Floor Standing Meat Grinder and Mincer Market Size (2023 – 2030)

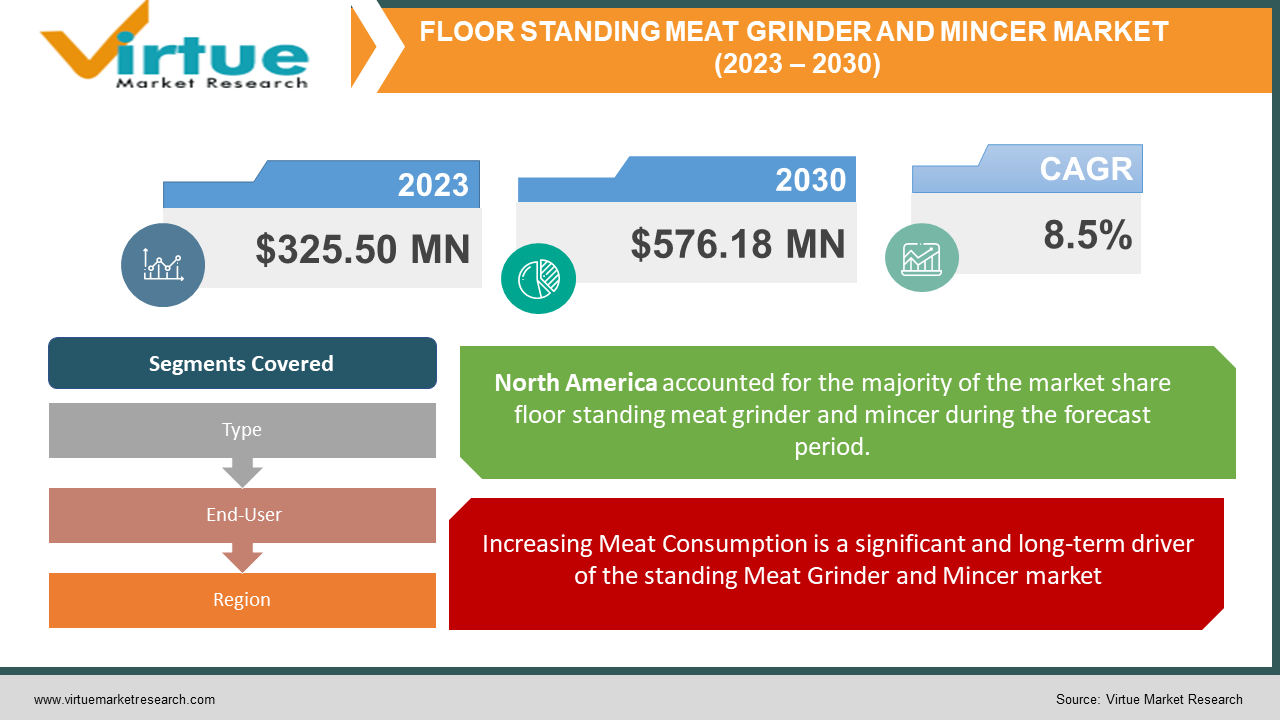

The Global Floor Standing Meat Grinder and Mincer Market is valued at USD 325.50 Million in 2023 and is projected to reach a market size of USD 576.18 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.5%.

The Floor Standing Meat Grinder and Mincer Market is witnessing steady growth due to increasing consumer demand for freshly ground meat products, rising meat consumption, and the expansion of meat processing industries. The Floor Standing Meat Grinder and Mincer is a vital equipment category within the food processing industry, catering to the needs of commercial establishments and large-scale meat processors. These machines are engineered to grind and mince meat efficiently, ensuring consistent product quality and texture. They are typically designed for heavy-duty operations, offering robust construction and high-performance motors that can handle large volumes of meat. Floor-standing models provide stability and reliability, allowing for continuous production, and making them ideal for butcher shops, supermarkets, meatpacking plants, and other food processing facilities. With the global demand for meat products steadily rising, the Floor Standing Meat Grinder and Mincer Market is poised for sustained growth, driven by the need for efficient, reliable, and sanitary meat processing solutions across various sectors of the food industry.

Key Market Insights:

The global processed meat market experienced significant expansion, achieving a CAGR of 5.4% between 2016 and 2021, ultimately reaching a market value of USD 191.92 billion by 2021. This notable growth can be primarily attributed to the surging demand for convenient food options, evolving lifestyles, and the increasing disposable incomes witnessed in emerging economies.

Increasing awareness among consumers regarding the advantageous health attributes associated with the consumption of processed meat products has indirectly heightened the need for meat grinders and mincers as well. These benefits encompass qualities like lean protein content, reduced fat levels, and enhanced nutritional value when compared to traditional unprocessed red meats. Consequently, consumers are increasingly inclined towards opting for processed meat products over their unprocessed counterparts.

In June 2022, meat prices around the world reached their highest levels ever because there wasn't a lot of meat available globally. Meat production for 2022 is predicted to increase only a little because of problems like animal diseases, higher costs for inputs, and extreme weather conditions.

Floor Standing Meat Grinder and Mincer Market Drivers:

Increasing Meat Consumption is a significant and long-term driver of the standing Meat Grinder and Mincer market.

The growing global consumption of meat products, including beef, pork, poultry, and other meats, is a key driver for this market. As populations expand and incomes rise in many parts of the world, there is a rising demand for meat-based dishes and processed meat products. Floor-standing meat grinders and mincers are essential equipment for efficiently processing large quantities of meat, and meeting the needs of commercial meat processors, butchers, and restaurants. This increased demand for meat products fuels the need for more advanced and productive meat processing equipment, driving the market's growth.

Adoption of Floor Standing Meat Grinder and Mincers is increasing because of the heightened focus on food safety and hygiene.

Stringent food safety regulations and a heightened awareness of foodborne illnesses have driven the adoption of modern meat processing equipment, including floor-standing meat grinders and mincers. These machines are designed with features that enhance food safety and hygiene, such as easy-to-clean components, stainless steel construction, and safety mechanisms that minimize the risk of contamination. As consumers and regulatory authorities place a greater emphasis on safe and hygienic meat processing, businesses are compelled to invest in equipment that meets these standards, driving the market for floor-standing meat grinders and mincers as a critical component of ensuring food safety in the meat processing industry.

Floor Standing Meat Grinder and Mincer Market Restraints and Challenges:

Stringent Regulations and Compliance on meat processing machines could hinder the full potential of this market.

One significant challenge facing the Floor Standing Meat Grinder and Mincer market is the need to adhere to strict food safety and hygiene regulations imposed by government authorities. These machines are used for processing meat, which is a highly perishable food product, and ensuring the safety of the final product is of paramount importance. Compliance with regulations regarding sanitation, cross-contamination prevention, and the use of safe materials can be demanding and costly for manufacturers. Additionally, evolving regulatory standards and the need to adapt to different regulations in various regions can pose a significant challenge, particularly for companies operating in multiple markets. Non-compliance can lead to fines, recalls, and damage to brand reputation.

The cost of Investment and Maintenance associated with Floor-standing meat grinders and mincers could be problematic for some businesses and owners.

Floor-standing meat grinders and mincers are often considered capital-intensive equipment, and the initial investment cost can be substantial. This cost can deter smaller businesses from adopting or upgrading their meat processing equipment. Additionally, ongoing maintenance and servicing costs, including the replacement of parts and blades, can be significant over time. Ensuring the proper functioning and longevity of these machines is crucial for businesses, but it can strain their operational budgets. Balancing the need for efficient, reliable equipment with cost constraints is a persistent challenge for both equipment manufacturers and end-users in the market.

Floor Standing Meat Grinder and Mincer Market Opportunities:

The Floor Standing Meat Grinder and Mincer Market presents promising opportunities driven by evolving consumer preferences, including a growing demand for specialty meat products and a preference for fresh and customized meat blends. As health-conscious consumers seek leaner and safer meat options, manufacturers can innovate by developing machines with improved safety features and ease of cleaning, meeting the demand for high standards of hygiene. The expanding global food service industry, driven by rising urbanization and changing dietary habits, creates a substantial market for floor-standing meat grinders and mincers in commercial kitchens and restaurants. Furthermore, advancements in automation and technology, such as the integration of smart controls and IoT capabilities, offer opportunities to enhance efficiency and productivity, further bolstering the market's growth potential in the coming years.

FLOOR STANDING MEAT GRINDER AND MINCER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hobart Corporation, BIRO Manufacturing Company, Butcher Boy Machines International, Treif USA, Sirman, Globe Food Equipment Company, Gourmia, Minerva Omega Group s.r.l, Weston Brands, Avantco Equipment |

Floor Standing Meat Grinder and Mincer Market Segmentation: By Type

-

Manual Meat Grinder

-

Electric Meat Grinder

The largest segment by product type in the Floor Standing Meat Grinder and Mincer market is typically the Electric Meat Grinders having a market share of 67%. Electric meat grinders are popular because they offer greater convenience and efficiency compared to manual alternatives. They are widely used in both commercial kitchens and households due to their ability to handle a variety of meat types quickly and with less physical effort.

The fastest-growing segment is also the Electric Meat Grinders expanding at a CAGR of 21%. This growth is primarily driven by the increasing demand for convenience and time-saving kitchen appliances among both commercial and home users. Electric meat grinders offer efficient and effortless meat processing, making them popular among busy consumers and food service establishments. Their ease of use, speed, and versatility in handling various meat types and quantities contribute to their rapid growth. Additionally, advancements in motor power, safety features, and smart technology integration have further boosted the appeal of electric meat grinders.

Floor Standing Meat Grinder and Mincer Market Segmentation: By End-User

-

Commercial Kitchen

-

Households

The largest segment by end user in the Floor Standing Meat Grinder and Mincer market is typically the Commercial Kitchens segment which has a market share of over 70%. Commercial establishments such as restaurants, butcheries, and meat processing plants often require heavy-duty meat grinders and mincers to handle large quantities of meat regularly. These businesses rely on floor-standing equipment due to their higher capacity and durability.

The fastest-growing segment by end-users in the Floor Standing Meat Grinder and Mincer market is the Home Use category. This growth is primarily fueled by the increasing trend of home cooking and food preparation, driven by factors such as health-consciousness, desire for homemade meals, and the rise of culinary enthusiasts. Home cooks are increasingly investing in quality kitchen equipment, including meat grinders and mincers, to create customized meat blends, control ingredient quality, and experiment with various recipes.

Floor Standing Meat Grinder and Mincer Market Segmentation: Regional Analysis

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest segment in the Floor Standing Meat Grinder and Mincer market is North America having a market share of 37%. This dominance is primarily attributed to the region's well-established food service industry, a high demand for meat-based cuisines, and a strong presence of food processing businesses. North American consumers often prioritize convenience and versatility in kitchen appliances, driving the adoption of meat grinders and mincers. The region's market leadership is further bolstered by the preference for electric and advanced meat processing equipment, aligning with the evolving consumer preferences and technological advancements in the kitchen appliance sector.

The fastest-growing segment is the Asia-Pacific region with a CAGR of over 15%. This growth is primarily driven by the region's expanding middle class, rising disposable incomes, and a growing interest in Western-style cuisines and food preparation methods. As consumers in Asia-Pacific embrace a more meat-centric diet and seek efficient kitchen appliances, the demand for meat grinders and mincers has surged. The combination of changing dietary habits, increasing urbanization, and a burgeoning food culture is propelling the robust growth of this market segment in Asia-Pacific.

COVID-19 Impact Analysis on the Global Floor Standing Meat Grinder and Mincer Market:

The COVID-19 pandemic significantly impacted the Global Floor Standing Meat Grinder and Mincer Market, causing disruptions in supply chains, manufacturing, and consumer behavior. Lockdowns and restrictions on restaurant operations led to a temporary decline in demand from the food service sector. However, the pandemic also accelerated the shift towards home cooking and meal preparation, resulting in increased sales of meat grinders and mincers for domestic use as consumers sought to process meat at home for safety and convenience. Manufacturers faced challenges related to workforce availability and supply chain disruptions but adapted by emphasizing e-commerce channels and remote servicing. The market is expected to rebound as restaurants recover, and the trend of at-home cooking persists, with a growing emphasis on food safety and customization driving further opportunities for the industry.

Latest Trends/ Developments:

Companies in this market are continually innovating their products to meet the evolving demands of consumers and businesses. They develop meat grinders and mincers with advanced features such as adjustable grind settings, multiple attachments for various meat types, and safety enhancements like automatic shut-off mechanisms. Customization options, including the ability to grind different textures and sizes, cater to the preferences of customers seeking specific meat blends. This trend aligns with the growing consumer desire for personalized, high-quality meat products and allows companies to differentiate themselves in a competitive market.

Companies are adopting eco-friendly practices by designing energy-efficient machines and reducing material waste during manufacturing. Some are exploring the use of more sustainable materials for components. Additionally, manufacturers are developing machines that minimize meat wastage, aligning with both environmental and cost-saving objectives. This trend not only addresses environmental concerns but also appeals to customers looking for socially responsible and efficient equipment solutions.

Key Players:

-

Hobart Corporation

-

BIRO Manufacturing Company

-

Butcher Boy Machines International

-

Treif USA

-

Sirman

-

Globe Food Equipment Company

-

Gourmia

-

Minerva Omega Group s.r.l

-

Weston Brands

-

Avantco Equipment

Chapter 1. Floor Standing Meat Grinder and Mincer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Floor Standing Meat Grinder and Mincer Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Floor Standing Meat Grinder and Mincer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Floor Standing Meat Grinder and Mincer Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Floor Standing Meat Grinder and Mincer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Floor Standing Meat Grinder and Mincer Market – By Type

6.1 Introduction/Key Findings

6.2 Manual Meat Grinder

6.3 Electric Meat Grinder

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Floor Standing Meat Grinder and Mincer Market – By End-User

7.1 Introduction/Key Findings

7.2 Commercial Kitchen

7.3 Households

7.4 Y-O-Y Growth trend Analysis By End-User

7.5 Absolute $ Opportunity Analysis By End-User, 2023-2030

Chapter 8. Floor Standing Meat Grinder and Mincer Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Type

8.1.2 By End-User

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Floor Standing Meat Grinder and Mincer Market – Company Profiles – (Overview, Floor Standing Meat Grinder and Mincer Market Portfolio, Financials, Strategies & Developments)

9.1 Hobart Corporation

9.2 BIRO Manufacturing Company

9.3 Butcher Boy Machines International

9.4 Treif USA

9.5 Sirman

9.6 Globe Food Equipment Company

9.7 Gourmia

9.8 Minerva Omega Group s.r.l

9.9 Weston Brands

9.10 Avantco Equipment

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Floor Standing Meat Grinder and Mincer Market was valued at USD 300 Million and is projected to reach a market size of USD 576.18 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 8.5%.

Increasing Meat Consumption and a heightened focus on food safety and hygiene are driving the demand for Floor Standing Meat grinders and Mincer in the market.

Based on type, the Global Floor Standing Meat Grinder and Mincer Market is segmented into manual meat grinder and electric meat grinder.

North America is the most dominant region for the Global Floor Standing Meat Grinder and Mincer Market.

Hobart Corporation, BIRO Manufacturing Company, Butcher Boy Machines International, and Treif USA are the key players operating in the Global Floor Standing Meat Grinder and Mincer Market.