Filtration and Separation Market Size (2025-2030)

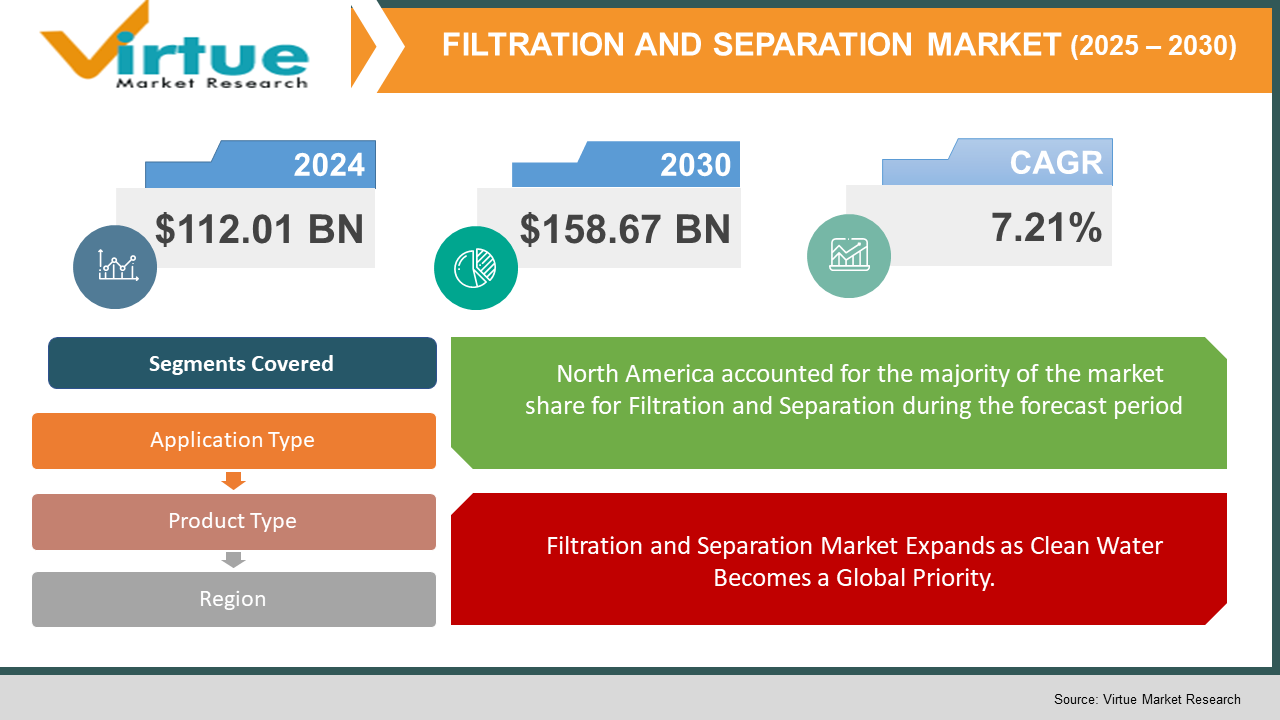

The Filtration and Separation Market was valued at USD 112.01 billion and is projected to reach a market size of USD 158.67 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.21%.

As pollution across the world’s urban canters has worsened dramatically with very high AQI levels and polluted waters, there is an acute threat to people's health. As demand for clean and sustainable air has increased rapidly the Filtration and Separation systems offer an innovative private market solution to these problems. The technology is not only used for personal use but also has industrial applications, industries such as pharmaceuticals, food & beverage, and water treatment are adopting high-efficiency filtration systems to comply with stringent environmental and safety regulations. Investments in nanofiltration and reverse osmosis (RO) technologies are also on the rise to meet the growing demand for ultrapure water. Key players in the industry are expanding their product portfolios and investing in AI-driven filtration monitoring systems to enhance efficiency, reduce operational costs, and comply with global sustainability goals.

Key Market Insights:

- A 2023 survey by the World Water Council revealed that 60% of industrial facilities reported investing in advanced filtration solutions to meet regulatory compliance, highlighting the market's strong growth potential.

- According to the International Energy Agency (IEA), over 70% of industrial emissions stem from inefficient filtration systems, driving increased demand for high-performance air and gas filtration technologies in power plants, automotive, and manufacturing sectors.

- The biopharmaceutical filtration segment is expected to grow at a CAGR of 8.2% through 2030, fuelled by the rapid expansion of vaccine production, cell therapy, and monoclonal antibody treatments that require ultrafiltration and microfiltration processes.

- A recent market study found that reverse osmosis (RO) systems now account for over 40% of water filtration installations globally, making it the most widely used filtration technology in desalination, residential, and industrial applications.

- Rising industrialization, especially in developing economies, is accelerating the need for wastewater treatment, emissions control, and clean energy solutions. Governments and corporations are making large-scale investments in filtration infrastructure, boosting market growth across multiple sectors, including oil and gas, electronics, and food & beverage processing.

Filtration and Separation Market Drivers:

Filtration and Separation Market Expands as Clean Water Becomes a Global Priority.

The increasing demand for clean and safe water is one of the primary drivers of the Filtration and Separation Market. With global water scarcity affecting over 2.3 billion people, governments and industries are heavily investing in water filtration and wastewater treatment infrastructure. Advanced filtration technologies such as reverse osmosis (RO), ultrafiltration (UF), and activated carbon filtration are being widely adopted in municipal water plants, industrial facilities, and desalination projects. The rapid expansion of industrial activities, particularly in developing economies like China, India, and Brazil, has led to higher wastewater discharge, necessitating strict filtration and separation processes to remove contaminants, heavy metals, and microplastics. Additionally, government regulations, including the EU Water Framework Directive and the U.S. Clean Water Act, are compelling industries to adopt high-efficiency filtration solutions to reduce environmental pollution and ensure regulatory compliance. The food and beverage industry is also a significant contributor to the growing filtration market, with increasing demand for ultra-pure water, dairy filtration, and beverage clarification systems. Filtration plays a crucial role in removing impurities, bacteria, and allergens from food processing, ensuring product safety and extending shelf life.

Filtration technology has developed rapidly as demand has increased, this has been compounded with the help of the automotive industry and electronics industry which are making advancements in this technology for cars and other tech.

The market for filtration and separation is changing due to advancements in nanotechnology, membrane filtration, and AI-driven filtration monitoring. The development of intelligent filtration systems with sensors for real-time monitoring and predictive maintenance is assisting businesses in increasing productivity, decreasing downtime, and cutting expenses. Nanofiltration membranes are becoming more popular in the semiconductor, biotechnology, and pharmaceutical industries due to their increased selectivity and reduced energy usage. Furthermore, growing concerns about sustainability are driving an increase in the use of eco-friendly and biodegradable filter materials. As cleanroom conditions and emission controls gain importance, the automotive and electronics sectors are also seeing notable developments in gas and air filtration systems. In order to increase filtration lifespan and lower maintenance needs, businesses are concentrating on creating self-cleaning filtration systems, which will further propel market expansion.

Filtration and Separation Market Restraints and Challenges:

The maintenance requirements for these filtration and separation systems is cumbersome and so are the regulatory requirements which drive up the initial costs.

Despite significant market growth, the Filtration and Separation Market faces challenges, including high initial costs, complex maintenance requirements, and regulatory compliance issues. The installation of advanced filtration systems, particularly in industrial and municipal water treatment facilities, requires substantial capital investment, which can be a deterrent for small and mid-sized enterprises. Additionally, filter replacement costs and energy consumption associated with high-performance filtration technologies remain a concern for industries striving to balance operational efficiency and cost-effectiveness. Regulatory compliance also poses a challenge, as filtration systems must meet strict environmental and safety standards, requiring continuous technological upgrades. Furthermore, disruptions in global supply chains and shortages of raw materials for filter manufacturing have led to price fluctuations, impacting market expansion. Overcoming these challenges requires continuous R&D investments, cost-effective innovations, and strong government support.

Filtration and Separation Market Opportunities:

The expansion of the biopharmaceutical and healthcare industries presents a significant growth opportunity for the filtration market. The rising demand for vaccines, monoclonal antibody therapies, and cell and gene therapies is increasing the need for high-purity filtration technologies, such as microfiltration, ultrafiltration, and virus filtration. Additionally, air filtration solutions in hospitals, laboratories, and cleanroom environments are witnessing higher adoption due to the need for sterile environments and infection control measures. Filtration companies focusing on high-performance, medical-grade filtration solutions will benefit from this trend, as healthcare providers prioritize patient safety and regulatory compliance.

FILTRATION AND SEPARATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.21% |

|

Segments Covered |

By Product Type, application type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

|

Filtration and Separation Market Segmentation:

Filtration and Separation Market Segmentation: By Application Type:

- Water

- Air

- Pharmaceuticals

- Oil and Gas

- Electronics

The water filtration segment holds the largest share of the Filtration and Separation Market, driven by the increasing demand for clean drinking water, wastewater treatment, and industrial water recycling. With over 2.3 billion people lacking access to safe drinking water, governments and industries are investing in advanced filtration systems, such as reverse osmosis (RO), ultrafiltration (UF), and activated carbon filtration, to improve water quality. The air filtration market is also witnessing significant growth, fuelled by rising concerns over indoor and outdoor air pollution.

The pharmaceutical industry relies heavily on sterile filtration systems to ensure the safety and purity of drugs, vaccines, and biopharmaceutical products. The pharmaceutical industry relies heavily on sterile filtration systems to ensure the safety and purity of drugs, vaccines, and biopharmaceutical products.

Filtration and Separation Market Segmentation: By Product Type:

- Membranes

- Filters

- Separators

The membrane filtration segment is experiencing rapid growth, driven by its increasing use in water treatment, pharmaceuticals, and food & beverage industries. Membrane technologies such as reverse osmosis (RO), ultrafiltration (UF), nanofiltration (NF), and microfiltration (MF) are widely adopted for purification, sterilization, and contaminant removal. Filters are another dominant product category, used extensively in air purification, industrial gas processing, and HVAC systems. The adoption of high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) filters has surged in industries requiring strict contamination control, such as electronics manufacturing and aeronautics.

Separators play a crucial role in industries requiring high-performance liquid-solid, gas-liquid, and gas-solid separation technologies. The oil & gas industry heavily relies on centrifugal separators and coalescing separators for oil-water separation, gas purification, and fuel refining. Space, and healthcare

Filtration and Separation Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

North America holds a dominant share in the Filtration and Separation Market, driven by stringent environmental regulations, high industrial adoption, and significant investments in water and air purification technologies. The United States and Canada lead the region, with growing demand for advanced filtration solutions in oil & gas, pharmaceuticals, and municipal water treatment. Europe follows closely, with countries like Germany, the UK, and France leading in industrial filtration adoption due to strict EU environmental directives. The European market is witnessing a surge in demand for biodegradable filters, HEPA air filtration systems, and high-purity water filtration for pharmaceuticals.

The Asia Pacific region is projected to witness the fastest CAGR, driven by rapid industrialization, urbanization, and government-led water conservation initiatives. China, India, and Japan are leading in wastewater treatment infrastructure, with increasing investments in desalination plants and membrane-based filtration technologies to combat water pollution challenges. South America and the Middle East & Africa (MEA) are emerging markets, with growing investments in water treatment and industrial filtration. Countries like Brazil and Argentina are focusing on improving air and water quality in urban centres, while Saudi Arabia and the UAE are heavily investing in advanced desalination technologies to address water scarcity challenges.

COVID-19 Impact Analysis on the Filtration and Separation Market:

The COVID-19 pandemic led to an unprecedented demand for air and liquid filtration technologies, particularly in healthcare, pharmaceuticals, and industrial hygiene applications. The surge in face mask and HEPA filter production, along with stringent air purification requirements in hospitals and laboratories, significantly boosted market growth. Industries also accelerated the adoption of water filtration systems to ensure safe and clean water supply amid disruptions in traditional supply chains and water treatment infrastructure. Additionally, the pandemic prompted increased investment in self-sustaining filtration systems, as businesses sought to reduce dependence on external water and air purification services.

Trends/Developments:

Pall Corporation and 3M are investing in next-generation biopharmaceutical filtration solutions to meet the growing demand for sterile drug manufacturing and vaccine production. Eaton and Suez are expanding their sustainable water filtration offerings, focusing on membrane-based purification and wastewater recycling technologies.

There is a growing shift toward biodegradable, energy-efficient, and recyclable filtration materials. Companies are developing carbon-neutral filtration systems using plant-based, ceramic, and nano-fibre filters to replace traditional synthetic materials.

Companies are investing in automated filtration solutions that enhance operational efficiency while meeting stringent regulatory requirements in sectors like pharmaceuticals, water treatment, and air purification.

Chapter 1. FILTRATION AND SEPARATION MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. FILTRATION AND SEPARATION MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. FILTRATION AND SEPARATION MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. FILTRATION AND SEPARATION MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. FILTRATION AND SEPARATION MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. FILTRATION AND SEPARATION MARKET – By Application Type

6.1 Introduction/Key Findings

6.2 Water

6.3 Air

6.4 Pharmaceuticals

6.5 Oil and Gas

6.6 Electronics

6.7 Y-O-Y Growth trend Analysis By Application Type

6.8 Absolute $ Opportunity Analysis By Application Type , 2025-2030

Chapter 7. FILTRATION AND SEPARATION MARKET – By Product Type

7.1 Introduction/Key Findings

7.2 Membranes

7.3 Filters

7.4 Separators

7.5 Y-O-Y Growth trend Analysis By Product Type

7.6 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 8. FILTRATION AND SEPARATION MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product Type

8.1.3. By Application Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application Type

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application Type

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application Type

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application Type

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market is growing due to increasing demand for clean water, air purification, and industrial filtration solutions. Stricter environmental regulations, rapid industrialization, and advancements in membrane and nanofiltration technologies are also fuelling market expansion.

Major industries using filtration technologies include water & wastewater treatment, pharmaceuticals, food & beverage, oil & gas, chemicals, and electronics. The demand is particularly high in sectors requiring ultrapure water, sterile environments, and high-efficiency air and gas filtration.

AI-driven smart filtration systems are revolutionizing the industry by enhancing efficiency, enabling real-time monitoring, and reducing operational costs. Automated filtration technologies help industries optimize energy use, improve maintenance schedules, and ensure compliance with regulatory standards.

The Asia Pacific region is projected to grow the fastest due to rapid urbanization, increasing industrial activity, and strong government initiatives in water conservation and pollution control. Countries like China, India, and Japan are investing heavily in advanced filtration systems.

Key trends include the rise of sustainable and biodegradable filtration materials, the expansion of smart filtration systems with IoT integration, and increased investment in high-performance membrane filtration for water treatment and industrial applications.