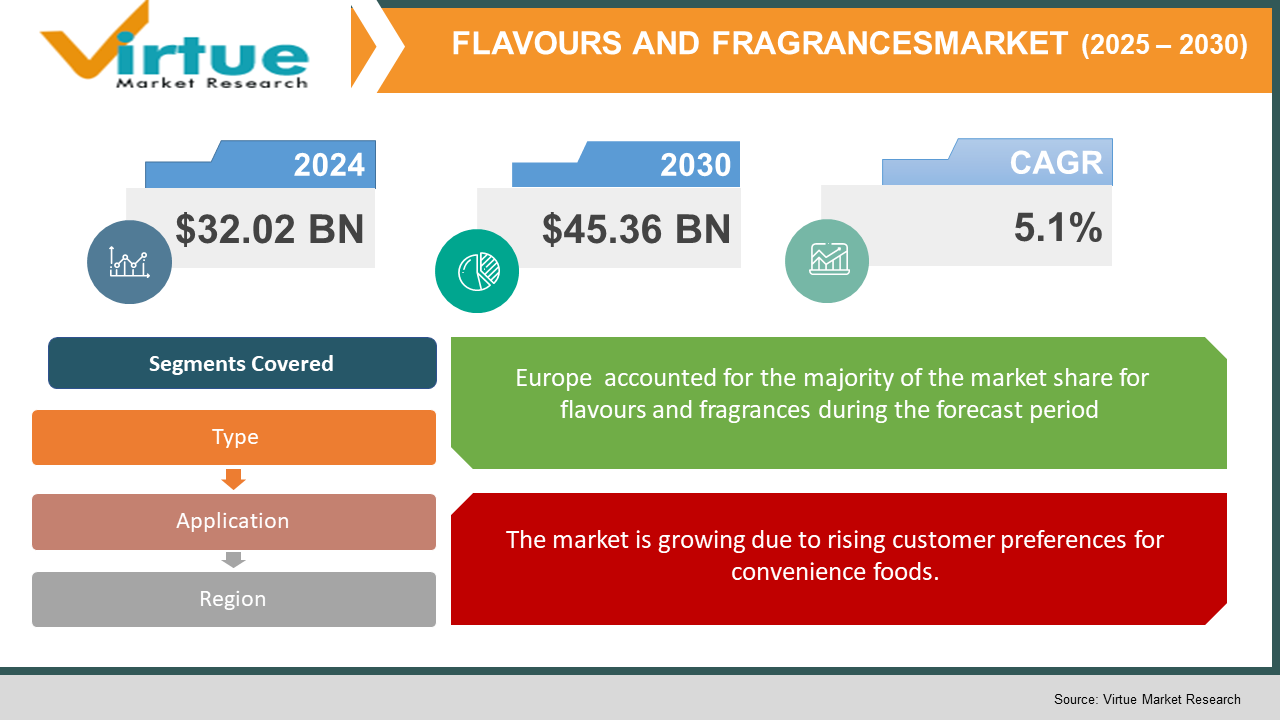

Flavours and Fragrances Market size (2024 - 2030)

The Global Flavours And Fragrances Market was valued at USD 32.02 Billion and is projected to reach a market size of USD 45.36 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.1%.The increased public awareness of the advantages of the substances used in food and consumer products is also driving up demand for flavours and perfumes.

Market overview

Consumer demand for the most nuanced and subtle flavour in food drives the total flavour sector, with flavours being the most particular aspect influencing a consumer's purchasing decision. The importance of flavoursin last 5 years has risen considerably, with 86 per cent of customers prioritising flavours over other food features when making a purchase.

Consumer goods are expected to be the largest segment in the fragrance industry. The demand for high-end cosmetics, detergents, soaps, perfumes, and other household and personal care items is being fuelled by rising disposable income and changing consumer lifestyles. This, in turn, contributes to the consumer products segment's total growth. Consumer buying patterns in developing countries have shifted, particularly in recent years. This trend is projected to continue to boost the market in developing countries.

The expanding population in emerging economies such as China, India, Indonesia, South Korea, Brazil, and South Africa is driving the rise of the flavours and fragrances market. The demand for flavours and fragrances is also driven by a growing public knowledge of the benefits of the substances used in food and consumer items in nations including the United States, Japan, France, Canada, Germany, and the United Kingdom. Consumer flavours for convenience foods are changing, and demand for consumer products is expanding, which is driving up demand for flavours and scents. Government rules banning the use of synthetic flavours and perfumes in Japan, China, the United States, and European countries are limiting the market's expansion. APAC is crucial. In terms of value, APAC is the most important market for flavours and fragrances worldwide, followed by Europe and North America.

Covid-19 Impact on Flavours and fragrances market

Disruptions in the global supply chain are projected to have a moderate impact on the flavours and fragrances market. The market is heavily reliant on the food, beverage, and consumer goods industries.

China is a significant market exporter as well as an industrial producer. Industrial activity in the country was hampered by strict lockdowns in the country's major provinces. The first quarter of 2020 saw a major drop in demand for flavours and perfumes, owing to the emergence of COVID-19. China is one of the world's leading producers of flavours and perfumes. The demand for convenient food, as well as increased production of consumer goods such as personal care, home care, and fabric care, boosted flavour and fragrance production in the country.

COVID-19 has had a significant impact on North America and Europe, and an economic downturn is projected in the United States, Canada, Italy, and Spain in the next two to three years. Because Chinese exports are likely to fall, profit margins for flavours and fragrances dealers are expected to suffer, and the price of flavours and perfumes is expected to rise during this time.

MARKET DRIVERS

The market is growing due to rising customer preferences for convenience foods.

Convenience foods are pre-processed foods that require little or no additional preparation before consumption. Packaged foods, preserved foods, and ready-to-eat food products are among them. Individual flavour elements are added to certain food products to improve their flavours. Convenience food consumption has increased as a result of rapid urbanisation and a rise in the working-class population in both developed and developing nations. Furthermore, rising middle-class disposable income and increased expenditure on convenience foods are predicted to promote demand for convenience foods, which would in turn drive demand for flavours.

The majority of women in most European and North American countries work, which lowers their time available to cook at home. As a result, convenience food becomes a convenient alternative that is both tasty and healthy. Frozen food is also simple to prepare, consume, and store for a longer period, making it handier for single homes; these qualities contribute to their popularity among the younger population.

The retail industry's digitalization is slowing market growth.

Online food and consumer goods purchasing, as well as the advent of new apps that make it easier for customers to select their chosen products, are two of the most recent trends driving the flavours and scent sector. Consumers like internet purchasing because of the convenience and variety it offers. According to Eurostat, about 25% of the population purchased food and consumables through online retail channels. Retail grocery shopping is evolving as one of the platforms for companies to demonstrate and sell their products as the Internet and smartphone usage grows. The number of stores that accept online payments is increasing around the world. Increased smartphone usage, dedicated apps, and evolving payment methods all help to fuel the larger online grocery sector, which in turn helps the flavours and scent market grow.

MARKET RESTRAINTS

Market expansion is being stifled by adherence to quality and regulatory standards.

The flavours and fragrances sector is required by law to follow the rules and regulations of numerous regulatory bodies. These regulatory standards differ per country, but they all have the same purpose of safeguarding consumer safety. Different countries' legislation also places a premium on the use of flavours and perfumes, as well as correct consumer product labelling. These strict rules have the potential to delay or prevent the launch of new products, raise the price of any new product that is presented to the market, and result in product recalls. As a result, new restrictions and adjustments, in addition to existing regulations, have a detrimental impact on market growth.

Many products' pricing stifles market expansion.

Key players focus on producing unique flavouring mixes and investing considerably in R&D operations as their competitive competition grows. Furthermore, the lack of effective rules has resulted in significant pricing irregularities for the bulk of products. Depending on the firm, some grades of these items might cost anywhere from a few dollars per litre to hundreds of dollars per litre. This aspect has a significant impact on market growth and discourages potential end-users from using high-quality items in their manufacturing processes.

FLAVOURS AND FRAGRANCES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Givaudan (Switzerland), Firmenich SA (Switzerland), International Flavors & Fragrances (IFF) (US), Symrise AG (Germany), Takasago (Japan), Archer Daniels Midland Company (ADM) (US), Sensient Technologies (US), Mane SA (France), Robertet (France), T. Hasegawa (Japan), and Bell Flavors & Fragrances (US) |

This research report is based on flavours and fragrances and is segmented and sub-segmented by type, application and region.

flavours and fragrances by type

- Flavours

- Fragrances

Flavours are expected to account for a large portion of the market because they appeal to both the senses of smell and flavours. Based on kind, this market is divided into flavours and fragrances, which are further divided into natural and synthetic. Flavours dominate the market among the two groups due to their widespread use in the food and beverage industry. Flavours appeal to both the senses of smell and flavours, which is one of the main reasons for their bigger market share than scents. They are used to enhance the flavour of a variety of foods and beverages, including dairy products, sodas, snacks, and desserts. They're chemicals that cover over a product's natural flavour and give it a more appealing appearance. Milk, for example, has a rather bland flavour. Nonetheless, dairy product makers add flavours like rose, saffron, and cardamom to milk and milk products, giving them a different scent and flavours.

Fragrances, on the other hand, are employed to mask bad odours in the surroundings by absorbing or replacing odour molecules in the air with aromatic chemicals like esters, which smell like frats and flowers. Cosmetics, personal care products, house and floor care solutions, and other products contain them. Fragrances in cosmetics offer the products a captivating aroma, making them appealing to consumers. The main rationale for the use of scents in cosmetics is the social norm of having a pleasant smelling personality.

flavours and fragrances by application

- Food Beverage

- Cosmetics & Personal Care

- Pharmaceutical

- Home & Floor Care

- Fine Fragrances

- Others

Based on application, the global market is divided into food & drinks, cosmetics & personal care, pharmaceutical, home & floor care, fine fragrances, and others. Food and beverage are predicted to remain the most popular application among them during the projection period. Flavours are commonly employed in food and beverage processing to give food materials an appealing flavours and fragrance. Furthermore, flavour applications have evolved beyond sweets and savoury foods to include speciality applications such as hot beverages, soups, and tobacco products. The food and beverage industry's large-scale consumption of flavours will be the primary driver of market expansion.

Many house and floor care solutions are made with phenol and its derivatives, which have a strong odour that makes them unsuitable for interior use. As a result, perfumes are added to such products to make them more appealing to consumers. The quest for cleanliness that gained traction during the corona pandemic has raised the demand for home care goods in recent years. These are employed in these items to disguise the odorants that are included in the product, making the environment inhabitable. The need for perfumes to mask the unpleasant smell of pesticides is likely to rise as the use of pest control chemicals has expanded in recent years.

flavours and fragrances by region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In 2020, Europe held a substantial portion of the flavours and fragrances industry, accounting for USD 7.96 billion. The main reason for the lead is the high demand from food and beverage businesses, as well as the significant penetration of the fine fragrance and cosmetics manufacturers in the region. Furthermore, the bulk of international manufacturers has their headquarters in Europe, making trading easier. Demand for use in liquor-based cocktails has also risen dramatically in recent years, which is projected to drive the European industry.

In Asia-Pacific, China is the market leader. However, because of a surge in demand for flavoured products in these nations, India and Southeast Asia are likely to experience rapid growth. Because these sensory enhancement goods are needed to manufacture food and cosmetics in China, China accounts for a major part. Furthermore, the market is likely to gain traction as the pharmaceutical industry in the region develops.

North America, on the other hand, is predicted to increase at a moderate rate. In this region, the market has reached maturity. Still, demand for products like sodas and canned cocktails is anticipated to expand soon. The United States is a major user of these products. Because of the rising demand for flavoured desserts, the United States is a major consumer of these items in North America.

In recent years, the need for flavours for the production of local beverages has increased dramatically in Latin America. Furthermore, due to rising health concerns, the region needs a house and floor care goods. The Middle East and Africa market, on the other hand, is predicted to rise rapidly due to the region's high demand for cosmetics and fine fragrances applications.

flavours and fragrances by the company

The flavours and fragrance market is fiercely competitive, with major firms vying for major market share and minor regional competitors vying for market share in smaller regions. The majority of key players are headquartered in North America and Europe. International Flavours & Fragrances, Merck Group, Solvay SA, and Sensient are some of the market's prominent participants. To achieve a better market share, a stronger consumer base, and a competitive edge over other competitors, businesses in this market are focused on a variety of important tactics, such as rapid market expansions, new product launches, and mergers and acquisitions. Companies are targeting regional markets and strengthening their worldwide footprint through new product developments as part of their strategic expansion. Solvay is boosting its European natural vanillin manufacturing capacity by 60 metric tonnes, demonstrating its commitment to satisfying long-term growth forecasts for natural food and beverage components like

- vanillin. Givaudan (Switzerland),

- Firmenich SA (Switzerland)

- International Flavors & Fragrances (IFF) (US)

- Symrise AG (Germany)

- Takasago (Japan)

- Archer Daniels Midland Company (ADM) (US)

- Sensient Technologies (US)

- Mane SA (France)

- Robertet (France)

- T. Hasegawa (Japan)

- Bell Flavors & Fragrances (US) are among the (US).

NOTABLE HAPPENINGS IN THE flavours and fragrances IN THE RECENT PAST.

- PRODUCT LAUNCH

- In January 2021, Solvay introduced Eugenol Synth for fragrance applications with odour qualities similar to those found in cloves.

- EXPANSION

- In October 2020, IFF will open a new Dubai flavours Creation Center in the United Arab Emirates to better serve its customers' particular demands and accelerate growth in the African, Middle Eastern, Turkish, and Indian markets. Snacks, beverages, savoury, sweet, and dairy products will all benefit from the new lab's creation and application capabilities.

- COLLABORATION

- In December 2020, Givaudan and Novozymes will form a research partnership to collaborate on the research and development of novel sustainable food and cleaning solutions.

Chapter 1.Flavours and fragrances Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Flavours and fragrances Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Flavours and fragrances Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Flavours and fragrances Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Flavours and fragrances Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Flavours and fragrances Market – By Type

6.1. Flavours

6.2. Fragrances

Chapter 7.Flavours and fragrances Market – By Service

7.1. Education Service

7.2. Implementation Service

7.3. Consulting Service

7.4. Others

Chapter 8.Flavours and fragrances Market – By Application

8.1. Food Beverage

8.2. Cosmetics & Personal Care

8.3. Pharmaceutical

8.4. Home & Floor Care

8.5. Fine Fragrances

8.6. Others

Chapter 9.Flavours and fragrances Market – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.Flavours and fragrances Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. vanillin. Givaudan (Switzerland

10.2. Firmenich SA (Switzerland)

10.3. International Flavors & Fragrances (IFF) (US)

10.4. Symrise AG (Germany)

10.5. Takasago (Japan)

10.6. Archer Daniels Midland Company (ADM) (US)

10.7. Sensient Technologies (US)

10.8. Mane SA (France)

10.9. Robertet (France)

10.10. T. Hasegawa (Japan)

10.11 . Bell Flavors & Fragrances (US)

Download Sample

Choose License Type

2500

4250

5250

6900