Fire Suppression Systems Market Size (2024 – 2030)

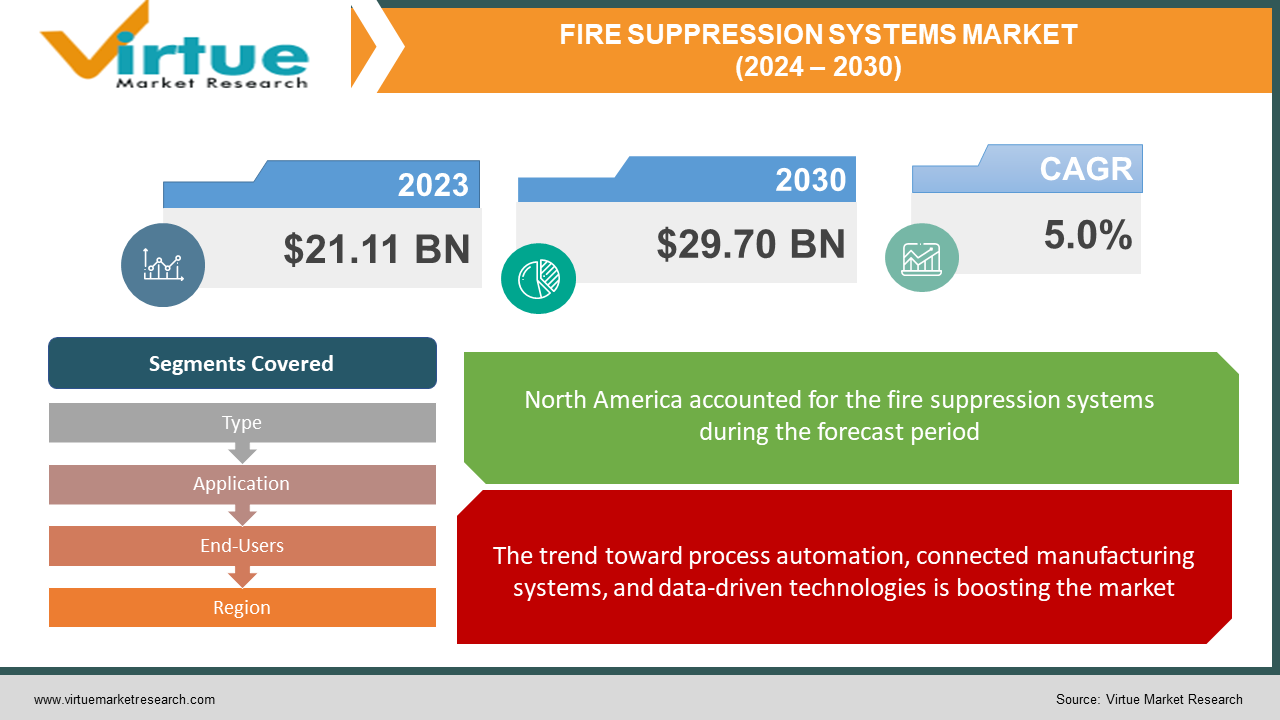

The global fire suppression systems market was valued at USD 21.11 billion in 2023 and is projected to reach a market size of USD 29.70 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.0%.

The fire suppression systems market is a vital segment of the global safety and security industry. These systems are engineered to detect, contain, and extinguish fires promptly, minimizing damage to property and assets, and most importantly, protecting human lives. With growing urbanization, industrial expansion, and evolving safety regulations, the demand for reliable fire suppression systems is on a steady upward trajectory. Governments worldwide continue to strengthen fire codes and mandate the installation of fire suppression systems in various buildings. Reduced fire risk leads to lower insurance premiums, incentivizing investment in fire safety systems. Increased efficiency of suppression agents, more sensitive detectors, and integration with smart building systems enable better fire management. Rapid industrial development, especially in emerging markets, drives demand for robust fire protection solutions. The global fire suppression systems market is poised for continued growth due to the ever-present need for advanced safety.

Key Market Insights:

One of the most significant factors fueling this market is the constant updating and tightening of fire safety regulations around the world. Governments recognize the devastating impact of fires on life and property, and they're continuously updating building codes and industrial safety standards to mandate more sophisticated fire suppression systems. The search for safer, more environmentally sustainable, and more effective fire suppression agents is ongoing. There's a push for specialized agents tailored to specific fire hazards, with less reliance on traditional, potentially harmful chemicals. Fire detection technology is becoming more intelligent, with a move towards multi-criteria detectors that combine smoke, heat, and even gas detection. This reduces false alarms and provides faster, more targeted responses. Fire suppression systems are no longer standalone. They're being integrated into building management systems (BMS) and industrial Internet of Things (IIoT) networks. This allows for centralized monitoring, remote control, and data-driven optimization of fire safety responses. The Asia-Pacific region, particularly countries like China and India, experiences fast-paced industrial development. This expansion includes factories, power plants, and oil and gas refineries—all sectors with a high need for fire suppression systems. As infrastructure grows in these regions, so does the demand for advanced safety measures, fueling market growth. While technological advancements are exciting, cost remains a factor. Small to medium-sized businesses may still favor traditional sprinkler systems for affordability. Finding the right balance between cutting-edge suppression technologies and budget limitations is an ongoing challenge that suppliers strive to address.

Global Fire Suppression Systems Market Drivers:

Governments and regulatory bodies across the globe are continuously upgrading and enforcing more stringent fire safety rules and regulations to improve building fire protection.

Stringent and frequently updated fire safety rules, codes, and standards at both national and international levels are some of the most significant factors driving the adoption of fire suppression systems worldwide. Governments and regulatory agencies are continuously tightening fire protection requirements through legislation and codes to boost life safety in buildings and infrastructure. In the United States, the National Fire Protection Association (NFPA) updates codes like NFPA 13, 72, 101, and others regularly. NFPA 13 deals with system installation, NFPA 72 covers fire alarms, and NFPA 101 focuses on life safety standards. Updates typically expand the scope of occupancy types that require fire sprinklers and suppression systems. The International Code Council (ICC) also modifies the International Building Code (IBC) and International Fire Code (IFC) periodically to improve provisions for fire sprinklers, detection devices, maintenance, and training. Factory Mutual Global (FMG) and the American Society of Testing Materials (ASTM) also issue important standards relating to system design, performance, and maintenance that influence product development. Adherence to changing codes and standards is mandatory across commercial, residential, and industrial facilities for approval. This pressures owners, developers, contractors, and system manufacturers to invest in upgrades. In the oil and gas industry, norms set by NFPAs like NFPA 11, 15, and others guide fire safety. New plants cannot operate without complying with these benchmarks. The FM Global standards also provide loss prevention guidance, which is widely followed in this sector. Similar examples exist in other industries like mining, power, and textiles, where evolving regulations boost system uptake.

The trend toward process automation, connected manufacturing systems, and data-driven technologies is boosting the market.

The proliferation of high-rise buildings and large infrastructure projects globally has become a major demand driver for fire suppression systems. With urbanization, space constraints in cities have led to vertical growth through tall commercial and residential complexes. Massive public infrastructure development is also underway, especially in emerging economies. Protecting such constructions requires extensive and sophisticated fire safety systems. Modern high-rise structures have unique risks like smoke movement challenges, stack effects, and evacuation difficulties. The push for fire sprinklers in high-rises has created significant opportunities for manufacturers of water-based and non-water-based systems. Water mist sprinklers are gaining ground given their efficacy in tall buildings. Clean agent systems using environmentally sustainable FM-200 or Novec 1230 are also widely used as compressor rooms, and basements cannot use water-based suppression. Large public infrastructure projects like airports, stadiums, shopping malls, hospitals, railways, highways, etc. also have substantial fire safety requirements given their size, occupancy loads, and high asset value. Their scale and open spaces make fire detection and containment difficult. Intelligent addressable systems, gas suppression for critical rooms, and quick response sprinklers are commonly integrated during the building services planning stage itself.

Global Fire Suppression Systems Market Restraints and Challenges:

The upfront cost of procuring and installing fire suppression systems like sprinklers and gaseous agents is quite high.

The high upfront installation costs and ongoing maintenance expenses associated with fire suppression systems are major restraints influencing procurement decisions and adoption rates, especially in developing economies. Modern fire protection systems like sprinklers, gaseous agents, foam, and dry chemicals involve considerable capital investment in equipment, accessories, design, piping, and integration. Moreover, regular inspection, testing, and service are crucial for fire systems to remain effective. Sprinkler heads, pipes, alarm valves, cylinders, and detectors need periodic checks, flushing, and replacement. Unanticipated repairs may also be required. Such maintenance can cost $1500 to $5000 for smaller systems annually. Large complexes easily spend over $100,000 in recurring expenses on labor, equipment parts and refills, and system downtime. Many commercial and industrial units perceive these maintenance costs as a burden and try to minimize spending, compromising system integrity. Building owners delay mandatory upgrades to the latest fire codes to save on installation costs, risking liability issues. Such reluctance, due to high capital and operating costs, hampers market growth. However, technological evolution is helping mitigate this price challenge. For instance, costs have declined considerably as sprinkler system installation has become standardized. Modern plastic piping lasts longer with lower maintenance than older steel pipes. Wireless fire alarms and IoT-enabled smart systems also reduce wiring complexity and failure points. The use of more efficient water mist nozzles has brought down water usage and pumping needs in tall buildings. Clean-agent systems have become more compact and flexible. Overall life cycle costs are decreasing with better product designs.

Global Fire Suppression Systems Market Opportunities:

The global fire suppression systems market presents attractive growth opportunities, driven by increasing construction activity, stricter safety regulations, technological advances, and higher adoption across emerging economies. With changing fire safety codes, there is a rising need to retrofit existing residential and commercial buildings to upgrade to the latest standards and comply with regulations. Developed countries in Europe and North America have a huge stock of old buildings that require retrofitting with modern sprinkler systems, fire alarms, etc. This presents a steady demand opportunity for fire suppression firms over the next decade. Advancements such as intelligent sensors, real-time monitoring, IoT integration, clean agent systems, and environment-friendly products are key opportunities. Connected systems allow remote diagnostics and predictive maintenance. Companies are investing in R&D and new solutions like water mist and nanofiber sprinkler research. Customers also demand smaller, more flexible, and easy-to-install systems. Innovative offerings that improve performance, reduce costs, and provide eco-friendly fire suppression will see rapid adoption.

FIRE SUPPRESSION SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.0% |

|

Segments Covered |

By Type, Application, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Carrier Global, Johnson Controls, Honeywell International, Robert Bosch GmbH, Minimax Viking, NAFFCO, Hochiki Corporation, Halma plc |

Global Fire Suppression Systems Market Segmentation: By Type

-

Water-based Systems

-

Chemical Agents

-

Foam-based Systems

Water-based systems are the most dominant, with a 70–75% share, as they are effective against a wide range of common fire types. Water is readily available and relatively inexpensive compared to specialized chemical agents. This includes sprinklers, water mist, and deluge systems. Building regulations often mandate water-based systems in many structures. Chemical agents are expected to see the fastest growth at over 10% CAGR owing to their higher efficiency and adoption in mission-critical facilities. This encompasses clean agents and inert gas systems.

Global Fire Suppression Systems Market Segmentation: By Application

-

Smoke Detectors

-

Heat Detectors

-

Flame Detectors

-

Control Panels

Smoke detectors hold the largest market share, roughly 55–65%. This is due to their widespread use, versatility, and relative affordability. Their dominance stems from their effectiveness in detecting a wide range of fires (smoldering and flaming). Heat detectors occupy a significant portion, around 20–30%. They are essential in situations where smoke may not be a reliable early indicator of fires. Flame detectors are specialized for applications with rapid-fire risks or where potential obstructions could hinder smoke detection. Flame detectors are likely experiencing the fastest growth rate due to the rising demand for fire protection in hazardous industrial settings where rapid fire development is a risk. Control panels, while not detection systems themselves, are an integral component with an inherent market share linked to all the detector types.

Global Fire Suppression Systems Market Segmentation: By End-Users

-

Industrial

-

Residential

-

Commercial

The industrial segment is the largest, accounting for around 49%. Fire suppression systems used in manufacturing facilities, warehouses, storage buildings, data hosting centers, etc. make up the industrial portion of the market. Due to their frequent handling of combustible and hazardous chemicals, these industrial facilities are more likely to have a fire than commercial or residential structures, raising the demand. The residential sector is the fastest-growing. The need for fire suppression systems installed in residential structures is predicted to increase as end users worldwide become more conscious of the need for fire safety procedures intended for home settings.

Global Fire Suppression Systems Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With about 35% of the global market value for fire suppression systems, North America is the largest growing market. Due to its developed industry, high level of awareness, and strict fire safety standards, the United States is the largest market in North America. At almost 25% of the global market for fire suppression systems, Europe has the second-largest share. Strong acceptance is observed in European nations such as the UK, Germany, France, Italy, and others, bolstered by the application of EU fire safety regulations. Market expansion is aided by requirements for product certification and mandatory fire risk assessments. With a market share of over 20%, the Asia-Pacific area is the one with the fastest rate of growth for fire suppression systems worldwide. Adoption is being driven by high-growth nations such as China, India, Indonesia, Malaysia, the Philippines, Thailand, and so on. The market is expanding because of rapid industrialization, the construction of new infrastructure, and an emphasis on enhancing safety in public and commercial areas.

COVID-19 Impact Analysis on the Global Fire Suppression Systems Market:

Border closures, factory shutdowns, and logistical disruptions created bottlenecks in the supply of essential components and raw materials. This led to delays in manufacturing and fulfilling orders for fire suppression systems. Economic uncertainty, lockdowns, and safety concerns have caused many industries to suspend or cancel planned construction and expansion projects. This resulted in a decrease in demand for new fire suppression installations. Travel restrictions and social distancing guidelines made it difficult to deploy technicians for on-site installation, maintenance, and repairs of fire suppression systems. This led to service disruptions and potential safety concerns. Fire safety remained critical in essential sectors like healthcare, power generation, and data centers. These industries continued to invest in and prioritize reliable fire suppression solutions. Manufacturers and service providers accelerated the development of remote monitoring tools, diagnostics, and virtual support solutions. This helped address service challenges while adhering to safety protocols. The pandemic underlined the importance of preparedness and risk mitigation. Industries likely became more receptive to investing in fire protection systems in the long term.

Latest Trends/ Developments:

IoT integration is one of the most significant ongoing trends in fire suppression technology. It enables connected, intelligent systems with real-time monitoring and control capabilities. Sensors can provide alerts on system status and predict issues before failure. Automatic and instant adjustments are possible. This reduces maintenance costs and downtime. Major companies like Johnson Controls, Honeywell, and Siemens offer IoT-enabled smart fire products. Sustainability is a key focus area in the fire suppression industry. Manufacturers are developing more eco-friendly clean agents, green chemicals, and water-based systems with lower environmental impact. Products like Ansul's LVS, a non-toxic, biodegradable foam suppressant, and Sea-Fire Marine's HFC-227 clean agent are gaining popularity. Minimal residue agents are ideal for sensitive locations. Water mist nozzles are an emerging alternative technology, providing fire suppression using far less water than traditional sprinkler systems. This makes them suitable for water-scarce regions and allows for smaller pipe sizes. High-pressure mist absorbs heat and displaces oxygen efficiently to extinguish fires. Ideal for hospitals, museums, and offices. Cloud-based monitoring platforms allow access to real-time system data from anywhere. It enables tracking performance, detecting issues early, and predictive analytics. Automatic alerts and reports can be generated. JCI's HOLMAC and Marinoff's FOG sense are examples of remote monitoring tools gaining adoption, especially for large installations.

Key Players:

-

Carrier Global

-

Johnson Controls

-

Honeywell International

-

Robert Bosch GmbH

-

Minimax Viking

-

NAFFCO

-

Hochiki Corporation

-

Halma plc

Chapter 1. Fire Suppression Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fire Suppression Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fire Suppression Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fire Suppression Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fire Suppression Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fire Suppression Systems Market – By Type

6.1 Introduction/Key Findings

6.2 Water-based Systems

6.3 Chemical Agents

6.4 Foam-based Systems

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Fire Suppression Systems Market – By End-Users

7.1 Introduction/Key Findings

7.2 Industrial

7.3 Residential

7.4 Commercial

7.5 Y-O-Y Growth trend Analysis By End-Users

7.6 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 8. Fire Suppression Systems Market – By Application

8.1 Introduction/Key Findings

8.2 Smoke Detectors

8.3 Heat Detectors

8.4 Flame Detectors

8.5 Control Panels

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Fire Suppression Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-Users

9.1.4 By : By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-Users

9.2.4 : By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-Users

9.3.4 : By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-Users

9.4.4 : By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-Users

9.5.4 : By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Fire Suppression Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Carrier Global

10.2 Johnson Controls

10.3 Honeywell International

10.4 Robert Bosch GmbH

10.5 Minimax Viking

10.6 NAFFCO

10.7 Hochiki Corporation

10.8 Halma plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Governments worldwide are strengthening fire safety codes and regulations and mandating the installation and maintenance of fire suppression systems in various buildings and industrial facilities, which is driving the consistent demand for these systems.

Advanced systems, especially those using specialized suppression agents or complex detection technologies, can be expensive, which is a major barrier.

Johnson Controls, Carrier Global, Honeywell International, Robert Bosch GmbH, Minimax Viking, and NAFFCO are the key players.

North America currently holds the largest market share, estimated at around 35%.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.