Fibreglass Pipes Market Size (2023 - 2030)

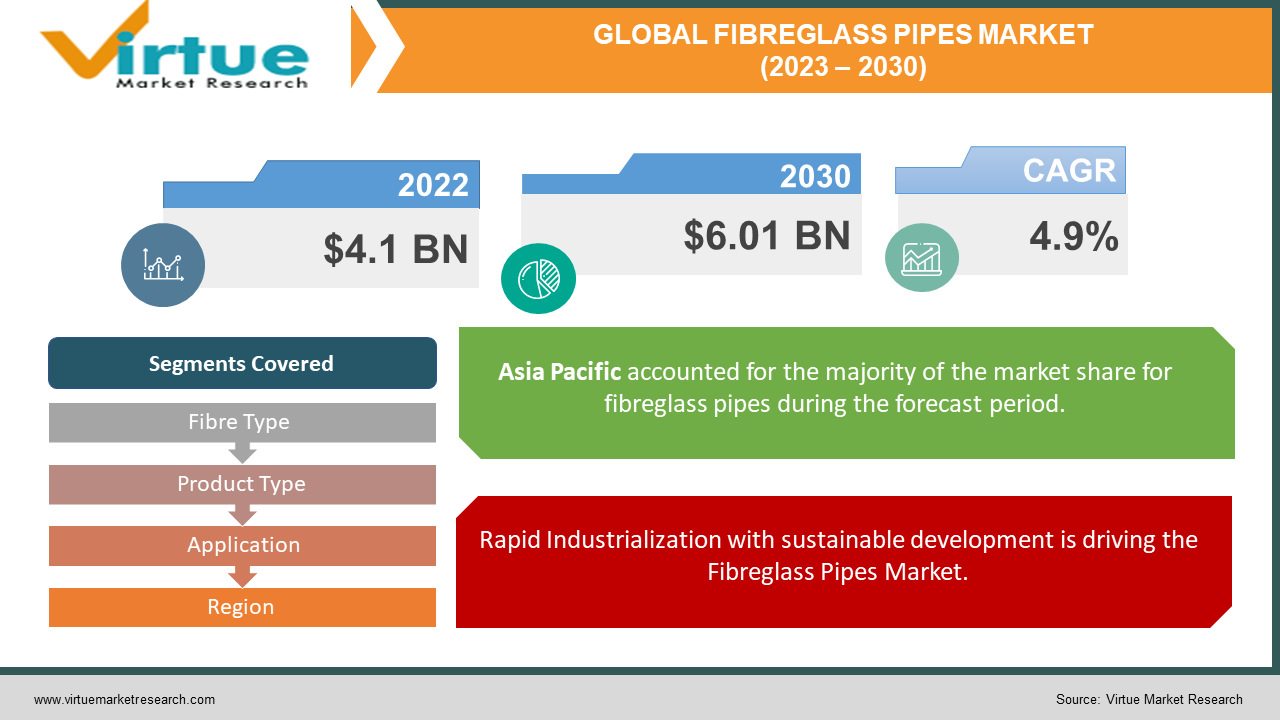

The Global Fibreglass Pipes Market was valued at USD 4.1 Billion and is projected to reach a market size of USD 6.01 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.9%.

Fiberglass pipes are composite materials that combine the properties of multiple materials, including glass fibers and resins. They find applications across various industries such as chemicals, irrigation, oil & gas, sewage, and others. Among these industries, the GRE (Glass-Reinforced Epoxy) product segment plays a significant role, especially in offshore and onshore oil & gas exploration and production activities. One of the notable advantages of fiberglass pipes is their flexibility in manufacturing. They can be produced in a wide range of diameters and shapes to meet diverse customer needs across a variety of applications. Furthermore, fiberglass pipes maintain excellent hydraulic performance, thanks to reduced internal friction within the pipe's surface. The market for fiberglass pipes is gaining widespread acceptance as an attractive alternative to conventional pipe materials for several reasons. The fiberglass pipes offer a longer lifespan due to their superior corrosion resistance. Additionally, they are easier to handle due to their lighter weight. The increasing adoption of fiberglass pipes in various applications is also driven by stringent regulations that encourage environmentally friendly materials. The global demand for fiberglass pipes is on the rise due to the growing need for products that offer benefits such as easy installation, low maintenance costs, the ability to produce complex shapes, and corrosion resistance. Traditional materials like polyvinyl chloride (PVC), concrete, and steel often fall short of meeting the evolving demands of consumers, which is driving the rapid growth of fiberglass pipes in the market.

Key Market Insights:

The market for fiberglass pipes is experiencing robust growth driven by their exceptional properties. Fiberglass pipes, particularly the GRE (Glass-Reinforced Epoxy) segment, are gaining traction in industries such as oil & gas, chemicals, irrigation, sewage, and more due to their superior corrosion resistance and lightweight characteristics. Their adaptability in terms of manufacturing, offering a wide range of diameters and shapes, aligns with diverse customer requirements. As reported by Zippia, Inc., a prominent provider of online recruitment services based in the United States, the value of the oil drilling and gas extraction market in the United States stood at an impressive $463.8 billion in the year 2021. Furthermore, in the preceding year, 2020, the gas and oil sector within the United States recorded substantial revenues of $110.7 billion. This sector was comprised of 67,901 companies engaged in the extraction of gas and oil, collectively employing 218,966 individuals and contributing to the sustenance of 10.3 million jobs. Consequently, the escalating exploration endeavors within the oil and gas industries are serving as a significant catalyst for the growth trajectory of the fiberglass pipes market Stringent environmental regulations are propelling the adoption of fiberglass pipes as eco-friendly alternatives to conventional materials. Additionally, their ease of installation, low maintenance costs, capacity to accommodate complex shapes, and immunity to corrosion position them as a preferred choice in a market where traditional materials often fall short of meeting evolving consumer needs. These insights underscore the growing significance and bright prospects of the fiberglass pipe market.

Global Fibreglass Pipes Market Drivers:

Rapid Industrialization with sustainable development is driving the Fibreglass Pipes Market

The surging expenses associated with metal pipes and tubes have driven a heightened demand for cost-effective and sustainable pipe solutions, especially amidst the rapid industrialization observed worldwide. With a growing global population, the need for fuel, oil, and gas has escalated, necessitating the expansion of pipelines for efficient transportation. Notably, fiberglass pipes are anticipated to witness a substantial surge in demand during the forecast period, mainly due to their exceptional performance in high-pressure conditions. The cost-effectiveness of fiberglass pipes, characterized by low maintenance requirements, stands as a pivotal factor contributing to the growth of this market. Furthermore, the fiberglass pipe market is poised to benefit from the increased exploration and production activities within the oil and gas sector. Additionally, the rising demand for solutions in wastewater and water management further amplifies the market's revenue prospects, reinforcing its position as a promising and lucrative industry.

Increasing usage of software tools like Computer-Aided Design (CAD) is propelling the Fibreglass Pipes Market

The growth of the market is being propelled by the integration of computer-aided design technology and the introduction of modern production techniques, such as the utilization of four-axis helical winding methods and dual helical filament binding. These innovations play a crucial role in reducing production time and improving precision in product specifications. Another significant driver of market expansion is the widespread adoption of these products across essential industries, including metallurgical sewage facilities, industrial effluent treatment plants, chemical facilities, and the oil and gas sector, among others.

Easy handling of the Fibreglass Pipes Market is augmenting the growth of the Market

Many Engineering, Procurement, and Construction (EPC) firms are actively seeking ways to minimize overall project costs, and one effective strategy is the adoption of lightweight components. Lightweight pipes, in particular, have emerged as a favored choice due to their ability to reduce transportation and installation expenses compared to their heavier counterparts. This preference for lightweight pipes is anticipated to significantly boost the demand for fiberglass pipes in the foreseeable future. Additionally, the surge in population growth has led to an increased demand for essential resources such as fuel, oil, and gas, necessitating the construction and deployment of pipelines for their transportation. This growing need for pipeline infrastructure is a major driving force expected to fuel the demand for fiberglass pipes in the coming years.

Increased application of Fibreglass Pipes in Sewage and underground management is driving the Market

Fiberglass pipes are prized for their corrosion resistance, cost-effectiveness, lightweight nature, and exceptional durability. Notably, these pipes maintain a consistently low frictional coefficient, ensuring that their hydraulic performance remains efficient over time, making them well-suited for both above-ground and underground sewage applications. Within the realm of sewage pipes, fiberglass pipes find extensive use in various critical facilities, including water treatment plants, metallurgical sewage facilities, wastewater treatment plants, and industrial effluent treatment facilities, among others. In many Asia-Pacific countries, there has been a concerted effort by governments and private entities to enhance sanitary conditions and improve industrial sewage management. This concerted focus on sanitation and wastewater management is expected to be a significant driving force behind the market's growth during the forecast period.

Global Fibreglass Pipes Market Opportunities:

The increasing emphasis on environmental sustainability and the need for corrosion-resistant, long-lasting pipes make fiberglass pipes an attractive choice across various industries. Moreover, the integration of advanced technologies like computer-aided design and modern production processes is opening doors for more efficient and precise manufacturing, reducing production time and costs. The global infrastructure development, particularly in emerging economies, is creating a robust demand for pipes, and fiberglass pipes, with their lightweight and durable properties, are well-positioned to meet these needs. Additionally, the expansion of the oil and gas sector and the growing focus on wastewater treatment and management further expand the market's horizons. With ongoing innovations and the versatility of fiberglass pipes, the market is poised for continuous growth and innovation, offering ample opportunities for both existing and new players in the industry.

Global Fibreglass Pipes Market Restraints and Challenges:

The fiberglass pipes market faces a notable hurdle stemming from the volatility in raw material prices. Fiberglass finds widespread applications across diverse industries, including energy, electronics, automotive, transportation, construction materials, and infrastructure building materials, thanks to its exceptional attributes like high strength, lightweight properties, and design versatility. However, the year 2021 witnessed substantial increases in the costs of raw materials, fuel, and labor, thereby exerting upward pressure on the production expenses associated with fiberglass. This surge in production costs has presented a challenging scenario for the fiberglass pipes industry.

FIBREGLASS PIPES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Fibre Type, Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fibrex Corporation, Future Pipe Industries, Graphite India Limited, Abu Dhabi Pipe Factory LLC, Amiblu Holding GmbH, Chemical Process Piping, HOBAS, Sarplast GRP, Hengrun Group Co. Ltd., Russel Metals Inc |

Fibreglass Pipes Market Segmentation: By Fibre Type

-

E-Glass

-

T-Glass

-

S-Glass

-

R-Glass

-

Others

In 2022, E-glass fiber emerged as the dominant segment, contributing to 35% of the global revenue share. E-glass fiber serves as a reinforcement component in numerous composites, enhancing the performance of resins by acting as a strengthening agent. These high-end pipes boast resistance to oils, solvents, and a wide array of chemical agents. Their exceptional attributes include high strength, lightweight construction, and smooth inner and outer surfaces, making them ideal for trenchless applications such as micro tunneling and relining. They also find applications in various sectors, including sewer systems, potable water lines, storage tanks, drainage pipes, hydropower penstocks, and industrial pipeline systems. Notably, the chemical sector stands out as the primary market for the E-Glass segment, propelled by the substantial increase in chemical production from diverse sources, including petroleum, coal, and biomass, leading to the development of extensive production facilities worldwide. The S-Glass segment is experiencing rapid growth, particularly due to its applications in construction drainage and marine cooling systems.

Fibreglass Pipes Market Segmentation: By Product Type

-

Glass Fiber Reinforced Plastic (GRP) Pipes

-

Glass Reinforced Epoxy (GRE) Pipes

-

Others

In 2022, the GRE (Glass-Reinforced Epoxy) pipes segment dominated the Fiberglass Pipes Market, holding the largest share. GRE pipes present a range of advantages, including dimensional stability, lightweight properties, ease of installation, and corrosion resistance, setting them apart from conventional metallic and concrete pipes. As a result of these benefits, the utilization of the GRE segment of fiberglass pipes has been steadily rising in industries such as oil & gas, sewage, and chemicals. Notably, the primary market for GRE pipes lies within the water treatment sector. The GRP (Glass-Reinforced Plastic) segment is experiencing rapid growth, largely attributed to its exceptional durability in challenging conditions and its lower maintenance requirements.

Fibreglass Pipes Market Segmentation: By Application

-

Oil & Gas

-

Chemicals

-

Sewage

-

Irrigation

-

Others

In 2022, the oil & gas industry emerged as the predominant end-use segment, contributing to 39% of the global revenue share. The market's trajectory is significantly influenced by the oil & gas sectors in emerging countries across Asia Pacific, South & Central America, and the Middle East & Africa. This influence stems from the ongoing energy and infrastructure reforms aimed at modernizing aging infrastructure and meeting escalating energy demands, spurred by rapid growth and development in these regions.

In contrast, the chemical industry is the fastest-growing market segment in Europe and North America. The growth of fiberglass pipes in North America and Europe is propelled by declining natural gas prices, a vital feedstock in many chemical processing industries. Additionally, the construction sector, characterized by diverse projects, anticipates robust growth due to the escalating infrastructure development activities taking place in the region.

Fibreglass Pipes Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Asia-Pacific (APAC) emerged as the dominant region in the Fiberglass Pipes market, commanding a substantial share of 44%, with North America and Europe following closely behind. The economic landscape of APAC has long been influenced by the dynamics of countries like China and India. However, there's a shifting scenario with growing foreign direct investments aimed at driving economic development in Southeast Asia. In emerging economies such as China, India, and Japan, where there is a rapid surge in energy demand, there's a notable trend favoring natural gas as a cleaner alternative to coal. Importing natural gas can be costly, making pipeline transportation a more economical choice compared to large LNG vessels.

Europe stands out as the fastest-growing market region in terms of revenue, expected to witness a robust CAGR of 3.6% over the forecast period. This growth is propelled by economic recovery in European nations and an increasing reliance on Russia for natural gas imports. Moreover, the European region is experiencing heightened urbanization and facing drought conditions, leading to the proliferation of desalination facilities across several countries. The demand for GRP and GRE piping equipment in desalination plants, as well as their use in chemical manufacturing and effluent treatment facilities, is expected to surge in response to these developments.

COVID-19 Impact on the Global Fibreglass Market:

The COVID-19 pandemic has had a notable impact on the fiberglass pipes market. The initial outbreak and subsequent lockdown measures disrupted supply chains and manufacturing processes across the globe, leading to temporary delays and interruptions in production. Uncertainties surrounding the pandemic also led to project postponements and reduced investment in various industries, affecting the demand for fiberglass pipes. However, as the world adapted to the new normal and industries gradually resumed operations, the market began to recover. Additionally, the need for robust and durable infrastructure, including pipes for water supply and wastewater management, became even more apparent during the pandemic, driving demand in certain segments. While the market experienced challenges, it also showcased resilience and adaptability in navigating the evolving circumstances posed by the pandemic.

Latest Trends/ Developments:

The global market for fiberglass pipes is primarily propelled by the substantial expansion in the oil and gas industry. Fiberglass pipes find extensive use throughout the extraction, processing, refining, and distribution stages, primarily owing to their outstanding flow characteristics and exceptional performance capabilities under extreme pressures and high-capacity loads. The integration of cutting-edge technologies such as computer-aided design (CAD) and the introduction of advanced production methods like dual helical filament binding and four-axis helical winding are actively contributing to market growth. These innovations not only reduce production time but also enhance specifications with greater precision. Additionally, the widespread adoption of fiberglass pipes in various sectors, including metallurgical sewage facilities, wastewater treatment plants, and industrial effluent treatment facilities, aimed at enhancing sanitary conditions and improving industrial sewage management, serves as another significant growth factor. The upsurge in construction activities has led to a heightened demand for lightweight and durable pipelines, particularly in commercial and residential complexes, further bolstering the market's prospects. The increased government investments in water and waste management systems, extensive infrastructure development projects, and the widespread adoption of fiberglass pipes in the chemical industry are all expected to contribute to the market's expansion.

Key Market Players:

-

Fibrex Corporation

-

Future Pipe Industries

-

Graphite India Limited

-

Abu Dhabi Pipe Factory LLC

-

Amiblu Holding GmbH

-

Chemical Process Piping

-

HOBAS

-

Sarplast GRP

-

Hengrun Group Co. Ltd.

-

Russel Metals Inc

In March 2023, Perma-Pipe International Holdings announced the recent inauguration of its largest production facility located in the Emirate of Abu Dhabi in the United Arab Emirates, marking a significant expansion beyond North America.

In August 2021, Superlit, a subsidiary of the Karamanci Holding group that specializes in the global production and distribution of tubes and pipes, is set to shutter its manufacturing facility in Buzau, Romania. Established in 2018 as part of a €10 million project, the factory, with a turnover of approximately €10 million and nearly 100 employees, has faced significant challenges. The group cites a substantial decline in domestic sales, rising transportation expenses, and difficulties in recovering payments from local customers as reasons for this decision.

Chapter 1. Fibreglass Pipes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fibreglass Pipes Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fibreglass Pipes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fibreglass Pipes Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fibreglass Pipes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fibreglass Pipes Market – By Fibre Type

6.1 Introduction/Key Findings

6.2 E-Glass

6.3 T-Glass

6.4 S-Glass

6.5 R-Glass

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Fibre Type

6.8 Absolute $ Opportunity Analysis By Fibre Type , 2023-2030

Chapter 7. Fibreglass Pipes Market – By Product Type

7.1 Introduction/Key Findings

7.2 Glass Fiber Reinforced Plastic (GRP) Pipes

7.3 Glass Reinforced Epoxy (GRE) Pipes

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Product Type

7.6 Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 8. Fibreglass Pipes Market – By Application

8.1 Introduction/Key Findings

8.2 Oil & Gas

8.3 Chemicals

8.4 Sewage

8.5 Irrigation

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 9. Fibreglass Pipes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Fibre Type

9.1.3 By Product Type

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Fibre Type

9.2.3 By Product Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Fibre Type

9.3.3 By Product Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Fibre Type

9.4.3 By Product Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Fibre Type

9.5.3 By Product Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Fibreglass Pipes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Fibrex Corporation

10.2 Future Pipe Industries

10.3 Graphite India Limited

10.4 Abu Dhabi Pipe Factory LLC

10.5 Amiblu Holding GmbH

10.6 Chemical Process Piping

10.7 HOBAS

10.8 Sarplast GRP

10.9 Hengrun Group Co. Ltd.

10.10 Russel Metals Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Fibreglass Pipes Market was valued at USD 4.1 Billion and is projected to reach a market size of USD 6.01 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.9%.

Its increasing application in Oil & Gas and Sewage Treatment sector coupled with its easy installation and lower maintenance cost are the drivers.

Based on Product Type, the global Fibreglass Pipes Market is segmented into Glass Fiber Reinforced Plastic (GRP) Pipes, Glass Reinforced Epoxy (GRE) Pipes, and Others.

China is the most dominant country in the region of Asia-Pacific for Fibreglass Pipes Market.

Fibrex Corporation, Future Pipe Industries, Graphite India Limited, Abu Dhabi Pipe Factory LLC, Amiblu Holding GmbH, Chemical Process Piping, HOBAS, Sarplast GRP, Hengrun Group Co. Ltd., Russel Metals Inc.