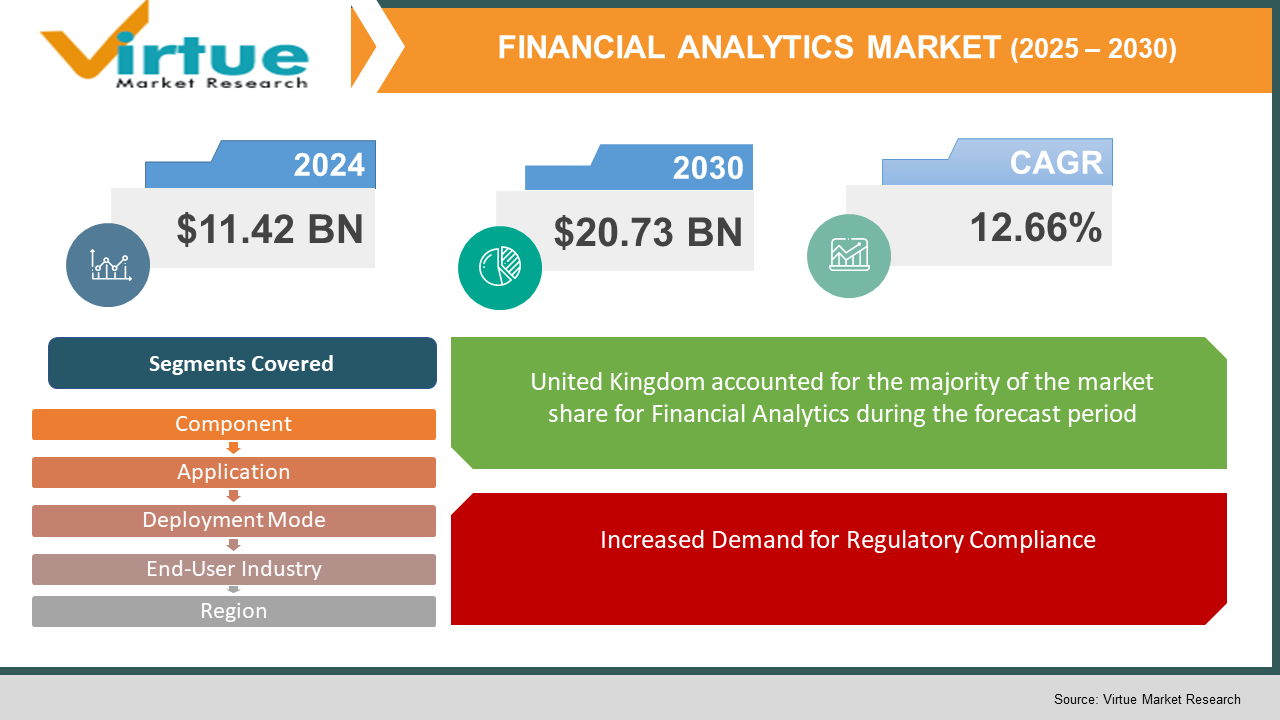

Financial Analytics Market Size (2025-2030)

The Financial Analytics Market was valued at USD 11.42 billion and is projected to reach a market size of USD 20.73 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.66%.

The financial analytics market is a fast-growing industry that offers organisations tools and solutions to interpret and analyse financial information. This market is concerned with using cutting-edge technologies such as artificial intelligence, machine learning, and big data to offer actionable insights for decision-making, risk management, and forecasting. Financial analytics is highly relevant in industries like banking, insurance, and investment, as it enables companies to maximize operations, maintain regulatory compliance, and identify fraudulent transactions. As financial data becomes more complex and real-time analysis more essential, organizations are implementing on-premises and cloud-based solutions for improved financial management. The market is witnessing strong growth because of the increasing need for improved financial planning, risk management, and prevention of fraud. In addition, with digital transformation gaining momentum across sectors, the usage of financial analytics solutions will grow across a variety of industries such as healthcare, retail, and government. The changing landscape of financial information and analytics is putting this market in a position to grow and innovate further in the next few years.

Key Market Insights:

- In 2024, data analytics investment in the insurance sector alone saw an incredible growth of 220% through September. The growth points to the sector's focus on using data for operational efficiency improvement, customer experience enhancement, and the creation of innovative insurance models.

- The 2024 Alkami Telemetry Data Report exposed considerable changes in consumer financial behaviours under the current high interest rate regime. Importantly, home equity line of credit (HELOC) originations reached their highest point in 2022, and average monthly rent grew 24.4% during the last four years to $971 per month in Q4 2023. Furthermore, automobile buyers paid monthly auto loans 32.5% to 57.1% more for used and new vehicles, respectively, between 2019 and 2023.

- The financial analytics market has experienced a sharp incorporation of innovative technologies like artificial intelligence (AI), machine learning, natural language processing (NLP), data mesh, edge computing, and cloud technologies. These technologies enabled quicker data processing, better insights, and easier access, allowing financial institutions to make better decisions and improve customer experiences.

- A 2024 Deloitte survey of about 150 U.S. banking industry senior professionals identified a heavy focus on analytics and data across the banking industry. In 2023, U.S. banks were to invest more than $5 billion in data programs, fueled by the need to leverage generative AI for operational efficiencies and not lag in data capabilities.

- Investors, including large companies like Goldman Sachs, increasingly looked to "alternative data" streams like credit card purchases, consumer surveys, and social media trends to predict retail performance. This method seeks to gain a competitive advantage by delivering more precise projections of consumer trends and retailer performance, going beyond conventional data sources like earnings statements.

Financial Analytics Market Drivers:

Advanced Tech Adoption Set to Propel Financial Analytics Market Expansion

The swift adoption of advanced technologies like artificial intelligence (AI), machine learning (ML), and cloud computing has transformed data processing in the financial analytics industry. These technologies allow businesses to process enormous amounts of data more effectively, resulting in improved accuracy in risk analysis and decision-making. Consequently, banks and other financial institutions are in greater demand for such solutions to automate processes and improve analytical power. This technological trend is poised to drive the financial analytics market to grow significantly soon.

Increased Demand for Regulatory Compliance

Financial institutions face mounting pressure to adhere to strict regulatory requirements, fueling the need for sophisticated financial analytics solutions. These solutions are essential for coping with intricate reporting obligations and maintaining compliance with continuously changing regulations. As governments across the globe keep implementing increasingly complex compliance regimes, financial institutions are resorting to advanced analytics solutions to reduce risks and simplify compliance procedures. The increasing regulatory load is likely to be a major driver of the market's growth.

Growing Need for Real-Time Financial Insights

In recent years, the need for real-time financial insights in instant form has been on the rise as investors and businesses alike demand quicker, smarter decisions. Platforms for financial analytics that provide access to real-time market data, economic statistics, and investment metrics are increasingly important tools for organizations today. The requirement for timely financial information has become especially significant in rapidly changing markets, where lagged decision-making can lead to heavy losses. This escalating demand for real-time analytics is a prime growth driver in the financial analytics market.

Financial Analytics Market Restraints and Challenges:

Privacy and Security Issues

With financial institutions increasingly depending on cloud-based and AI-driven analytics solutions, issues of data privacy and security have emerged as a major challenge. The privacy of financial information makes it an attractive target for cyberattacks, which heightens the stakes for firms to secure their systems and meet data protection laws. As much as progress has been achieved in encryption and security measures, ensuring the integrity of data continues to be a challenge. These security issues might hamper the adoption of financial analytics solutions, particularly for those organizations with strict compliance mandates.

Legacy Systems Integration

Most financial institutions continue to use legacy systems for conducting their business, and integrating new financial analytics solutions is challenging. The incompatibility between new analytics platforms and legacy infrastructure can lead to higher costs of implementation, technical complexity, and operational interruption. Financial organizations have to spend valuable resources on system upgrade or suffer from delayed use of advanced analytics tools. This is particularly urgent for small institutions that do not have the capital and technical skills to upgrade their systems cost-effectively.

High Implementation and Maintenance Costs

The installation and continued maintenance of advanced financial analytics solutions can be expensive, especially for small firms or new start-ups with constrained budgets. These solutions tend to demand specialized talent, regular upgrades, and high-performance support infrastructure, leading to high operating costs. Moreover, organizations can find it difficult to justify the ROI of such solutions, particularly if they do not have the resources or infrastructure to utilize them to their full potential. Consequently, some organizations might be reluctant to invest in end-to-end analytics tools, which might cap market growth in some segments.

Financial Analytics Market Opportunities:

The financial analytics market of the future offers many growth opportunities, fueled by new technology and changing industry needs. One of the main opportunities is in the use of AI and machine learning to enhance predictive analytics and enable financial institutions to make better investment decisions, manage risk, and understand customer behaviour. As digitalization proceeds, the use of cloud-based financial analysis is anticipated to grow, providing flexibility, scalability, and cost savings to organizations of every size. Furthermore, the growth in the application of alternative sources of data, for example, social media patterns and satellite photography, provides new opportunities for understanding consumer behaviour and market environments. Financial institutions are also beginning to emphasize individualized financial services, prompting a need for sophisticated analytics tools that are able to meet the unique requirements of individual customers. Lastly, as regulatory burdens increase around the world, financial companies will continue to look for solutions that enable them to manage complicated compliance rules, further increasing demand for reliable financial analytics platforms. These trends indicate a rosy future for the financial analytics market, with prospects in several sectors and technologies.

FINANCIAL ANALYTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.66% |

|

Segments Covered |

By component, application, end user, deployment mode, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SAS Institute Inc., Oracle Corporation, IBM Corporation, Microsoft Corporation, Finastra, Qlik Technologies, Deloitte, SAP SE, Tableau Software (a Salesforce company), TIBCO Software Inc |

Financial Analytics Market Segmentation:

Financial Analytics Market Segmentation: by Component

- Software

- Services

The financial analytics market is primarily segmented into software and services. The software segment includes solutions designed to perform tasks like data analysis, reporting, forecasting, and predictive analytics. Software solutions dominate the market, capturing approximately 70% of the market share, as businesses increasingly turn to automation and data-driven decision-making. The services segment encompasses consulting, implementation, and maintenance services that help organizations deploy and manage financial analytics tools. This segment is growing rapidly, accounting for about 30% of the market share, as companies look for expert guidance and ongoing support to fully optimize their software solutions.

Financial Analytics Market Segmentation: by Application

- Risk Management

- Fraud Detection and Prevention

- Budgeting and Forecasting

- Regulatory Compliance

The financial analytics market is divided into various applications, with risk management and fraud detection and prevention being key drivers. The risk management application holds the largest share, approximately 35%, as financial institutions need to assess and mitigate financial risks using analytics. Fraud detection and prevention follow closely, representing 25% of the market, as financial institutions deploy analytics to detect anomalies and safeguard against fraudulent activities. Budgeting and forecasting tools are increasingly adopted to enhance financial planning and predict future trends, accounting for around 20%. Finally, regulatory compliance tools, which ensure adherence to complex financial regulations, hold about 20% of the market share, as compliance becomes more critical in a tightly regulated environment.

Financial Analytics Market Segmentation: by Deployment Mode

- On-Premises

- Cloud-Based

Financial analytics solutions are deployed either on-premises or in the cloud. The cloud-based segment has been growing rapidly and now holds the majority of the market share at about 60%, driven by its flexibility, scalability, and cost-efficiency, particularly for businesses without extensive IT infrastructure. On-premises deployment, which offers greater control and security for sensitive data, represents around 40% of the market. However, this segment is gradually declining as cloud-based solutions continue to improve in terms of security and performance, offering more appealing options for organizations of all sizes.

Financial Analytics Market Segmentation: by End-User Industry

- Banking

- Financial Services, and Insurance (BFSI)

- Retail and E-commerce

- Healthcare

The Banking, Financial Services, and Insurance (BFSI) sector remains the largest end-user of financial analytics solutions, holding about 45% of the market share. This is due to the high demand for risk management, compliance, and customer insight solutions in this sector. The retail and e-commerce industry, representing 25% of the market, leverages financial analytics for understanding consumer behaviour, sales trends, and inventory management. The healthcare sector is a growing adopter of financial analytics, accounting for around 15% of the market, as hospitals and insurers use data to manage costs, billing, and patient care financials. Other industries, including government and energy, contribute to the remaining 15%.

Financial Analytics Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The financial analytics market is experiencing significant growth across various regions, with North America leading the market, holding approximately 40% of the global share. The region benefits from the presence of major financial institutions, strong technological infrastructure, and high adoption of advanced analytics solutions in sectors such as BFSI and retail.

Asia-Pacific follows as the second-largest market, accounting for around 30% of the market share, driven by the rapid digitalization of financial services and a growing emphasis on financial technology in countries like China, India, and Japan.

Europe holds about 20% of the market, with strong growth in financial analytics adoption, particularly in countries like the UK, Germany, and France, driven by regulatory pressures and the need for compliance.

South America and the Middle East and Africa contribute approximately 5% and 5% of the global market share, respectively. In South America, the adoption of financial analytics is still emerging but growing steadily, while in the Middle East and Africa, the market is gaining momentum due to increasing investments in financial technology and banking modernization, particularly in regions like the UAE and South Africa.

COVID-19 Impact Analysis on the Global Financial Analytics Market:

The pandemic of COVID-19 significantly influenced the market for financial analytics, and it speeded up the use of digital financial solutions and analytics tools. During economic uncertainty and disruption, as companies were facing, business-critical needs such as real-time financial insights, risk management, and forecasting became increasingly important. Numerous financial institutions and organizations migrated to cloud-based solutions to maintain business continuity and distant access to information, increasing the demand for financial analytics software. The pandemic also accentuated the role of fraud detection and compliance, as more investment flowed into these aspects. As a whole, COVID-19 was a driving force for the digitalization of the financial sector, with far greater dependence on data analytics in navigating through unpredictable financial environments.

Latest Trends/ Developments:

The financial analytics space has witnessed some significant trends and changes in 2023 and 2024, specifically through the incorporation of AI and machine learning for augmenting predictive analytics and facilitating decision-making processes. Cloud-based financial analytics solutions have experienced a strong pull due to their scalability, affordability, and versatility in processing huge data sets. On the other hand, real-time data analysis has also been a priority of late, as financial institutions make more and more use of up-to-the-moment information to inform quicker, wiser decisions under conditions of great market uncertainty. Another important development is the widespread use of alternative data sources, including social media sentiment and satellite imagery, to better predict consumer trends and market directions. In addition, regulatory compliance is a key issue, with sophisticated analytics tools enabling organizations to manage intricate global financial regulations effectively.

Key Players:

- SAS Institute Inc.

- Oracle Corporation

- IBM Corporation

- Microsoft Corporation

- Finastra

- Qlik Technologies

- Deloitte

- SAP SE

- Tableau Software (a Salesforce company)

- TIBCO Software Inc.

Chapter 1. Financial Analytics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Global Financial Analytics Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Financial Analytics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Financial Analytics Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Financial Analytics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Financial Analytics Market– By Deployment Mode

6.1 Introduction/Key Findings

6.2 On-Premises

6.3 Cloud-Based

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode , 2025-2030

Chapter 7. Global Financial Analytics Market– By Application

7.1 Introduction/Key Findings

7.2 Risk Management

7.3 Fraud Detection and Prevention

7.4 Budgeting and Forecasting

7.5 Regulatory Compliance

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Global Financial Analytics Market– By Components

8.1 Introduction/Key Findings

8.2 Software

8.3 Services

8.4 Y-O-Y Growth trend Analysis Components

8.5 Absolute $ Opportunity Analysis Components , 2025-2030

Chapter 9. Global Financial Analytics Market– By End-User Industry

9.1 Introduction/Key Findings

9.2 Banking

9.3 Financial Services, and Insurance (BFSI)

9.4 Retail and E-commerce

9.5 Healthcare

9.6 Y-O-Y Growth trend Analysis End-User Industry

9.7 Absolute $ Opportunity Analysis End-User Industry , 2025-2030

Chapter 10. Financial Analytics Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Deployment Mode

10.1.3. By Components

10.1.4. By Application

10.1.5. End-User Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Deployment Mode

10.2.3. By Components

10.2.4. By Application

10.2.5. End-User Industry

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Deployment Mode

10.3.3. By End-User Industry

10.3.4. By Application

10.3.5. Components

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-User Industry

10.4.3. By Application

10.4.4. By Deployment Mode

10.4.5. Components

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Components

10.5.3. By End-User Industry

10.5.4. By Application

10.5.5. Deployment Mode

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Financial Analytics Market– Company Profiles – (Overview, Service End-User Industry Deployment Mode Portfolio, Financials, Strategies & Developments)

11.1 SAS Institute Inc.

11.2 Oracle Corporation

11.3 IBM Corporation

11.4 Microsoft Corporation

11.5 Finastra

11.6 Qlik Technologies

11.7 Deloitte

11.8 SAP SE

11.9 Tableau Software (a Salesforce company)

11.10 TIBCO Software Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Financial Analytics Market was valued at USD 11.42 billion and is projected to reach a market size of USD 20.73 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.66%.

Processing Technological Advancements, Increased Demand for Regulatory Compliance, and Growing Need for Real-Time Financial Insights are some of the key market drivers in the Financial Analytics Market.

On-premises and Cloud-Based are the segments by deployment mode in the Financial Analytics Market.

North America is the most dominant region in the global Financial Analytics Market

SAS Institute Inc., Oracle Corporation, IBM Corporation, Microsoft Corporation, Finastra, Qlik Technologies, Deloitte, SAP SE, Tableau Software (a Salesforce company), TIBCO Software Inc. etc.