Field Sales Software Market Size (2024 – 2030)

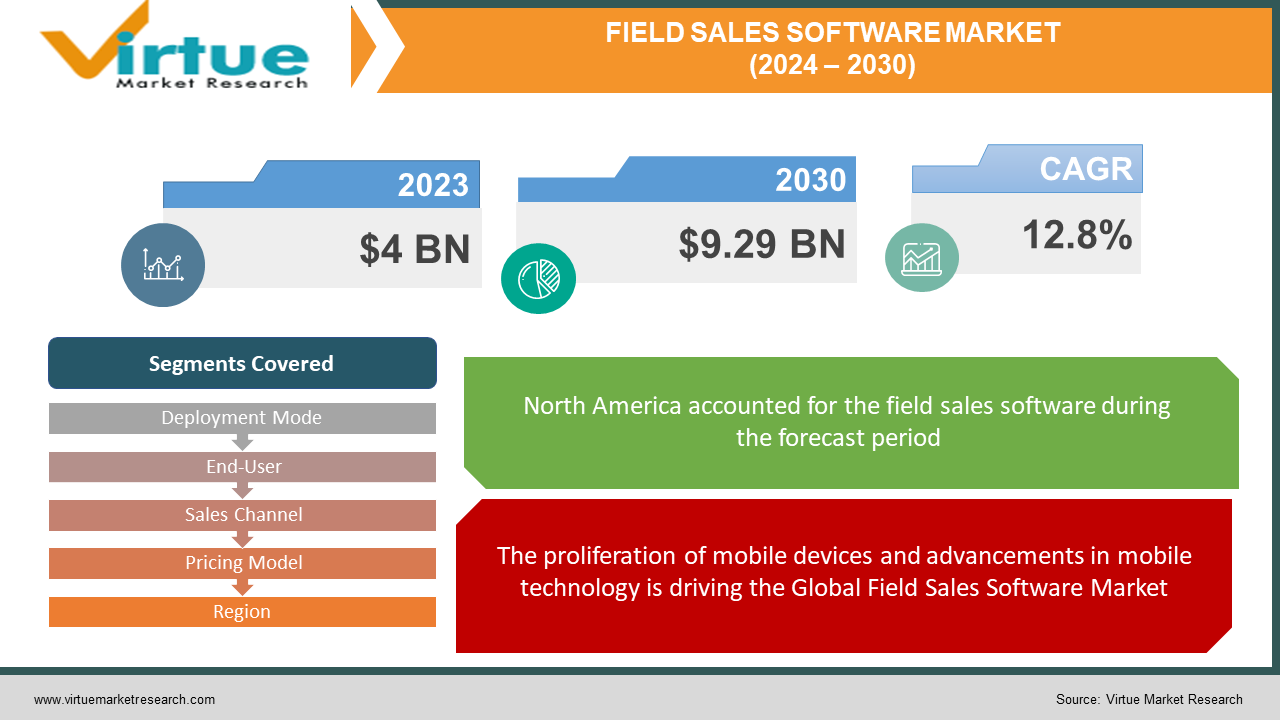

The global fire suppression systems market was valued at USD 4 billion in 2023 and is projected to reach a market size of USD 9.29 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12.8%.

The field sales software market has experienced an extraordinary revolution from manual procedures to advanced cloud-based solutions. In the earlier, sales representatives struggled with limited access to real-time data and relied on outdated CRM systems. Today, the market is booming, with a plethora of offerings integrating mobile technology, data analytics, and CRM functionalities. Modern field sales software enables real-time data access, route optimization, lead management, and performance analytics, empowering sales teams to operate more efficiently. Looking ahead, the market is poised for further growth driven by increased adoption of mobile devices, AI, and IoT technologies. Personalization, integration with emerging technologies like AR and VR, and heightened focus on data security are expected trends. Overall, the future promises continued innovation and efficiency gains in field sales operations.

Key Market Insights:

The field sales software market is categorized by a transformative modification from manual processes to advanced, cloud-based solutions. Beforehand constrained by restricted data access, sales representatives now profit from real-time insights and sophisticated CRM integrations. The market has expanded rapidly, fueled by mobile technology, data analytics, and a mounting demand for efficiency in sales operations. Key market insights reveal a heightened emphasis on personalization and customization to meet individual customer needs, driving increased adoption of AI and IoT technologies. Furthermore, the integration of emerging technologies like AR and VR is reshaping how sales teams interact with customers and showcase products. Security remains a top concern, spurring innovation in robust data protection measures. Consolidation is anticipated as larger players acquire smaller competitors to expand their product portfolios and market reach. Looking ahead, the field sales software market is poised for continued growth, with innovation expected to drive efficiency gains and productivity enhancements in field sales operations.

Global Field Sales Software Market Drivers:

The proliferation of mobile devices and advancements in mobile technology is driving the Global Field Sales Software Market:

The global field sales software market is pushed by several key drivers. Firstly, the growing acceptance of mobile technology empowers sales representatives with real-time access to serious data and tools, enhancing their productivity and openness. The proliferation of mobile devices and advancements in mobile technology have transformed sales operations, enabling sales representatives to access critical information and communicate with clients on the go. The COVID-19 pandemic has accelerated the digital transformation of sales processes, boosting the adoption of remote selling techniques supported by field sales software's virtual selling capabilities. The expanding global salesforce and the need for efficient territory management are driving the demand for field sales software with robust territory mapping and optimization features, enabling organizations to maximize sales opportunities across diverse geographic regions. These driving forces collectively underscore the innovation and growth potential within the global field sales software market.

The demand for data-driven decision-making fuels the incorporation of advanced analytics and CRM functionalities within field sales software, permitting companies to gain deeper insights into customer behaviors and preferences.

The integration of advanced analytics capabilities within field sales software is meeting the rising demand for real-time data insights, empowering sales teams to make informed decisions and enhance performance. Furthermore, the emphasis on improving customer experience and relationship management is propelling the adoption of field sales software, facilitating personalized sales pitches, and strengthening customer relationships. The mounting prominence on enhancing customer knowledge drives the need for tailored and customized sales interactions, urging the development of innovative landscapes within field sales solutions. The globalization of markets and the rise of remote work preparations impose flexible and scalable software solutions that can care for dispersed sales teams. These drivers emphasize the importance of field sales software in allowing organizations to familiarize themselves with evolving market dynamics and stay competitive in today's commercial landscape.

Global Field Sales Software Market Restraints and Challenges:

Despite its rapid growth, the global field sales software market faces several restraints and challenges. One noteworthy hurdle is the resistance to adoption among traditional sales teams, who may be reluctant to embrace new technologies or modify established workflows. Furthermore, concerns about data privacy and security remain paramount, especially as regulations tighten worldwide. Integration complexities pose another challenge, particularly when attempting to merge field sales software with existing CRM or ERP systems. Moreover, the high initial investment mandatory for implementing and customizing field sales software can deter smaller businesses from entering the market. Furthermore, the diverse needs of different industries and regions necessitate flexible solutions, further complicating product development and market penetration efforts. Lastly, the ongoing need for user training and support can strain resources and slow down the implementation process. Overcoming these challenges will require strategic innovation, collaboration, and a focus on addressing the specific pain points of field sales teams globally.

Global Field Sales Software Market Opportunities:

The global field sales software market presents several lucrative opportunities for businesses. Firstly, the increasing demand for mobile-centric solutions creates a ripe environment for companies to develop innovative applications that cater to the needs of mobile sales teams. Furthermore, the growing importance of data-driven decision-making opens avenues for the integration of advanced analytics and artificial intelligence capabilities within field sales software, enabling businesses to derive actionable insights and enhance sales strategies. Furthermore, the expansion of global markets and the rise of e-commerce present opportunities for field sales software vendors to offer solutions that simplify seamless integration between online and offline sales channels. Moreover, as businesses line up customer experience, there is a rising need for personalized and interactive sales tools, creating opportunities for companies to distinguish themselves through the development of customizable and engaging field sales software solutions. Finally, partnerships and collaborations with industry stakeholders can deliver avenues for market expansion and product diversification, enabling corporations to tap into new customer sections and geographic regions.

FIELD SALES SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.8% |

|

Segments Covered |

By Deployment Mode, End-User, Sales Channel, Pricing Model, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Salesforce, Oracle Corporation, SAP SE, Microsoft Corporation, Zoho Corporation, IBM Corporation, Pipedrive, HubSpot, Inc., Freshworks Inc., Veeva Systems Inc. |

Field Sales Software Market Segmentation: By Deployment Mode

-

On-Premises

-

Cloud-based

Cloud-based deployment mode dominates the market due to its flexibility, scalability, and cost-effectiveness. Organizations gradually wish cloud-based solutions for their field sales operations to access data remotely, ensure real-time updates, and streamline collaboration among distributed sales teams. Although on-premises deployment is deteriorating overall, certain industries or enterprises with precise regulatory or security requirements still opt for on-premises solutions. However, the growth rate for on-premises deployment is slower associated with cloud-based solutions due to the limitations in scalability and agility.

Field Sales Software Market Segmentation: By End-User

-

-

Retail

-

Healthcare

-

Manufacturing

-

BFSI (Banking, Financial Services, and Insurance)

-

IT and Telecom

-

Others

-

The IT and Telecom sector emerges as the largest end-user segment, leveraging field sales software to manage complex sales processes, track customer interactions, and drive revenue growth in highly competitive markets. With increasing digitization in healthcare, the adoption of field sales software is rapidly growing. Healthcare organizations utilize these solutions to optimize sales operations, improve patient engagement, and boost the overall efficiency of sales representatives.

Field Sales Software Market Segmentation: By Sales Channel

-

Direct Sales

-

Indirect Sales

Direct sales channels continue to dominate the market as organizations uphold direct control over customer interactions, permitting personalized selling approaches and deeper relationships with clients. Indirect sales channels, such as distributors, resellers, and partners, are witnessing rapid growth as companies expand their reach into new markets and segments. Indirect sales deliver opportunities for scalability and market penetration, driving their accelerated growth rate.

Field Sales Software Market Segmentation: By Pricing Model

-

Subscription-Based

-

Pay-Per-Use

-

Premium

Subscription-based pricing models are prevalent in the field sales software market, offering predictable recurring revenue streams for vendors and flexibility for customers in terms of scalability and budget management. Premium models, which offer basic features for free with optional premium upgrades, are experiencing noteworthy growth as they attract a wide user base originally and inspire upselling to premium features over time.

Field Sales Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the global field sales software market due to its strong technological infrastructure, high acceptance of advanced sales technologies, and presence of key market players. Asia Pacific region is undergoing the fastest growth in the field sales software market, driven by rapid economic development, increasing investments in sales technology, and the growth of businesses into emerging markets within the region.

COVID-19 Impact Analysis on the Global Field Sales Software Market:

The COVID-19 pandemic noteworthyly obstructed the global field sales software market, fast-tracking the adoption of digital sales solutions as businesses modified to remote work and social distancing measures. With traditional sales channels disrupted, organizations increasingly relied on field sales software to maintain customer relationships, manage sales pipelines, and enable virtual selling. The crisis highlighted the importance of cloud-based and mobile-friendly solutions for remote access and collaboration, driving a surge in demand for such platforms. While some industries faced budget constraints and delayed technology investments, others prioritized digital transformation initiatives, chief to an overall resilience and innovation within the field sales software market amidst the pandemic's challenges.

Latest Trends/ Developments:

The latest trends and developments in the field sales software market reflect a continued focus on enhancing efficiency, personalization, and adaptability. Firstly, there's a notable shift towards AI-powered sales automation, enabling predictive analytics, lead scoring, and intelligent sales recommendations to optimize sales processes. Furthermore, there's a growing emphasis on mobile-first solutions, catering to the collective reliance on smartphones and tablets among field sales representatives. Moreover, the incorporation of emerging technologies like augmented reality (AR) and virtual reality (VR) is gaining traction, offering immersive product demonstrations and enhanced customer experiences. Furthermore, there's a rising demand for real-time data analytics and reporting capabilities to enable proactive decision-making and performance tracking. Another noteworthy trend is the convergence of field sales software with CRM, marketing automation, and ERP systems, facilitating seamless data flow and comprehensive sales management. Lastly, the COVID-19 pandemic has enhanced the adoption of distant selling tools and virtual meeting platforms, driving innovation in communication and association features within field sales software solutions.

Key Players:

-

Salesforce

-

Oracle Corporation

-

SAP SE

-

Microsoft Corporation

-

Zoho Corporation

-

IBM Corporation

-

Pipedrive

-

HubSpot, Inc.

-

Freshworks Inc.

-

Veeva Systems Inc.

Chapter 1. Field Sales Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Field Sales Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Field Sales Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Field Sales Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Field Sales Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Field Sales Software Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 On-Premises

6.3 Cloud-based

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Field Sales Software Market – By End-User

7.1 Introduction/Key Findings

7.2 Retail

7.3 Healthcare

7.4 Manufacturing

7.5 BFSI (Banking, Financial Services, and Insurance)

7.6 IT and Telecom

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End-User

7.9 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Field Sales Software Market – By Sales Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Indirect Sales

8.4 Y-O-Y Growth trend Analysis By Sales Channel

8.5 Absolute $ Opportunity Analysis By Sales Channel, 2024-2030

Chapter 9. Field Sales Software Market – By Pricing Model

9.1 Introduction/Key Findings

9.2 Subscription-Based

9.3 Pay-Per-Use

9.4 Premium

9.5 Y-O-Y Growth trend Analysis By Pricing Model

9.6 Absolute $ Opportunity Analysis By Pricing Model, 2024-2030

Chapter 10. Field Sales Software Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Deployment Mode

10.1.2.1 By End-User

10.1.3 By Sales Channel

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Deployment Mode

10.2.3 By End-User

10.2.4 By Sales Channel

10.2.5 By Pricing Model

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Deployment Mode

10.3.3 By End-User

10.3.4 By Sales Channel

10.3.5 By Pricing Model

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Deployment Mode

10.4.3 By End-User

10.4.4 By Sales Channel

10.4.5 By Pricing Model

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Deployment Mode

10.5.3 By End-User

10.5.4 By Sales Channel

10.5.5 By Pricing Model

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Field Sales Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Salesforce

11.2 Oracle Corporation

11.3 SAP SE

11.4 Microsoft Corporation

11.5 Zoho Corporation

11.6 IBM Corporation

11.7 Pipedrive

11.8 HubSpot, Inc.

11.9 Freshworks Inc.

11.10 Veeva Systems Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving global Field Sales Software market growth include demand for mobile solutions, data-driven decision-making, globalization, and enhanced customer experiences.

The main concerns about the global Field Sales Software market include data security, integration complexities, resistance to adoption, and diverse industry needs.

Key players in the global Field Sales Software market include Salesforce, Oracle, SAP, Microsoft, Zoho, IBM, Pipedrive, HubSpot, Freshworks, and Veeva Systems.

North America holds the largest share in the global Field Sales Software market, driven by robust technological infrastructure and high adoption rates of advanced sales technologies.

Asia Pacific is expanding at the highest rate in the global Field Sales Software market, fueled by rapid economic development and increasing investments in sales technology.