Fish Feed Market Size (2024 – 2030)

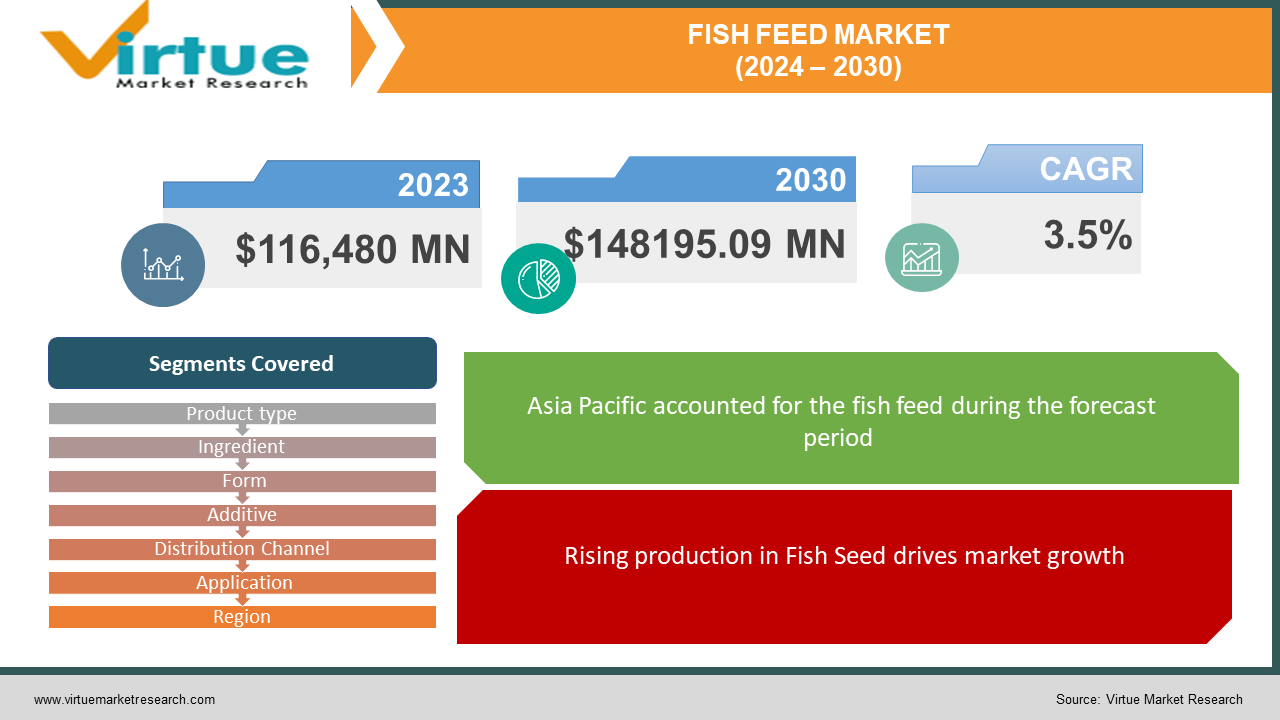

The Fish Feed Market was valued at USD 116,480 million in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 148195.09 million by 2030, growing at a CAGR of 3.5%.

Fish feed comprises a blend of fundamental constituents, supplements, and supplementary additives sourced from natural or synthetic origins and administered to cultivated fish.

Key Market Insights:

Fish is estimated to contribute approximately 15% of the protein consumed per capita globally. Its minimal carbon footprint, high yield per unit, and distinctive protein composition have spurred an increase in fish consumption, thereby driving the demand for fish feed due to the scarcity of marine feed.

Moreover, the fish feed market encompasses products tailored for diverse purposes, including aquarium fish feed designed for consumption by pet fish housed in aquariums or ponds. Additionally, ornamental fish feed, formulated for vibrantly colored fish kept as pets in confined environments such as aquariums, constitutes a significant segment of the market. Consequently, fish feed manufacturers develop varying formulations of feed ingredients to cater to different market segments and broaden their consumer base.

Fish Feed Market Drivers:

Rising production in Fish Seed drives market growth.

The surge in demand for fish seed and aquaculture feed production is primarily fueled by the escalating need for aqua food products. In India, within the framework of contract farming, farmers are furnished with aquafeed and fish seeds essential for the development of aquaculture.

Furthermore, the burgeoning health consciousness among consumers has led to an increased preference for residue-free food, thereby exerting pressure on exporters to cultivate seafood that aligns with health-conscious preferences. This trend significantly impacts the aquafeed industry, as the provision of appropriate feed for aquatic animals facilitates disease-free growth. Consequently, this dynamic creates numerous opportunities within the industry for stakeholders to introduce a plethora of natural and innovative products.

Fish Feed Market Restraints and Challenges:

The fish feed market is susceptible to disruptions caused by fluctuations in the availability and pricing of essential raw materials necessary for feed preparation. Fluctuations in the prices of essential ingredients such as fish oil, fish meal, corn, and soybean often arise due to disruptions in supply chain dynamics or geopolitical influences. During adverse conditions resulting in price increases, there is typically a corresponding surge in demand for fish feed.

Fish Feed Market Opportunities:

The burgeoning concern among consumers regarding the health risks associated with excessive meat consumption has led to an uptick in demand for meat substitutes. Concurrently, aquafarmers are increasingly prioritizing environmental considerations, prompting a shift towards plant-based fish feed to supply essential nutrients to farmed fish while mitigating adverse impacts on wild fish populations and aquatic ecosystems.

Extensive research endeavors are underway to develop and introduce plant-based fish feed into the market. Studies indicate that these feeds possess the capacity to support the growth and development of fish, particularly in contexts where fish meal is in high demand and relatively scarce.

By harnessing plant-derived protein and lipid sources, plant-based fish feed aims to address these pressing concerns. Aquaculture experts and researchers are actively exploring ways to optimize feed formulations derived from plants to meet the nutritional requirements of farmed fish while promoting sustainable farming practices.

The increasing popularity of fish food products, coupled with a supportive logistics network and innovative distribution channels, presents numerous opportunities in the market. The rising demand within the pisciculture industry is underscored by the widespread acceptance of fish food products such as fish sauce and fish wafers among the general populace. Notably, the growth of fish farming hinges on the availability of fish feed to maximize production capacity.

FISH FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Product type, Ingredient, Form, Additive, Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Inc., Aller Aqua A/S, Zeigler Bros., Inc., Alltech Inc, Archer Daniels Midland, Nutreco N.V., Skretting AS, Biomin Holding GmbH, Sonac B.V., BioMar Group, Ridley Corp.Ltd |

Fish Feed Market Segmentation - By Product Type

-

Microorganism

-

Fish & Fish Products

-

Plant-based

Categorized by product type, the fish feed market is segmented into microorganisms, fish & fish products, and plant-based feeds. Forecasts indicate that the plant-based segment is poised for substantial growth during the projection period, driven by increasing awareness of environmental sustainability and the soaring costs associated with fish oil and fishmeal. Plant-based fish feeds, sourced from soybean, corn, wheat bran, and canola oil, are anticipated to witness heightened popularity as they offer a cost-effective and nutritious alternative to traditional fish feeds.

Fish Feed Market Segmentation - By Ingredient

-

Soybean

-

Corn

-

Fish Oil

-

Additives

-

Fish Meal

-

Other Ingredients

Segmented by ingredients, the global market comprises soybean, corn, fish oil, additives, fish meal, and other components. Projections suggest that the soybean segment will demonstrate a significant compound annual growth rate (CAGR) throughout the forecast period, attributed to its optimal protein content, improved digestibility, and enriched omega-3 levels. Soybean-based fish products are favored for their cost-effectiveness and widespread acceptance among fish farmers. Moreover, there is a growing demand for soybean derivatives like fermented soy and soybean protein concentrate in the market.

Fish Feed Market Segmentation - By Form

-

Granules

-

Pellet

-

Flakes

-

Powder

-

Sticks

In the realm of form, the fish feed market is categorized into granules, pellets, flakes, powder, and sticks. Projections indicate that the pellet segment will experience rapid expansion throughout the forecast period, driven by its capacity to offer balanced nutrition and enhanced digestibility to aquatic life. Pellet fish feeds are recognized for providing well-rounded nutrients to aquatic organisms and are readily accessible in the market.

Fish Feed Market Segmentation - By Additive

-

Feed Enzymes

-

Feed Acidifiers

-

Vitamins

-

Antibiotics

-

Amino Acids

-

Antioxidants

-

Other Additives

Categorized by additives, the fish feed market encompasses feed enzymes, feed acidifiers, vitamins, antibiotics, amino acids, antioxidants, and other supplementary substances. Projections suggest that the feed enzymes segment will undergo rapid expansion throughout the forecast period, attributed to its capacity to facilitate optimal growth and prolonged sustenance for fish. Fish farmers depend on feed enzymes to maximize profits by enabling fish to reach their full potential size, thereby commanding higher prices in the market and securing greater profit margins. Utilization of feed enzymes empowers fish farmers to enhance their economic viability through increased fish production.

Fish Feed Market Segmentation - By Distribution Channel

-

B2C

-

B2B

Segmented by distribution channel, the fish feed market is divided into B2C (Business-to-Consumer) and B2B (Business-to-Business). Forecasts indicate that the B2B segment will demonstrate a robust growth rate throughout the forecast period, attributed to the supportive infrastructure and advantageous arrangements offered to both suppliers and buyers within the business-to-business framework. B2B practices facilitate a steady stream of orders from buyers to suppliers, thereby bolstering growth within the segment.

Fish Feed Market Segmentation - By Application

-

Household

-

Commercial

Categorized by application, the fish feed market comprises household and commercial sectors. Projections suggest that the commercial segment will experience robust expansion during the forecast period, driven by the burgeoning growth of the packaged fish food products industry and the escalating adoption of fish farming practices to cater to industry demands. The packaged fish food industry relies on a continuous supply of fish and other aquatic life forms. As natural habitats for aquatic life diminish, fishermen are increasingly embracing pisciculture. Fish farmers employ aquaculture methods to bolster fish production and meet the surging demand for fish in the market.

Fish Feed Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

During the projection period, Asia Pacific is poised to assert dominance over the global market, primarily due to the deeply ingrained incorporation of fish and fish products into the local diet across the region. Fish constitutes a staple part of daily dietary habits in many regions of Asia Pacific, thereby exerting a significant positive impact on the fish feed market.

Moreover, the Asia Pacific region is anticipated to witness robust growth, while other regions such as Europe and North America, with an increasing inclination towards salmon farming, are experiencing heightened demand for seafood. Governmental initiatives and interest in the aquaculture industry in these regions have further contributed to a surge in demand for aquafeed intended for various aquaculture species.

COVID-19 Pandemic: Impact Analysis

The fish feed market experienced significant adverse effects as a result of the Covid-19 pandemic, primarily due to disruptions in the global supply chain and restricted logistics operations. The widespread implementation of lockdown measures globally shifted consumer priorities towards essential goods, resulting in limitations on fish feed production. Furthermore, temporary closures of industries and the enforcement of social distancing measures contributed to workforce shortages in both feed manufacturing facilities and aquaculture farms. The resulting market instability, coupled with uncertainties surrounding the adoption of new processes, prompted many companies to scale back their investments, thereby impacting the overall fish feed market.

Latest Trends/ Developments:

-

In April 2022, Zeigler Brothers introduced a new generation of shrimp post-larvae prepared diets, aiming to provide a viable alternative to Artemia usage. The diet boasts easily absorbed microparticles that have been microencapsulated to preserve sensitive colors, fatty acids, enzymes, vitamins, and other essential nutrients within a digestible matrix.

-

Similarly, in April 2022, the FNBP Division of the ICAR-Central Institute of Fisheries Education in Mumbai, Maharashtra, officially launched the Mobile Fish Feed Mill (CIFE Model). The inauguration ceremony was graced by Jatindra Nath Swain, Secretary (Fisheries), Department of Fisheries, Ministry of Fisheries, Animal Husbandry & Dairying, Government of India.

-

In February 2022, Taiyo Feed Mill Pvt Ltd, headquartered in Chennai, made history by becoming the first fish feed producing and exporting facility in India. They unveiled "BUGS IN," an innovative line of insect-based meals designed for fish and turtles. The company emphasizes that BUGS-IN represents a sustainable and nutritious fish diet, featuring premium ingredients derived from Black Soldier Fly Larvae.

Key Players:

These are top 10 players in the Fish Feed Market: -

-

Cargill, Inc.

-

Aller Aqua A/S

-

Zeigler Bros., Inc.

-

Alltech Inc

-

Archer Daniels Midland

-

Nutreco N.V.

-

Skretting AS

-

Biomin Holding GmbH

-

Sonac B.V.

-

BioMar Group

-

Ridley Corp.Ltd

Chapter 1. Fish Feed Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fish Feed Market – Executive Summary

2.1 Market Size & Forecast – (2024– 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fish Feed Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fish Feed Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fish Feed Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fish Feed Market – By Product Type

6.1 Introduction/Key Findings

6.2 Microorganism

6.3 Fish & Fish Products

6.4 Plant-based

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Fish Feed Market – By Ingredient

7.1 Introduction/Key Findings

7.2 Soybean

7.3 Corn

7.4 Fish Oil

7.5 Additives

7.6 Fish Meal

7.7 Other Ingredients

7.8 Y-O-Y Growth trend Analysis By Ingredient

7.9 Absolute $ Opportunity Analysis By Ingredient, 2024-2030

Chapter 8. Fish Feed Market – By Form

8.1 Introduction/Key Findings

8.2 Granules

8.3 Pellet

8.4 Flakes

8.5 Powder

8.6 Sticks

8.7 Y-O-Y Growth trend Analysis End-Use Industry

8.8 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Fish Feed Market – By Additive

9.1 Introduction/Key Findings

9.2 Feed Enzymes

9.3 Feed Acidifiers

9.4 Vitamins

9.5 Antibiotics

9.6 Amino Acids

9.7 Antioxidants

9.8 Other Additives

9.9 Y-O-Y Growth trend Analysis By Additive

9.10 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 10. Fish Feed Market – By Application

10.1 Introduction/Key Findings

10.2 Household

10.3 Commercial

10.4 Y-O-Y Growth trend Analysis Construction

10.5 Absolute $ Opportunity Analysis Construction, 2024-2030

Chapter 11. Fish Feed Market – By Distribution Channel

11.1 Introduction/Key Findings

11.2 B2C

11.3 B2B

11.4 Y-O-Y Growth trend Analysis By Distribution Channel

11.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 12. Fish Feed Market, By Geography – Market Size, Forecast, Trends & Insights

12.1 North America

12.1.1 By Country

12.1.1.1 U.S.A.

12.1.1.2 Canada

12.1.1.3 Mexico

12.1.2 By Product Type

12.1.2.1 By Ingredient

12.1.3 By Form

12.1.4 By Application

12.1.5 Countries & Segments - Market Attractiveness Analysis

12.2 Europe

12.2.1 By Country

12.2.1.1 U.K

12.2.1.2 Germany

12.2.1.3 France

12.2.1.4 Italy

12.2.1.5 Spain

12.2.1.6 Rest of Europe

12.2.2 By Product Type

12.2.3 By Ingredient

12.2.4 By Form

12.2.5 By Additive

12.2.6 By Application

12.2.7 Countries & Segments - Market Attractiveness Analysis

12.3 Asia Pacific

12.3.1 By Country

12.3.1.1 China

12.3.1.2 Japan

12.3.1.3 South Korea

12.3.1.4 India

12.3.1.5 Australia & New Zealand

12.3.1.6 Rest of Asia-Pacific

12.3.2 By Product Type

12.3.3 By Ingredient

12.3.4 By Form

12.3.5 By Additive

12.3.6 By Application

12.3.7 Countries & Segments - Market Attractiveness Analysis

12.4 South America

12.4.1 By Country

12.4.1.1 Brazil

12.4.1.2 Argentina

12.4.1.3 Colombia

12.4.1.4 Chile

12.4.1.5 Rest of South America

12.4.2 By Product Type

12.4.3 By Ingredient

12.4.4 By Form

12.4.5 By Additive

12.4.6 By Application

12.4.7 Countries & Segments - Market Attractiveness Analysis

12.5 Middle East & Africa

12.5.1 By Country

12.5.1.1 United Arab Emirates (UAE)

12.5.1.2 Saudi Arabia

12.5.1.3 Qatar

12.5.1.4 Israel

12.5.1.5 South Africa

12.5.1.6 Nigeria

12.5.1.7 Kenya

12.5.1.8 Egypt

12.5.1.9 Rest of MEA

12.5.2 By Product Type

12.5.3 By Ingredient

12.5.4 By Form

12.5.5 By Additive

12.5.6 By Application

12.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 13. Fish Feed Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

13.1 Cargill, Inc.

13.2 Aller Aqua A/S

13.3 Zeigler Bros., Inc.

13.4 Alltech Inc

13.5 Archer Daniels Midland

13.6 Nutreco N.V.

13.7 Skretting AS

13.8 Biomin Holding GmbH

13.9 Sonac B.V.

13.10 BioMar Group

13.11 Ridley Corp.Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The surge in demand for fish seed and aquaculture feed production is primarily fueled by the escalating need for aqua food products. In India, within the framework of contract farming, farmers are furnished with aquafeed and fish seeds essential for the development of aquaculture.

The top players operating in the Fish Feed Market are - Cargill, Inc., Aller Aqua A/S, Zeigler Bros., Inc., Alltech Inc.

The fish feed market experienced significant adverse effects as a result of the Covid-19 pandemic, primarily due to disruptions in the global supply chain and restricted logistics operations.

In April 2022, Zeigler Brothers introduced a new generation of shrimp post-larvae prepared diets, aiming to provide a viable alternative to Artemia usage. The diet boasts easily absorbed microparticles that have been microencapsulated to preserve sensitive colors, fatty acids, enzymes, vitamins, and other essential nutrients within a digestible matrix.

The Asia Pacific region is anticipated to witness robust growth, while other regions such as Europe and North America, with an increasing inclination towards salmon farming, are experiencing heightened demand for seafood.