Flow Meters Market Size (2025 – 2030)

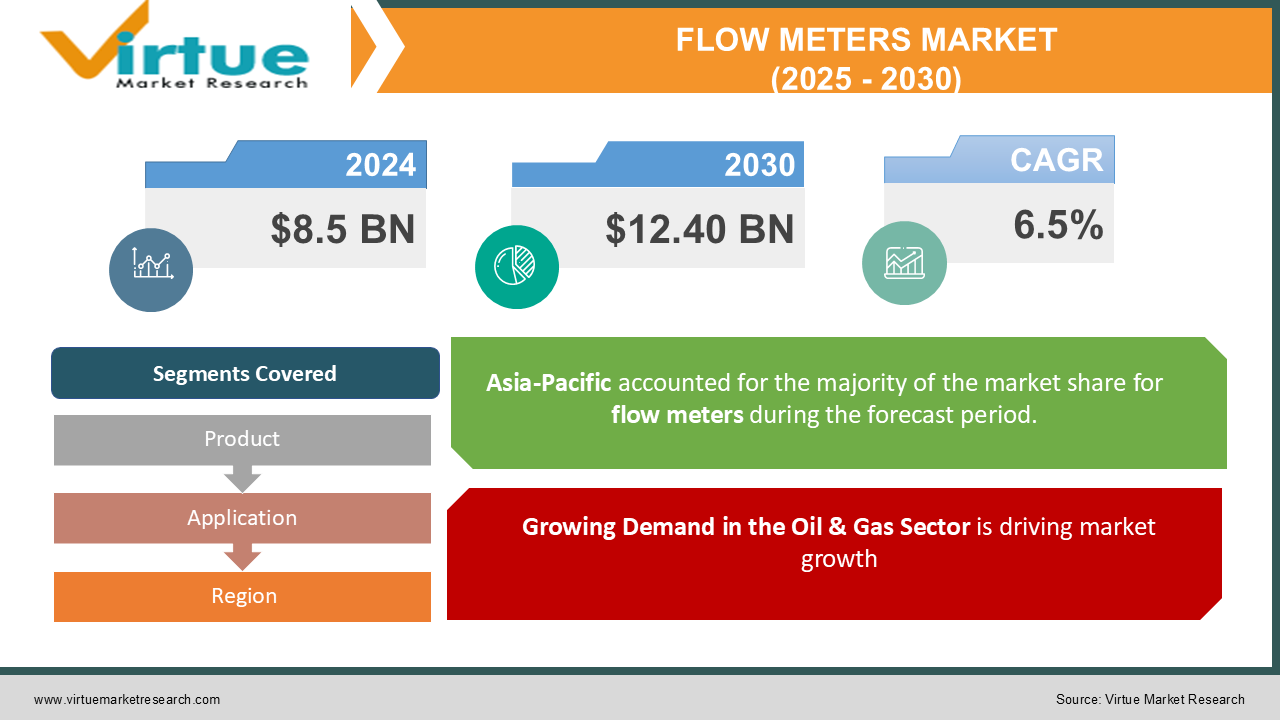

The Global Flow Meters Market was valued at USD 8.5 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2030. The market is anticipated to reach USD 12.40 billion by 2030.

Flow meters play a crucial role in sectors such as oil & gas, water & wastewater management, power generation, and chemical processing by ensuring accurate flow measurement, optimizing processes, and enhancing operational efficiency. The increasing adoption of automation, coupled with the rising demand for precision in industrial processes, is driving significant growth in this market.

Key Market Insights

-

The integration of IoT and smart flow meters with real-time monitoring capabilities saw a surge in adoption, with a 12% increase among industrial users in 2024.

-

Water and wastewater management emerged as a fast-growing sector, driven by rising investments in sustainable water infrastructure and stringent government regulations. Differential pressure flow meters retained a significant market share, thanks to their versatility and widespread application across industries.

-

Growing energy demand worldwide is pushing the adoption of advanced flow metering technologies to improve operational efficiency in energy production and distribution.

Global Flow Meters Market Drivers

Growing Demand in the Oil & Gas Sector is driving market growth:

The oil & gas industry remains a dominant driver for the flow meters market. Accurate flow measurement is critical for activities like drilling, refining, and pipeline transportation. With the global rise in energy consumption, particularly in emerging economies, exploration activities have intensified, necessitating the use of high-precision flow meters. For instance, in 2024, flow meters contributed to a 10% improvement in operational efficiency in oil refineries by reducing measurement errors. Additionally, advancements in technologies like ultrasonic and Coriolis flow meters, which offer high accuracy and reliability, are becoming increasingly popular in this sector.

Rising Adoption of Smart Flow Meters is driving market growth:

The increasing integration of IoT and digital technologies into industrial processes has led to the development of smart flow meters capable of real-time data collection and analysis. These devices provide actionable insights, enabling predictive maintenance and process optimization. Industries such as water management and chemical processing are witnessing widespread adoption of these smart meters to improve accuracy and reduce operational costs. In 2024, the use of smart flow meters resulted in a 20% reduction in water wastage in municipal systems, showcasing their impact on sustainable resource management.

Expanding Water and Wastewater Management Projects is driving market growth:

With growing concerns about water scarcity and environmental sustainability, governments and private organizations worldwide are investing heavily in water and wastewater management infrastructure. Flow meters are essential for monitoring and controlling water distribution, ensuring compliance with regulatory standards. For example, the global water treatment market reported a 15% increase in flow meter installations in 2024, driven by stricter environmental regulations and public awareness campaigns.

Global Flow Meters Market Challenges and Restraints

High Initial Costs and Maintenance Challenges is restricting market growth:

Advanced flow meters, particularly those employing ultrasonic, Coriolis, or electromagnetic technologies, often come with high initial costs, limiting their adoption among small and medium enterprises (SMEs). Moreover, the complexity of installation and calibration for some types of flow meters adds to the overall operational costs. A study conducted in 2024 revealed that 40% of industrial users cited high costs as a significant barrier to upgrading their flow measurement systems. Additionally, maintaining accuracy in harsh industrial environments remains a challenge for many flow meter technologies, requiring frequent recalibration and skilled personnel.

Variability in Flow Conditions is restricting market growth:

Flow meters often face challenges in environments where flow conditions are highly variable or involve mixed-phase fluids, such as slurries or multiphase flows. These conditions can lead to inaccuracies in measurement and reduced operational reliability. For instance, differential pressure flow meters, while versatile, struggle with accuracy when dealing with fluctuating pressure or temperature conditions. Addressing these challenges requires continuous technological innovation and the development of more robust and adaptive flow measurement solutions.

Market Opportunities

The flow meters market presents substantial opportunities, particularly in emerging economies where industrialization and urbanization are driving demand for modern infrastructure. The water and wastewater management sector is expected to be a key growth area, with governments prioritizing investments in smart water infrastructure to address global water scarcity issues. For example, India’s Smart Cities Mission has spurred demand for advanced flow meters to monitor water usage and reduce losses in distribution systems.

In addition to water management, the transition to renewable energy sources offers growth potential for flow meters in applications such as hydrogen production and geothermal energy systems. Technological advancements, such as the integration of AI and machine learning with flow measurement systems, are also creating opportunities for predictive analytics and enhanced process optimization. Furthermore, the rise of green manufacturing and sustainability initiatives is pushing industries to adopt energy-efficient flow meters, ensuring compliance with environmental regulations while reducing operational costs.

FLOW METERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, Emerson Electric Co., ABB Ltd., Yokogawa Electric Corporation, Honeywell International Inc., Schneider Electric, Endress+Hauser Group, Badger Meter, Inc., Krohne Messtechnik GmbH, Omega Engineering |

Flow Meters Market Segmentation - By Product

-

Ultrasonic Flow Meters

-

Coriolis Flow Meters

-

Electromagnetic Flow Meters

-

Differential Pressure Flow Meters

-

Thermal Flow Meters

-

Positive Displacement Flow Meters

Ultrasonic flow meters emerged as the dominant segment in 2024, accounting for 28% of the market share. Their non-invasive measurement capabilities, high accuracy, and versatility across applications such as water management and chemical processing have driven their adoption.

Flow Meters Market Segmentation - By Application

-

Oil & Gas

-

Water and Wastewater Management

-

Chemical Processing

-

Power Generation

-

Food and Beverages

-

Pharmaceuticals

The oil & gas sector was the most dominant application area, contributing over 30% of revenues in 2024. The critical need for precision and reliability in exploration, refining, and distribution processes has made flow meters indispensable in this industry.

Flow Meters Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific was the dominant region in the global flow meters market, accounting for more than 35% of the total market share in 2024. Rapid industrialization, urbanization, and infrastructure development in countries like China, India, and Indonesia have significantly boosted demand for flow meters. The region’s strong focus on water and wastewater management projects, coupled with the expansion of the oil & gas and chemical industries, has further fueled market growth. For instance, China’s water treatment initiatives have led to a 25% increase in the adoption of advanced flow meters over the past five years.

COVID-19 Impact Analysis on the Flow Meters Market

The COVID-19 pandemic had a mixed impact on the flow meters market, with initial challenges such as supply chain disruptions, project delays, and reduced demand from industries like oil & gas and manufacturing due to lockdowns. These factors led to a temporary slowdown in market growth. However, the market experienced a strong rebound in sectors like water management, healthcare, and food & beverages, where flow meters were essential for maintaining operations and meeting hygiene standards. The pandemic also spurred the adoption of smart flow meters, particularly those with remote monitoring capabilities. These innovations allowed industries to maintain operational efficiency while adhering to social distancing measures. In 2024, the water management sector saw a 15% increase in the adoption of IoT-enabled flow meters, driven by the need for real-time monitoring and automation to ensure the smooth functioning of critical infrastructure. Overall, the pandemic highlighted the need for resilient and adaptive flow measurement systems that can withstand disruptions and continue operating in a rapidly changing environment. This shift towards smarter, more flexible solutions is expected to drive sustained growth in the flow meters market in the post-pandemic era. The ongoing demand for reliable and efficient flow measurement technology in industries like water management, healthcare, and food & beverages is set to further accelerate market expansion as businesses continue to prioritize automation, safety, and operational continuity.

Latest Trends/Developments

The development of wireless and battery-powered flow meters is gaining momentum, offering increased flexibility and ease of deployment in remote or hard-to-reach locations. These advancements allow industries to install flow meters in areas without reliable power sources, ensuring continuous operation and data collection in challenging environments. Simultaneously, the adoption of artificial intelligence (AI) and machine learning is transforming flow measurement by enabling predictive analytics. These technologies allow industries to optimize their processes by predicting potential failures and minimizing downtime, leading to more efficient and cost-effective operations. The integration of 5G technology with flow meters is further enhancing the industry by enabling faster and more reliable data transmission. This development significantly boosts real-time monitoring capabilities, allowing for quicker decision-making and better overall system performance. Additionally, smart flow meters with IoT connectivity are becoming increasingly popular, particularly in sectors such as water management and energy. These IoT-enabled systems facilitate remote monitoring and control, helping businesses manage resources more effectively and reduce operational costs. Moreover, the rise of green manufacturing and sustainability initiatives is contributing to the growing demand for energy-efficient flow meters. As companies worldwide focus on reducing their carbon footprints, energy-efficient solutions are essential for meeting environmental goals while maintaining high levels of operational efficiency. This trend aligns with the broader push toward sustainability, driving innovation and adoption of flow meters that are not only technologically advanced but also environmentally responsible. These combined advancements are expected to fuel significant growth and transformation within the flow meters market in the coming years.

Key Players

-

Siemens AG

-

Emerson Electric Co.

-

ABB Ltd.

-

Yokogawa Electric Corporation

-

Honeywell International Inc.

-

Schneider Electric

-

Endress+Hauser Group

-

Badger Meter, Inc.

-

Krohne Messtechnik GmbH

-

Omega Engineering

Chapter 1. Flow Meters Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flow Meters Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flow Meters Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flow Meters Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flow Meters Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flow Meters Market – By Product

6.1 Introduction/Key Findings

6.2 Ultrasonic Flow Meters

6.3 Coriolis Flow Meters

6.4 Electromagnetic Flow Meters

6.5 Differential Pressure Flow Meters

6.6 Thermal Flow Meters

6.7 Positive Displacement Flow Meters

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Flow Meters Market – By Application

7.1 Introduction/Key Findings

7.2 Oil & Gas

7.3 Water and Wastewater Management

7.4 Chemical Processing

7.5 Power Generation

7.6 Food and Beverages

7.7 Pharmaceuticals

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Flow Meters Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Flow Meters Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Siemens AG

9.2 Emerson Electric Co.

9.3 ABB Ltd.

9.4 Yokogawa Electric Corporation

9.5 Honeywell International Inc.

9.6 Schneider Electric

9.7 Endress+Hauser Group

9.8 Badger Meter, Inc.

9.9 Krohne Messtechnik GmbH

9.10 Omega Engineering

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Flow Meters Market was valued at USD 8.5 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2030. The market is anticipated to reach USD 12.40 billion by 2030.

Key drivers include growing demand in the oil & gas sector, rising adoption of smart flow meters, and expanding water and wastewater management projects.

The market is segmented by product (ultrasonic, Coriolis, electromagnetic, differential pressure, thermal, positive displacement) and application (oil & gas, water and wastewater, chemical processing, power generation, food & beverages, pharmaceuticals).

Asia-Pacific is the most dominant region, accounting for over 35% of the market share in 2024, driven by rapid industrialization and infrastructure development.

Leading players include Siemens AG, Emerson Electric Co., ABB Ltd., Yokogawa Electric Corporation, and Honeywell International Inc.