Fiberglass Pipes Market Size (2024 – 2030)

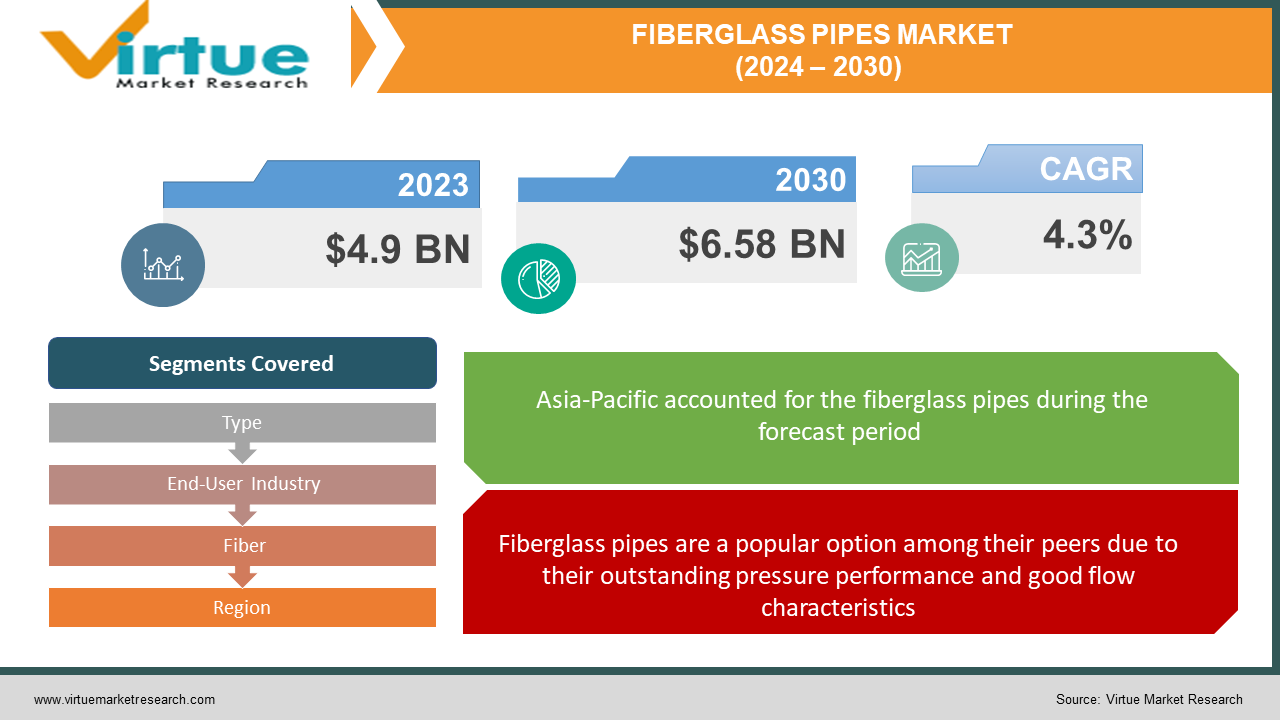

The global fiberglass pipe market was valued at USD 4.9 billion and is projected to reach a market size of USD 6.58 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4.3%.

Glass fibers, fillers, and polyester resins are combined to create fiberglass pipes, which are composed of composite materials. They have a variety of qualities, including resistance to corrosion, chemical inertness, durability, and affordability. They have a long product life, a high electrical modulus, good tensile properties, and great efficiency, even at very high temperatures. They are extensively utilized in chemical, sewage, irrigation, and water treatment and distribution applications. Fibreglass pipes are also considered appropriate for transporting biological liquids, acids, and compounds with strong corrosion resistance. These days, fiberglass pipes are widely used in the chemical, oil, gas, and agricultural industries because of their excellent strength-to-weight ratio.

Fibreglass reinforcement and resin systems, such as polyester, epoxy, and phenolic resin, are used in the contact molding or filament winding processes to create fiberglass pipes. The transportation of natural gas and petroleum products has long been done via fiberglass pipes. Fibreglass pipes are composite pipes that can withstand various corrosive conditions found in any oil field, such as soils, hydrocarbons, salt water, H2S, and chemical compounds. Fibreglass pipes are highly desired in oil and gas applications because they are exceptionally durable, have a modest friction coefficient, and show less wear. Fiberglass pipe is a great and economical option for wastewater and water supply applications because of its long-term maintenance-free nature and reduced pump operating costs resulting from corrosion-related friction loss.

Key Market Insights:

The primary driver of the global market is the significant growth of the oil and gas industry. Fiberglass pipes are widely used in the extraction procedure, processing, refinement, and distribution processes because of their exceptional flow properties and ability to function well at high pressures and high capacity loads. The market is also being bolstered by the integration of computer-aided design (CAD) technology and the creation of innovative production processes such as dual helical filament binding and four-axis helical winding technologies. These advancements contribute to more precise requirements and faster production schedules. The widespread usage of these items to improve the hygiene of and integrate computer-aided design (CAD) technology and create industrial sewage management in wastewater treatment plants, industrial wastewater treatment plants, metallurgical sewage facilities, and other similar establishments is another factor propelling expansion. Additionally, the market is expected to grow as a result of the increased demand for strong and lightweight pipelines in residential and commercial complexes brought about by the growth in construction activities. The market is expected to be driven by several other factors, such as the growing investments made by various governments in waste and water management systems, the broad infrastructure development initiatives, and the widespread use of new products in the chemical sector.

Global Fiberglass Pipe Market Drivers:

Fiberglass pipes are a popular option among their peers due to their outstanding pressure performance and good flow characteristics.

Twin helical four-axis fiberglass pipes may now be produced more quickly and with higher quality due to technological advancements. Therefore, the benefits of fibreglass pipes over alternative materials as well as continuous improvements in production technology are driving the market's expansion. The oil and gas industry's phenomenal growth is the primary driver of the global market. Because of their remarkable high-pressure performance, huge capacity loads, and exceptional flow qualities, fiberglass pipes are widely employed in the extraction process, processing, improvement, and distribution operations. The need for lightweight thermal insulation products in residential and commercial buildings has increased due to better market conditions.

The market standard for fiberglass pipes has been influenced by the integration of FRP with fiberglass tubes for increased corrosion resistance.

Glass fibers incorporated in a polymer matrix make up a composite material used in FRP pipes, which are a state-of-the-art solution for industrial piping. These pipes offer improved mechanical and chemical qualities, combining the strength of glass fibers with the flexibility and resistance to corrosion of polymers, which makes them perfect for a range of industrial applications. Furthermore, by combining thermoplastic materials with carefully positioned reinforcement layers, reinforced thermoplastic pipes (RTPs) further advance the bounds of piping technology. Square FRP tubes are a prime example of FRP structural elements because of their square cross-sectional shape. These tubes combine the durability of polymer resin with the strength of glass fibers to create a lightweight, strong material that may be used in a variety of applications.

Global Fiberglass Pipes Market Restraints and Challenges:

To achieve maximum performance, fiberglass pipes have a few issues that must be resolved. First of all, compared to traditional materials, their initial cost is often greater, which can play a big role in cost-sensitive industries or areas when making purchases. Moreover, to guarantee optimal performance and durability, installing fiberglass pipes calls for specialized knowledge and experience. A shortage of professionals or installers with the necessary training could cause problems. Fibreglass pipes can also have restrictions when it comes to their compatibility with severe or highly reactive substances, despite their remarkable resistance to corrosion and chemicals. Determining the compatibility of the materials is crucial to avoid any unwanted reactions or composite material breakdown.

Global Fiberglass Pipe Market Opportunities:

The need for long-lasting and corrosion-resistant piping solutions in sectors like water treatment, petrochemicals, and chemicals is driving the growth of the fiberglass pipe market. Because of their durability and resistance to corrosive substances, fiberglass-reinforced pipes are preferred. The use of fiberglass pipes has been fueled by the demand for durable and dependable piping systems in the chemical processing industry. These pipes are also used in the water and wastewater treatment industry for the distribution and conveyance of water, sewage, and other fluids, which supports market expansion. Fiberglass pipes are also used in the construction sector for sewage and drainage systems in both residential and commercial structures.

FIBERGLASS PIPES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, End-User Industry, Fiber, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hengrun Group Co., Ltd., Balaji Fiber Reinforced Pvt. Ltd., HOBAS, Abu Dhabi Pipe Factory, Chemical Process Piping Pvt. Ltd., Graphite India Limited., National Oilwell Varco, ZCL Composites, Inc., Future Pipe Industries, Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd. |

Global Fiberglass Pipes Market Segmentation: By Type

-

Glass Fiber Reinforced Plastic (GRP) Pipes

-

Glass-reinforced epoxy (GRE) Pipes

-

Other

Glass Fiber Reinforced Plastic (GRP) is both the largest and fastest-growing segment. These pipes are distinguished by their high fire rating, lightweight design, and corrosion resistance. They are a well-liked option in the market because they provide great mechanical strength at a competitive price range, which is especially important for sewage water transportation. GRP pipes are becoming increasingly in demand because of their many advantages, such as their ability to withstand severe environments and lower maintenance costs. This increase in demand is evidence of the market's growing recognition of GRP pipes as a dependable and affordable option for a range of applications.

Global Fiberglass Pipes Market Segmentation: By End-User Industry

-

Oil & Gas

-

Chemicals

-

Agriculture

-

Sewage

-

Others

The oil & gas category has the largest market share due to its extensive application in a variety of end-use industries. These sectors of the oil and gas industry include transportation, petrochemical processing, oil drilling, and other upstream and downstream uses. The reason for this segment's dominance is the increased demand for pipes with low weight-to-strength ratios and exceptional corrosion resistance. Their unique set of characteristics makes them especially appropriate for the severe conditions and surroundings commonly seen in the oil and gas sector. The chemical segment is the fastest-growing category. They are employed in the transportation of biological liquids as well as acids and caustic substances. Fibreglass pipes are resistant to rust and corrosion and can tolerate high temperatures. Besides, they are lightweight and easy to install. This makes them suitable for applications in the chemical industry.

Global Fiberglass Pipes Market Segmentation: By Fiber

-

T-Glass

-

E-Glass

-

Others

E-glass is the largest growing fiber. E-glass fiber is frequently used as reinforcement in a variety of composites, significantly improving the performance of resins. E-glass fiber strengthens the composite materials it is put into, enhancing their mechanical characteristics and durability. Its market dominance highlights its adaptability and efficiency in a variety of applications, from the automotive and aerospace sectors to the construction sector. T-glass is the fastest-growing segment. They are designed to provide better mechanical qualities, temperature resistance, and corrosion resistance. Its rise in the fiberglass pipe market may be attributed to the growing need for high-performance materials in industries including chemical processing, infrastructure construction, and oil and gas.

Global Fiberglass Pipes Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest market for fiberglass pipes. In these areas, demand for fiberglass pipes is furled by an increasing awareness of its benefits, which include cost-effectiveness, durability, and resistance to corrosion. This region is the largest contributor to the worldwide fiberglass market, owing mainly to its huge manufacturing sector and swift industrial expansion. Fibreglass pipes are becoming increasingly popular in several industries around the region, which greatly adds to their dominant market share. The need for fiberglass pipes is predicted to rise even more as industrial activity and infrastructural projects multiply. North America is the fastest-growing region. Across several industries, including construction, chemical processing, oil and gas, wastewater treatment, and water supply and management, this region has seen significant infrastructure development. The sheer volume of urbanization, industrialization, and infrastructure development occurring in nations such as Canada and the United States greatly augments the need for fiberglass pipes.

COVID-19 Impact Analysis on the Global Fiberglass Pipes Market:

The COVID-19 pandemic hurt the world economy and hindered the expansion of several sectors, including agriculture, chemicals and materials, and oil and gas. The worldwide supply chain was affected by the closure of several factories and manufacturing facilities in North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Numerous businesses forecasted a decline in their product sales and indicated potential delays in product deliveries. Additionally, economic cooperation and partnership potential were hampered by travel restrictions implemented by North American, Asia-Pacific, and European nations. The development of the chemicals and materials sector as well as the expansion of adjacent markets were both impeded by these causes. Businesses were able to resume manufacturing in the latter half of the pandemic after the governments of several nations relaxed the limitations that had been in place earlier. Additionally, a surge in COVID-19 vaccination campaigns alleviated the situation and sparked an upsurge in global commercial activity. The market for fiberglass pipes was positively impacted by the opening of manufacturing facilities. Manufacturers might also close the gap between supply and demand by running at maximum capacity. Furthermore, it is anticipated that in the upcoming years, the chemicals and materials industry's volume of imports and exports will rise dramatically.

Latest Trends/ Developments:

Petronel Petroleum Co., a strategic business partner of Future Pipe Industries (Egypt), awarded the company a Certificate of Appreciation for its exceptional work in establishing a GRE crude dill transition line from tanks to Petrico (Egypt). This recognition highlights Future Pipe Industries' dedication to excellence in providing top-notch solutions to satisfy the demands of its clients and partners in the petroleum sector. Furthermore, Future Pipe Industries added two more production lines to its Saudi Arabian manufacturing facility to accommodate its Flex StrongTM product, which is a high-pressure spoolable pipe with a maximum diameter of six inches. The company's commitment to meeting changing market demands is demonstrated by this expansion, which also bolsters its standing as the area's top supplier of state-of-the-art piping systems.

Key players:

-

Hengrun Group Co., Ltd.

-

Balaji Fiber Reinforced Pvt. Ltd.

-

HOBAS

-

Abu Dhabi Pipe Factory

-

Chemical Process Piping Pvt. Ltd.

-

Graphite India Limited.

-

National Oilwell Varco

-

ZCL Composites, Inc.

-

Future Pipe Industries

-

Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd.

Chapter 1. Fiberglass Pipes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fiberglass Pipes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fiberglass Pipes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fiberglass Pipes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fiberglass Pipes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fiberglass Pipes Market – By Type

6.1 Introduction/Key Findings

6.2 Glass Fiber Reinforced Plastic (GRP) Pipes

6.3 Glass-reinforced epoxy (GRE) Pipes

6.4 Other

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Fiberglass Pipes Market – By Fiber

7.1 Introduction/Key Findings

7.2 T-Glass

7.3 E-Glass

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Fiber

7.6 Absolute $ Opportunity Analysis By Fiber, 2024-2030

Chapter 8. Fiberglass Pipes Market – By End-user

8.1 Introduction/Key Findings

8.2 Oil & Gas

8.3 Chemicals

8.4 Agriculture

8.5 Sewage

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-user

8.8 Absolute $ Opportunity Analysis By End-user, 2024-2030

Chapter 9. Fiberglass Pipes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Fiber

9.1.4 By By End-user

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Fiber

9.2.4 By End-user

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Fiber

9.3.4 By End-user

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Fiber

9.4.4 By End-user

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Fiber

9.5.4 By End-user

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Fiberglass Pipes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Hengrun Group Co., Ltd.

10.2 Balaji Fiber Reinforced Pvt. Ltd.

10.3 HOBAS

10.4 Abu Dhabi Pipe Factory

10.5 Chemical Process Piping Pvt. Ltd.

10.6 Graphite India Limited.

10.7 National Oilwell Varco

10.8 ZCL Composites, Inc.

10.9 Future Pipe Industries

10.10 Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global fiberglass pipe market is segmented based on fiber, end-user, type, and region.

In the global fiberglass pipe market, Asia-Pacific is anticipated to hold the largest share.

The global fiberglass pipe market is predicted to reach a value of USD 6.58 billion by 2030.

The global fiberglass pipe market is expected to grow between 2024 and 2030.

In 2023, the global market was estimated to be worth $4.9 billion.