Flat Glass Market Size (2024 – 2030)

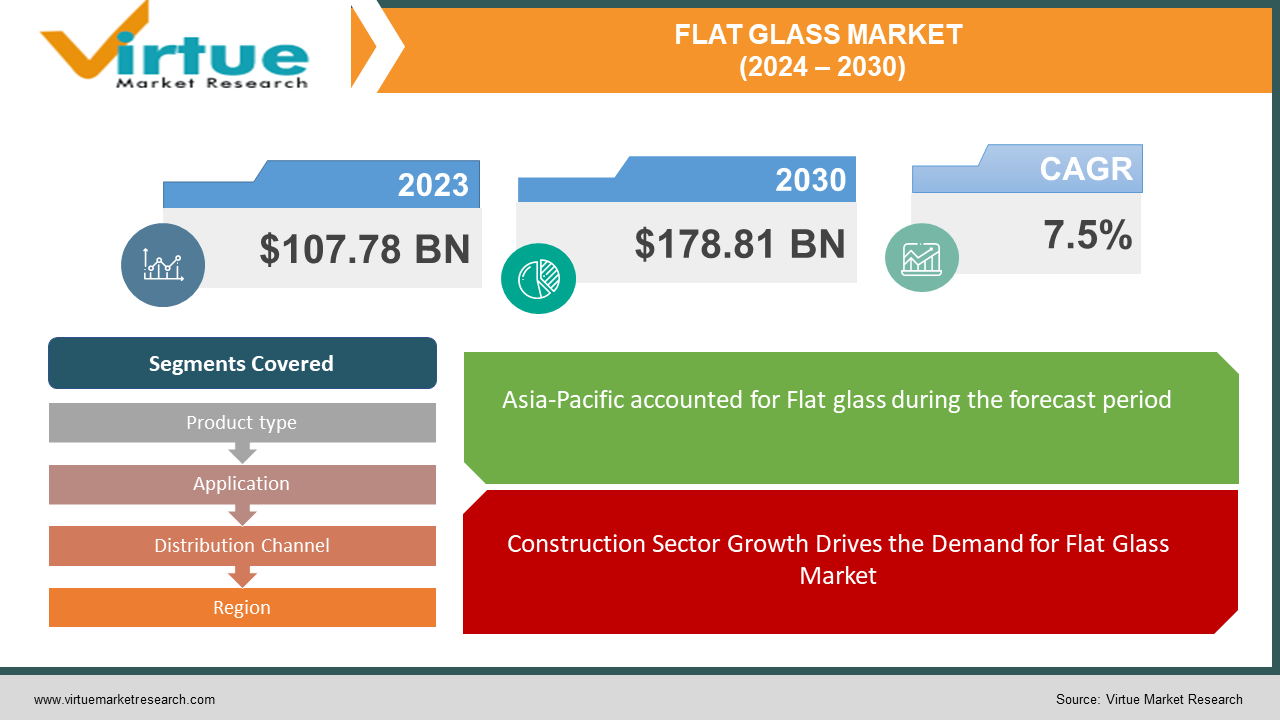

The Global Flat Glass Market was valued at USD 107.78 billion and is projected to reach a market size of USD 178.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.5%.

Flat glass includes float glass, rolled glass, and sheet glass. It is widely used in various applications such as windows, doors, facades, and automotive windshields. The Flat Glass Market is expected to grow significantly in the coming years due to increasing demand from the construction and automotive industries. Increasing vehicle production and technological advancements in automotive glass are fueling the Flat Glass Market. The major well-established key players in the Flat Glass Market are Asahi Glass Co., Ltd., Saint-Gobain S.A., Nippon Sheet Glass Co., Ltd. (NSG Group), Guardian Industries, and AGC Inc.

Key Market Insights:

Construction Sector Growth, Automotive Industry Demand, Energy Efficiency Regulations, Technological Advancements, Shift towards Smart Glass are propelling the Flat Glass Market. The restraints to the Flat Glass Market include the cyclical nature of the construction sector, environmental concerns related to manufacturing processes, competition from substitute materials, volatility in raw material prices, slow adoption of advanced technologies, and regulatory compliance and standards. Ongoing advancements in technology have led to the development of more high-quality flat glass with improved properties such as strength, clarity, and durability. Asia-Pacific occupies the highest share of the Flat Glass Market. Middle East and Africa is the fastest-growing segment during the forecast period.

Flat Glass Market Drivers:

Construction Sector Growth Drives the Demand for Flat Glass Market

The construction sector plays an important role in flat glass globally. Urbanization continues and populations grow rapidly during the present time. There is an increased need for infrastructure development, commercial buildings, and residential constructions. Flat glass is a fundamental component in the construction of buildings. It is used for windows, doors, facades, and interior partitions. The construction sector is booming, particularly in Asia and Africa. This contributes to the growth of the flat glass market. Renovations and upgrades in existing buildings with the latest trends such as green building initiatives and smart buildings demand flat glass products with enhanced energy efficiency and aesthetic appeal.

Automotive Industry Demand is propelling the Flat Glass Market

The automotive industry plays an important role in the flat glass market. Flat glass is used for manufacturing automotive windshields, windows, and sunroofs. The global population is growing and disposable income is increasing. The demand for automobiles such as passenger cars, commercial vehicles, and electric vehicles, is surging. There is a continuous demand for flat glass in the automotive industry. Advancements in automotive technologies, such as the integration of heads-up displays, augmented reality features, and advanced driver-assistance systems (ADAS), demand specialized glass products with properties like high optical clarity, strength, and resistance to impact and scratches.

Flat Glass Market Restraints and Challenges

The major challenges faced by the Flat Glass Market are the fluctuations in the prices of raw materials such as silica sand, soda ash, and limestone. This is mainly due to supply chain disruptions, geopolitical tensions, or changes in exchange rates. This further impacts production costs and profit margins for flat glass manufacturers. Another challenge in the Flat Glass Market is the cyclical nature of the construction sector. Economic downturns or slowdowns in construction activity lead to reduced demand for flat glass. The other restraints to the Flat Glass Market include environmental concerns related to manufacturing processes, competition from substitute materials, slow adoption of advanced technologies, and regulatory compliance and standards.

Flat Glass Market Opportunities:

The Flat Glass Market has various opportunities in the market. With increasing demand for energy-efficient and smart glass solutions, Flat Glass Market is anticipated to witness significant growth in the coming years. Growth in emerging markets and advancements in specialty glass applications such as photovoltaic and electronic displays presents significant opportunities. The potential for innovation leads to the development of advanced Flat Glass with enhanced textures and properties. Other Opportunities in the Flat Glass Market include expanding applications in the healthcare and electronics sectors and collaboration in sustainable manufacturing practices.

FLAT GLASS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Asahi Glass Co., Ltd., Saint-Gobain S.A., Nippon Sheet Glass Co., Ltd. (NSG Group), Guardian Industries, AGC Inc. (formerly known as Asahi Glass Co.), PPG Industries, Inc., Sisecam Group, Vitro, S.A.B. de C.V., China Glass Holdings Limited, Fuyao Glass Industry Group Co., Ltd. |

Flat Glass Market Segmentation: By Product Type

-

Float Glass

-

Rolled Glass

-

Sheet Glass

-

Coated Glass

-

Laminated Glass

-

Toughened Glass

-

Mirrored Glass

In 2023, based on market segmentation by Product Type, Float Glass occupies the highest share of the Flat Glass Market. This is mainly due to its widespread use in construction and automotive applications. It has high optical quality and uniform thickness.

However, Coated Glass and Laminated Glass is the fastest-growing segment during the forecast period. This is due to increasing demand for energy-efficient and safety-enhanced glass solutions in construction, automotive, and other industries. Coated glass gives improved thermal insulation and solar control properties. laminated glass offers safety features such as shatter resistance and sound insulation.

Flat Glass Market Segmentation: By Application

-

Construction (Residential, Commercial, Industrial)

-

Automotive (Windshields, Windows, Sunroofs)

-

Electronics (Displays, Touchscreens)

-

Solar Energy (Photovoltaic Panels)

-

Aerospace

-

Healthcare (Medical Devices, Laboratory Equipment)

-

Furniture

-

Others

In 2023, based on market segmentation by Application, Construction, with subcategories including Residential, Commercial, and Industrial construction occupies the highest share of the Flat Glass Market. This is mainly due to the extensive use of flat glass in buildings. Flat glass is used for windows, doors, facades, and interior partitions.

However, Solar Energy (Photovoltaic Panels) is the fastest-growing segment during the forecast period. This is mainly due to the increasing investments in renewable energy and the expansion of solar energy infrastructure globally.

Flat Glass Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors/Wholesalers

-

Retailers

-

E-commerce

In 2023, based on market segmentation by the Distribution Channel, the Direct Sales segment occupies the highest share of the Flat Glass Market. This is mainly due to greater control over pricing, product quality, and customer relationships as it involves manufacturers selling their products directly to customers.

However, E-commerce is the fastest-growing segment during the forecast period. This growth is driven by the increasing trend of online purchasing and the convenience it offers to both consumers and businesses. Online platforms provide a wide range of flat glass products, easy comparison, and customization options. This makes them attractive to customers seeking efficiency and accessibility.

Flat Glass Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, Asia-Pacific occupies the highest share of the Flat Glass Market. This growth is due to rapid urbanization, infrastructure development, and a booming automotive industry. Countries like China, India, Japan, and Australia, have significant market share due to high demand for flat glass in construction and automotive applications. However, Middle East and Africa is the fastest-growing segment during the forecast period. This is mainly due to urbanization, infrastructure projects, and investments in renewable energy. Countries like the United Arab Emirates and Saudi Arabia are key markets for flat glass in construction and solar energy applications.

COVID-19 Impact Analysis on the Global Flat Glass Market:

The COVID-19 pandemic had a significant impact on the Flat Glass Market. There were lockdowns, social distancing measures, supply chain disruptions, and other restrictions. This led to delays or cancellations of construction projects globally. This resulted in a decline in demand for flat glass in the residential, commercial, and industrial construction sectors. The automotive industry, a major consumer of flat glass for windshields, windows, and sunroofs, also experienced a slowdown. This also resulted in reduced demand for flat glass. The pandemic accelerated the adoption of digital technologies. The remote working arrangements led to increased demand for electronic displays, touchscreens, and smart glass solutions in homes, offices, and public spaces. Thus, the pandemic accelerated certain trends in the Flat Glass Market.

Latest Trends/ Developments:

One of the developments in the Flat Glass Market is the rise in digitalization and Industry 4.0 technologies to optimize production processes, improve quality control, and enhance supply chain management. Automation, robotics, data analytics, and artificial intelligence are integrated into manufacturing facilities to increase efficiency and competitiveness. There is a growing emphasis on sustainability and energy efficiency in the flat glass market. Manufacturers are investing in research and development to produce eco-friendly glass products with improved thermal insulation, solar control, and energy-saving properties.

Key Players:

-

Asahi Glass Co., Ltd.

-

Saint-Gobain S.A.

-

Nippon Sheet Glass Co., Ltd. (NSG Group)

-

Guardian Industries

-

AGC Inc. (formerly known as Asahi Glass Co.)

-

PPG Industries, Inc.

-

Sisecam Group

-

Vitro, S.A.B. de C.V.

-

China Glass Holdings Limited

-

Fuyao Glass Industry Group Co., Ltd.

Market News:

-

In 2024, European glass manufacturer Vetropack launched a new 0.33-litre returnable bottle, designed to be one-third lighter than conventional counterparts and made with over two-thirds recycled glass. This innovation aims to support Austria's brewing industry while promoting economic and environmental benefits.

-

In 2024, British Glass unveiled a roadmap aiming to achieve a 90% glass recycling target by 2030, in collaboration with WRAP. This initiative seeks to enhance sustainability within the glass packaging industry, promoting a closed-loop system for glass recycling while emphasizing the importance of separate glass collections and reducing residual waste collections' frequency and capacity.

-

In 2024, Ardagh Glass Packaging South Africa expanded its operations by commissioning the N3 plant in Nigel, now operating three Sorg furnaces. This expansion contributes to the growth of the glass industry in South Africa.

-

In 2024, a Qatari conglomerate has announced plans to invest $240 million in constructing a float glass manufacturing facility in India, reflecting the industry's global reach and potential for growth.

Chapter 1. Flat Glass Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flat Glass Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flat Glass Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flat Glass Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flat Glass Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flat Glass Market – By Product Type

6.1 Introduction/Key Findings

6.2 Float Glass

6.3 Rolled Glass

6.4 Sheet Glass

6.5 Coated Glass

6.6 Laminated Glass

6.7 Toughened Glass

6.8 Mirrored Glass

6.9 Y-O-Y Growth trend Analysis By Product Type

6.10 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Flat Glass Market – By Application

7.1 Introduction/Key Findings

7.2 Construction (Residential, Commercial, Industrial)

7.3 Automotive (Windshields, Windows, Sunroofs)

7.4 Electronics (Displays, Touchscreens)

7.5 Solar Energy (Photovoltaic Panels)

7.6 Aerospace

7.7 Healthcare (Medical Devices, Laboratory Equipment)

7.8 Furniture

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Flat Glass Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors/Wholesalers

8.4 Retailers

8.5 E-commerce

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Flat Glass Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Flat Glass Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Asahi Glass Co., Ltd.

10.2 Saint-Gobain S.A.

10.3 Nippon Sheet Glass Co., Ltd. (NSG Group)

10.4 Guardian Industries

10.5 AGC Inc. (formerly known as Asahi Glass Co.)

10.6 PPG Industries, Inc.

10.7 Sisecam Group

10.8 Vitro, S.A.B. de C.V.

10.9 China Glass Holdings Limited

10.10 Fuyao Glass Industry Group Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Flat Glass Market was valued at USD 107.78 billion and is projected to reach a market size of USD 178.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.5%.

Construction Sector Growth, Automotive Industry Demand, Energy Efficiency Regulations, Technological Advancements, Shift towards Smart Glass are the market drivers of the Global Flat Glass Market.

Float Glass, Rolled Glass, Sheet Glass, Coated Glass, Laminated Glass, Toughened Glass, and Mirrored Glass are the segments under the Global Flat Glass Market by Product Type.

North America is the most dominant region for the Global Flat Glass Market.

Asahi Glass Co., Ltd., Saint-Gobain S.A., Nippon Sheet Glass Co., Ltd. (NSG Group), Guardian Industries, and AGC Inc. are the key players in the Global Flat Glass Market.