Flax Fiber-based Composite Market Size (2024 – 2030)

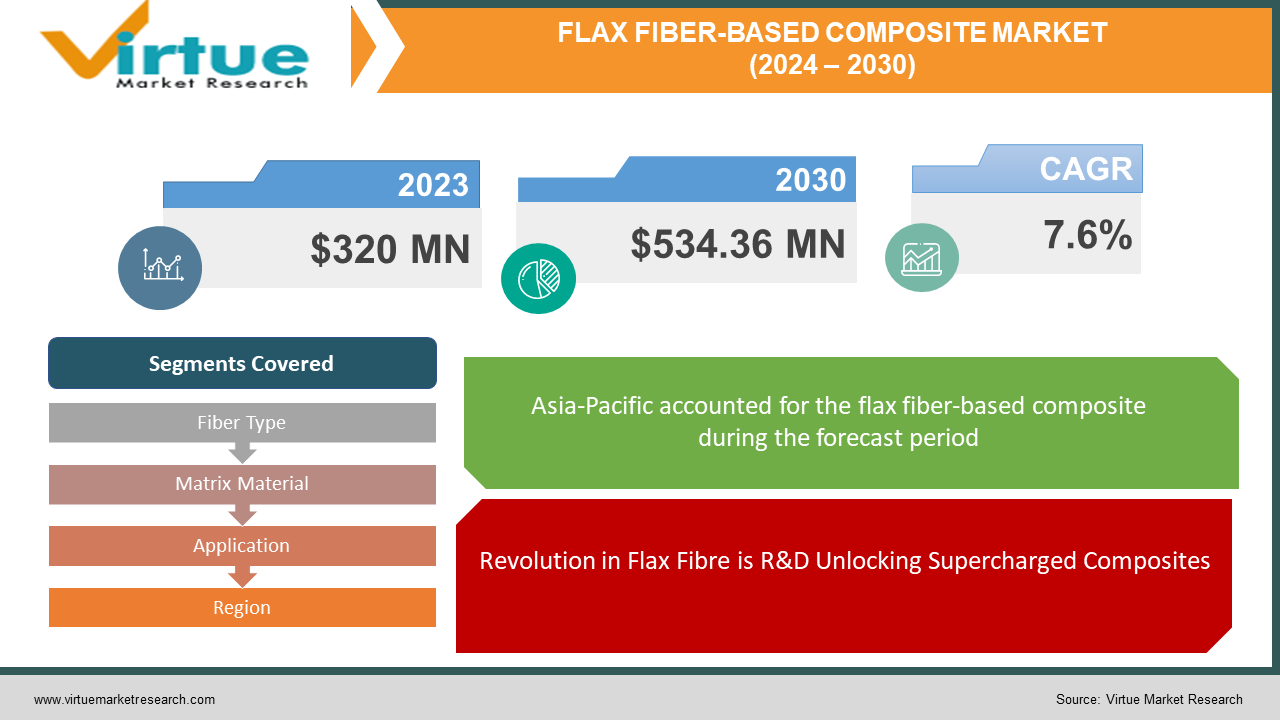

The Global Flax Fiber-based Composite Market size was exhibited at USD 320 million in 2023 and is projected to hit around USD 534.36 million by 2030, growing at a CAGR of 7.6% during the forecast period from 2024 to 2030.

Recycled and lightweight, flax fibers are derived from the flax plant and are utilized as reinforcement in composite materials. A polymer matrix, such as polyester or epoxy, is used to bind these composites together to attain qualities. In comparison to conventional choices, flax fiber-based composites have several benefits, including being lighter because of the flax fibers, renewable since the flax plant grows quickly, biodegradable for little environmental impact, and typically less priced. They do, however, have several disadvantages, including inferior fire resistance, more moisture absorption that can weaken the composite, and lower overall strength when compared to glass or carbon fibers. Flax fiber composites are becoming more popular in a variety of applications, including automotive parts, sporting goods, and even some aerospace components, despite these drawbacks.

Key Market Insights:

A significant tailwind is the increased emphasis on sustainability. Flax composites are a wonderful fit for the eco-friendly alternatives that consumers and industry are currently pursuing because they are renewable and biodegradable. Lightweighting is a major priority in industries like aerospace and automotive. Because flax composites are so light, they are a great choice for applications where reducing weight is essential to increasing efficiency. The qualities of flax fibers themselves and their compatibility with the polymer matrix that binds them are both being progressively improved by continuing research. results in improved overall performance for flax composites, which are now even more competitive with conventional materials like glass or carbon fibers thanks to improvements in strength and moisture resistance. To increase their appeal, processing techniques must, however, undergo some cost optimization.

Global Flax Fiber-based Composite Market Drivers:

Revolution in Flax Fibre is R&D Unlocking Supercharged Composites

The goal of research and development is to accelerate the use of flax fiber composites. Through modifications to the fibers and their bonding to the binding matrix, scientists can achieve unprecedented levels of efficiency. Genetic manipulation of the fibers could result in super flax with increased stiffness, strength, and possibly fire resistance. Furthermore, different chemical treatments are being investigated to enhance the fibre-resin bond. Consider how little surface modifications like acetylation or mercerization strengthen the bond between the resin and fiber. Ultimately, reducing the fibers to micro- or nanofibers enhances their dispersion throughout the matrix, producing a composite that is stronger and more homogeneous. But the fibers aren't the only thing on display. Another area of intense research is improving the bond between the matrix and fiber. While nanotechnology presents the possibility of a supercharged bond at the fiber-matrix interface, sizing agents serve as a compatibility bridge. It may also be possible to experiment with modifying the matrix's surface chemistry to provide a stronger organic attraction to the fibers. These developments have revolutionary benefits. Flax composites will soon be able to rival traditional materials more successfully thanks to their increased strength and stiffness. One of flax's previous weaknesses, moisture resistance, can be greatly enhanced to produce composites that last longer. Furthermore, the flexibility to modify these attributes makes it possible to create flax composites with uses, such as enhanced electrical conductivity or fire resistance.

A Sustainable Material Revolution Propelled by High Performance and Eco-Consciousness

The narrative surrounding material selection is being rewritten by the growing emphasis on environmental responsibility. Flax composites are the main characters in this new story. Their commitment to the environment is evident. Unlike materials that rely on finite resources, flax is a renewable resource that is replanted every year. Another advantage is that flax composites are biodegradable so less waste ends up in landfills. Compared to conventional composites, the production process uses less energy, leaving a less carbon imprint. A further benefit to the environment is the decreased use of harsh chemicals during processing. Research on bio-based resins to replace petroleum-based alternatives and create a composite that is entirely bio-derived is making the future even greener. The market for flax composites is being driven by these benefits. Concerns about sustainability are motivating consumers and companies to look for environmentally suitable substitutes.

Global Flax Fiber-based Composite Market Restraints and Challenges:

The market for composites made of flax fiber is not without challenges. Though moisture absorption can be a problem and strength isn’t quite up to pace with conventional choices, research is tackling these issues. Applications are limited by processing complexity and present costs, but advances are paving the way. Increased availability of flax fiber is also necessary to fulfill anticipated demand. Notwithstanding these obstacles, the novelty of the market can be managed, and flax composites are well-positioned to surmount these difficulties and gain traction as a more widely accepted alternative with continued advancements.

Global Flax Fiber-based Composite Opportunities:

The market for composites made of flax fiber is full of opportunities. Demand for these environmentally friendly materials is being driven by concerns about sustainability, and their inherent lightness makes them appealing for applications where weight is a crucial factor. Improvements in nanotechnology and bio-based resins are enabling research to produce composites that are stronger and more useful. The industry can take advantage of flax's advantages by concentrating on perfect applications like sporting products and auto parts. Resolving outstanding cost issues will increase attractiveness. All things considered, composites made of flax fiber have the potential to upend current materials and provide a high-performing, environmentally friendly alternative.

FLAX FIBER-BASED COMPOSITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By Fiber Type, Matrix Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

FlexForm Technologies, GreenCore Composites Inc., Jelu-Werk Josef Ehrler GmbH Co & Co. KG, Meshlin Composites Zrt Polyvlies Franz Beyer GmbH & Co. KG, Procotex SA, Tecnaro GmbH |

Global Flax Fiber-based Composite Market Segmentation: By Fiber Type

-

Long Flax Fibers

-

Short Flax Fibers

Determining the exact largest and fastest-growing category of the flax fiber-based composite market is difficult due to its dynamic nature. There are few trustworthy sources of information, and some may claim that short flax fibers are unique in this regard. But a closer examination paints a more complex picture. Even though their current volume may be lesser, long flax fibers may represent a greater market sector due to their better strength and potential for future developments. Improvements can also cause them to expand at the quickest rate. Conversely, short flax fibers are more easily manipulated and can be used for a wider range of purposes. This has led to a constant expansion in output volume. In contrast to long fibers, their performance constraints in high-end applications may limit their growth.

Global Flax Fiber-based Composite Market Segmentation: By Matrix Material

-

Epoxy Resin

-

Polyester Resin

-

Bio-based Resins

The market leader in flax fiber-based composites now is epoxy resin. Epoxy is the material of choice for demanding applications due to its well-established strength and compatibility with flax fibers. But the future is probably going green. Bio-based resins are expected to develop at the quickest rate due to the increased emphasis on sustainability. With increased availability and improved performance, these environmentally friendly substitutes are anticipated to challenge epoxy's hegemony and maybe overtake it as the industry leader in flax fiber composites. Recall that the industry is dynamic and that, despite epoxy's present dominance, bio-based resins are the ones to look out for potential future expansion. You may get the most recent information about market trends, growth rates, and segment sizes by consulting a variety of sources.

Global Flax Fiber-based Composite Market Segmentation: By Application

-

Automotive

-

Aerospace

-

Sporting Goods

-

Consumer Goods

-

Building & Construction

The automotive industry is perhaps the biggest candidate for the top slot because of the sheer volume of cars manufactured and the continuous need for eco-friendly, lightweight auto parts. Flax composites are a top choice because of government requirements and consumer preferences for fuel efficiency, which further push the car sector towards sustainable materials. Sports items may be seeing the highest rise. Here, the emphasis on weight reduction and performance in gear like bicycles and skis nicely complement the advantages of flax composites. Compared to high-volume industries, the niche nature of the sporting goods industry facilitates the speedier adoption of novel materials, which is conducive to the rapid rise of flax composite use.

Global Flax Fiber-based Composite Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market for composites made of flax fiber is divided into two geographical areas: Asia-Pacific and Europe. Right now, Europe is in the lead thanks to its extensive history of cultivating flax and its research capabilities. They are the industry leader now because they have established a strong infrastructure for the processing, manufacturing, and production of flax. Still, Asia-Pacific appears to have a bright future ahead of it. Advanced materials are in high demand in this fast-developing region, and government backing for sustainable technology is helping to fuel this growth. Their potential for expansion is further fuelled by their thriving automotive industry, which is a prime market for lightweight flax composites. Asia-Pacific is predicted to grow at the quickest rate and may overtake Europe as the region's dominant market in the years to come, even though North America is also showing promise.

COVID-19 Impact Analysis on the Global Flax Fiber-based Composite Market:

There are two sides to the COVID-19 pandemic's effects on the market for composites made of flax fiber. It most certainly created problems in the short term. Lockdowns and social distancing tactics hindered output and produced supply chain bottlenecks, which might have stopped the market's early expansion. On the other hand, there might have been an unintended benefit to the pandemic in the long run. The market for flax composites may advance during this time because of the increased emphasis on sustainability. With their inherent renewability and biodegradability, flax composites have emerged as an attractive alternative to traditional materials as consumers and industry have grown more ecologically concerned. Because of their environmental benefits, flax composites may see a sharp increase in demand in the years to come as more people become concerned with sustainability.

Recent Trends and Developments in the Global Flax Fiber-based Composite Market:

Because flax composites are renewable and biodegradable, they are an ideal choice for consumers and industries looking for environmentally acceptable solutions. Additionally, because of their intrinsic lightweight, they are highly desirable for industries like aircraft and automotive, where weight reduction results in notable efficiency advantages. Research is continuing to improve the characteristics of flax fibers and their compatibility with the binding matrix; therefore, innovation is also not slowing down. Improved flax composites result from this, and further developments in nanotechnology may lead to even stronger and more useful materials. The flax composite tale gains additional sustainability with the introduction of bio-based resins as an alternative to conventional petroleum-based alternatives. However, providing a sustainable option alone is insufficient.

Key Players:

-

-

FlexForm Technologies

-

GreenCore Composites Inc.

-

Jelu-Werk Josef Ehrler GmbH Co & Co. KG

-

Meshlin Composites Zrt

-

Polyvlies Franz Beyer GmbH & Co. KG

-

Procotex SA

-

Tecnaro GmbH

-

Chapter 1. Flax Fiber-based Composite Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flax Fiber-based Composite Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flax Fiber-based Composite Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flax Fiber-based Composite Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flax Fiber-based Composite Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flax Fiber-based Composite Market – By Fiber Type

6.1 Introduction/Key Findings

6.2 Long Flax Fibers

6.3 Short Flax Fibers

6.4 Y-O-Y Growth trend Analysis By Fiber Type

6.5 Absolute $ Opportunity Analysis By Fiber Type, 2024-2030

Chapter 7. Flax Fiber-based Composite Market – By Matrix Material

7.1 Introduction/Key Findings

7.2 Epoxy Resin

7.3 Polyester Resin

7.4 Bio-based Resins

7.5 Y-O-Y Growth trend Analysis By Matrix Material

7.6 Absolute $ Opportunity Analysis By Matrix Material, 2024-2030

Chapter 8. Flax Fiber-based Composite Market – By Application

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Aerospace

8.4 Sporting Goods

8.5 Consumer Goods

8.6 Building & Construction

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Flax Fiber-based Composite Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Fiber Type

9.1.3 By Matrix Material

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Fiber Type

9.2.3 By Matrix Material

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Fiber Type

9.3.3 By Matrix Material

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Fiber Type

9.4.3 By Matrix Material

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Fiber Type

9.5.3 By Matrix Material

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Flax Fiber-based Composite Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 FlexForm Technologies

10.2 GreenCore Composites Inc.

10.3 Jelu-Werk Josef Ehrler GmbH Co & Co. KG

10.4 Meshlin Composites Zrt

10.5 Polyvlies Franz Beyer GmbH & Co. KG

10.6 Procotex SA

10.7 Tecnaro GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Flax Fiber-based Composite Market size is valued at USD 320 million in 2023.

The worldwide Global Flax Fiber-based Composite Market growth is estimated to be 7.6 % from 2024 to 2030.

The Global Flax Fiber-based Composite Market is segmented By Fiber Type (Long Flax Fibers, Short Flax Fibers), By Matrix Material (Epoxy Resin, Polyester Resin, Bio-based Resins), By Application (Automotive, Aerospace, Sporting Goods, Consumer Goods, Building & Construction) and Region.

Exciting new trends and opportunities are anticipated in the flax fiber-based composite market. Technological developments in nanotechnology have the potential to improve flax fiber characteristics even more, and genetic engineering of the flax plant itself may result in composite materials that are even more robust and adaptable. Furthermore, the flax composite market's reputation as an environmentally responsible and sustainable option will be strengthened by the introduction of bio-based resins to replace conventional petroleum-based matrices.

The manufacture of flax fiber-based composites and supply networks were probably temporarily disrupted by the COVID-19 epidemic, but things are looking up in the long run. The pandemic may have helped the market by increasing awareness of sustainability, which could have helped flax composites become more popular as an environmentally benign material option.