Flare Gas Recovery System Market Size (2024 – 2030)

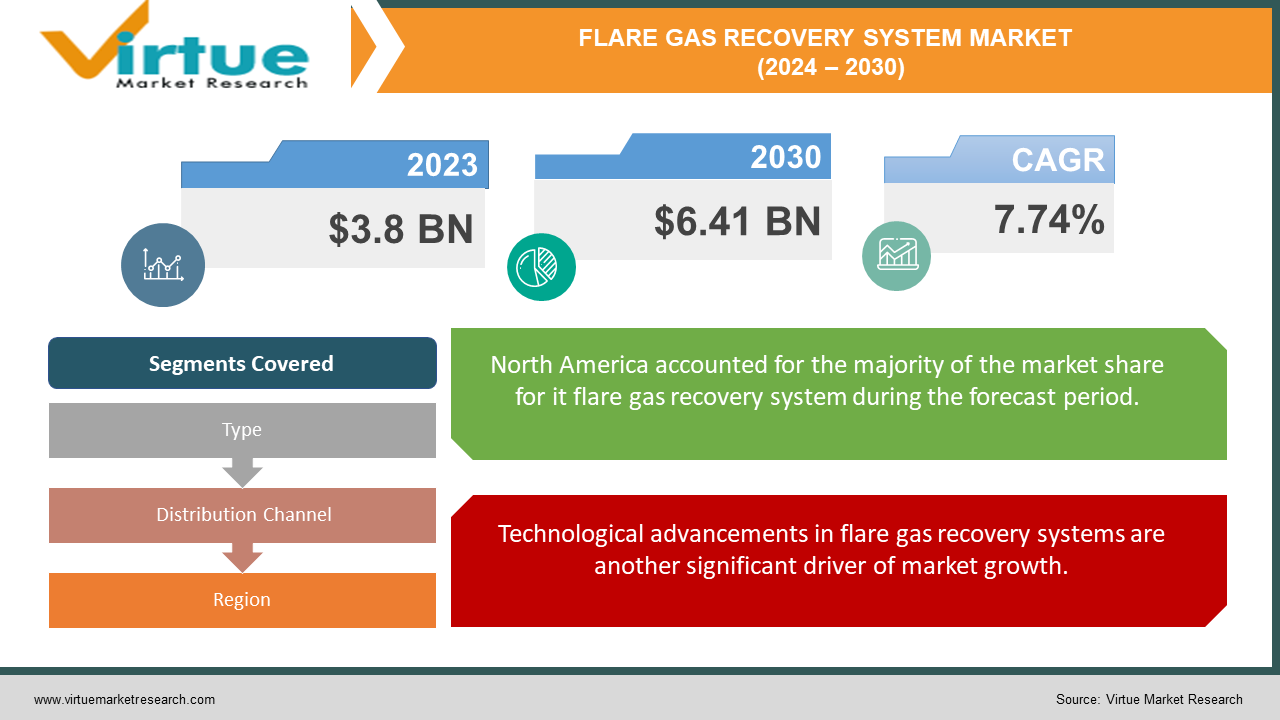

The Global Flare Gas Recovery System Market was valued at USD 3.8 Billion in 2023 and is projected to reach a market size of USD 6.41 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.74%.

Due to growing environmental regulations, technological advancements, and increased consumer awareness of waste minimization and energy efficiency, the market for flare gas recovery systems is predicted to grow significantly. Burning off flare gas, a byproduct of the extraction and refinement of oil and gas is a common practice that results in significant emissions of greenhouse gases. However, flare gas recovery systems capture this gas, reducing emissions and producing a useful energy source. Flare gas recovery systems are essential to the oil and gas industry because they minimize environmental impact while boosting economic efficiency. By gathering and repurposing gas that would have been flared, these devices produce useful energy.

Key Market Insights:

Flare gas recovery systems can capture between 90-99% of the flared gas, depending on the specific technology and gas composition.

Utilizing recovered gas for power generation can contribute to reducing greenhouse gas emissions by up to 60% compared to flaring.

Studies suggest that implementing flare gas recovery systems can offer payback periods within 2-5 years due to the recovered gas's economic value.

The upfront capital expenditure for installing a flare gas recovery system can range from USD 0. 5 million to USD 10 million or more, depending on the size, capacity, and complexity of the system.

Around 60% of the total project cost for a flare gas recovery system is attributed to equipment procurement, including compressors, separators, and processing units.

The global market for high-pressure flare gas recovery systems is expected to surpass USD 1. 5 billion by 2027, catering to applications in deepwater oil and gas exploration.

Over 25% of the flare gas recovery systems currently in operation utilize thermal oxidation technology, which involves burning the recovered gas in a controlled environment

Over 10,000 flare gas recovery systems are currently operational worldwide, with the number expected to grow steadily in the coming years.

The operation and maintenance (O&M) costs of a flare gas recovery system typically account for 5-10% of the total lifecycle cost.

Flare Gas Recovery System Market Drivers:

One of the primary drivers of the flare gas recovery system market is the increasing stringency of environmental regulations and policies aimed at reducing greenhouse gas emissions.

Governments and regulatory agencies worldwide are enforcing stricter emission standards and penalizing flaring, which is compelling oil and gas companies to adopt sustainable practices. Europe's industries are obliged by the EU Emission Trading System (ETS) and other regulatory frameworks to reduce their carbon footprints. Similar initiatives are underway in other regions, like the Middle East and Africa, where governments are focusing on reducing carbon emissions to comply with international agreements like the Paris Accord. These regulations aim to reduce environmental pollution while also promoting resource efficiency. Another factor pushing businesses to implement flare gas recovery systems is the growing emphasis on sustainability and corporate social responsibility (CSR). Businesses can drastically cut emissions, perform better environmentally, and improve their reputation by collecting and reusing flare gas. As a result, they are better able to compete in the market and satisfy the rising demands of all parties involved, such as investors, clients, and government agencies.

Technological advancements in flare gas recovery systems are another significant driver of market growth.

The adoption of these technologies by businesses has been facilitated by the development of recovery systems that are more dependable, efficient, and affordable. Flare gas recovery systems now function better and are more appealing to oil and gas companies thanks to advancements in gas compression, refrigeration, and gas processing technologies. For example, advances in compressor technology have increased gas recovery efficiency, allowing for higher recovery rates and improved performance. The quality of the recovered gas has also improved due to advancements in gas separation and purification technologies. This makes it appropriate for a range of uses, such as power generation, reinjection, and petrochemical process feedstock.

Flare Gas Recovery System Market Restraints and Challenges:

The high initial cost associated with installing these systems is one of the major barriers to the flare gas recovery system market. Complex machinery and technology, such as compressors, heat exchangers, and control systems, are used in flare gas recovery systems, and they can be costly. For many businesses, especially small and medium-sized enterprises (SMEs), the high cost of these components combined with the difficulty of installation and integration with current infrastructure can be a barrier. Flare gas recovery systems can have significant ongoing maintenance and operating costs in addition to their high initial investment. To guarantee peak performance and avoid any operational problems, these systems need to be maintained on a regular basis. Flare gas recovery systems' operational and technical difficulties can also pose serious obstacles to the market's expansion. Recovery system design and operation may be complicated by the fluctuating composition and flow rate of flare gas. Hydrogen sulfide and heavy hydrocarbons are two common contaminants and impurities found in flare gas that can impair the effectiveness and performance of recovery systems. Operational issues, such as equipment failure, corrosion, and fouling, can also affect the performance of flare gas recovery systems. These issues can lead to downtime and reduced efficiency, increasing maintenance costs and affecting the overall economic viability of the systems. Addressing these technical challenges requires continuous innovation and the development of more robust and efficient technologies, which can be a resource-intensive process.

Flare Gas Recovery System Market Opportunities:

There are a lot of opportunities for the flare gas recovery system market due to the rising global demand for energy and the need for cost savings in the oil and gas industry. The world's need for energy is constantly growing due to the expanding population and quickening industrialization. To help meet this increasing demand, flare gas recovery systems provide a valuable source of energy. Through the capture and repurposing of flare gas, businesses can decrease their dependency on outside energy providers and produce their own energy, resulting in substantial financial savings. As a dependable and affordable energy source, the recovered gas can be applied to a variety of tasks such as heating, power generation, and petrochemical process feedstock. The market for flare gas recovery systems has a lot of room to grow as a result of the expansion into emerging markets. Rapid industrialization and urbanization are occurring in emerging economies, especially in the Asia-Pacific, Latin America, and the Middle East. This is raising concerns about the environment and the demand for energy. These areas are also seeing large-scale infrastructure investments related to oil and gas, which creates a favorable atmosphere for the use of flare gas recovery systems.

FLARE GAS RECOVERY SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.74% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Baker Hughes Company (USA), Halliburton (USA), John Zink Hamworthy Combustion LLC (USA), GE Oil & Gas (USA) (now Baker Hughes), Honeywell International Inc. (USA), Siemens Energy AG (Germany), Wood Plc (UK), Emerson Electric Co. (USA), Kanooz Gas Processing (UAE), Future Fuel Technologies (Canada), Manulife Investment Management (Canada) , Ecopetrol S.A. (Colombia) |

Flare Gas Recovery System Market Segmentation: By Type

-

Small Capacity Systems

-

Medium Capacity Systems

-

Large Capacity Systems

The market is dominated by large-capacity flare gas recovery systems because they are widely used in petrochemical plants, large oil refineries, and other large oil and gas processing facilities. These systems are essential in industries with significant gas flaring activities because they are made to handle large volumes of flare gas. Large capacity systems' high performance and efficiency allow them to command a substantial market share. Large volumes of gas that would otherwise be flared can be recovered by these systems and turned into useful energy.

Medium-capacity flare gas recovery systems are growing at the fastest rate, although large-capacity systems still command the majority of the market. These systems offer a cost-effective solution that balances capacity for mid-sized oil and gas processing facilities. Medium capacity systems are adaptable and capable of handling different flare gas volumes with efficiency, which makes them appropriate for a variety of applications. Systems with a medium capacity are made to be adaptable and flexible so they can effectively handle various flare gas volumes. They are therefore appropriate for mid-sized facilities with potentially variable flare gas volumes. For mid-sized operations, these systems provide an affordable option. When compared to large capacity systems, they have a lower initial investment requirement and offer significant economic benefits from gas recovery.

Flare Gas Recovery System Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors and Wholesalers

-

Online Sales

For flare gas recovery systems, direct sales have become the main distribution route. Through this channel, systems are sold straight from manufacturers to final consumers, eschewing middlemen like resellers and distributors. Manufacturers and customers benefit greatly from direct sales in a number of ways. Manufacturers can interact directly with clients through direct sales, gaining insight into their unique wants and demands. The ability to provide precisely tailored solutions to address the specific needs of various operations is made possible by this direct relationship.

Online sales are rapidly emerging as the fastest-growing distribution channel for flare gas recovery systems. This channel involves the sale of systems through digital platforms, including manufacturers’ websites and third-party e-commerce sites. The growth of online sales is driven by several factors, including the increasing digitalization of industrial procurement processes and the need for convenient and efficient purchasing options. Online sales platforms provide manufacturers with access to a global customer base, transcending geographical barriers. This wider reach is particularly beneficial for expanding into emerging markets where traditional sales channels may be underdeveloped.

Flare Gas Recovery System Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

Led by the United States and Canada, North America accounts for a sizeable portion of the market for flare gas recovery systems. Due in part to its substantial investments in the oil and gas industry, strict environmental regulations, and robust industrial base, the region is currently in the lead. The deployment of flare gas recovery systems is made easier in North America by the region's strong infrastructure and adoption of cutting-edge technology. Policies implemented by the government to lower greenhouse gas emissions and encourage sustainable energy practices support the market share in this region.

Flare gas recovery system sales are rising quickly in the Asia-Pacific region as a result of rising industrial activity, especially in China and India. Flare gas recovery systems are in high demand due to the region's growing oil and gas industry and growing environmental consciousness. Governmental programs to reduce pollution and support cleaner energy sources also have an impact on Asia-Pacific's market share. The growth trajectory of the region is bolstered by substantial investments in technology and infrastructure aimed at improving energy efficiency and lowering carbon footprints.

COVID-19 Impact Analysis on the Flare Gas Recovery System Market:

The worldwide demand for energy has significantly decreased as a result of travel restrictions and lockdowns. Consequently, there was a decrease in the output of oil and gas. As a result, as businesses focused on core activities and dealt with financial difficulties, a number of flare-gas recovery projects saw delays or even cancellations. Global supply networks experienced severe disruptions as a result of the pandemic. Current flare gas recovery operations were impeded by travel restrictions that made it difficult to travel and shortages of essential supplies and equipment. This resulted in longer project schedules and higher expenses. Social distancing protocols and travel restrictions made it challenging to mobilize skilled personnel for project installation and maintenance. This resulted in labor shortages, further hindering project execution.

Latest Trends/ Developments:

The market for flare gas recovery systems is being shaped in part by the increasing sway of environmental rules. Stricter emission reduction objectives are being implemented by governments globally, compelling oil and gas businesses to embrace more environmentally friendly technologies. By combining flare gas recovery with CCUS technologies, the environmental effect of these operations can be further reduced by having the ability to capture and store the CO2 emissions related to gas consumption. Advanced data analytics and machine learning can be used to maximize flare gas recovery system performance. This could entail anticipating maintenance requirements to maximize uptime or customizing recovery procedures based on real-time gas composition data. Operating expenses are decreased because online sales do not require a physical sales infrastructure.

Key Players:

-

Baker Hughes Company (USA)

-

Halliburton (USA)

-

John Zink Hamworthy Combustion LLC (USA)

-

GE Oil & Gas (USA) (now Baker Hughes)

-

Honeywell International Inc. (USA)

-

Siemens Energy AG (Germany)

-

Wood Plc (UK)

-

Emerson Electric Co. (USA)

-

Kanooz Gas Processing (UAE)

-

Future Fuel Technologies (Canada)

-

Manulife Investment Management (Canada)

-

Ecopetrol S.A. (Colombia)

Chapter 1. Flare Gas Recovery System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flare Gas Recovery System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flare Gas Recovery System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flare Gas Recovery System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flare Gas Recovery System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flare Gas Recovery System Market – By Type

6.1 Introduction/Key Findings

6.2 Small Capacity Systems

6.3 Medium Capacity Systems

6.4 Large Capacity Systems

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Flare Gas Recovery System Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors and Wholesalers

7.4 Online Sales

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Flare Gas Recovery System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Flare Gas Recovery System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Baker Hughes Company (USA)

9.2 Halliburton (USA)

9.3 John Zink Hamworthy Combustion LLC (USA)

9.4 GE Oil & Gas (USA) (now Baker Hughes)

9.5 Honeywell International Inc. (USA)

9.6 Siemens Energy AG (Germany)

9.7 Wood Plc (UK)

9.8 Emerson Electric Co. (USA)

9.9 Kanooz Gas Processing (UAE)

9.10 Future Fuel Technologies (Canada)

9.11 Manulife Investment Management (Canada)

9.12 Ecopetrol S.A. (Colombia)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Flare gas recovery captures a significant portion of the natural gas that would otherwise be burned off, releasing harmful greenhouse gases like CO2. This directly contributes to climate change mitigation efforts.

Installing a flare gas recovery system can be expensive, with costs ranging from USD 0. 5 million to USD 10 million or more depending on size, capacity, and complexity. This can be a hurdle for smaller oil and gas companies or projects with limited budgets.

Baker Hughes Company (USA), Halliburton (USA), John Zink Hamworthy, Combustion LLC (USA), GE Oil & Gas (USA) (now Baker Hughes), Honeywell International Inc. (USA), Siemens Energy AG (Germany).

With a market share of roughly 45–50% worldwide, Led by the United States and Canada, North America accounts for a sizeable portion of the market for flare gas recovery systems.

Flare gas recovery system sales are rising quickly in the Asia-Pacific region as a result of rising industrial activity, especially in China and India.