Flexible Substrates Market Size (2025 – 2030)

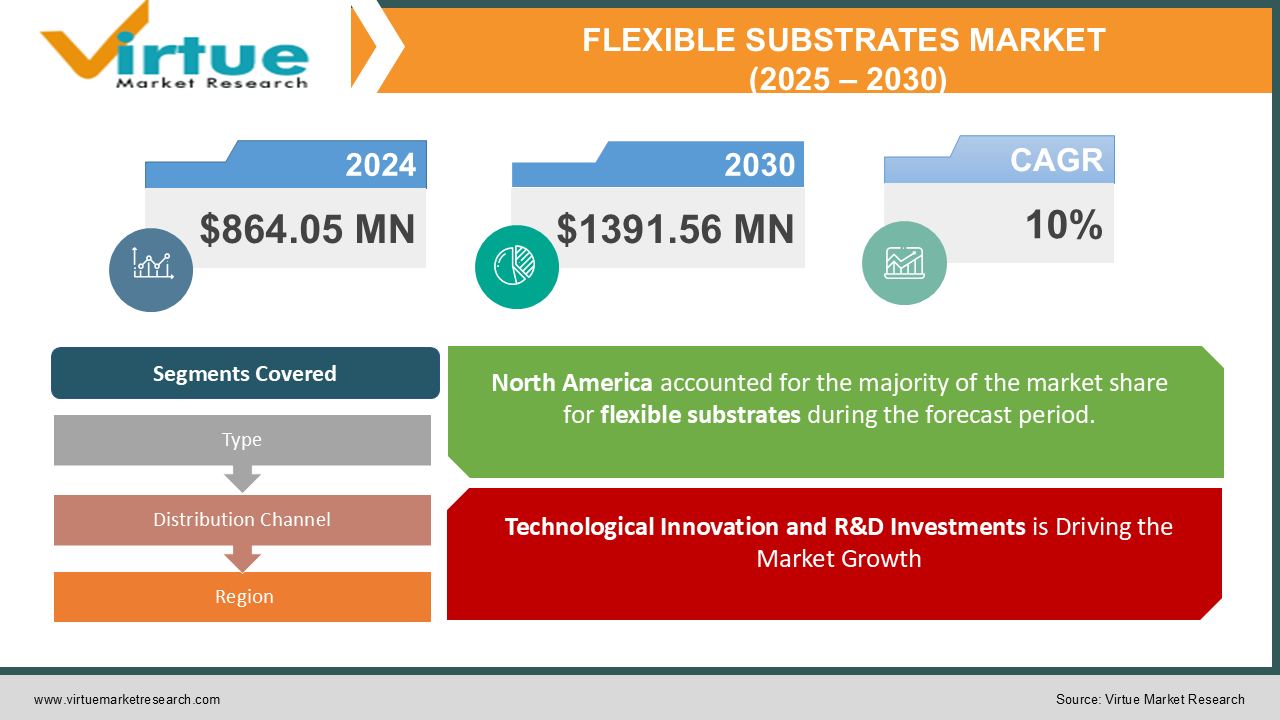

The Flexible Substrates Market was valued at USD 864.05 million in 2024 and is projected to reach a market size of USD 1391.56 million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10%.

The global market for flexible substrates has experienced a dynamic evolution over recent years, driven by rapid technological innovations and the increasing demand for lightweight, adaptable materials across various industries. Flexible substrates, which form the basis of printed electronics, wearable devices, advanced display technologies, and more, have become a key enabler in the transition toward more agile and responsive manufacturing methods. In 2024, the market has demonstrated robust performance as companies invest in research and development to integrate these substrates into a broad array of applications—from flexible solar panels to next-generation sensors and healthcare devices.

Key Market Insights:

-

Over 1,200 innovative flexible substrate products were launched globally in 2024.

-

The cost per unit of flexible substrates decreased by nearly 20% due to improved manufacturing efficiencies.

-

Over 500 patents related to flexible substrates were filed globally in 2024.

-

More than 90% of surveyed industry leaders forecast that flexible substrate technology will drive major advancements in future electronics.

Market Drivers:

Technological Innovation and R&D Investments is Driving the Market Growth

A primary driver propelling the flexible substrates market in 2024 is the substantial focus on technological innovation, largely fueled by extensive research and development investments. Manufacturers and research institutions alike are investing heavily in developing novel fabrication techniques and material formulations that enhance the inherent properties of flexible substrates. By incorporating nanomaterials, advanced polymers, and hybrid composites, companies are achieving breakthroughs in substrate performance, such as enhanced thermal conductivity, improved electrical performance, and superior mechanical strength. These technological advancements have opened up new avenues for flexible substrates in sectors that demand high-performance materials under strenuous operating conditions. The relentless pursuit of innovation is also fostering the emergence of customized substrates tailored for specific applications, ranging from high-resolution flexible displays to wearable sensors and beyond.

Growing Demand from Diverse End-Use Industries

Another significant market driver for flexible substrates is the burgeoning demand from an increasingly diverse range of end-use industries. In 2024, sectors such as consumer electronics, healthcare, automotive, and renewable energy have rapidly embraced flexible substrate technology, leveraging its unique advantages to overcome traditional design limitations. The consumer electronics industry, in particular, has been instrumental in driving growth, as manufacturers race to develop thinner, lighter, and more versatile devices that integrate seamlessly into everyday life. This shift is further supported by the growing trend towards wearable technology, where flexibility and durability are essential for devices that must conform to the human body while remaining resilient under constant motion.

Market Restraints and Challenges:

Despite the promising advancements and the evident potential for flexible substrates, the market does face several restraints and challenges that could hinder its growth. One of the primary challenges is the high cost of production, which remains a significant barrier for many manufacturers. The sophisticated processes involved in producing high-quality flexible substrates, such as precision deposition and the incorporation of advanced materials, require substantial capital investment and specialized expertise. This financial burden often limits the ability of smaller players to compete, leading to market consolidation and reduced innovation diversity. Furthermore, maintaining consistency in quality and performance across large-scale production batches continues to be a persistent technical challenge, necessitating rigorous quality control protocols and substantial R&D investments to mitigate variability in substrate properties. Intellectual property issues also emerge as a challenge, as rapid innovation leads to overlapping patents and potential litigation among industry players. The intricate web of proprietary technologies can deter collaborative innovation, thereby impeding industry-wide progress.

Market Opportunities:

Opportunities in the flexible substrates market abound, with emerging applications and new technological paradigms paving the way for expansive growth. One of the most promising opportunities lies in the realm of next-generation electronics, where the demand for flexible, lightweight, and high-performance substrates is intensifying. The continuous evolution of wearable devices, foldable smartphones, and flexible displays is creating an insatiable appetite for materials that can deliver robust performance while offering unprecedented design freedom. This demand is driving research into new material formulations and fabrication methods that not only enhance substrate properties but also significantly reduce production costs. The ability to integrate flexible substrates into everyday consumer products offers manufacturers a competitive edge, as it opens up new markets and drives volume growth. Another lucrative opportunity is in the healthcare and biomedical sectors. Flexible substrates are increasingly being adopted for innovative applications such as bio-integrated sensors, implantable devices, and advanced diagnostic tools. These applications require materials that can conform to complex anatomical surfaces, provide real-time data, and operate reliably under the dynamic conditions of the human body. The convergence of healthcare and technology has created a fertile ground for innovation, with flexible substrates playing a pivotal role in the development of personalized medicine and remote patient monitoring systems. This not only improves patient outcomes but also significantly reduces healthcare costs, making it an attractive prospect for both public and private healthcare providers.

FLEXIBLE SUBSTRATES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M, DuPont, Hitachi Chemical, Coveme, Toray Industries, UBE Industries, SABIC, LG Chem, Asahi Kasei, Saint-Gobain |

Flexible Substrates Market Segmentation: by Type

-

Polyimide (PI)

-

Polyethylene terephthalate (PET)

-

Polyethylene naphthalate (PEN)

-

Thermoplastic Polyurethane (TPU)

-

Metal Foils

-

Paper-based Substrates

In this segmentation, the fastest-growing type in recent developments is the polyimide (PI) substrate, driven by its exceptional thermal stability and mechanical robustness, which have made it a favorite in high-performance applications such as flexible displays and advanced sensors. Meanwhile, the most dominant type remains polyethylene terephthalate (PET), largely due to its cost-effectiveness, broad availability, and reliable performance in consumer electronics and packaging applications. The contrasting strengths of these materials have spurred intense research and tailored manufacturing approaches to harness their full potential in various market niches.

Flexible Substrates Market Segmentation: by Distribution Channel

-

Direct Sales

-

Online Retailers

-

Distributors

-

OEM Partnerships

-

System Integrators

Within this distribution framework, direct sales have emerged as the fastest-growing channel as companies increasingly choose to build closer relationships with their end users through customized product solutions and after-sales support. In contrast, the most dominant channel continues to be OEM partnerships, which leverage established supply chains and deep integration within end-use industries. This channel dominance is a reflection of longstanding relationships and the efficiency gained through integrated value chains, allowing for smoother transitions from research to production and ultimately, market delivery.

Flexible Substrates Market Segmentation - by Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

The market share is distributed among key regions such that North America holds approximately 30% of the market share, owing to its advanced technological infrastructure and significant investments in innovation. Europe accounts for roughly 25% of the market share, driven by a strong emphasis on sustainable manufacturing practices and a robust automotive and healthcare sector. Asia-Pacific, however, leads in terms of overall production volume with an estimated 35% share, buoyed by rapid industrialization, high consumer demand, and significant manufacturing capabilities. The remaining regions, including Latin America and the Middle East, collectively account for about 10% of the market share.

COVID-19 Impact Analysis on the Market:

The COVID-19 pandemic presented unprecedented challenges and opportunities within the flexible substrates market. In 2024, the market continues to feel the residual impacts of the pandemic, as global supply chains recalibrate and production strategies are revisited to ensure greater resilience. During the pandemic, manufacturers encountered significant disruptions in the supply of critical raw materials and experienced fluctuations in demand from various sectors. However, the crisis also catalyzed accelerated innovation, as companies were compelled to adopt remote production monitoring and digital transformation strategies to maintain operational continuity. As a result, the market witnessed a rapid digital shift, with an increased reliance on automation and advanced data analytics to streamline manufacturing processes and ensure consistent quality. The pandemic also forced a revaluation of supply chain dependencies and led to the diversification of sourcing strategies, which has now evolved into a competitive advantage. Manufacturers established more robust local supply networks and invested in multi-source procurement models to mitigate the risks associated with global disruptions. Additionally, the need for remote healthcare solutions during the pandemic drove significant investment in flexible substrate-based wearable medical devices, a trend that has persisted into 2024. This shift has not only broadened the application base of flexible substrates but also opened new revenue streams in the healthcare sector. Furthermore, enhanced government support and stimulus measures aimed at revitalizing the manufacturing sector have provided additional impetus for growth in the flexible substrates market. Overall, while COVID-19 initially posed challenges related to logistics and production, it ultimately spurred transformative changes that have strengthened the industry's resilience and set the stage for long-term growth.

Latest Trends and Developments:

The flexible substrates market in 2024 is marked by a wave of pioneering trends and developments that are reshaping the industry landscape. One notable trend is the integration of smart materials and nano-engineered composites into flexible substrates, leading to devices that are not only mechanically robust but also imbued with enhanced sensing and adaptive capabilities. Innovations in material science are driving the creation of substrates that can actively respond to environmental stimuli, thus opening up opportunities in fields such as wearable technology and smart packaging. Moreover, manufacturers are increasingly exploring environmentally sustainable solutions by adopting biodegradable polymers and recycled materials in substrate production. This trend reflects a growing emphasis on sustainability, as companies align with global efforts to reduce waste and minimize carbon footprints. Digital transformation is another key development that is having a profound impact on the market. With the adoption of advanced simulation software, predictive maintenance systems, and data-driven quality control measures, manufacturers are now able to optimize production processes and reduce material wastage. These digital tools are enabling a higher degree of precision and reliability in substrate fabrication, ultimately enhancing overall product performance. Additionally, strategic collaborations and joint ventures between technology providers, research institutions, and manufacturing firms have accelerated the pace of innovation. These partnerships have not only fueled product development but have also helped in overcoming challenges related to scalability and cost-efficiency.

Key Players in the Market:

-

3M

-

DuPont

-

Hitachi Chemical

-

Coveme

-

Toray Industries

-

UBE Industries

-

SABIC

-

LG Chem

-

Asahi Kasei

-

Saint-Gobain

Chapter 1. Flexible Substrates Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flexible Substrates Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flexible Substrates Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flexible Substrates Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flexible Substrates Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flexible Substrates Market – By Type

6.1 Introduction/Key Findings

6.2 Polyimide (PI)

6.3 Polyethylene terephthalate (PET)

6.4 Polyethylene naphthalate (PEN)

6.5 Thermoplastic Polyurethane (TPU)

6.6 Metal Foils

6.7 Paper-based Substrates

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Flexible Substrates Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Online Retailers

7.4 Distributors

7.5 OEM Partnerships

7.6 System Integrators

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Flexible Substrates Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Flexible Substrates Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M

9.2 DuPont

9.3 Hitachi Chemical

9.4 Coveme

9.5 Toray Industries

9.6 UBE Industries

9.7 SABIC

9.8 LG Chem

9.9 Asahi Kasei

9.10 Saint-Gobain

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumer demand for clean-label, natural ingredients, coupled with technological innovations, enhanced processing techniques, and increased investments in research and development, drives the Flexible Substrates Market. Additional factors include rising health consciousness, premium product demand, improved shelf-life, and regulatory standards.

The main concerns in the Flexible Substrates Market include high production costs, inconsistent quality control, supply chain vulnerabilities, intellectual property disputes, regulatory uncertainties, environmental sustainability challenges, and scalability issues that complicate manufacturing and hinder widespread adoption of flexible substrate technologies.

3M, DuPont, Hitachi Chemical, Coveme, Toray Industries, UBE Industries

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.