysis By Vaccine Type

6.5 Absolute $ Opportunity Analysis By Vaccine Type , 2025-2030

Chapter 7. FMD VACCINE MARKET – By Animal Type

7.1 Introduction/Key Findings

7.2 Cattle

7.3 Swine

7.4 Sheep & Goat

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Animal Type

7.7 Absolute $ Opportunity Analysis By Animal Type , 2025-2030

Chapter 8. FMD VACCINE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Animal Type

8.1.3. By Vaccine Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Vaccine Type

8.2.3. By Animal Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Vaccine Type

8.3.3. By Animal Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Vaccine Type

8.4.3. By Animal Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Vaccine Type

8.5.3. By Animal Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. FMD VACCINE MARKET – Company Profiles – (Overview, Vaccine Type , Portfolio, Financials, Strategies & Developments)

9.1 MSD Animal Health (Merck & Co., Inc.)

9.2 Boehringer Ingelheim International GmbH

9.3 Indian Immunologicals Ltd.

9.4 Bayer AG (Elanco Animal Health, post-divestiture)

9.5 Zoetis Inc.

9.6 Biogénesis Bagó S.A.

9.7 Brilliant Bio Pharma Pvt. Ltd.

9.8 VETAL Animal Health Products Inc.

9.9 Ceva Santé Animale

9.10 Agrovet Co. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The FMD Vaccine Market was valued at USD 2.99 billion and is projected to reach a market size of USD 4.50 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.51%.

High Economic Impact of FMD Outbreaks, Government-Led Mass Vaccination Campaigns, Rising Livestock Populations and Intensified Farming are some of the key market drivers in the FMD Vaccine Market.

Conventional Vaccine, Emergency Vaccine/Marker Vaccine are the segments by Vaccine Type in the FMD Vaccine Market.

Asia-Pacific is the most dominant region for the Global FMD Vaccine Market.

MSD Animal Health (Merck & Co., Inc.), Boehringer Ingelheim International GmbH, Indian Immunologicals Ltd., Bayer AG (Elanco Animal Health, post-divestiture), Zoetis Inc., Biogénesis Bagó S.A., Brilliant Bio Pharma Pvt. Ltd., VETAL Animal Health Products Inc., Ceva Santé Animale, Agrovet Co. Ltd. etc.