Flavonoids Market Size (2024 – 2030)

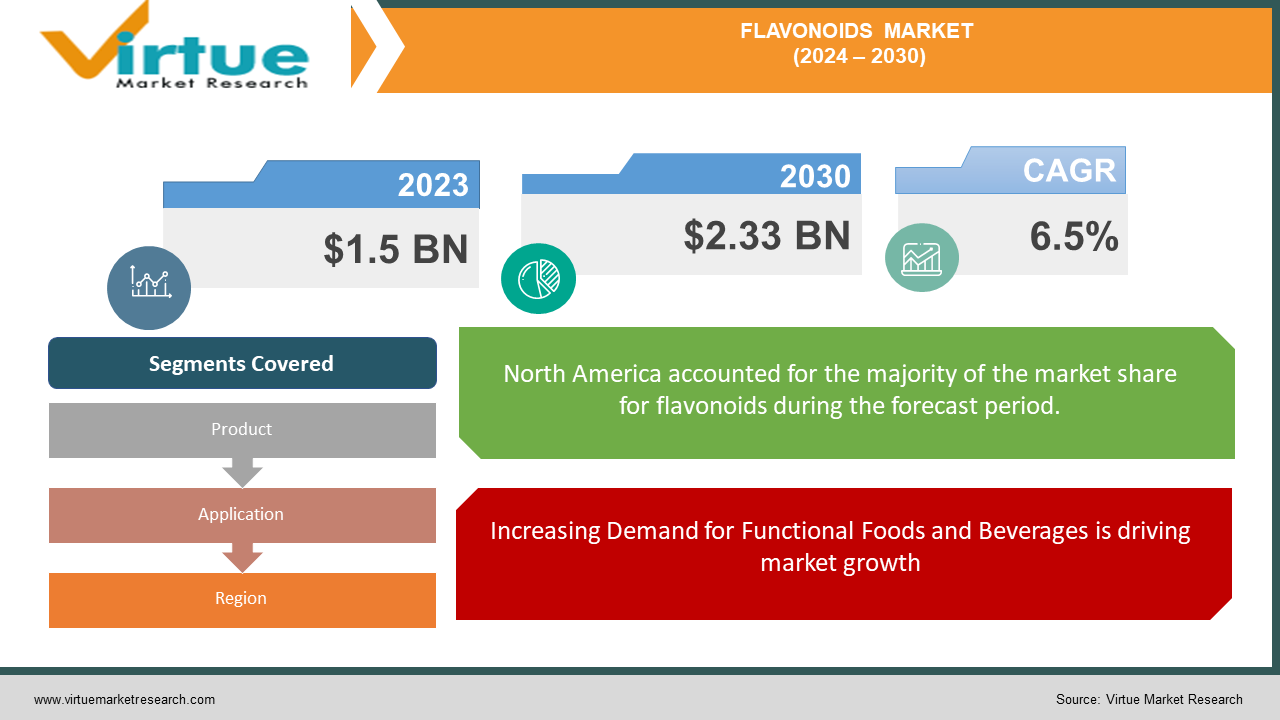

The global Flavonoids market was valued at USD 1.5 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030, reaching USD 2.33 billion by 2030.

The global flavonoids market is witnessing significant growth, driven by the increasing awareness of their health benefits and rising demand across various industries, including food and beverages, pharmaceuticals, and cosmetics. Flavonoids, known for their antioxidant, anti-inflammatory, and anti-cancer properties, are naturally occurring compounds found in fruits, vegetables, and certain beverages. Their incorporation into various products is largely driven by the growing consumer preference for natural and healthy ingredients.

Key Market Insights

Increasing consumer awareness about the health benefits of flavonoids is driving market growth. Flavonoids are known to reduce the risk of chronic diseases, including heart disease and cancer.

The food and beverage industry is the largest consumer of flavonoids, using them as natural additives to enhance flavor, color, and nutritional value. The demand for functional foods and beverages is propelling market growth.

Flavonoids are widely used in pharmaceuticals for their therapeutic properties. They are being researched for their potential in treating various conditions such as inflammation, cardiovascular diseases, and neurodegenerative disorders.

The cosmetic industry is incorporating flavonoids into skincare and personal care products due to their antioxidant and anti-aging properties. This trend is expected to continue driving market growth.: Continuous research and development activities are leading to the introduction of innovative flavonoid-based products. Companies are investing in new extraction and formulation techniques to enhance product efficacy.

North America and Europe are the leading markets for flavonoids due to high consumer awareness and demand for natural products. The Asia-Pacific region is also emerging as a significant market due to increasing disposable incomes and health consciousness.

Regulatory frameworks in various countries are promoting the use of natural ingredients in food and beverages, pharmaceuticals, and cosmetics. This is positively impacting the flavonoids market.

The trend towards sustainability is driving the demand for naturally sourced ingredients like flavonoids. Companies are focusing on sustainable sourcing and production practices to meet consumer expectations.

Global Flavonoids Market Drivers

Increasing Demand for Functional Foods and Beverages is driving market growth:

The rising consumer preference for functional foods and beverages is a significant driver for the flavonoids market. Functional foods, which provide additional health benefits beyond basic nutrition, are becoming increasingly popular as consumers seek to enhance their overall well-being. Flavonoids, with their antioxidant, anti-inflammatory, and anti-cancer properties, are being incorporated into a wide range of food and beverage products, including juices, teas, and dietary supplements. The growing awareness of the health benefits associated with flavonoids is encouraging manufacturers to innovate and develop new products, further driving market growth.

Growth in the Pharmaceutical Industry is driving market growth:

The pharmaceutical industry is a major consumer of flavonoids, leveraging their therapeutic properties to develop new medications and treatments. Flavonoids are being researched for their potential in treating various health conditions, including cardiovascular diseases, inflammation, and neurodegenerative disorders. The increasing prevalence of chronic diseases and the growing focus on preventive healthcare are driving the demand for flavonoid-based pharmaceuticals. Additionally, ongoing research and development activities aimed at discovering new applications for flavonoids in the pharmaceutical sector are expected to boost market growth.

Rising Popularity of Natural and Organic Products is driving market growth:

The global trend towards natural and organic products is significantly impacting the flavonoids market. Consumers are increasingly seeking products made from natural ingredients, driven by concerns about synthetic additives and their potential health risks. Flavonoids, being naturally occurring compounds found in fruits, vegetables, and certain beverages, align perfectly with this trend. The demand for natural and organic food, beverages, cosmetics, and personal care products is driving the incorporation of flavonoids as natural additives and active ingredients. This shift towards natural and organic products is expected to continue driving the growth of the flavonoids market.

Global Flavonoids Market Challenges and Restraints

High Production Costs are restricting market growth:

One of the significant challenges faced by the flavonoids market is the high cost of production. The extraction and purification processes required to obtain flavonoids from natural sources can be complex and expensive. Additionally, the need for advanced technologies and specialized equipment further adds to the production costs. These high costs can limit the scalability of flavonoid production and make flavonoid-based products more expensive for consumers. Manufacturers are continuously exploring ways to optimize production processes and reduce costs, but this remains a key challenge for the market.

Regulatory and Quality Control Issues Restricting Market Growth:

The regulatory environment for flavonoids can be complex, with varying standards and requirements across different regions. Ensuring compliance with these regulations can be challenging for manufacturers, particularly when it comes to labeling, health claims, and safety standards. Additionally, maintaining consistent quality and purity of flavonoid extracts is critical to their effectiveness and consumer acceptance. Variations in raw material quality, extraction methods, and storage conditions can impact the final product's quality. These regulatory and quality control issues can pose significant challenges for market players, potentially hindering market growth.

Market Opportunities

The flavonoids market presents significant opportunities for growth, driven by increasing consumer awareness of health and wellness. One of the primary opportunities lies in the expansion of functional foods and beverages. As consumers become more health-conscious, there is a growing demand for products that offer additional health benefits. Flavonoids, known for their antioxidant, anti-inflammatory, and anti-cancer properties, are well-positioned to meet this demand. Manufacturers can capitalize on this trend by developing innovative functional food and beverage products that incorporate flavonoids as key ingredients. Another opportunity lies in the pharmaceutical industry, where flavonoids are being researched for their potential in treating various health conditions. With the increasing prevalence of chronic diseases, there is a growing need for effective and natural therapeutic solutions. Companies can invest in research and development to explore new applications for flavonoids in pharmaceuticals, thereby driving market growth. Additionally, the rising popularity of natural and organic products presents an opportunity for flavonoid-based cosmetics and personal care products. Consumers are increasingly seeking natural ingredients in their skincare and personal care routines, and flavonoids, with their antioxidant and anti-aging properties, can cater to this demand. Overall, the flavonoids market is poised for growth, with ample opportunities for innovation and expansion across various industries

FLAVONOIDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company (ADM), BASF SE, Chr. Hansen Holding A/S, DowDuPont Inc., Indena S.p.A., Kemin Industries, Naturex S.A., Nutra Green Biotechnology Co., Ltd., Quercegen Pharmaceuticals, Sphera Encapsulation |

Flavonoids Market Segmentation - By Product

-

Anthocyanins

-

Flavanones

-

Flavonols

-

Flavones

-

Isoflavones

The most dominant segment in the flavonoids market by product type is Anthocyanins. Anthocyanins are widely used in food and beverage applications due to their vibrant color and health benefits. They are known for their antioxidant properties and are increasingly incorporated into functional foods and beverages, driving their dominance in the market.

Flavonoids Market Segmentation - By Application

-

Food and Beverages

-

Pharmaceuticals

-

Cosmetics

-

Nutraceuticals

-

Animal Feed

The Food and Beverages segment is the most dominant application type in the flavonoids market. This dominance is driven by the extensive use of flavonoids as natural additives in food and beverages to enhance flavor, color, and nutritional value. The rising consumer demand for functional and health-promoting food and beverages is further contributing to the dominance of this segment.

Flavonoids Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the flavonoids market, driven by high consumer awareness and demand for natural and healthy products. The region's well-established food and beverage industry and the growing popularity of functional foods contribute significantly to this dominance. Additionally, the presence of leading market players and ongoing research and development activities further bolster the market's growth in North America.

COVID-19 Impact Analysis on the Flavonoids Market

The COVID-19 pandemic had a significant impact on the global flavonoids market. During the initial phases of the pandemic, disruptions in supply chains and manufacturing activities posed challenges for the market. However, the pandemic also underscored the importance of health and wellness, leading to an increased consumer focus on immunity-boosting and health-promoting products. This shift in consumer behavior positively influenced the demand for flavonoids, known for their antioxidant and anti-inflammatory properties. The heightened awareness of the benefits of natural ingredients and the growing demand for functional foods and beverages further fueled the market's growth. Additionally, the increased use of flavonoids in dietary supplements and pharmaceuticals aimed at enhancing immunity and overall health contributed to the market's resilience during the pandemic. Overall, while the market faced initial disruptions, the long-term impact of COVID-19 has been positive, with increased emphasis on health and wellness driving the demand for flavonoids.

Latest Trends/Developments

The flavonoids market is witnessing several key trends and developments that are shaping its growth. A significant trend is the increasing consumer preference for natural and organic products. As consumers become more health-conscious and wary of synthetic additives, the demand for products made from natural ingredients, including flavonoids, is rising. This trend is particularly evident in the food and beverage, pharmaceutical, and cosmetic industries. Another notable development is the growing investment in research and development activities. Companies are focusing on innovative extraction and formulation techniques to enhance the efficacy and stability of flavonoid-based products. Additionally, there is a rising interest in exploring new applications for flavonoids in various industries, further driving market growth. The trend towards sustainability is also influencing the market, with companies adopting sustainable sourcing and production practices to meet consumer expectations for environmentally friendly products.

Key Players

-

Archer Daniels Midland Company (ADM)

-

BASF SE

-

Chr. Hansen Holding A/S

-

DowDuPont Inc.

-

Indena S.p.A.

-

Kemin Industries

-

Naturex S.A.

-

Nutra Green Biotechnology Co., Ltd.

-

Quercegen Pharmaceuticals

-

Sphera Encapsulation

Chapter 1. Flavonoids Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flavonoids Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flavonoids Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flavonoids Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flavonoids Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flavonoids Market – By Product

6.1 Introduction/Key Findings

6.2 Anthocyanins

6.3 Flavanones

6.4 Flavonols

6.5 Flavones

6.6 Isoflavones

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Flavonoids Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.3 Pharmaceuticals

7.4 Cosmetics

7.5 Nutraceuticals

7.6 Animal Feed

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Flavonoids Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Flavonoids Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company (ADM)

9.2 BASF SE

9.3 Chr. Hansen Holding A/S

9.4 DowDuPont Inc.

9.5 Indena S.p.A.

9.6 Kemin Industries

9.7 Naturex S.A.

9.8 Nutra Green Biotechnology Co., Ltd.

9.9 Quercegen Pharmaceuticals

9.10 Sphera Encapsulation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global flavonoids market was valued at USD 1.5 billion in 2023 and is expected to reach USD 2.33 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030.

Key drivers include increasing consumer awareness of health benefits, rising demand for food and beverages, growth in pharmaceutical applications, and the popularity of natural and organic products.

The market is segmented by product type (Anthocyanins, Flavanones, Flavonols, Flavones, and Isoflavones) and by application (Food and Beverages, Pharmaceuticals, Cosmetics, Nutraceuticals, Animal Feed).

North America is the dominant region, driven by high consumer awareness, demand for natural products, and the presence of leading market players.

Leading players include Archer Daniels Midland Company (ADM), BASF SE, and Chr. Hansen Holding A/S, DowDuPont Inc., Indena S.p.A., Kemin Industries, Naturex S.A., Nutra Green Biotechnology Co., Ltd., Quercegen Pharmaceuticals, and Sphera Encapsulation.